The effect of climate risk and severe weather events on corporate earnings is meaningful. If left unmitigated, the impact could increase.

With climate change and severe weather events increasingly making headlines, lenders and institutional investors are becoming more interested in how these events are hitting the bottom lines of companies around the world. To answer this question, S&P Global Ratings collaborated with Bermuda-based climate risk management specialist Resilience Economics to determine the prevalence and materiality of climate risk for companies in the S&P 500 index. We examined public corporate research updates and earnings call transcripts from April 2017 to April 2018 (financial year 2017) to identify where a particular weather event had a material impact on earnings. This research complements our environmental and climate look-back analysis "How Environmental And Climate Risks And Opportunities Factor Into Global Corporate Ratings—An Update," published Nov. 9, 2017.

Climate change will continue to increase the incidence and severity of both chronic and acute weather events, which could lead to a more material impact on companies' earnings. We excluded from our research the entire financial institutions sector, which includes insurance companies.

Key Takeaways

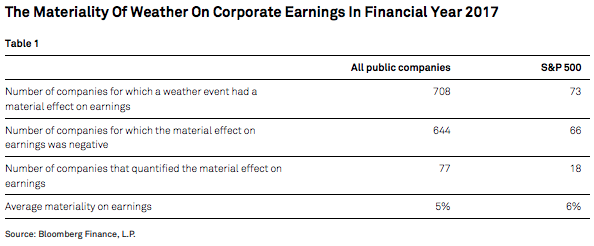

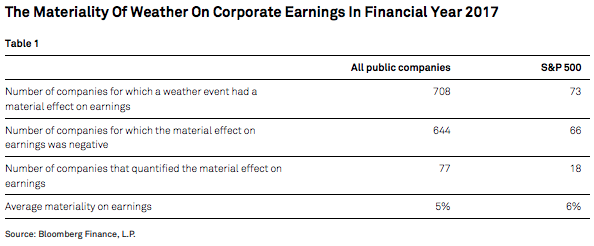

- In financial 2017, 73 companies (15%) on the S&P 500 publicly disclosed an effect on earnings from weather events, but only 18 companies (4%) quantified the effect.

- The average materiality on earnings for the small number of companies that quantified it was a significant 6%.

- Climate risk is a surprisingly prevalent topic of discussion for the CEOs of publicly traded companies, and management teams are becoming increasingly accountable for understanding and mitigating the impact of climate risk. Evidence of the impact of climate risk is found across all sectors, geographies, and seasons.

See also: Reducing Losses From Extreme Events

The results of our analysis show that in financial year 2017, 73 companies (15%) in the S&P 500 publicly disclosed an effect on earnings from weather events, but only 18 companies (4%) quantified the effect (see table 1). However, the average materiality on earnings for the small number of companies that quantified it was a significant 6%. In S&P Global Ratings' view, the effect of climate risk and severe weather events on corporate earnings is meaningful. If left unmitigated, the financial impact could increase over time as climate change makes disruptive weather events more frequent and severe.

Climate Risk and Weather Events Are Top Topics Among the CEOs of Publicly Traded Companies

Climate Risk and Weather Events Are Top Topics Among the CEOs of Publicly Traded Companies

A review of the earnings call transcripts of S&P 500 companies in the past 10 years revealed that "climate" and "weather" combined were among the most frequently discussed topics among executives, even more common than "Trump," "the dollar," "oil" and "recession."

Discussions of climate risk and its effect on companies' earnings are now reaching the CEO's office. Of the earnings calls in financial year 2017 where weather was mentioned as having a material effect on corporate earnings, more than half (53%) of these disclosures were made directly by the CEO. The CEO and CFO combined made 86% of all disclosures of climate-related impact on earnings.

Moreover, CEOs and other top company executives often cite climate and weather as a risk factor beyond the control of management.

You can find the full article here.

Climate Risk and Weather Events Are Top Topics Among the CEOs of Publicly Traded Companies

A review of the earnings call transcripts of S&P 500 companies in the past 10 years revealed that "climate" and "weather" combined were among the most frequently discussed topics among executives, even more common than "Trump," "the dollar," "oil" and "recession."

Discussions of climate risk and its effect on companies' earnings are now reaching the CEO's office. Of the earnings calls in financial year 2017 where weather was mentioned as having a material effect on corporate earnings, more than half (53%) of these disclosures were made directly by the CEO. The CEO and CFO combined made 86% of all disclosures of climate-related impact on earnings.

Moreover, CEOs and other top company executives often cite climate and weather as a risk factor beyond the control of management.

You can find the full article here.

Climate Risk and Weather Events Are Top Topics Among the CEOs of Publicly Traded Companies

A review of the earnings call transcripts of S&P 500 companies in the past 10 years revealed that "climate" and "weather" combined were among the most frequently discussed topics among executives, even more common than "Trump," "the dollar," "oil" and "recession."

Discussions of climate risk and its effect on companies' earnings are now reaching the CEO's office. Of the earnings calls in financial year 2017 where weather was mentioned as having a material effect on corporate earnings, more than half (53%) of these disclosures were made directly by the CEO. The CEO and CFO combined made 86% of all disclosures of climate-related impact on earnings.

Moreover, CEOs and other top company executives often cite climate and weather as a risk factor beyond the control of management.

You can find the full article here.