Group insurance is an approximately $65 billion market. While growth has been consistent but moderate at 3.5% to 4% per year over the last six years, changes in the employee-employer dynamic are reshaping group benefit needs and making investments and growth prospects in the sector more attractive.

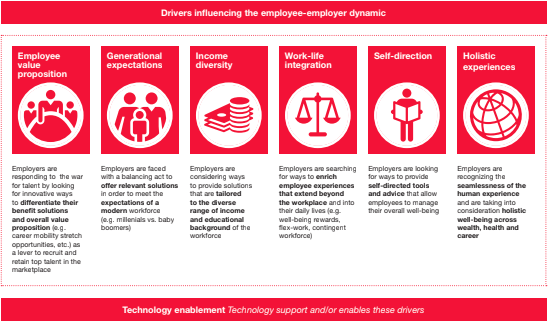

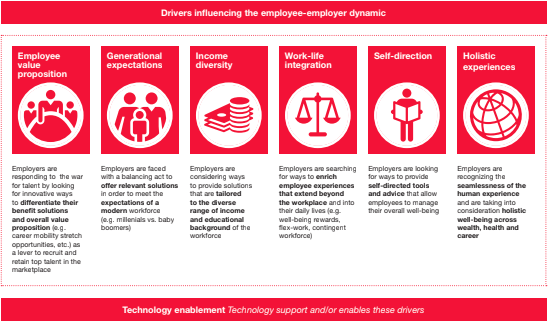

Carriers’ initial response has been to drive profitable growth by streamlining their operating models and making incremental investments in technology to upgrade their capabilities. However, employer and employee needs and expectations continue to rise.

Employers are using innovative benefit solutions to differentiate themselves when recruiting and retaining top talent. Employers recognize that employees no longer have the patience or time for benefit plans that are cumbersome to enroll in and manage. They’re looking for holistic solutions that employees themselves can direct. In addition, employees have different needs based on income diversity and – more so than in recent memory – generational circumstances. Consequently, they’re looking to employers to offer customizable solutions that help them meet their unique needs in a user-friendly fashion, 24/7.

Moving forward, five trends will continue to shape the group insurance market and influence carriers to move beyond incremental investment to fundamentally reposition their business and operating models. These trends will motivate group insurers to provide more measurable value for employers, employees and intermediaries by delivering more integrated products and services and better customer experiences. We also expect to see a) More and more players in adjacent markets such as health, workforce management and wealth to expand into market niches that overlap with group insurance; and b) More venture capital to flow to insurtech solutions that meet the group space’s evolving needs.

Group insurer solutions will take advantage of the convergence of

health-wealth-career management

Consumers are increasingly managing their health, wealth and career decisions in a coordinated way because they all affect the same wallet.

Decisions about health range from ways to maintain fitness to ensure their quality of life (and thus ability earn an income) to selecting the right combination of benefit products to reduce the key risks that could knock them and their families off track for an extended period of time. As people at the higher end of the socioeconomic scale live longer and healthier lives, they’re looking to manage their personal wealth to support their and their families’ financial positions for longer periods of time.

Moreover, as employers compete for top talent, they are increasingly providing benefits and programs that address the concerns their employees have about their and their families’ physical, mental and financial health. Employers are focusing on a) health and return to work programs that contribute to worker productivity and performance, and b) employee development programs.

See also: How to Unlock Group Insurance Market

The confluence of these factors is creating opportunities for group insurers to provide employers with solutions that help them improve their employees’ health, wealth and professional satisfaction. Some carriers are responding by offering more holistic solutions, either by expanding their own product offerings or through partnerships with others in which they can white label products. Other carriers have decided not to expand their own product offerings, but instead focus more on the wealth/ retirement or health. In either case, they’re trying to make their products and services fit with the other benefits employers’ chosen platforms offer.

