Standalone cyber insurance can successfully address a subset of privacy and security costs related to personally identifiable information, personal health information, payment card industry losses and increasingly some business interruption. However, outside of four industries (retail, hospitality, healthcare and financial institutions) generally no single insurance policy adequately covers cyber perils that result in funds transfers/crypto losses, bodily injury or tangible property damage-

type losses. Organizations of all sizes, geographies and industries

increasing rely on data analytics and technology, such as cloud computing, Internet of Things and artificial intelligence. These advancements add new and unique cyber exposures. Modeling of worst-case cyber scenarios compared with a review of the scope and exclusions of the base forms of multiple lines of insurance reveals potential material gaps in cyber coverage.

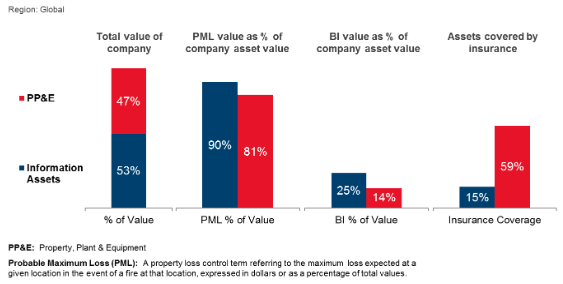

The number of cyber incidents with losses greater than $1 million (through early September 2018)

Recognize Financial Statement Impact

The number of cyber incidents with losses greater than $1 million (through early September 2018)

Recognize Financial Statement Impact

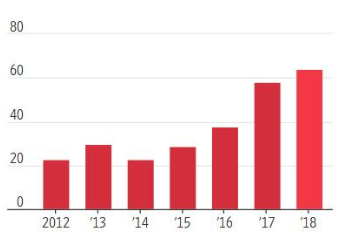

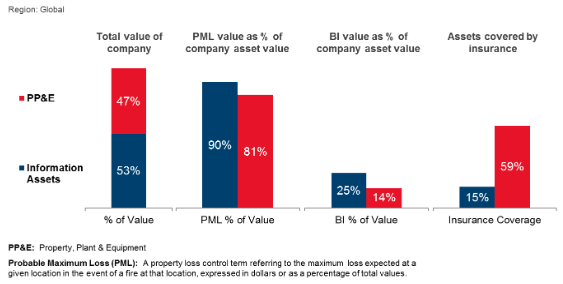

According to the Risk and Insurance Management Society, organizations’ total cost of risk declined for the fourth year in a row in 2017, but cyber costs moved in the opposite direction, rising

33%. Most boards of directors and management now include cyber perils and solutions in corporate governance discussions as they learn more regarding the potential financial statement impact of high-profile cyber

incidents. Yet, organizations only insure a relatively small portion of their intangible assets compared with insurance coverage for legacy

tangible assets.

Prudent organizations will spend the appropriate amount of time and resources on the risk management areas that are likely to have the greatest return on investment. For example, a disproportionate amount of attention is focused on cryptocurrency exposures, which affects a relatively small proportion of the corporate insurance buying population and related monetary losses. These are generally excluded from standalone cyber insurance policies.

See also: The New Cyber Insurance Paradigm

Almost every large organization and most middle-size organizations will have some reliance on distributed ledger technology within the next few years – either directly or via one of their third-party suppliers, distributors, vendors, partners or customers. It is important for organizations to educate and prepare themselves:

1. Understand the intended scope of standalone cyber and professional liability insurance policies

Typical standalone cyber insurance policies specifically exclude funds transfers, crypto transfers and other cash and securities monetary losses. Crime policies are intended to address fund losses under specified circumstances. Similarly, payment diversion fraud coverage for “spoofing,” “phishing" and other social engineering incidents is generally excluded under cyber policies but possibly covered under crime policies.

However, two federal appellate courts recently ruled that policyholders are entitled to crime insurance coverage for losses arising from social engineering schemes.

- July 2018: Facebook investors filed two different securities lawsuits: (1) the first based on the Cambridge Analytica user data incident; and (2) the second following Facebook’s lower-than-expected quarterly earnings release due to lower growth rate caused in part by allegedly unanticipated expenses and difficulties in complying with the European Union General Data Protection Regulation (“GDPR”).

- Aug. 8, 2018: Securities class action litigation against a publicly reporting media performance ratings company disclosed in its quarterly earnings release that GDPR-related changes affected the company’s growth rate, pressured the company’s partners and clients and disrupted the company’s advertising “ecosystem.”

Typical professional liability and cyber policies also specifically exclude shareholder derivative securities and similar fiduciary liability litigation. A well-crafted directors and officers insurance policy is recommended to provide certain defense and indemnity coverage for such claims.

Absent extensive policy wording customization, the typical cyber insurance policy specifically excludes all bodily injuries and tangible property damage – both first-party tangible property damage (the insured’s own property) and third-party tangible property damage (property owned by someone other than the insured).

2. Silent and affirmative cyber coverage under other lines of insurance

When cyber exposure losses first emerged, insurers had not priced cyber risks into their broadly worded legacy policies, such as property and general liability. However, absent specific cyber exclusions, such as the CL 380 Cyber Exclusion, it is possible that legacy property, general liability, environmental, product recall, marine and aviation could inadvertently cover unintended cyber perils, thus the so-called silent cyber insurance coverage.

