At SpatialKey, we’ve identified a few key doubts (or apprehensions) that seem to be holding some insurers back from embracing the true value of insurtech. The term “insurtech” gets thrown around a lot, and with all the hype it becomes easy to start tuning it out and diluting its value.

So what does “insurtech” really mean?

I view insurtech as a collaborative movement where insurers and technologists partner to solve insurance-specific problems. Through this collaboration, insurers are able to reap the benefits of digital evolution and transformation (e.g. increased underwriting profitability, reduced claims costs, improved operational efficiencies). From blockchain to the internet of things (IOT) and transformative business models, insurtech can touch any piece of the business. But from a SpatialKey perspective, I’m talking about insurtech in the context of advanced data and analytics.

As a software provider that builds solutions specifically for insurers, Spatialkey has insurtech near and dear to its heart. We’ve been pioneering geospatial insurance analytics since 2011, and we've been collaborating with insurers and expert data providers to deliver value to the industry. We’re passionate about showing insurers what insurtech can do for them. Going beyond disruptive technology and data solutions, insurtech enables insurers to compete, innovate and realize new opportunities in an industry that is rapidly changing. Specifically, it solves some key data and analytics challenges, such as lack of value-added data, visual analytics and cross-team communication (as illustrated below).

Right now, insurers are being presented with the opportunity to embrace insurtech, to grow and innovate quickly through collaborative partnerships. Insurtech partnerships represent the new path forward and are poised to change how many insurers do business. This is all positive; however, it seems as though negative misconceptions arise when insurtech gets linked to “disruption.” “Disruption” is just an acknowledgement that technology is changing the industry. But because disruption carries a negative connotation, insurtech sometimes doesn’t get the positive vibes it deserves.

See also: Insurtechs Are Pushing for Transparency

Maybe you're still on the fence thinking, “I’m not sure insurtech is worth it” — worth the change, the hassle, the investment, whatever. Let’s address these doubts head-on and debunk some common insurtech misconceptions that could be holding you back:

Misconception 1: Insurtech is a bunch of hype.

Reality: Judging by the investment landscape alone, I feel confident that this movement has gone past hype.

Investment is happening by investors outside of insurance. Seeing VC firms such as General Catalyst, with interests that are typically outside of insurance, step up to invest in insurtech is a sign that this movement has traction.

From 2011 to 2017, VC funding for insurtech companies grew

31%. Between Series B and Series D funding,

$2 to $3 billion is being directed to insurtechs annually. And, as of April 2017, Venture Scanner is tracking 1,185 insurance technology companies in 14 categories across 60 countries, with a total of

$17.8 billion in funding.

Investors clearly see the value of insurtech as a catalyst to change how customers interact with insurance; a way to understand troves of data streaming in from important new sources like IOT, catastrophe data and more. Consumers expect

real-time claims and smart driving apps, smart home devices and even rewards for wearables. Why, then, should insurers themselves expect less from technology? It makes sense that what technology can do for their customers, insurtech can do for them.

And, with the global insurance technology spend expected to reach

$185 billion this year, it’s becoming evident that insurers themselves are actively pursuing investments in insurtech. Some large insurers and reinsurers are even creating units focused on identifying new investment opportunities to drive innovation to the benefit of the industry. Some also serve as incubators to get new companies off the ground.

As Stephen O’Hearn, global insurance leader at PwC, stated, “Insurtech will be a game changer for those who choose to embrace it.”

Insurtech isn’t just hype, it’s happening, and “good enough” is no longer, well, good enough. Whether you’re in underwriting, claims, exposure management — or you’re a CIO — insurtech will have an impact on you.

Misconception 2: Implementing insurtech is too costly.

