In 1983, Microsoft Word was introduced. It wasn’t the first word processor, and it isn’t the only word processor, but it quickly became a standard — a “given.” From a productivity standpoint, the first adopters of word processing certainly had advantages over the alternatives (typewriters and ball point pens). Today, however, we all use Word and Excel and Outlook. Your only advantage may be in how quickly you can type or speak into your device.

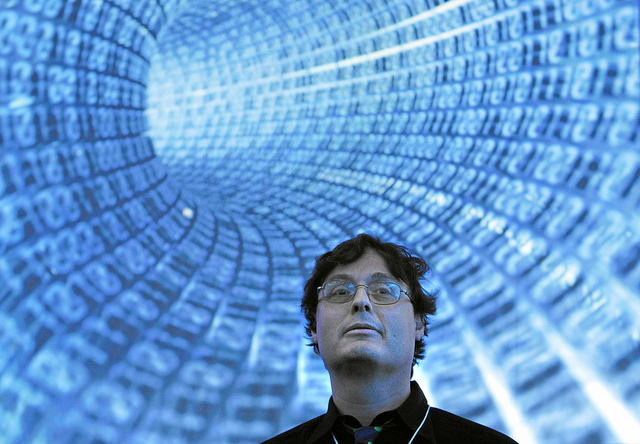

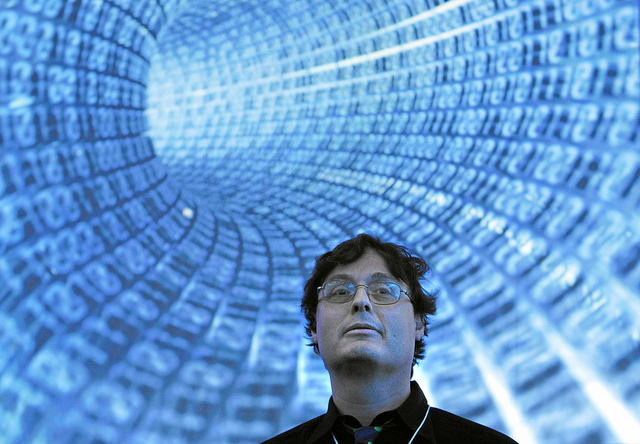

This is not unlike what is happening in the world of data. Data availability has become ubiquitous. Not only has data become freely available, but data analysis through tools, consolidators and rating companies has become freely available, as well. When everyone has access to the same information at the same time, that’s data symmetry.

In

Part 1 of our data symmetry blog, we followed the quickly shifting trends from asymmetrical data availability to a market filled with data symmetry. We illustrated how data symmetry is rapidly changing the idea of competitive advantage. If everyone has access to the same data and if digital technologies are increasing the number of data sources, an organization’s proprietary data will lose the ability to keep the company ahead.

Data symmetry will then throw established insurers into a mid-life crisis, with everyone from marketing to underwriting to claims asking, “What makes our insurance actually different?”

Once insurers are operating from the same data, and the prediction of symmetrically available data has become a full-blown reality, then data will no longer be a differentiator, and something else will be. But what?

The good news is that there will always be a way to create advantage if insurers remain active in fostering their uniqueness. From a data standpoint, here are three differentiators for your organization to consider:

Moving from individual histories to virtualized views

The data that is contained in today’s individual history will pale in comparison with tomorrow’s virtual record. In the very near future, everyone will take advantage of virtualized views of complete individuals or commercial accounts.

These will includ/.e every facet of someone’s lifestyle, health history, safety records, common travel patterns, activity levels and even purchase histories. Virtual individuals will be known and understood in ways that real individuals may not even know themselves. We already see this happening in online sales of music, books, movies, coffee, auto parts and tennis shoes. Where there is a purchase, there is a preference. Purchase patterns are allowing digital retailers to accurately predict which marketing messages will work with hyper-targeted methods. Modern insurers will use these same automations and data analysis to improve timing, not only for marketing but also for claims prevention. As virtual individual data interacts with external sources, such as geographic and weather data, the insurers who have been practicing their data science will become predictive pros. Predictive analytics will still allow some competitive asymmetry to exist.

Think of data streams as colors in a box of paints — the more colors one finds in the box, the clearer the picture that an insurer will be able to be paint. Data analytics

experience will be the art classes that will make some insurers capable of predictive masterpieces. The old colors will still be in the box. Claims histories and proprietary risk models will still be available, but they will sustain their value when they are supplemented with fresh colors and new data perspectives.

Innovating around products and services

Predicting results and preventing claims will support business in the current realm of insurance. Both are still subject, however, to data symmetry. Data symmetry will, in turn, push insurers to innovate. What will be striking to see is how often these front-end innovations of all types will enhance back-end data capabilities.

Early in 2016, for example, Liberty Mutual and Subaru announced a partnership that will bring usage-based insurance into Subaru’s connected car platform. Usage-based insurance is one of the clearest examples of innovative products, fueled by data that will also improve data analytics. This involves a new measure of innovation — how quickly data can move from collection to analysis. The quicker an insurer can transfer data gathering into meaningful action, the more valuable the innovation. Companies will be asking what levels of automation can be employed to turn prediction into prevention.

They will also be looking for formulas that make innovative products or services attractive to consumers. Data innovations aren’t instantly palatable to people. In-car telematics devices are a great example. The initial innovation was somewhat offset by the expense of installation and the perception that an installed device invaded consumer privacy.

Most efforts at product innovation will make consumer incentives part of the formula. As insurers turn “free data” into better ratios between pricing and risk, both the insurer and the consumer will need to see the clear benefits. Residential insurance is an example of an area ripe for innovation. Home insurance premiums are most often paid within the house payment. Most homeowners would be thrilled to have their house payment go down $100 to $200 per month. Property insurers that can take advantage of home sensor data and Internet of Things data could make that happen.

In exchange for the savings, many homeowners would sign off on the idea that their insurer now has monitoring capability. Property insurers would then be adding home data to their available data streams. This could give carriers a competitive difference. Lender/insurer partnerships (additional product innovation) may also arise with greater frequency if lenders can find corollary trends between home monitor data and clients with the fewest incidents.

This same data/pricing correlation will apply to commercial insurance. If the use of drones, security system monitoring and environmental system monitoring will result in lower insurance costs, most companies will see the value in an insurer that is looking out for their bottom line.

Insurers will find some of their differentiation in data-driven, value-added services. Anywhere that data can point to a better practice, an insurer will want to promote that to customers. Whether that means suggesting alternative travel routes for trucking companies or promoting add-on products for specialized risk, the influence of data symmetry can be overcome with creativity and innovative thinking.

Focusing on the stars

When we discuss data, our mindset traditionally envisions

incoming data. Customer experience data, however, is much more of a two-way data street. Consumers are painting a new world of service with their ratings and stars. These outside views are also subject to data symmetry. Prospects are now able to efficiently compare insurers with real service data, including both sources that are verifiable and those that contain unstructured, conjectural data.

In Competing in an Age of Data Symmetry, Part 3, we’ll look at what an insurer should be doing to prepare itself for greater customer scrutiny and how reputation analysis will validate or invalidate an organization’s brand promises.