Small changes can sometimes have a big impact. This is particularly true in the realm of behavioral economics. At its core, behavioral economics (BE) challenge the traditional economic theory that individuals are sound and rational (“slow”) thinkers, by asserting that we instead rely more on heuristics -- or mental shortcuts -- to make quick judgments. Using comprehensive experiments, BE allows us to test ways to encourage individuals to “slow down” this fast processing through simple redesign and rewording.

When BE techniques are applied to insurance applications, small changes in the way that questions are designed and worded can lead to more thoughtful completion by the individual. This, in turn, encourages an increased disclosure of medical conditions, resulting in a more comprehensive view of the individual’s health. Ultimately, this additional information and clarity can help the underwriting process, mortality and morbidity results and company profitability.

Gen Re was at the forefront of this research for the insurance industry, conducting a BE study related to individual life insurance applications in 2016. This study successfully determined several BE approaches to enhance an application and increase disclosure rates simply through changes in question design and layout.

Traditionally, the insurance industry has relied on a more tried-and-true approach to application design. For individual life, companies widely use standardized application questions relating to medical conditions.

See also: Making Life Insurance Personal

In 2018, Gen Re set up a new BE experiment to take another look at designs from the 2016 study and to assess the effectiveness of a standardized question design in encouraging medical condition disclosure. This study used standard questions as a control group, testing them against various “treatments,” or different ways of designing the application questions. A sampling of U.S. residents, ages 30-60, was asked to complete online life insurance application questions. Close to 2,500 online applications were completed. Overall, six different question designs (treatments) were tested across 12 medical conditions. The objectives of the study were:

-

- Primary: Understand how we can apply insights from behavioral science to increase an applicant’s disclosure level for insurance

- Secondary: Determine how long it takes an applicant to complete the various treatments, so we can better assess answers to the question, “What is the best combination of time and experience of completing, versus understanding and overload?”

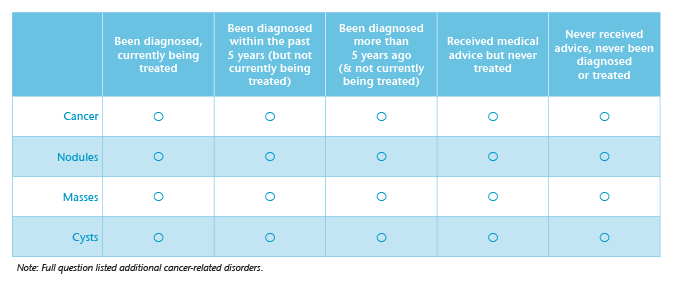

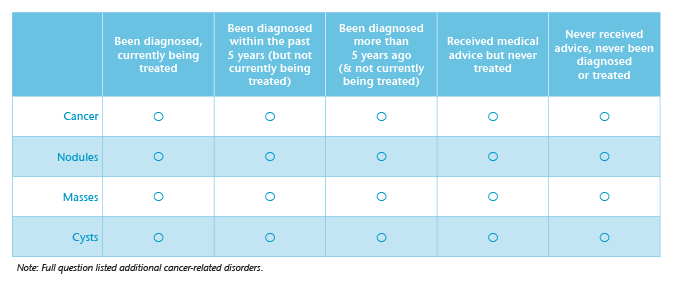

The results strongly supported what was found to be most effective in Gen Re’s 2016 BE study: a five-point scale question design (see Exhibit A). The multiple-choice options on the five-point scale prompt respondents to think about each medical condition, increasing their chance of remembering whether they have ever been diagnosed. Moreover, the clear definitions for each option eliminate the uncertainty respondents may have about whether they qualify as “having” the medical condition.

Exhibit A: 5-Point Scale

Have you ever been diagnosed, treated, tested positive for or been given medical advice by a member of the medical profession for a disease or disorder such as:

In comparison, the standardized questions used as the control group were open-ended and asked individuals whether they had ever been diagnosed, treated, tested positive for or been given advice by a member of the medical profession for a particular medical condition (for example, “Any cancer, tumor, cyst or nodule” for cancer-related conditions). This may require a level of medical knowledge beyond what can reasonably be expected of someone who is not a medical professional and can create some uncertainty or difficulty in recollection for individuals completing the application.