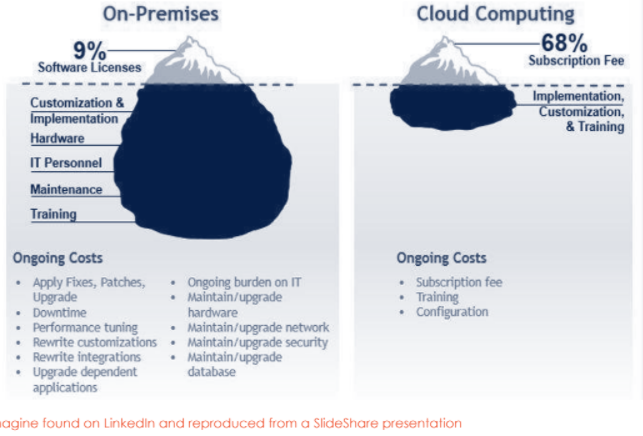

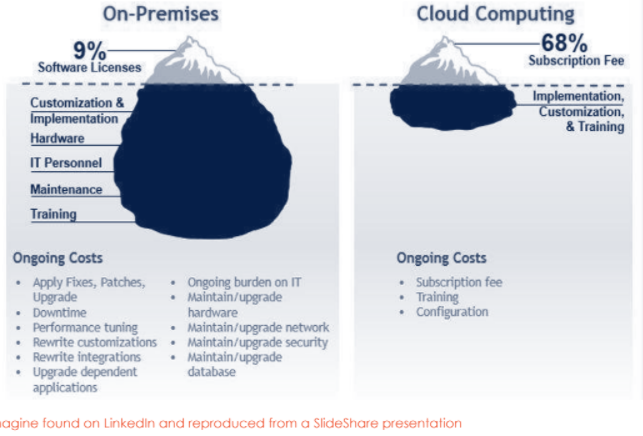

Reality: Cloud technology has made the implementation and maintenance affordable and has reduced (or eliminated) the need for IT support.

Insurers face so many challenges that it can be difficult to dedicate resources to insurtech. The business case for “good enough” can appear stronger than the case for change; change comes with preconceived resource and cost notions.

But, by not embracing change, insurers are stuck in limbo — with “good enough” legacy systems and practices that limit growth. In fact, in one survey,

81% of participants admitted their existing IT systems hinder innovation. Put simply, there’s a significant cost to inaction — to your ability to compete, to retain and attract new customers and to make better risk decisions. Furthermore, all of this could test the long-term relevance of your business.

While there’s a cost to inaction, there’s also the significant opportunity for cost reduction. A

2017 Accenture report, “The Cloud as Rainmaker,” states, “Without cloud’s capacity and firepower, digital does not happen. Nor does an 80% cost savings.”

The fact is, SaaS-based software via the Cloud has made implementation and maintenance a mole hill instead of a mountain (see illustration below). With SpatialKey, for example, there’s no need for IT support. Insurers can be up and running on an intuitive platform — gleaning deeper analytic insights with good data literally in hours.

Misconception 3: In this soft market, my bottom line is under siege, and realizing the upside of insurtech is long-term.

Reality: Insurers are, in fact, reaping the rewards of better analytics.

Misconception 3: In this soft market, my bottom line is under siege, and realizing the upside of insurtech is long-term.

Reality: Insurers are, in fact, reaping the rewards of better analytics.

Positive impacts of better risk decisions can be felt in the short term. A

2016 report from McKinsey & Company noted high-performing organizations were nearly twice as likely than their lower-performing peers to make advanced data and analytics accessible across their organizations. And high-performing organizations were twice as likely to employ self-serve analytics for their business users.

Furthermore, in a survey by West Monroe Partners, “Data Driven Insurance: Harness Disruption and Lead the Way,”

57% of insurers said they somewhat or strongly agree that their companies are fully realizing the benefits of advanced analytics. The most commonly cited benefits were increased customer experience (27%), reduced claims costs (21%) and increased sales (14%).

Harnessing the power of insurtech to aggregate data and improve analytic insights creates the potential for a healthier, more profitable book and competitive advantage. We’ve seen this with our own clients who have been able to more accurately assess risk in order to comfortably underwrite opportunities they otherwise may have passed on. For more on this topic, watch SpatialKey’s joint presentation with RLI Insurance from this year’s RAA event: “

Accelerating Quality Decisions with the Right Info, Right Now.”

See also: 5 Insurtech Trends for the Rest of 2017

Bottom line, all of these concerns are legitimate, and insurers are absolutely justified in questioning the value of something that has an impact on how they do business. The point of addressing these misconceptions is to prove that insurtech isn’t just buzz, it’s happening — it’s been happening — and it’s undoubtedly critical to staying competitive, relevant and profitable going forward.