Group insurers will look to serve more market segments

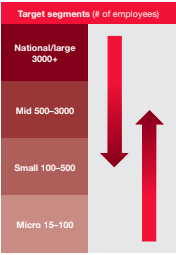

Many group insurers have long focused on certain market segments. For example, some have been dominant in the national account or large case segments and others in the small or mid-case account segments.

Group insurers will look to serve more market segments

Many group insurers have long focused on certain market segments. For example, some have been dominant in the national account or large case segments and others in the small or mid-case account segments.

Each market segment requires different operating model strengths. But, as employer and employee needs increasingly change, the traditional lines between small, mid, and large account segments are starting to blur.

Group carriers are now rebuilding core capabilities and introducing new ones in order to more profitably serve a broader range of employer segments. Recent M&A activity has resulted in significant new capabilities. For example, the Hartford, which acquired Aetna’s group life and disability business, and Lincoln Financial Group, which acquired Liberty Life, are examples of the priority group players are placing on adding or enhancing capabilities (such as integrated absence management) to serve broader segments of the market.

These moves indicate that the carriers which traditionally have been stronger in the small and mid-markets are building new capabilities and transforming their target operating models in order to serve the unique needs of larger account segments. Moreover, large account carriers are building new capabilities and changing their target operating models in order to standardize and automate their solutions to more profitably serve smaller market segments.

Group insurers will increasingly respond to increased absence management needs, even for down market clients

Absence and leave management services are a core service in the disability market and demand is growing.

Group insurers will increasingly respond to increased absence management needs, even for down market clients

Absence and leave management services are a core service in the disability market and demand is growing.

There has been a spike in requests by employers for absence and leave services as a result of:

a. The January 1, 2018 New York Paid Family Leave Law, which is the most significant paid leave program in the US;

b. Recent localized laws, such as the Paid Sick Leave Ordinance (PSLO) and Paid Parental Leave Ordinance, have increased the local complexity of employer leave and absence tracking; and

c. Increased cross-selling of disability, FMLA, and voluntary products makes the need for claims/absence integrated services more relevant.

In response to these changes, carriers are increasingly adding absence services and platforms to their repertoire. For those familiar with disability, FMLA, and other products, absence is not new. For those who aren’t, tracking the high number of federal, state, and local laws is a tremendous value-add to their client base. In order to improve customer service, carriers are integrating claims and absence into an “event” experience to radically reduce the burden of correspondence that explains payments and absence rights.

M&A activity and insurtech investment will continue to shape in the group market

Moving upstream and downstream among employer segments requires new capabilities.

The traditional way of doing business will not meet changing employer and employee expectations. As a result, M&A, insurtech investment, and maturing group technology solutions will continue to influence the group market in three ways:

a. In addition to the M&A activity we previously noted, there have been other transactions in the group space, including Meiji’s acquisition of Stancorp and Sumitomo Life’s acquisition of Symetra. Acquisitions like these potentially provide much needed capital investment for group players looking to take advantage of the convergence in the space and the opportunity to profitably expand across traditional market segments. This in turn could raise the bar for existing players, especially in areas where they need i) broker or consultant customers to recommend their products, and ii) to address employer needs to respond the changing employer- employee dynamic.

b. There also have been deals adjacent to group benefits, such as CVS’s acquisition of Aetna and the Amazon, Berkshire and JP Morgan joint venture. These developments may impact more than product solutions, pricing and omni-channel distribution and service; they also could significantly reshape the employer and employee customer experience.

c. Group carriers traditionally have often been reluctant to make significant investments in technology and when they have, they’ve attempted to build new technology solutions in-house. However, with the exponential growth of insurtech and the maturation of group-focused core technology, some carriers are finding it both necessary and easier to acquire new solutions rather than build them. Consequently, group insurers are accelerating their investment in core areas, including enrollment, policy administration, and claims, thereby allowing them to improve in a number of areas from quote to close ratios, and from employee program participation to claims management.

Group insurers will continue to build digital & data architecture and expand analytic capabilities

Artificial intelligence, predictive analytics, behavioral economics,

machine learning, robotic process automation, among other technological developments, represent opportunities for group insurers to better understand, acquire, serve and retain customers in new and more cost effective ways.

