It's no longer a question of whether insurers should prepare for the Internet of Things (IoT), but when and how to do so. Connected cars and homes are already here, with Ford's CEO predicting driverless cars on the road by 2020 (the same year that Toyota plans to launch its driverless car).

But preparing for the IoT isn't just about adapting existing business models or launching new services. It's an opportunity to innovate and develop new business models, ways of working and ways to understand risk. It's a chance to better connect with customers, to reinvent the claims process and to become an integral part of people's lives.

Keys to success in the IoT

Accenture has identified five keys to success for insurers to capitalize on IoT opportunities. This week, I'll look at two of them:

- Choose the role you intend to play. Accenture's Technology Vision for Insurance 2015 identified the need for insurers to become part of a digital ecosystem. Insurers must consider how they will collaborate with their ecosystem partners, and whether they will play a leading or supporting role. Either way, how will they administer the claims that result from the ecosystem and its partners? Further, insurers may need to tailor their approach for each market, business or region-and must bear in mind that, no matter what, they must offer a differentiated customer experience that delivers more than just claims administration.

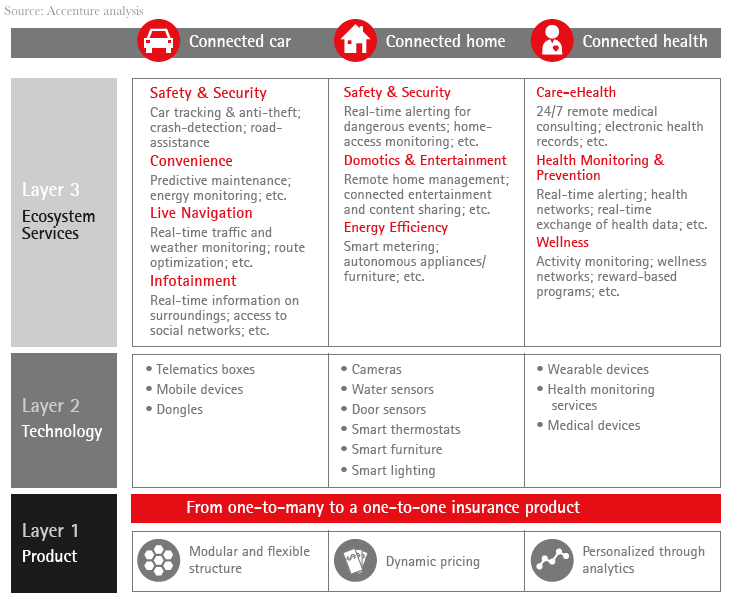

- Adopt a three-layer model for claims. The IoT demands a shift from one-to-many (one experience for many customers) to one-to-one (personalized service, delivered at scale), and a three-layer model can help insurers achieve this. As shown below, it's based on a foundation of product, upon which is layered technology and then service. Together, the layers enable insurers to offer a customer experience characterized by convenience and seamlessness-which should be cornerstones of the overall experience, and especially the claims experience. For claims leaders, the three-layer model presents opportunities to leverage new forms of technology for a more nuanced understanding of risk and liability. For example, a car accident involving a connected car can provide precise data about speed, direction and driving conditions. Claims leaders should also consider how they can plug into the extended services that are part of the three-layer model. How can they work with lifestyle partners within an ecosystem to ensure that claims can be administered effectively and efficiently?

That's some food for thought in the holiday season. I wish you a safe and happy holiday season and look forward to wrapping up this blog series in the new year. I'll be back in January to share three more keys to success for insurers in the IoT.