Today’s world is confusing, replete with mixed and conflicting signals. Reports of low unemployment and high inflation have muddied forecasting for a recovery or a looming recession and leaves us unsure of what to expect: traditional economic cycles or permanent change. Either way, such signals foster uncertainty and test our objectivity on a daily and even hourly basis.

The P&C insurance market is displaying its own mixed signals, making it difficult for insurance business leaders to plan and adjust, not to mention the tremendous disruption to agents and customers. Large and persistent rate increases contrast with the most recent improvements in combined ratios and net income. Tighter underwriting actions and lack of insurance availability is creating challenges in navigating the complex landscape by all stakeholders.

See also: How to Respond at Inflection Points

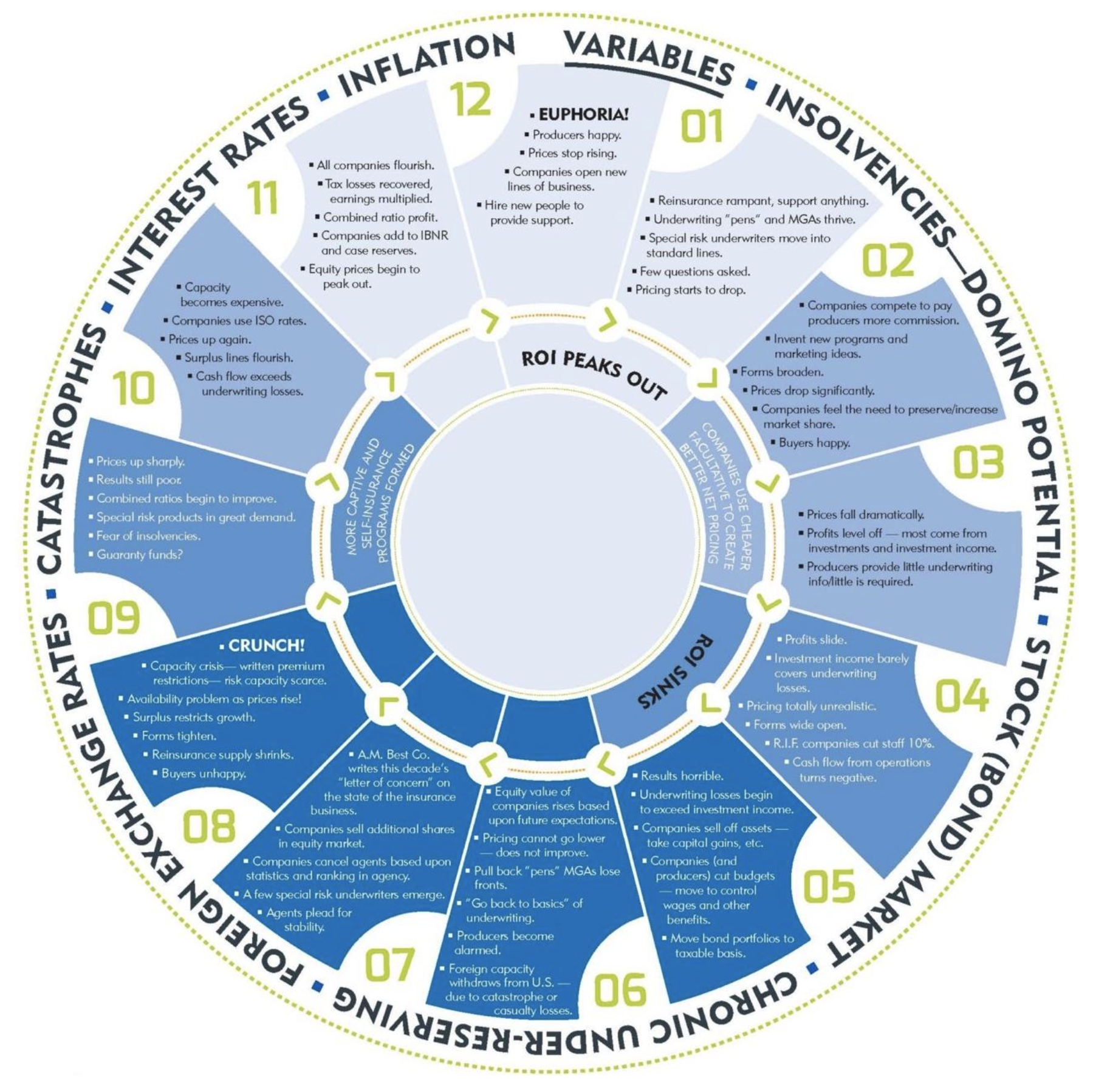

The Insurance Clock

Back to the question: cycle or permanent change? Despite P&C’s desired state of steady, profitable growth, the reality is a constant tension and cycle of writing new business followed by turning the dials for profitability. In just the last 25 years, major shockwaves from 9/11 terror attacks, wars and the housing and financial market collapse have tested industry cycles, yet the clock still ticks ahead, perhaps with more elongated recoveries after these shockwaves.

The Insurance Clock best illustrates these cycles and was introduced by Paul Ingrey, former Arch Capital Group director and board chairman, and still applies today. It is a sophisticated view beyond the simplified hard market, soft market labels. For instance:

- At 1 o’clock, “ROI Peaks Out” with few questions asked and falling prices. This feels like pre-pandemic conditions.

- At 4 o’clock, “ROI Sinks,” with horrible results and underwriting losses exceeding investment income. Perhaps this was 2022-23.

- From 7 to 10 o’clock, prices are up sharply, and capacity becomes expensive, which fits squarely with today’s market scenario.