After making the first unintended cyber claims payment, some insurers, but not yet all, either exclude or sub-limit cyber risk from new standard policies and renewals. Granting affirmative full cyber limits coverage for an additional premium in such legacy policies is rare and slow to develop. Silent cyber coverage remains. In fact, according to multiple large insurance companies, the 2017 total amount of cyber-related business interruption claims payments were greater under property insurance policies than under standalone cyber policies.

Furthermore, aggregated/correlated/systemic cyber exposures have the potential to cause damages that are multiples of any loss seen to date (i.e. 10,000 customers of a cloud provider or energy/power/utilities). Catastrophe modeling for aggregated/correlated/systemic cyber risk is in its infancy. Innovative approaches for assisting insurers concerned about aggregated, clash incidents – or two different policies covering the same cyber peril - and silent cyber exposures are

starting to emerge.

See also: Cyber: Black Hole or Huge Opportunity?

To achieve cyber resiliency, consider cyber as a peril rather than as a standalone insurance policy. Assess, test, improve, quantify, transfer and respond to the larger cyber risk management issues based on a cost-benefit analysis of resource allocation. Insurance is complementary to a robust cyber resiliency risk management approach. Each organization should identify and protect its critical intangible assets and balance sheet by aligning the cyber enterprise risk management strategy with corporate culture and risk tolerance.

All descriptions, summaries or highlights of coverage are for general informational purposes only and do not amend, alter or modify the actual terms or conditions of any insurance policy. Coverage is governed only by the terms and conditions of the relevant policy. If you have any questions about your specific coverage or are interested in obtaining coverage, please contact your Aon broker. For general questions about cyber insurance, contact: Stephanie Snyder at stephanie.snyder@aon.com. The number of cyber incidents with losses greater than $1 million (through early September 2018)

Recognize Financial Statement Impact

According to the Risk and Insurance Management Society, organizations’ total cost of risk declined for the fourth year in a row in 2017, but cyber costs moved in the opposite direction, rising 33%. Most boards of directors and management now include cyber perils and solutions in corporate governance discussions as they learn more regarding the potential financial statement impact of high-profile cyber incidents. Yet, organizations only insure a relatively small portion of their intangible assets compared with insurance coverage for legacy tangible assets.

The number of cyber incidents with losses greater than $1 million (through early September 2018)

Recognize Financial Statement Impact

According to the Risk and Insurance Management Society, organizations’ total cost of risk declined for the fourth year in a row in 2017, but cyber costs moved in the opposite direction, rising 33%. Most boards of directors and management now include cyber perils and solutions in corporate governance discussions as they learn more regarding the potential financial statement impact of high-profile cyber incidents. Yet, organizations only insure a relatively small portion of their intangible assets compared with insurance coverage for legacy tangible assets.

Prudent organizations will spend the appropriate amount of time and resources on the risk management areas that are likely to have the greatest return on investment. For example, a disproportionate amount of attention is focused on cryptocurrency exposures, which affects a relatively small proportion of the corporate insurance buying population and related monetary losses. These are generally excluded from standalone cyber insurance policies.

See also: The New Cyber Insurance Paradigm

Almost every large organization and most middle-size organizations will have some reliance on distributed ledger technology within the next few years – either directly or via one of their third-party suppliers, distributors, vendors, partners or customers. It is important for organizations to educate and prepare themselves:

1. Understand the intended scope of standalone cyber and professional liability insurance policies

Typical standalone cyber insurance policies specifically exclude funds transfers, crypto transfers and other cash and securities monetary losses. Crime policies are intended to address fund losses under specified circumstances. Similarly, payment diversion fraud coverage for “spoofing,” “phishing" and other social engineering incidents is generally excluded under cyber policies but possibly covered under crime policies.

However, two federal appellate courts recently ruled that policyholders are entitled to crime insurance coverage for losses arising from social engineering schemes.

Prudent organizations will spend the appropriate amount of time and resources on the risk management areas that are likely to have the greatest return on investment. For example, a disproportionate amount of attention is focused on cryptocurrency exposures, which affects a relatively small proportion of the corporate insurance buying population and related monetary losses. These are generally excluded from standalone cyber insurance policies.

See also: The New Cyber Insurance Paradigm

Almost every large organization and most middle-size organizations will have some reliance on distributed ledger technology within the next few years – either directly or via one of their third-party suppliers, distributors, vendors, partners or customers. It is important for organizations to educate and prepare themselves:

1. Understand the intended scope of standalone cyber and professional liability insurance policies

Typical standalone cyber insurance policies specifically exclude funds transfers, crypto transfers and other cash and securities monetary losses. Crime policies are intended to address fund losses under specified circumstances. Similarly, payment diversion fraud coverage for “spoofing,” “phishing" and other social engineering incidents is generally excluded under cyber policies but possibly covered under crime policies.

However, two federal appellate courts recently ruled that policyholders are entitled to crime insurance coverage for losses arising from social engineering schemes.