Carriers are choosing to invest in new digital capabilities to improve customer and channel segmentation and experience, as well as enhance their ability to acquire and retain the right customers. This helps carriers anticipate employer needs and enables solutions to change as employers do. It also promotes better carrier understand of employees’ broader needs beyond the employer relationship.

Also of note, group insurers have long had a significant amount of data and in recent years have taken advantage of advances in big data, reduced cost of computing power, and commoditized analytic techniques to increase their use of data for decision-making and insight generation. However, many of the advances in data have still not translated to improvements in employee level data across the value chain.

See also: Group Insurance: On the Path to Maturity

New investments in data will help group carriers 1) Improve the data architecture that is critical to improving workflow and customer experiences, 2) Focus on employee level data to better meet the needs of employees – especially in the areas of portability, and 3) Incorporate third-party and unstructured data with employee level data, which will help them be more consultative with employers about the design of responses to employee needs.

Implications

- Group insurance will be increasingly important as a business platform for addressing employee health, wealth and career needs, as well as employer needs to offer their employees differentiated solutions.

- Existing players cannot stand still because they face converging forces that are fundamentally transforming group business and operating models. Carriers that are business units of larger insurers which have underinvested in group capabilities (even if the group business unit has been consistently profitable) need to be particularly attuned to these developments.

- New group players, including those resulting from M&A, should do more than just make the mergers “look good on paper” but sincerely focus on designing new customer-centric operating models that leverage new business and technology architectures to create excellent B2B2C experiences.

This report was written by Jamie Yoder, Marie Carr, Jim Quick, Mike Mariani, and Josh Schwartz.

Carriers’ initial response has been to drive profitable growth by streamlining their operating models and making incremental investments in technology to upgrade their capabilities. However, employer and employee needs and expectations continue to rise.

Employers are using innovative benefit solutions to differentiate themselves when recruiting and retaining top talent. Employers recognize that employees no longer have the patience or time for benefit plans that are cumbersome to enroll in and manage. They’re looking for holistic solutions that employees themselves can direct. In addition, employees have different needs based on income diversity and – more so than in recent memory – generational circumstances. Consequently, they’re looking to employers to offer customizable solutions that help them meet their unique needs in a user-friendly fashion, 24/7.

Moving forward, five trends will continue to shape the group insurance market and influence carriers to move beyond incremental investment to fundamentally reposition their business and operating models. These trends will motivate group insurers to provide more measurable value for employers, employees and intermediaries by delivering more integrated products and services and better customer experiences. We also expect to see a) More and more players in adjacent markets such as health, workforce management and wealth to expand into market niches that overlap with group insurance; and b) More venture capital to flow to insurtech solutions that meet the group space’s evolving needs.

Group insurer solutions will take advantage of the convergence of

health-wealth-career management

Consumers are increasingly managing their health, wealth and career decisions in a coordinated way because they all affect the same wallet.

Decisions about health range from ways to maintain fitness to ensure their quality of life (and thus ability earn an income) to selecting the right combination of benefit products to reduce the key risks that could knock them and their families off track for an extended period of time. As people at the higher end of the socioeconomic scale live longer and healthier lives, they’re looking to manage their personal wealth to support their and their families’ financial positions for longer periods of time.

Moreover, as employers compete for top talent, they are increasingly providing benefits and programs that address the concerns their employees have about their and their families’ physical, mental and financial health. Employers are focusing on a) health and return to work programs that contribute to worker productivity and performance, and b) employee development programs.

See also: How to Unlock Group Insurance Market

The confluence of these factors is creating opportunities for group insurers to provide employers with solutions that help them improve their employees’ health, wealth and professional satisfaction. Some carriers are responding by offering more holistic solutions, either by expanding their own product offerings or through partnerships with others in which they can white label products. Other carriers have decided not to expand their own product offerings, but instead focus more on the wealth/ retirement or health. In either case, they’re trying to make their products and services fit with the other benefits employers’ chosen platforms offer.

