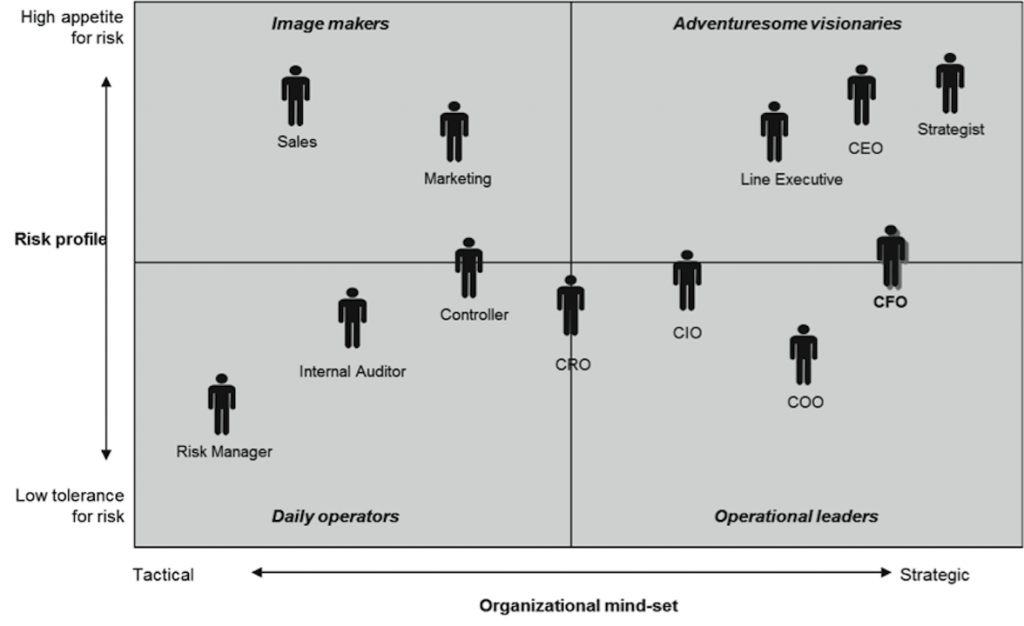

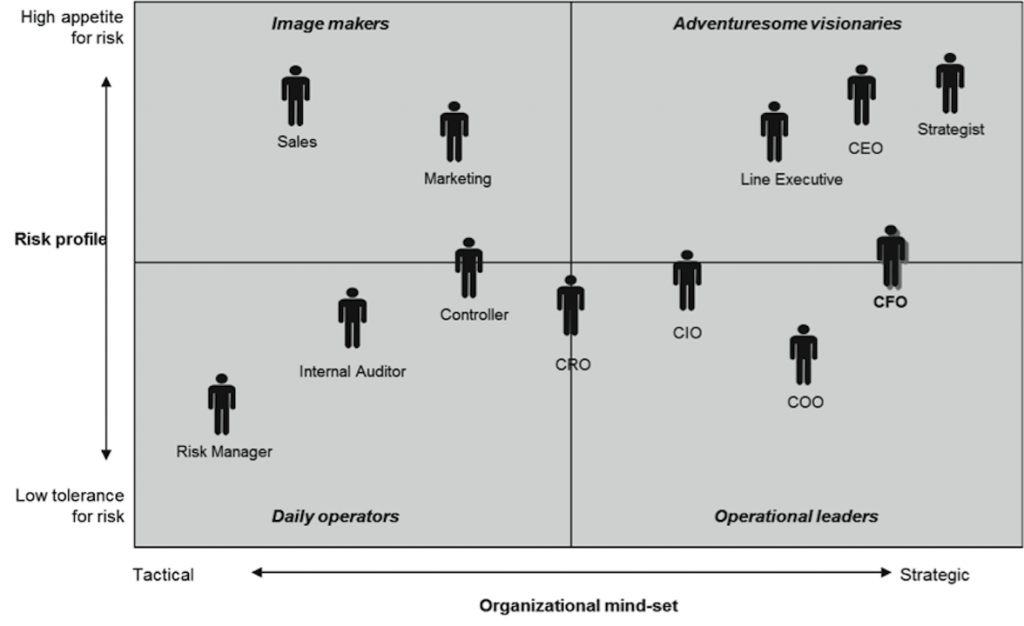

The chart above, from The Global CFO Study 2008: Balancing Risk and Performance Within an Integrated Finance Organization, reflects that risk managers, even chief risk officers, are perceived by chief financial officers as more tactical in mindset than strategic.

Never fear: Perceptions can be changed .

The chart above, from The Global CFO Study 2008: Balancing Risk and Performance Within an Integrated Finance Organization, reflects that risk managers, even chief risk officers, are perceived by chief financial officers as more tactical in mindset than strategic.

Never fear: Perceptions can be changed .

10 Building Blocks for Risk Leaders (Part 3)

Risk leaders must make themselves essential to others' successes, earning the kinds of points that count among the business' leaders.

The chart above, from The Global CFO Study 2008: Balancing Risk and Performance Within an Integrated Finance Organization, reflects that risk managers, even chief risk officers, are perceived by chief financial officers as more tactical in mindset than strategic.

Never fear: Perceptions can be changed .

The chart above, from The Global CFO Study 2008: Balancing Risk and Performance Within an Integrated Finance Organization, reflects that risk managers, even chief risk officers, are perceived by chief financial officers as more tactical in mindset than strategic.

Never fear: Perceptions can be changed .