But, in order to see any of these gains, insurtech must be viewed as a collaborative movement that helps us all win and moves the entire industry forward. And by “all,” that means commercial providers, too.

At SpatialKey, we know we can’t preach collaboration and not take a dose of our own medicine. It’s hypocritical to ask insurers to transform if, as solutions providers, we aren’t willing to do the same. Being a technology provider does not make SpatialKey immune from the need to digitally evolve; if anything, it’s infinitely more necessary that we always look to innovate. Our path is the same: collaboration. Collaborating with other experts — from technology to data providers — only makes us stronger. But, right now, there is unrealized potential to move the industry forward and deliver better, faster value to the industry as a whole.

As solutions providers, we, too, can do more, simply by embracing collaboration among each other.

To find out how collaboration leads to innovation, download: Mastering InsurTech with Smarter Collaboration.  Right now, insurers are being presented with the opportunity to embrace insurtech, to grow and innovate quickly through collaborative partnerships. Insurtech partnerships represent the new path forward and are poised to change how many insurers do business. This is all positive; however, it seems as though negative misconceptions arise when insurtech gets linked to “disruption.” “Disruption” is just an acknowledgement that technology is changing the industry. But because disruption carries a negative connotation, insurtech sometimes doesn’t get the positive vibes it deserves.

See also: Insurtechs Are Pushing for Transparency

Maybe you're still on the fence thinking, “I’m not sure insurtech is worth it” — worth the change, the hassle, the investment, whatever. Let’s address these doubts head-on and debunk some common insurtech misconceptions that could be holding you back:

Misconception 1: Insurtech is a bunch of hype.

Reality: Judging by the investment landscape alone, I feel confident that this movement has gone past hype.

Investment is happening by investors outside of insurance. Seeing VC firms such as General Catalyst, with interests that are typically outside of insurance, step up to invest in insurtech is a sign that this movement has traction.

From 2011 to 2017, VC funding for insurtech companies grew 31%. Between Series B and Series D funding, $2 to $3 billion is being directed to insurtechs annually. And, as of April 2017, Venture Scanner is tracking 1,185 insurance technology companies in 14 categories across 60 countries, with a total of $17.8 billion in funding.

Investors clearly see the value of insurtech as a catalyst to change how customers interact with insurance; a way to understand troves of data streaming in from important new sources like IOT, catastrophe data and more. Consumers expect real-time claims and smart driving apps, smart home devices and even rewards for wearables. Why, then, should insurers themselves expect less from technology? It makes sense that what technology can do for their customers, insurtech can do for them.

And, with the global insurance technology spend expected to reach $185 billion this year, it’s becoming evident that insurers themselves are actively pursuing investments in insurtech. Some large insurers and reinsurers are even creating units focused on identifying new investment opportunities to drive innovation to the benefit of the industry. Some also serve as incubators to get new companies off the ground.

As Stephen O’Hearn, global insurance leader at PwC, stated, “Insurtech will be a game changer for those who choose to embrace it.”

Insurtech isn’t just hype, it’s happening, and “good enough” is no longer, well, good enough. Whether you’re in underwriting, claims, exposure management — or you’re a CIO — insurtech will have an impact on you.

Misconception 2: Implementing insurtech is too costly.

Reality: Cloud technology has made the implementation and maintenance affordable and has reduced (or eliminated) the need for IT support.

Insurers face so many challenges that it can be difficult to dedicate resources to insurtech. The business case for “good enough” can appear stronger than the case for change; change comes with preconceived resource and cost notions.

But, by not embracing change, insurers are stuck in limbo — with “good enough” legacy systems and practices that limit growth. In fact, in one survey, 81% of participants admitted their existing IT systems hinder innovation. Put simply, there’s a significant cost to inaction — to your ability to compete, to retain and attract new customers and to make better risk decisions. Furthermore, all of this could test the long-term relevance of your business.

While there’s a cost to inaction, there’s also the significant opportunity for cost reduction. A 2017 Accenture report, “The Cloud as Rainmaker,” states, “Without cloud’s capacity and firepower, digital does not happen. Nor does an 80% cost savings.”

The fact is, SaaS-based software via the Cloud has made implementation and maintenance a mole hill instead of a mountain (see illustration below). With SpatialKey, for example, there’s no need for IT support. Insurers can be up and running on an intuitive platform — gleaning deeper analytic insights with good data literally in hours.

