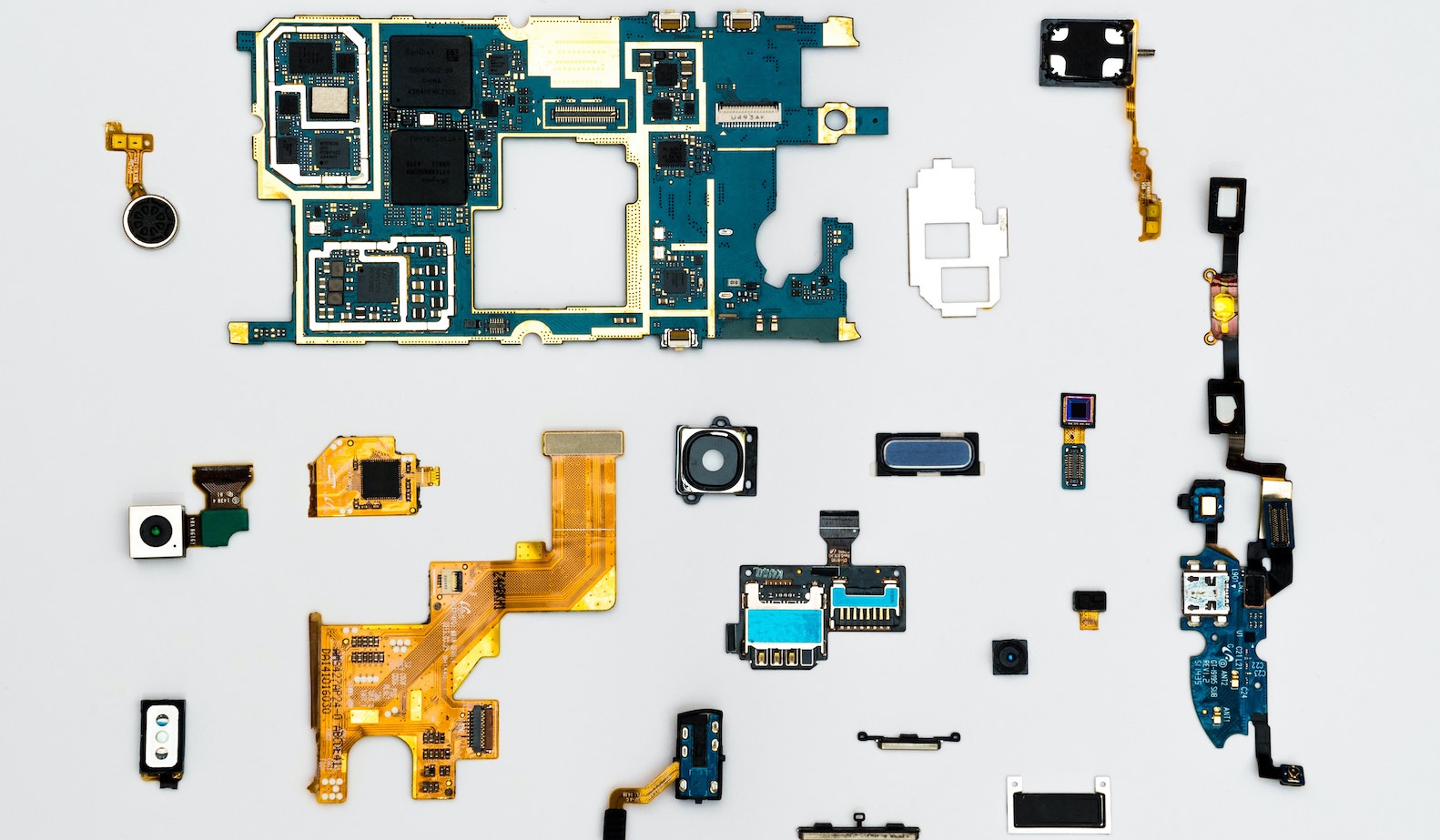

- Security and Privacy: This might just be the biggest overarching theme of the event. The advent of regulations like GDPR in Europe and the California Consumer Privacy Act (CCPA), coupled with the intense dialogue in society about these topics, has resulted in many companies coming forward with new or improved products. There were hundreds of new solutions, including those aimed at specific domains like smart homes or connected vehicles, payments and security for personal devices and personal digital data, and others focused on areas like the IoT infrastructure. Expect this area to continue to be a focus as both individuals and businesses grapple with cyber-risk and the issues of data ownership/sharing.

- The Expanding Mobility Ecosystem: The automotive ecosystem was already complex before the digital age, but now there are increasing numbers and types of companies offering new capabilities and services. As vehicles continue to become "computers on wheels,” the expectation is that occupants will be able to conduct, from their vehicles, every type of digital interaction that they can now do from their office or their living room couch.

- AI and Voice Everywhere: These technologies were prominent at CES2019, but the tech continues to advance and become embedded in more and more products. Voice is poised to become a dominant way that we interact with the smart, digital world around us. AI is becoming not only pervasive but, in many cases, invisible. The Consumer Technology Association describes it as the Consumerization of AI.

- Smart Tech for Commercial Vehicles: Just to reinforce what we at SMA have been saying for some time, it looks like connected, autonomous vehicles will have the most practical, real-world applications in commercial vehicles over the next few years. The options for autonomous public transportation vehicles continue to expand, and the use cases in controlled environments are many. Personal automobiles continue to add and enhance automated driver-assist systems (ADAS) features and advance up the autonomy levels. But the many challenges of autonomous personal vehicles on the open roads mean that, while the potential is tremendous, the reality is many years away.

CES2020: Big Themes for P&C Insurance

While 8K TVs are intriguing, many other tech products and advancements at CES2020 have important implications for P&C insurance. |