Carriers’ initial response has been to drive profitable growth by streamlining their operating models and making incremental investments in technology to upgrade their capabilities. However, employer and employee needs and expectations continue to rise.

Employers are using innovative benefit solutions to differentiate themselves when recruiting and retaining top talent. Employers recognize that employees no longer have the patience or time for benefit plans that are cumbersome to enroll in and manage. They’re looking for holistic solutions that employees themselves can direct. In addition, employees have different needs based on income diversity and – more so than in recent memory – generational circumstances. Consequently, they’re looking to employers to offer customizable solutions that help them meet their unique needs in a user-friendly fashion, 24/7.

Moving forward, five trends will continue to shape the group insurance market and influence carriers to move beyond incremental investment to fundamentally reposition their business and operating models. These trends will motivate group insurers to provide more measurable value for employers, employees and intermediaries by delivering more integrated products and services and better customer experiences. We also expect to see a) More and more players in adjacent markets such as health, workforce management and wealth to expand into market niches that overlap with group insurance; and b) More venture capital to flow to insurtech solutions that meet the group space’s evolving needs.

Group insurer solutions will take advantage of the convergence of

health-wealth-career management

Consumers are increasingly managing their health, wealth and career decisions in a coordinated way because they all affect the same wallet.

Decisions about health range from ways to maintain fitness to ensure their quality of life (and thus ability earn an income) to selecting the right combination of benefit products to reduce the key risks that could knock them and their families off track for an extended period of time. As people at the higher end of the socioeconomic scale live longer and healthier lives, they’re looking to manage their personal wealth to support their and their families’ financial positions for longer periods of time.

Moreover, as employers compete for top talent, they are increasingly providing benefits and programs that address the concerns their employees have about their and their families’ physical, mental and financial health. Employers are focusing on a) health and return to work programs that contribute to worker productivity and performance, and b) employee development programs.

See also: How to Unlock Group Insurance Market

The confluence of these factors is creating opportunities for group insurers to provide employers with solutions that help them improve their employees’ health, wealth and professional satisfaction. Some carriers are responding by offering more holistic solutions, either by expanding their own product offerings or through partnerships with others in which they can white label products. Other carriers have decided not to expand their own product offerings, but instead focus more on the wealth/ retirement or health. In either case, they’re trying to make their products and services fit with the other benefits employers’ chosen platforms offer.

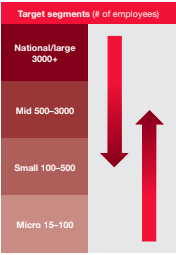

Group insurers will look to serve more market segments

Many group insurers have long focused on certain market segments. For example, some have been dominant in the national account or large case segments and others in the small or mid-case account segments.

Each market segment requires different operating model strengths. But, as employer and employee needs increasingly change, the traditional lines between small, mid, and large account segments are starting to blur.

Group carriers are now rebuilding core capabilities and introducing new ones in order to more profitably serve a broader range of employer segments. Recent M&A activity has resulted in significant new capabilities. For example, the Hartford, which acquired Aetna’s group life and disability business, and Lincoln Financial Group, which acquired Liberty Life, are examples of the priority group players are placing on adding or enhancing capabilities (such as integrated absence management) to serve broader segments of the market.

These moves indicate that the carriers which traditionally have been stronger in the small and mid-markets are building new capabilities and transforming their target operating models in order to serve the unique needs of larger account segments. Moreover, large account carriers are building new capabilities and changing their target operating models in order to standardize and automate their solutions to more profitably serve smaller market segments.

Group insurers will look to serve more market segments

Many group insurers have long focused on certain market segments. For example, some have been dominant in the national account or large case segments and others in the small or mid-case account segments.

Each market segment requires different operating model strengths. But, as employer and employee needs increasingly change, the traditional lines between small, mid, and large account segments are starting to blur.