Right now, insurers are being presented with the opportunity to embrace insurtech, to grow and innovate quickly through collaborative partnerships. Insurtech partnerships represent the new path forward and are poised to change how many insurers do business. This is all positive; however, it seems as though negative misconceptions arise when insurtech gets linked to “disruption.” “Disruption” is just an acknowledgement that technology is changing the industry. But because disruption carries a negative connotation, insurtech sometimes doesn’t get the positive vibes it deserves.

See also: Insurtechs Are Pushing for Transparency

Maybe you're still on the fence thinking, “I’m not sure insurtech is worth it” — worth the change, the hassle, the investment, whatever. Let’s address these doubts head-on and debunk some common insurtech misconceptions that could be holding you back:

Misconception 1: Insurtech is a bunch of hype.

Reality: Judging by the investment landscape alone, I feel confident that this movement has gone past hype.

Investment is happening by investors outside of insurance. Seeing VC firms such as General Catalyst, with interests that are typically outside of insurance, step up to invest in insurtech is a sign that this movement has traction.

From 2011 to 2017, VC funding for insurtech companies grew 31%. Between Series B and Series D funding, $2 to $3 billion is being directed to insurtechs annually. And, as of April 2017, Venture Scanner is tracking 1,185 insurance technology companies in 14 categories across 60 countries, with a total of $17.8 billion in funding.

Investors clearly see the value of insurtech as a catalyst to change how customers interact with insurance; a way to understand troves of data streaming in from important new sources like IOT, catastrophe data and more. Consumers expect real-time claims and smart driving apps, smart home devices and even rewards for wearables. Why, then, should insurers themselves expect less from technology? It makes sense that what technology can do for their customers, insurtech can do for them.

And, with the global insurance technology spend expected to reach $185 billion this year, it’s becoming evident that insurers themselves are actively pursuing investments in insurtech. Some large insurers and reinsurers are even creating units focused on identifying new investment opportunities to drive innovation to the benefit of the industry. Some also serve as incubators to get new companies off the ground.

As Stephen O’Hearn, global insurance leader at PwC, stated, “Insurtech will be a game changer for those who choose to embrace it.”

Insurtech isn’t just hype, it’s happening, and “good enough” is no longer, well, good enough. Whether you’re in underwriting, claims, exposure management — or you’re a CIO — insurtech will have an impact on you.

Misconception 2: Implementing insurtech is too costly.

Reality: Cloud technology has made the implementation and maintenance affordable and has reduced (or eliminated) the need for IT support.

Insurers face so many challenges that it can be difficult to dedicate resources to insurtech. The business case for “good enough” can appear stronger than the case for change; change comes with preconceived resource and cost notions.

But, by not embracing change, insurers are stuck in limbo — with “good enough” legacy systems and practices that limit growth. In fact, in one survey, 81% of participants admitted their existing IT systems hinder innovation. Put simply, there’s a significant cost to inaction — to your ability to compete, to retain and attract new customers and to make better risk decisions. Furthermore, all of this could test the long-term relevance of your business.

While there’s a cost to inaction, there’s also the significant opportunity for cost reduction. A 2017 Accenture report, “The Cloud as Rainmaker,” states, “Without cloud’s capacity and firepower, digital does not happen. Nor does an 80% cost savings.”

The fact is, SaaS-based software via the Cloud has made implementation and maintenance a mole hill instead of a mountain (see illustration below). With SpatialKey, for example, there’s no need for IT support. Insurers can be up and running on an intuitive platform — gleaning deeper analytic insights with good data literally in hours.

Misconception 3: In this soft market, my bottom line is under siege, and realizing the upside of insurtech is long-term.

Reality: Insurers are, in fact, reaping the rewards of better analytics.

Positive impacts of better risk decisions can be felt in the short term. A 2016 report from McKinsey & Company noted high-performing organizations were nearly twice as likely than their lower-performing peers to make advanced data and analytics accessible across their organizations. And high-performing organizations were twice as likely to employ self-serve analytics for their business users.

Misconception 3: In this soft market, my bottom line is under siege, and realizing the upside of insurtech is long-term.

