“Our agency is a relationship-based agency. We have the best interests of our clients at heart and offer the best advice and coverage in the most cost-effective manner,” a Dallas-based, independent P&C agent says, and I'm sure most independent agents say something similar. But agents have hundreds or thousands of customers and tons of data to recall for each client, and our memories can hold only so much at a time.

The good news is that a lot of data gets captured by agencies that can be consolidated with several other data sources to paint a better picture about the clients, allowing for a more thorough profile and better risk analysis. The core question an agent needs to ask is, “Do I have all the information I need about my clients and can I locate it quickly?”

Data is like Lego bricks, just waiting to be used to create valuable insights. Once you start putting them together into unique combinations of datasets, you can create real value and a competitive advantage.

Let’s take a peek into a client’s journey through the eyes of an agency and try to identify data needs. We will also look at how data management and data assets will provide a deeper understanding and better client management, with a

360-degree view of an insurance customer.

Such a view not only focuses on clients but creates an ecosystem that allows agents to gather, nurture, curate and enhance data about their clients. Agents understand that if a relationship is a life, then data is oxygen. There must be continuous feedback to systems using analytics to understand clients better.

See also: Using Technology to Enhance Your Agency

Shown below is a high-level flow of the client journey from a prospect to being a loyal customer, and all elements of communication and data points that can be used better.

1. Closing a prospect

1. Closing a prospect — Be the insurance commercial or personal, there is always an individual who will be involved/engaged for policy discussion. It is important to understand the primary contact, any affiliation to a business and the need for coverage. For instance, you may consider calling the contact who is operating a gas station or a convenience store but text or email someone who is looking for a cybersecurity policy. The approach should be tailored based on contact and business profile. By segmenting clients based on attributes, agencies can profile them accurately and develop customized communication approaches. These contacts can be ranked based on their coverage needs and likelihood to purchase a policy. Then, drip communication can be designed to increase positive outcomes, focusing on higher-rank leads and converting those prospect who are ready. You can use the deal board feature of

InsuredMine to achieve these results. In this case, initial client data, his communication response data, lifestyle and life stage data from social media can also play an important role.

2. Welcoming new clients: Successful agents pay special attention to a client’s onboarding to make sure there is proper communication at all times. They provide clients with all the information and channels (phone, text, email, chat, etc.) needed to contact them. This "availability on demand" leaves a good impression and reduces challenges when it comes to renewals. So, the question is what data do we have and how do we make the most of it in welcoming our clients? First thing would be to set them up on a welcome drip campaign, which will include sharing agency information, ways to connect and social media connections for updates and engagement. Follow-up communication may also include other cross sales and up-sales requests. (This becomes more effective when we capture more information about clients, including demographics and financial, family, lifestyle and life stages details). It is important to have a system that can help you capture all this data so it can be analyzed for better recommendations. Onboarding data can be as simple as knowing what is the best way to communicate -- email, text, phone or in-person. These are great pointers and need to be reflected in an agent’s communication at the right time with the help of the right tools.

3. Renewals: Come judgment day, and now agents need to go through the trial and prove their worth again, fighting against all odds like an increased carrier premium, other easier and cheaper options, more convenient methods of acquiring a policy through an app or online and many others. Agents need to start engaging clients about 90 days before the expiration of the policy. Agents can start with a drip campaign with a combination of email and text-based communication based on the client’s preferences. Knowledge of new or additional assets of the client will also help the agent provide bundling. Information about the client’s change in lifestyle and life stage data can also provide cover fire.

4. Claims management: This is a tricky one, as agencies may not have all the information to start with. Receiving an initial notification from the client about a claim situation should trigger communication, including carrier contact, claim filing options and customer service. Offering digital tools to help clients facilitate claims filing will provide information about the claim, and that information can be leveraged to better manage the claim and update the client’s risk profile for future needs.

5. General client management and annual updates: There are several clients who are on autopilot with very little overhead, but even those clients would appreciate periodic engagement for an opportunity to update their profile or share feedback. Other opportunities with this type of engagement can create cross sales and policy consolidation options, as well as suggestions for increased or improved coverage in line with changes in clients' financial situations. Connecting with customers at the right time for the right policy using available data and presenting special offers or promotions when they become a flight risk are other ways to engage.

