KEY TAKEAWAYS:

--One-off or standalone solutions acquired for specific tasks, incomplete conversions from one system to another and failures of large-scale modernization initiatives have resulted in insurers being invested in a myriad of systems and applications. Some work, some sort of work, some don’t work at all, but in a Lego sort of scenario, taking out the systems that don’t work is nigh on impossible because the “blocks” are now foundational to the insurer’s infrastructure.

--The solution lies in investing in specific areas that touch the customer and focusing on incremental change -- not attempting to do everything at once. It also requires a no-code/low-code environment, a more agile data platform and the right service provider.

----------

The future of insurance (and maybe the world) is personalized, streamlined and effortlessly automated. It rests in the capable hands of application programming interfaces (APIs), integrated systems, automation and insightful, democratized data. It is driven by digital transformation and the need to invest in systems and applications that will grow with the business and ensure increased data accessibility and visibility.

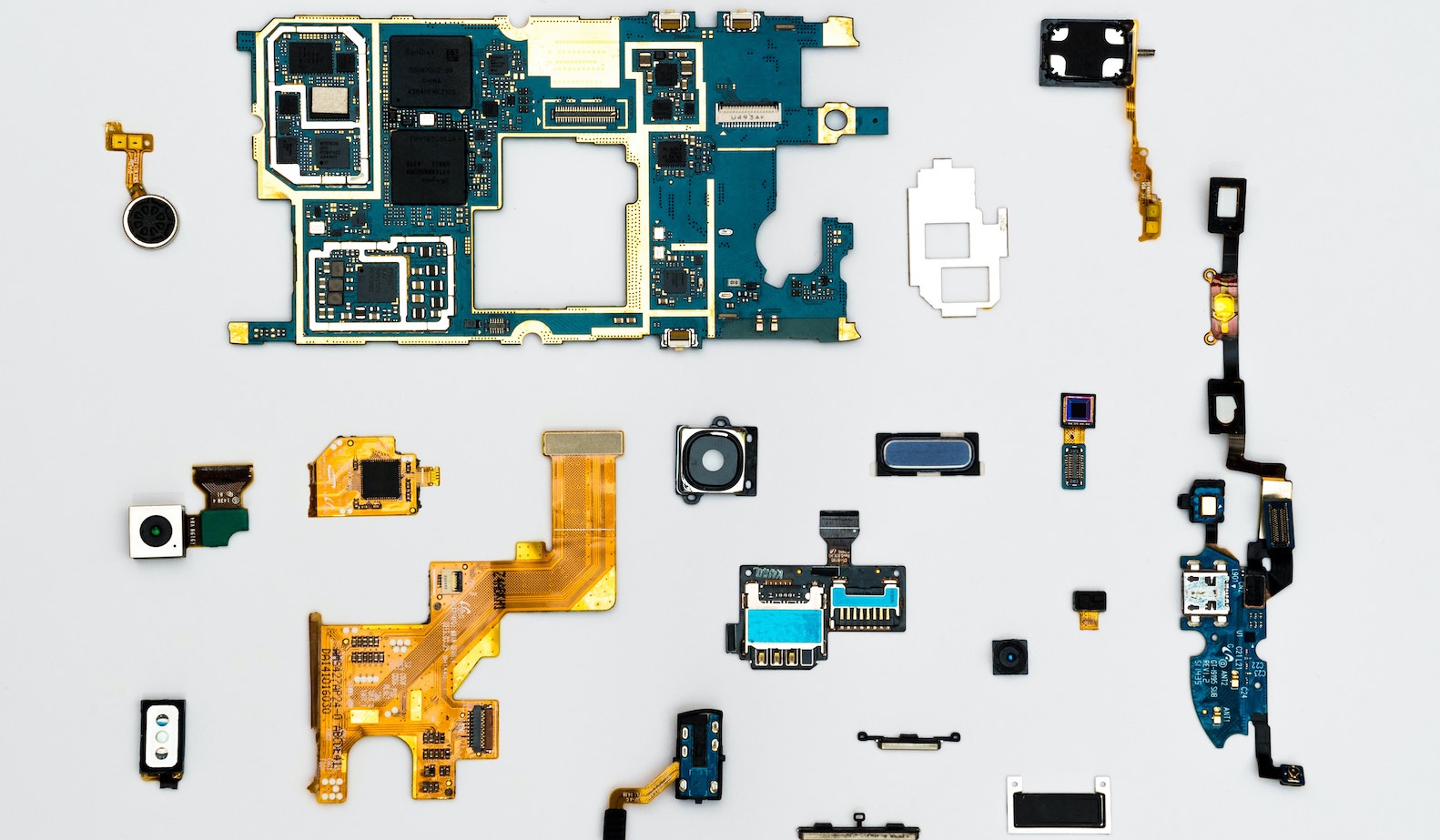

Over the years, insurance companies have amassed considerable, and complex, technology infrastructure, which is slowly failing. One-off or standalone solutions acquired for specific tasks, incomplete conversions from one system to another and failures of large-scale modernization initiatives have resulted in insurers being invested in a myriad of systems and applications. Some work, some sort of work, some don’t work at all, but in a Lego sort of scenario, taking out the systems that don’t work is nigh on impossible because the “blocks” are now foundational to the insurer’s infrastructure. Many insurers do want to find a way to consolidate data and integrate systems, but building connected systems through integration is hardly ever a simple task.

To ensure system integration and automation deliver on so many promises, there are five key steps insurers should take.

01: Meet Customer Demand With Intelligent Investment

Customers are more demanding today than ever, and customers will only become more demanding, more insistent on seamless, customized solutions. There will be an inevitable “lift and shift” to companies meeting increasing and evolving customer demands more efficiently.

Investments into digital transformation are the natural first step toward successful integration. In recent research, McKinsey finds that companies focusing on marketing and sales, underwriting and pricing, policy servicing and claims -- four areas that affect the customer journey, the customer experience and customer value -- are most likely to see measurable return on investment (ROI).

See also: Insurers Turn to Automation

02: Focus on Incremental Change

The insurance industry juggles data challenges unique to its offerings and business structures. Most insurance solutions run for many years, introducing legacy data problems that affect efficiency and access. And, unfortunately, it is difficult to increase data mastery if significant percentages of solutions are legacy-driven and inherently complex.

