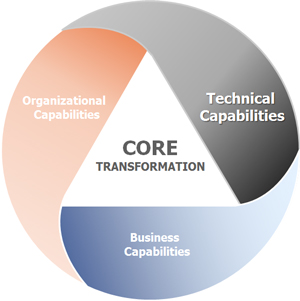

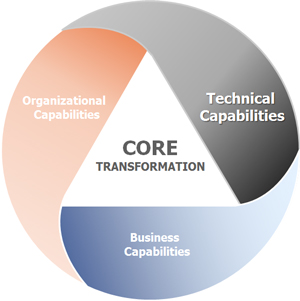

Insurers recognize the need for core transformation but need three technical capabilities to be able to keep up with changes in the market.

Ready, GO, set! That might not describe every core modernization project, but it certainly can seem that way in today’s fast-moving environment. Now that the insurance industry recognizes modernization as an indispensable tool for remaining competitive, it is worthwhile to take a step back and look at the technical capabilities that insurers really need from modern core systems to fulfill the potential of core transformation.

First, it helps to define what exactly a modern system is today. This is trickier than it sounds because the definition of “modern” has changed in recent years – and will continue to change. Core systems that were considered modern in 2010 are already showing their age, as recent systems have far outpaced their capabilities. Strategy Meets Action (SMA) defines a modern system as an application that includes robust configuration capabilities usable by both IT and business users, uses standardized application programming interfaces (APIs) to facilitate integration of new systems and technologies and leverages service-oriented architecture (SOA) principles to enable scalability. Each of these capabilities is crucial to being able to use core modernization as a launch pad for core transformation.

In our recent study on trends in policy administration, an amazing 94% of P&C insurers reported that product configuration capabilities are a required feature in a new policy administration system. This is a requirement across the industry for all core systems. Configuration capabilities are so important because they are critical to accelerating speed to market and speed to service. An insurer’s ability to react to market changes and take advantage of new opportunities is limited by the amount of time it takes internally to roll out new products and services or modify existing ones. Robust configuration tools not only make configuration easier but also spread it throughout a wider portion of the company, reducing the bottlenecks that often occur when all changes must be coded by a programmer. In a market where products and services are more personalized, configuration within policy, billing and claims becomes an essential tool.

Core systems today are required to dynamically integrate with various internal and external systems and new and real-time data, as well as big data. SMA’s research reveals that, as the sophistication of the solutions on the market has grown, insurers are often using third-party solutions for ancillary systems like business intelligence, agent portals, new business and document management. The number of data sources continues to grow significantly each year, including maturing and emerging technologies like telematics and the Internet of Things (IoT) that generate large quantities of data ripe for analysis. Data from these and other new technologies have myriad uses, including to rate a risk, personalize a service or present a new product offering. Specific solutions depend on integration with the core, and reducing the time and effort demanded by integration promotes the consideration of, for example, a business intelligence (BI) solution capable of vastly more in-depth analysis than the integrated BI component of a PAS, or an external data source that provides information that an insurer otherwise could not use. Easing the friction of integration benefits insurers well into the future, because easier integration today also translates to less arduous integration with systems and applications not yet imagined.

The most modern solution on the market is only as good as the book of business it can manage. With transaction volume and speed increasing, insurers must have scalable systems capable of meeting new and increasing demands, which requires leveraging SOA principles. Not only do insurers gain the ability to use a modern system’s capabilities with an increasing number of transactions, they also can extend the life of the system by enabling it to expand. When demand spikes after a catastrophic event or when a new market opportunity is identified, the system is well prepared to manage it. Cloud capabilities are presenting real alternatives to provide the scalability needed to successfully handle peak workloads, both anticipated and unexpected.

These three critical components of a modern system are not just what insurers need today – they prepare insurers to adapt to the future. Modern core systems with these capabilities can evolve along with the insurer. Insurers need to be able to shift their technology environment as needed to meet the future’s unknown opportunities and challenges, and that requires the ability to create products, integrate the latest systems and technologies and scale in concert with an insurer’s book of business. When the need arises for integration of artificial intelligence, for example, or processing millions more transactions per hour than ever before, the capacity is already ready and waiting. Once insurers know they can depend on their core systems to support them through market changes, they can focus their attention on optimizing their current processes and innovating to become a Next-Gen Insurer.

The order is important – ready, set, go. No matter how fast you want to move, you need to plan and then execute! Don’t let technology drive you – embrace the change and adopt technology with your future vision in sight.