Reality: Insurers are, in fact, reaping the rewards of better analytics.

Positive impacts of better risk decisions can be felt in the short term. A 2016 report from McKinsey & Company noted high-performing organizations were nearly twice as likely than their lower-performing peers to make advanced data and analytics accessible across their organizations. And high-performing organizations were twice as likely to employ self-serve analytics for their business users.

Furthermore, in a survey by West Monroe Partners, “Data Driven Insurance: Harness Disruption and Lead the Way,” 57% of insurers said they somewhat or strongly agree that their companies are fully realizing the benefits of advanced analytics. The most commonly cited benefits were increased customer experience (27%), reduced claims costs (21%) and increased sales (14%).

Harnessing the power of insurtech to aggregate data and improve analytic insights creates the potential for a healthier, more profitable book and competitive advantage. We’ve seen this with our own clients who have been able to more accurately assess risk in order to comfortably underwrite opportunities they otherwise may have passed on. For more on this topic, watch SpatialKey’s joint presentation with RLI Insurance from this year’s RAA event: “Accelerating Quality Decisions with the Right Info, Right Now.”

See also: 5 Insurtech Trends for the Rest of 2017

Bottom line, all of these concerns are legitimate, and insurers are absolutely justified in questioning the value of something that has an impact on how they do business. The point of addressing these misconceptions is to prove that insurtech isn’t just buzz, it’s happening — it’s been happening — and it’s undoubtedly critical to staying competitive, relevant and profitable going forward.

But, in order to see any of these gains, insurtech must be viewed as a collaborative movement that helps us all win and moves the entire industry forward. And by “all,” that means commercial providers, too.

At SpatialKey, we know we can’t preach collaboration and not take a dose of our own medicine. It’s hypocritical to ask insurers to transform if, as solutions providers, we aren’t willing to do the same. Being a technology provider does not make SpatialKey immune from the need to digitally evolve; if anything, it’s infinitely more necessary that we always look to innovate. Our path is the same: collaboration. Collaborating with other experts — from technology to data providers — only makes us stronger. But, right now, there is unrealized potential to move the industry forward and deliver better, faster value to the industry as a whole.

As solutions providers, we, too, can do more, simply by embracing collaboration among each other.

To find out how collaboration leads to innovation, download: Mastering InsurTech with Smarter Collaboration.

Furthermore, in a survey by West Monroe Partners, “Data Driven Insurance: Harness Disruption and Lead the Way,” 57% of insurers said they somewhat or strongly agree that their companies are fully realizing the benefits of advanced analytics. The most commonly cited benefits were increased customer experience (27%), reduced claims costs (21%) and increased sales (14%).

Harnessing the power of insurtech to aggregate data and improve analytic insights creates the potential for a healthier, more profitable book and competitive advantage. We’ve seen this with our own clients who have been able to more accurately assess risk in order to comfortably underwrite opportunities they otherwise may have passed on. For more on this topic, watch SpatialKey’s joint presentation with RLI Insurance from this year’s RAA event: “Accelerating Quality Decisions with the Right Info, Right Now.”

See also: 5 Insurtech Trends for the Rest of 2017

Bottom line, all of these concerns are legitimate, and insurers are absolutely justified in questioning the value of something that has an impact on how they do business. The point of addressing these misconceptions is to prove that insurtech isn’t just buzz, it’s happening — it’s been happening — and it’s undoubtedly critical to staying competitive, relevant and profitable going forward.

But, in order to see any of these gains, insurtech must be viewed as a collaborative movement that helps us all win and moves the entire industry forward. And by “all,” that means commercial providers, too.

At SpatialKey, we know we can’t preach collaboration and not take a dose of our own medicine. It’s hypocritical to ask insurers to transform if, as solutions providers, we aren’t willing to do the same. Being a technology provider does not make SpatialKey immune from the need to digitally evolve; if anything, it’s infinitely more necessary that we always look to innovate. Our path is the same: collaboration. Collaborating with other experts — from technology to data providers — only makes us stronger. But, right now, there is unrealized potential to move the industry forward and deliver better, faster value to the industry as a whole.

As solutions providers, we, too, can do more, simply by embracing collaboration among each other.

To find out how collaboration leads to innovation, download: Mastering InsurTech with Smarter Collaboration.