In addition, although the five-point-scale questions were one of the longest in terms of respondent time to complete -- averaging almost eight minutes - condition disclosure increased by four to eight times over the standardized (control) questions.

The standardized question format was the shortest for respondents to complete, averaging just 2.34 minutes, yet it was found to be the least effective question design in terms of increasing medical condition disclosure.

See also: Digital Distribution in Life Insurance

By implementing a new design framework, insurance carriers can improve not only the clarity of the application questions but also the level of information that is disclosed by applicants. While companies have much to consider when making changes to their applications, the results of Gen Re’s BE experiments show that small changes can have a big impact.

In addition to our leading behavioral economics research, Gen Re also conducts numerous studies that benefit the U.S. Group and Individual Life/Health insurance industry. Our wide variety of industry studies, and our MarketChecks on key topics of interest, keep us at the forefront of insurance research.

If you are interested in learning more about our research capabilities,

contact me.

You can find the article originally published here.

Reprinted with permission from Gen Re. ©2019 General Re Life Corporation In comparison, the standardized questions used as the control group were open-ended and asked individuals whether they had ever been diagnosed, treated, tested positive for or been given advice by a member of the medical profession for a particular medical condition (for example, “Any cancer, tumor, cyst or nodule” for cancer-related conditions). This may require a level of medical knowledge beyond what can reasonably be expected of someone who is not a medical professional and can create some uncertainty or difficulty in recollection for individuals completing the application.

In addition, although the five-point-scale questions were one of the longest in terms of respondent time to complete -- averaging almost eight minutes - condition disclosure increased by four to eight times over the standardized (control) questions.

The standardized question format was the shortest for respondents to complete, averaging just 2.34 minutes, yet it was found to be the least effective question design in terms of increasing medical condition disclosure.

See also: Digital Distribution in Life Insurance

By implementing a new design framework, insurance carriers can improve not only the clarity of the application questions but also the level of information that is disclosed by applicants. While companies have much to consider when making changes to their applications, the results of Gen Re’s BE experiments show that small changes can have a big impact.

In addition to our leading behavioral economics research, Gen Re also conducts numerous studies that benefit the U.S. Group and Individual Life/Health insurance industry. Our wide variety of industry studies, and our MarketChecks on key topics of interest, keep us at the forefront of insurance research.

If you are interested in learning more about our research capabilities, contact me.

You can find the article originally published here.

Reprinted with permission from Gen Re. ©2019 General Re Life Corporation

In comparison, the standardized questions used as the control group were open-ended and asked individuals whether they had ever been diagnosed, treated, tested positive for or been given advice by a member of the medical profession for a particular medical condition (for example, “Any cancer, tumor, cyst or nodule” for cancer-related conditions). This may require a level of medical knowledge beyond what can reasonably be expected of someone who is not a medical professional and can create some uncertainty or difficulty in recollection for individuals completing the application.

In addition, although the five-point-scale questions were one of the longest in terms of respondent time to complete -- averaging almost eight minutes - condition disclosure increased by four to eight times over the standardized (control) questions.

The standardized question format was the shortest for respondents to complete, averaging just 2.34 minutes, yet it was found to be the least effective question design in terms of increasing medical condition disclosure.

See also: Digital Distribution in Life Insurance

By implementing a new design framework, insurance carriers can improve not only the clarity of the application questions but also the level of information that is disclosed by applicants. While companies have much to consider when making changes to their applications, the results of Gen Re’s BE experiments show that small changes can have a big impact.

In addition to our leading behavioral economics research, Gen Re also conducts numerous studies that benefit the U.S. Group and Individual Life/Health insurance industry. Our wide variety of industry studies, and our MarketChecks on key topics of interest, keep us at the forefront of insurance research.

If you are interested in learning more about our research capabilities, contact me.

You can find the article originally published here.

Reprinted with permission from Gen Re. ©2019 General Re Life Corporation