The pandemic reimagined work, and organizations were swift to adapt digital technologies and embrace a remote work model. This not only enabled flexibility for employees but allowed employers to tap a borderless workforce. With the pandemic in the rearview mirror, as organizations navigate the shift from remote work to return-to-office (RTO) or a hybrid work model, the focus is on innovative approaches to providing incentives to the workforce.

This includes focusing on group benefits and how data and AI can play a pivotal role in providing value-based care.

Why employers need to focus on group benefits

Employees face myriad stressors such as isolated or remote work environments, rising inflation and social pressures. There is no finite line separating personal priorities from work responsibilities, and stress related to caregiving, finances, untenable workloads, etc. can accumulate. With increased focus on RTO, employers need to provide benefits that are personalized, to alleviate stress, and affordable, to attract and retain the talent.

See also: Survey Data Is Your Secret Weapon

How to personalize group benefits

Employers need to take a holistic view of wellness and demonstrate care while designing the plan for employees. Employers should use pulse surveys, benefits discussions, healthcare literacy townhalls, etc. to make sure benefits have a meaningful impact and broad utilization.

Factors such as high healthcare costs, diversified care needs, preferences and outcomes should drive organizations toward value-based care.

Role of data and AI in group benefits

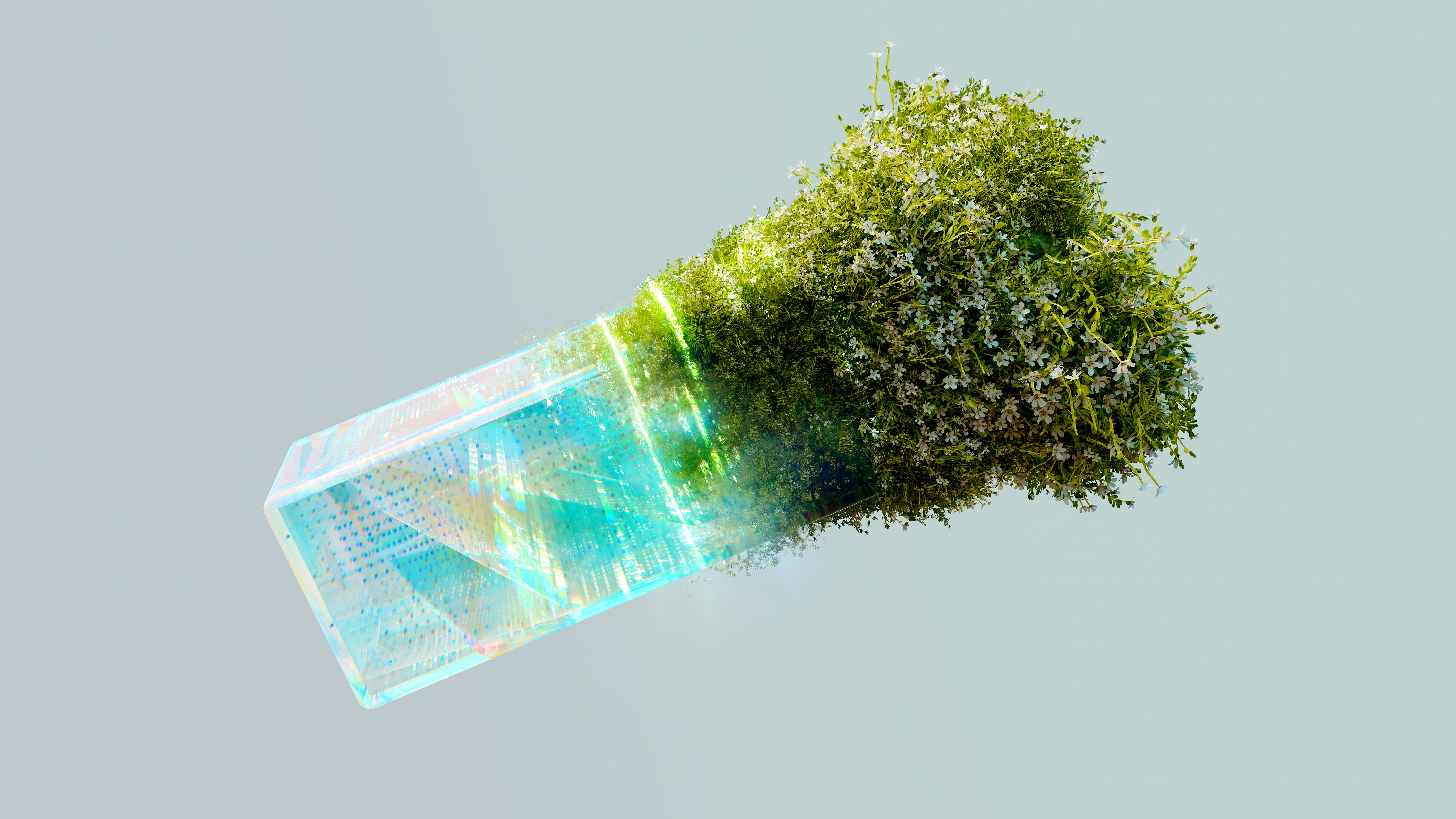

Data and AI hold the key to delivering personalized, value-based care while reducing costs, accelerating diagnostics, providing recommendations for treatment plans, speeding recovery and improving wellbeing. Here are some approaches:

Virtual Benefits Adviser - This is a digital twin illustrating to employees the value of the benefits they select, how they work and how to maximize their use based on the employees' needs. The adviser can also serve as a guide to improve health through its well-being score and insights.

AI-Driven Employee Assistance Program (EAP) - Mental health is a focal point in employee wellbeing, and an effective program requires access to a tailored provider network. AI and machine learning can match patients with providers based on treatment sought, demographics, social determinants of health (SDOH), member preferences, etc.

AI-Driven Claims to Improve Provider Experience - Delay in payment to providers is one of the sticking points that can drive quality providers out of a network. Delays are primarily due to manual processing of treatment plans, procedures, bills, etc. and lack of adoption of unstructured or semi-structured data. Delays can be addressed by leveraging AI to process radiographs/X-rays, charting, etc. and improve adjudication of expenses.

Predictive Analytics - They can be used to monitor the treatment patterns of participating provider and identify instances to see if usage of procedures goes above the norm in a peer group.

Wearables for Workplace Safety - Workplace injuries such as overexertion, slips and trips and falls contribute significantly to lost time. Wearables can supplement workers' physical capabilities and speed an injured worker’s return to work. Also, data associated with the wearables can help to detect hazardous conditions, measure the posture and lifting techniques of the worker and thereby prevent future injuries.

See also: 6 Words to Focus Your AI Innovation Strategy

Way forward

Data and AI can function as a personalized fitness coach and virtual care provider, while aiding in recovery/rehabilitation and improving overall wellbeing.