The answer lies in incremental change to systems, data integration and the implementation of a platform capable of blending legacy with innovation. This hybrid approach minimizes disruption while ensuring the organization continues to move forward. With the right technology and service provider, incremental change can help the business adapt and evolve to ensure longevity.

03: Create Flexibility With a Low-Code/No-Code Environment

Custom code, while great upon initial release, can grow stagnant with time or as requirements change. Unexpected delays, struggles with development processes or even data changes and growth, can affect written code and cripple a business’s ability to adapt to solutions and systems on demand. With a low-code/no-code environment, businesses can ensure data and operations remain agile and adaptable to new system requirements or as sales and marketing efforts call for segmentation.

04: Use a Platform That Empowers Data

Investment into a modern data platform is about more than just checking boxes, disrupting competitors or driving the business toward trends. It is about enabling and empowering every silo and solution within the business. This is the key to unlocking the door to a scalable, extensible and enterprise-ready solution that sits at the very center of your dataverse. What is needed is a solution that is powerful and future-proof. This does not equate to disruptive, destructive or expensive. It equates to elegant, intuitive and intelligent.

Investing in a solution that enables the efficient use of data allows for the hyper-personalization of policies, the creation of customized customer journeys and the ability to refine insurance policies into bespoke products. Such investments provide the freedom to innovate and the ability to truly explore intelligent decision-making. This requires more than just a giant box of tech; it needs to be backed by strategy that will help achieve the right value, improve speed of delivery and ensure investments can move dynamically with evolving business requirements.

See also: What’s Beyond Robotic Process Automation

05: Choose a Solution Provider That Simplifies

Successful system integration and modernization requires more than just a digital overlay. It asks that the organization stop seeing technology as a magic cure-all for legacy data complexities. It isn’t. The real cure lies in finding solutions that simplify complicated situations and take every part of the customer’s organization into account to ensure the seamless flow of information across silo, system and solution.

Often, this means finding a capable, compatible solution provider that can be trusted to help the organization increase data transparency and implement rules and policies that align with integration and data usage and ensure the workplace and workflows are managed intelligently.

Insurance enterprises today must meet the challenge of modernizing legacy data, automating business processes and building connected systems. In one scenario, the solution is a hybrid data automation platform implemented in a low-code/no-code environment. Insurers that are going to make it to the next level of this game need powerful technology and insurance-savvy expertise to grow and to make the most of data resources, today and in the future.