It all boils down to the right engagement with the right context, using the right medium, which will start to show results for any agency in a short time. For all the stages above, pulling data from Linkedin, Zillow, DMV, KBB, HazardHub, meteorological department, social media, and census data adds additional context and will help the agent communicate both effectively and efficiently. Other data sources that are equally valuable, but beyond the scope of this discussion, include telematics, sensors (IoT), wearables and GIS data.

Understanding business from a client’s perspective and all data elements required at each stage and their respective data sources will do a tremendous favor to your organization:

- Helps create a 360-degree view of your clients

- Provides actionable intelligence to act at each stage

- Improves profitability and retention

- Creates a competitive advantage of data assets

Once you are able to bring in all the available structured and unstructured data, you are ready to tell your data story. We believe every agency has a data story that needs to be analyzed and narrated to operate effectively, showing a deeper understanding of clients. You may use the following four components to discover how to use your data story.

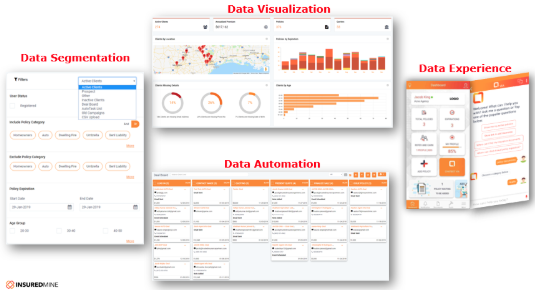

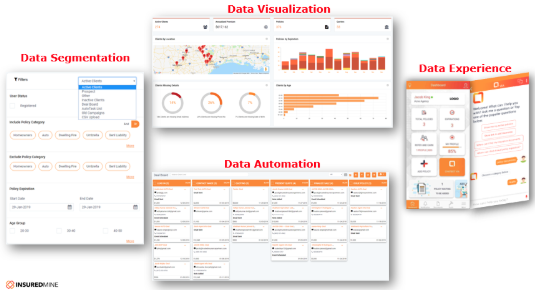

- Understand your business DNA with data segmentation

- Design simple and memorable graphics with data visualization

- Develop intelligent processes with data automation

- Humanize engagement with data experience

Understand your business DNA with data segmentation

Understand your business DNA with data segmentation

According to

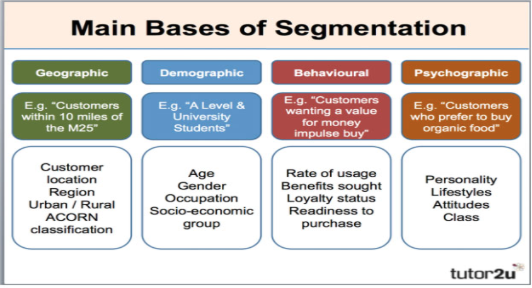

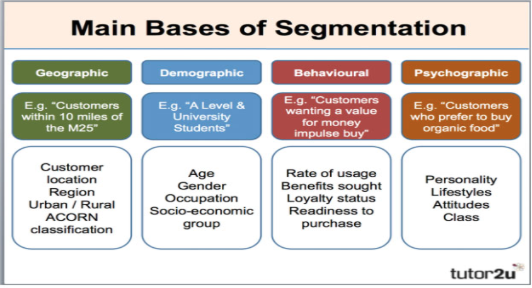

market analysis, customer (data) segmentation generates increased revenue for businesses. Customer segmentation tools help identify areas of improvement in business marketing strategies and inform you what strategies are working and what aren’t. Segmentation can also help increase conversion rates along every step. You can segment your customers based on several attributes based on demographic, geographical, psychographic and behavioral data and tailor your services accordingly.

Design simple and memorable graphics with data visualization

Design simple and memorable graphics with data visualization

Data Visualization involves presenting complex data in simple graphs and charts, making it easy to understand. Gone are the days of long spreadsheets or databases! Data visualization tools make data user-friendly and interactive with no need for formal training. InsuredMine has developed some of the best tools to help agents convert their precious reports into attractive and simple visuals to understand data better.