Group carriers are now rebuilding core capabilities and introducing new ones in order to more profitably serve a broader range of employer segments. Recent M&A activity has resulted in significant new capabilities. For example, the Hartford, which acquired Aetna’s group life and disability business, and Lincoln Financial Group, which acquired Liberty Life, are examples of the priority group players are placing on adding or enhancing capabilities (such as integrated absence management) to serve broader segments of the market.

These moves indicate that the carriers which traditionally have been stronger in the small and mid-markets are building new capabilities and transforming their target operating models in order to serve the unique needs of larger account segments. Moreover, large account carriers are building new capabilities and changing their target operating models in order to standardize and automate their solutions to more profitably serve smaller market segments.

Group insurers will increasingly respond to increased absence management needs, even for down market clients

Absence and leave management services are a core service in the disability market and demand is growing.

There has been a spike in requests by employers for absence and leave services as a result of:

a. The January 1, 2018 New York Paid Family Leave Law, which is the most significant paid leave program in the US;

b. Recent localized laws, such as the Paid Sick Leave Ordinance (PSLO) and Paid Parental Leave Ordinance, have increased the local complexity of employer leave and absence tracking; and

c. Increased cross-selling of disability, FMLA, and voluntary products makes the need for claims/absence integrated services more relevant.

In response to these changes, carriers are increasingly adding absence services and platforms to their repertoire. For those familiar with disability, FMLA, and other products, absence is not new. For those who aren’t, tracking the high number of federal, state, and local laws is a tremendous value-add to their client base. In order to improve customer service, carriers are integrating claims and absence into an “event” experience to radically reduce the burden of correspondence that explains payments and absence rights.

M&A activity and insurtech investment will continue to shape in the group market

Moving upstream and downstream among employer segments requires new capabilities.

The traditional way of doing business will not meet changing employer and employee expectations. As a result, M&A, insurtech investment, and maturing group technology solutions will continue to influence the group market in three ways:

a. In addition to the M&A activity we previously noted, there have been other transactions in the group space, including Meiji’s acquisition of Stancorp and Sumitomo Life’s acquisition of Symetra. Acquisitions like these potentially provide much needed capital investment for group players looking to take advantage of the convergence in the space and the opportunity to profitably expand across traditional market segments. This in turn could raise the bar for existing players, especially in areas where they need i) broker or consultant customers to recommend their products, and ii) to address employer needs to respond the changing employer- employee dynamic.

b. There also have been deals adjacent to group benefits, such as CVS’s acquisition of Aetna and the Amazon, Berkshire and JP Morgan joint venture. These developments may impact more than product solutions, pricing and omni-channel distribution and service; they also could significantly reshape the employer and employee customer experience.

c. Group carriers traditionally have often been reluctant to make significant investments in technology and when they have, they’ve attempted to build new technology solutions in-house. However, with the exponential growth of insurtech and the maturation of group-focused core technology, some carriers are finding it both necessary and easier to acquire new solutions rather than build them. Consequently, group insurers are accelerating their investment in core areas, including enrollment, policy administration, and claims, thereby allowing them to improve in a number of areas from quote to close ratios, and from employee program participation to claims management.

Group insurers will continue to build digital & data architecture and expand analytic capabilities

Artificial intelligence, predictive analytics, behavioral economics,

machine learning, robotic process automation, among other technological developments, represent opportunities for group insurers to better understand, acquire, serve and retain customers in new and more cost effective ways.

Carriers are choosing to invest in new digital capabilities to improve customer and channel segmentation and experience, as well as enhance their ability to acquire and retain the right customers. This helps carriers anticipate employer needs and enables solutions to change as employers do. It also promotes better carrier understand of employees’ broader needs beyond the employer relationship.

Also of note, group insurers have long had a significant amount of data and in recent years have taken advantage of advances in big data, reduced cost of computing power, and commoditized analytic techniques to increase their use of data for decision-making and insight generation. However, many of the advances in data have still not translated to improvements in employee level data across the value chain.