- Finally, from 11 to 12 o’clock, there is combined ratio profit leading to Euphoria at the very top of the dial. Hiring, happy producers, prices stop rising.

Source: Paul Ingrey, Arch Capital, 1985

Underlying this turbulence is the age-old question: Is this simply a cycle, or are we witnessing lasting changes driven by new technologies, altered consumer expectations, post-pandemic inflation and weather changes? To understand the current state of the P&C insurance market, it is necessary to delve into these key factors.

Rate Increases

One of the most noticeable trends in the P&C insurance market has been the steady increase in insurance rates. The drivers behind these rate increases are multifaceted. Post-pandemic inflation has led to higher costs across the board, from materials to labor. Additionally, the frequency and severity of natural disasters and extreme weather events have been on the rise, leading to increased claims payouts. Insurers are responding by adjusting their pricing models to reflect these new realities, which has resulted in higher premiums for policyholders.

Emerging and growing cost factors are real and may not yet be fully reflected in today’s rates. Namely, social inflation, nuclear verdicts, aging drivers and related auto injury costs, new car technology and repair/replacement costs and auto repair technician shortages are obscured by the two obvious culprits: inflation and weather losses.

Positive Insurer Profitability Picture

Despite these challenges, several insurers are beginning to see positive signals in profitability, particularly looking at Q4 of 2023. This improvement can be attributed to several factors, namely higher rates and fewer storms during the end of 2023. Additionally, more rigorous underwriting standards are leading to healthier books of business.

Net income and combined ratios among several leading carriers are making what looks to be an impressive rebound, with Progressive, Chubb, Travelers and GEICO among the most vibrant, to name a few. Progressive’s most recent combined ratio dropped to 87.3. Allstate’s combined ratio for homeowners’ insurance during Q4 was down 30.8 points to 62, and their auto line fell to 98.9 in Q4. Allstate CEO Tom Wilson said “improved auto profitability and mild weather” drove the fourth quarter turnaround. However, “rate increases will continue to be implemented to keep pace with loss trends and improve margins in states where we have not yet achieved rate adequacy.”

The improving profitability picture in Q4 2023 is a welcome development for insurers, as it indicates that efforts to adapt to changing market conditions are bearing fruit. However, it remains to be seen whether this trend will continue in the face of inflation and weather wild cards.

See also: 5 Key Mistakes in Long-Term Planning

Lack of Insurance Availability

Insurers are becoming more selective about the risks they underwrite, creating a lack of insurance availability in high-risk regions, leaving homeowners and businesses vulnerable. Higher deductibles, less coverage, push toward wind pools and flat participation in NFIP’s flood insurance program despite more flooding is becoming the norm. The widening protection gap, underinsured and uninsured are highly concerning and defy the risk-transfer proposition of insurance.

The lack of insurance availability is a complex issue with no easy solutions. Insurers are caught between the need to manage their risk exposure and the desire to provide coverage to those in need. Finding the right balance between is crucial to ensuring the long-term sustainability of the insurance market.

Recurring Cycle or Permanent Change?

According to the Insurance Clock, there is little need for panic, in fact, good reason for optimism. Although one might interpret the return of a stable market not so far away, just two to three hours, according to the clock, that does not seem remotely possible. Yes, raising rates has always served as the ultimate relief valve and the fastest way to recovery. Bolt on some re-underwriting actions, and the combination becomes the fixer of all underpriced or unfavorable risk selections. Once rates become adequate, risk appetite increases, and carriers revert to a growth mindset in what compares to financial yoyo dieting. At least, this is how it has worked in the past.

Things are different now as inflation is proving persistent and as catastrophic weather exposure is accepted as here to stay -- more frequent and more severe. Certainly, things are vastly different from 1985 when the Insurance Clock was invented. Still, there are continuing shockwaves from COVID-19, which reshaped the economy and changed the workforce in terms of participation and shortages. Population migration to CAT-exposed Southern states and away from cities like San Francisco and New York are shifting exposure in real time. Changing social attitudes and risks are happening at a quicker pace. Massive rate increases and pull-out from markets and whole states is widespread. Although it is difficult to forecast all future COVID-related impacts, those identified are more pronounced and longer-lasting, bringing the cycle into question.

Arguably the most significant changes since the Insurance Clock was introduced in 1985 are those resulting from new technologies. These include: cell phones, World Wide Web, notebook computers, the personal digital assistant, VOIP, Amazon, eBay, WebEx, WiFi, Google, Blackberry, Bluetooth, Apple iPod, Wikipedia, wireless internet, application programming interfaces (APIs), wireless high-speed internet access, Facebook, YouTube, Twitter, social media, Apple iPhone, Apple iPad, Skype video conferencing, tablet computers, Amazon Echo, VR headsets, facial recognition, IoT, AI, 5G, cloud computing, blockchain, quantum computing, virtual meeting software and virtual hybrid events. The combined impact of these advances is unprecedented in how deeply and widely it has permanently changed almost every aspect of the insurance industry, leaving one to consider how new technology might ballast current trends or how much worse would today’s results be without all these advances.

We believe that the traditional insurance cycle is no longer as relevant as it once was, primarily because underlying market conditions have permanently changed – and will continue to change. In this environment, insurance leaders must become more entrepreneurial, encourage and embrace innovation and reshape their organizational cultures to be the same.

Carriers should seek to develop strategic partnerships and alliances with more nimble technology-enabled partners. Recruiting, hiring, training and upskilling strategies should be revisited to ensure appropriate alignment of required skills today and tomorrow. And diversification of product and even business focus could be appropriate as a means of spreading the risks presented by changing and unpredictable future conditions.