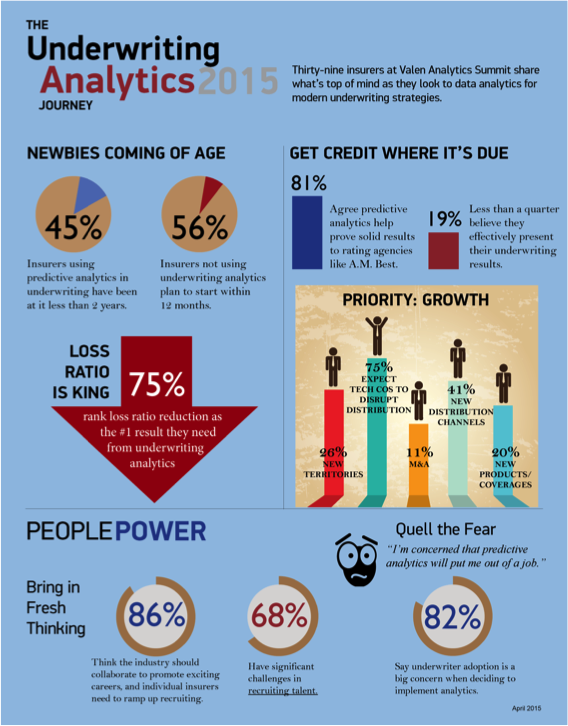

There's little doubt about the proven value in using predictive analytics for risk selection and pricing in P/C insurance. In fact, 56% of insurers at this year's Valen Analytics Summit that are not currently using predictive analytics in underwriting plan to start within a year. However, many insurers haven't spent enough energy planning exactly how they can implement analytics to get the results they want. It's a common misconception that competitive advantage is won by simply picking the right model.

In reality, the model itself is just a small part of a much larger process that touches nearly every part of the insurance organization. Embracing predictive analytics is like recruiting a star quarterback; alone, he's not enough to guarantee a win. He both requires a solid team and a good playbook to achieve his full potential.

The economic crash of 2008 emphasized the importance of predictive modeling as a means to replace dwindling investment income with underwriting gains. However, insurance companies today are looking at a more diverse and segmented market than pre-2008, which makes the "old way of doing things" no longer applicable. The insurance industry is increasing in complexity, and with so many insurers successfully implementing predictive analytics, greater precision in underwriting is becoming the "new normal." In fact, a recent A.M. Best study shows that P/C insurers are facing more aggressive pricing competition than any other insurance sector.

Additionally, new competitors like Google, which have deep reservoirs of data and an established rapport and trust with the Millennial generation, means that traditional insurers must react to technologies faster than ever. Implementing predictive analytics is the logical place to start.

The most important first step in predictive modeling is making sure all relevant stakeholders understand the business goals and organizational commitment. The number one cause of failure in predictive modeling initiatives isn't a technical or data problem, but instead a lack of clarity on the business objective combined with a defect in the implementation plan (or lack thereof).

ASSESSMENT OF ORGANIZATIONAL READINESS

If internal conversations are focused solely on the technical details of building and implementing a predictive model, it's important to take a step back and make sure there's support and awareness across the organization.

Senior-Level Commitment - Decide on the metrics that management will use to measure the impact of the model. What problems are you trying to solve, and how will you define success? Common choices include loss ratio improvement, pricing competitiveness and top-line premium growth. Consider the risk appetite for this initiative and the assumptions and sensitivities in your model that could affect projected results.

Organizational Buy-In - What kind of predictive model will work for your culture? Will this be a tool to aid in the underwriting process or part of a system to automate straight-through processing? Consider the level of transparency appropriate for the predictive model. It's usually best to avoid making the model a "black box" if underwriters need to be able to interact with model scores on their way to making the final decisions on a policy.

Data Assets - Does your organization plan to build a predictive model internally, with a consultant or a vendor that builds predictive models on industry-wide data? How will you evaluate the amount of data you need to build a predictive model, and what external data sources do you plan to use in addition to your internal data? Are there resources available on the data side to provide support to the modeling team?

MODEL IMPLEMENTATION,/p>

After getting buy-in from around the organization, the next step is to lay out how you intend to achieve your business goals. If it can be measured, it can be managed. This step is necessary to gauge the success or failure post-implementation. Once you've set the goals for assessment, business and IT executives should convene and detail a plan for implementation, including responsibilities and a rollout timeline.

Unless you're lucky enough to work with an entire group of like-minded individuals, this step must be taken with all players involved, including underwriting, actuarial, training and executive roles. Once you've identified the business case and produced the model and implementation plan, make sure all expected results are matched up with the planned deliverables. Once everything is up and running, it is imperative to monitor the adoption in real-time to ensure that the results are matching the initial model goals put in place.,/p>

UNDERWRITING TRAINING

A very important but often overlooked step is making sure that underwriters understand why the model is being implemented, what the desired outcomes are and what their role is in implementing it. If the information is presented correctly, underwriters understand that predictive modeling is a tool that can improve their pricing and risk selection as opposed to undermining the underwriters. But there are still some who rely solely on their own experience and knowledge who may feel threatened by a data-driven underwriting process. In fact, nearly half of the attending carriers at the 2015 Valen Summit cited lack of underwriting adoption as one of the primary risks in a predictive analytics initiative.

Insurers that have found the most success with predictive modeling are those that create a specific set of underwriting rules and showcase how predictive analytics are another tool to enhance their performance, rather than something that will replace them entirely. Not stressing this point can result in resistance from underwriters, and it is essential to have their buy-in. At the same time, it is also important to monitor the implementation of underwriting guidelines, ensuring that they are being followed appropriately.

KEEPING THE END IN MIND,/p>

Many of the challenges and complexities in the P/C marketplace are out of an individual insurer's control. One of the few things insurers can control is their use of predictive modeling to know what they insure. It's one of the best ways an insurer is able to protect its business from new competitors and maintain consistent profit margins.

Using data and analytics to evaluate your options allows you to test and learn, select the best approach and deliver results that make the greatest strategic impact.

While beginning a predictive analytics journey can be difficult and confusing at first glance, following these best practices will increase your chances of getting it right on the first try and ensuring your business goals will be met.