See also: The Future of the Agency Channel

Develop intelligent processes with data automation

Data automation is performing high frequency, low-value touches with real-time actionable data designed with a mix of business intelligence, micro-customization and user response to the communication. Intelligent processes also lead to improved decision-making and provide for easy governance of processes. Data automation reduces human errors in handling large amounts of data and frees up support time. Data automation provides faster results and insights into analytics. For starters, it can be as simple as automating birthday wishes or renewal reminders. For more sophisticated users, it can be sending out a prospect drip email or client welcome drip email, with continued fine-tuning and segmentation to hyper-target for best outcomes.

Humanize engagement with data experience

Making effective engagements with clients is valued in this era of automation and robotics. Yes, you can experience data! That can happen through AI-driven chatbots and analytics-powered mobile apps. Both approaches provide a highly contextualized, data-driven experience for clients and reduce the frustration that comes with arranging to meet an agent by resolving non-material issues at the convenience of the client. Data tools help businesses analyze and explore opportunities to provide improved services. When clients experience the difference, they are sure to come back for more.

Conclusion: I believe this blog provides a perspective on how an independent insurance agent can leverage internal, external, structured, and unstructured data to augment their efforts at engaging clients and providing them an extraordinary experience. Having a 360-degree understanding of clients will help the agent engage and segment clients at different stages of their insurance journey. These efforts show multiplied results through the use of data automation and data visualization and allow the customers to have the last say with their data experience. Adding in digital tools like a chatbot or a mobile app not only adds to it but will keep your clients coming back just for the experience. So what’s the delay? No matter how and where you start your story, we will help you end it with ‘happily ever after!’

1. Closing a prospect — Be the insurance commercial or personal, there is always an individual who will be involved/engaged for policy discussion. It is important to understand the primary contact, any affiliation to a business and the need for coverage. For instance, you may consider calling the contact who is operating a gas station or a convenience store but text or email someone who is looking for a cybersecurity policy. The approach should be tailored based on contact and business profile. By segmenting clients based on attributes, agencies can profile them accurately and develop customized communication approaches. These contacts can be ranked based on their coverage needs and likelihood to purchase a policy. Then, drip communication can be designed to increase positive outcomes, focusing on higher-rank leads and converting those prospect who are ready. You can use the deal board feature of InsuredMine to achieve these results. In this case, initial client data, his communication response data, lifestyle and life stage data from social media can also play an important role.

2. Welcoming new clients: Successful agents pay special attention to a client’s onboarding to make sure there is proper communication at all times. They provide clients with all the information and channels (phone, text, email, chat, etc.) needed to contact them. This "availability on demand" leaves a good impression and reduces challenges when it comes to renewals. So, the question is what data do we have and how do we make the most of it in welcoming our clients? First thing would be to set them up on a welcome drip campaign, which will include sharing agency information, ways to connect and social media connections for updates and engagement. Follow-up communication may also include other cross sales and up-sales requests. (This becomes more effective when we capture more information about clients, including demographics and financial, family, lifestyle and life stages details). It is important to have a system that can help you capture all this data so it can be analyzed for better recommendations. Onboarding data can be as simple as knowing what is the best way to communicate -- email, text, phone or in-person. These are great pointers and need to be reflected in an agent’s communication at the right time with the help of the right tools.

3. Renewals: Come judgment day, and now agents need to go through the trial and prove their worth again, fighting against all odds like an increased carrier premium, other easier and cheaper options, more convenient methods of acquiring a policy through an app or online and many others. Agents need to start engaging clients about 90 days before the expiration of the policy. Agents can start with a drip campaign with a combination of email and text-based communication based on the client’s preferences. Knowledge of new or additional assets of the client will also help the agent provide bundling. Information about the client’s change in lifestyle and life stage data can also provide cover fire.

4. Claims management: This is a tricky one, as agencies may not have all the information to start with. Receiving an initial notification from the client about a claim situation should trigger communication, including carrier contact, claim filing options and customer service. Offering digital tools to help clients facilitate claims filing will provide information about the claim, and that information can be leveraged to better manage the claim and update the client’s risk profile for future needs.

5. General client management and annual updates: There are several clients who are on autopilot with very little overhead, but even those clients would appreciate periodic engagement for an opportunity to update their profile or share feedback. Other opportunities with this type of engagement can create cross sales and policy consolidation options, as well as suggestions for increased or improved coverage in line with changes in clients' financial situations. Connecting with customers at the right time for the right policy using available data and presenting special offers or promotions when they become a flight risk are other ways to engage.