See also: Group Insurance: On the Path to Maturity

New investments in data will help group carriers 1) Improve the data architecture that is critical to improving workflow and customer experiences, 2) Focus on employee level data to better meet the needs of employees – especially in the areas of portability, and 3) Incorporate third-party and unstructured data with employee level data, which will help them be more consultative with employers about the design of responses to employee needs.

Implications

Group insurers will increasingly respond to increased absence management needs, even for down market clients

Absence and leave management services are a core service in the disability market and demand is growing.

There has been a spike in requests by employers for absence and leave services as a result of:

a. The January 1, 2018 New York Paid Family Leave Law, which is the most significant paid leave program in the US;

b. Recent localized laws, such as the Paid Sick Leave Ordinance (PSLO) and Paid Parental Leave Ordinance, have increased the local complexity of employer leave and absence tracking; and

c. Increased cross-selling of disability, FMLA, and voluntary products makes the need for claims/absence integrated services more relevant.

In response to these changes, carriers are increasingly adding absence services and platforms to their repertoire. For those familiar with disability, FMLA, and other products, absence is not new. For those who aren’t, tracking the high number of federal, state, and local laws is a tremendous value-add to their client base. In order to improve customer service, carriers are integrating claims and absence into an “event” experience to radically reduce the burden of correspondence that explains payments and absence rights.

M&A activity and insurtech investment will continue to shape in the group market

Moving upstream and downstream among employer segments requires new capabilities.

The traditional way of doing business will not meet changing employer and employee expectations. As a result, M&A, insurtech investment, and maturing group technology solutions will continue to influence the group market in three ways:

a. In addition to the M&A activity we previously noted, there have been other transactions in the group space, including Meiji’s acquisition of Stancorp and Sumitomo Life’s acquisition of Symetra. Acquisitions like these potentially provide much needed capital investment for group players looking to take advantage of the convergence in the space and the opportunity to profitably expand across traditional market segments. This in turn could raise the bar for existing players, especially in areas where they need i) broker or consultant customers to recommend their products, and ii) to address employer needs to respond the changing employer- employee dynamic.

b. There also have been deals adjacent to group benefits, such as CVS’s acquisition of Aetna and the Amazon, Berkshire and JP Morgan joint venture. These developments may impact more than product solutions, pricing and omni-channel distribution and service; they also could significantly reshape the employer and employee customer experience.

c. Group carriers traditionally have often been reluctant to make significant investments in technology and when they have, they’ve attempted to build new technology solutions in-house. However, with the exponential growth of insurtech and the maturation of group-focused core technology, some carriers are finding it both necessary and easier to acquire new solutions rather than build them. Consequently, group insurers are accelerating their investment in core areas, including enrollment, policy administration, and claims, thereby allowing them to improve in a number of areas from quote to close ratios, and from employee program participation to claims management.

Group insurers will continue to build digital & data architecture and expand analytic capabilities

Artificial intelligence, predictive analytics, behavioral economics,

machine learning, robotic process automation, among other technological developments, represent opportunities for group insurers to better understand, acquire, serve and retain customers in new and more cost effective ways.

Carriers are choosing to invest in new digital capabilities to improve customer and channel segmentation and experience, as well as enhance their ability to acquire and retain the right customers. This helps carriers anticipate employer needs and enables solutions to change as employers do. It also promotes better carrier understand of employees’ broader needs beyond the employer relationship.

Also of note, group insurers have long had a significant amount of data and in recent years have taken advantage of advances in big data, reduced cost of computing power, and commoditized analytic techniques to increase their use of data for decision-making and insight generation. However, many of the advances in data have still not translated to improvements in employee level data across the value chain.

See also: Group Insurance: On the Path to Maturity

New investments in data will help group carriers 1) Improve the data architecture that is critical to improving workflow and customer experiences, 2) Focus on employee level data to better meet the needs of employees – especially in the areas of portability, and 3) Incorporate third-party and unstructured data with employee level data, which will help them be more consultative with employers about the design of responses to employee needs.

Implications