It all boils down to the right engagement with the right context, using the right medium, which will start to show results for any agency in a short time. For all the stages above, pulling data from Linkedin, Zillow, DMV, KBB, HazardHub, meteorological department, social media, and census data adds additional context and will help the agent communicate both effectively and efficiently. Other data sources that are equally valuable, but beyond the scope of this discussion, include telematics, sensors (IoT), wearables and GIS data.

Understanding business from a client’s perspective and all data elements required at each stage and their respective data sources will do a tremendous favor to your organization:

1. Closing a prospect — Be the insurance commercial or personal, there is always an individual who will be involved/engaged for policy discussion. It is important to understand the primary contact, any affiliation to a business and the need for coverage. For instance, you may consider calling the contact who is operating a gas station or a convenience store but text or email someone who is looking for a cybersecurity policy. The approach should be tailored based on contact and business profile. By segmenting clients based on attributes, agencies can profile them accurately and develop customized communication approaches. These contacts can be ranked based on their coverage needs and likelihood to purchase a policy. Then, drip communication can be designed to increase positive outcomes, focusing on higher-rank leads and converting those prospect who are ready. You can use the deal board feature of InsuredMine to achieve these results. In this case, initial client data, his communication response data, lifestyle and life stage data from social media can also play an important role.

2. Welcoming new clients: Successful agents pay special attention to a client’s onboarding to make sure there is proper communication at all times. They provide clients with all the information and channels (phone, text, email, chat, etc.) needed to contact them. This "availability on demand" leaves a good impression and reduces challenges when it comes to renewals. So, the question is what data do we have and how do we make the most of it in welcoming our clients? First thing would be to set them up on a welcome drip campaign, which will include sharing agency information, ways to connect and social media connections for updates and engagement. Follow-up communication may also include other cross sales and up-sales requests. (This becomes more effective when we capture more information about clients, including demographics and financial, family, lifestyle and life stages details). It is important to have a system that can help you capture all this data so it can be analyzed for better recommendations. Onboarding data can be as simple as knowing what is the best way to communicate -- email, text, phone or in-person. These are great pointers and need to be reflected in an agent’s communication at the right time with the help of the right tools.

3. Renewals: Come judgment day, and now agents need to go through the trial and prove their worth again, fighting against all odds like an increased carrier premium, other easier and cheaper options, more convenient methods of acquiring a policy through an app or online and many others. Agents need to start engaging clients about 90 days before the expiration of the policy. Agents can start with a drip campaign with a combination of email and text-based communication based on the client’s preferences. Knowledge of new or additional assets of the client will also help the agent provide bundling. Information about the client’s change in lifestyle and life stage data can also provide cover fire.

4. Claims management: This is a tricky one, as agencies may not have all the information to start with. Receiving an initial notification from the client about a claim situation should trigger communication, including carrier contact, claim filing options and customer service. Offering digital tools to help clients facilitate claims filing will provide information about the claim, and that information can be leveraged to better manage the claim and update the client’s risk profile for future needs.

5. General client management and annual updates: There are several clients who are on autopilot with very little overhead, but even those clients would appreciate periodic engagement for an opportunity to update their profile or share feedback. Other opportunities with this type of engagement can create cross sales and policy consolidation options, as well as suggestions for increased or improved coverage in line with changes in clients' financial situations. Connecting with customers at the right time for the right policy using available data and presenting special offers or promotions when they become a flight risk are other ways to engage.

It all boils down to the right engagement with the right context, using the right medium, which will start to show results for any agency in a short time. For all the stages above, pulling data from Linkedin, Zillow, DMV, KBB, HazardHub, meteorological department, social media, and census data adds additional context and will help the agent communicate both effectively and efficiently. Other data sources that are equally valuable, but beyond the scope of this discussion, include telematics, sensors (IoT), wearables and GIS data.

Understanding business from a client’s perspective and all data elements required at each stage and their respective data sources will do a tremendous favor to your organization:

Understand your business DNA with data segmentation

According to market analysis, customer (data) segmentation generates increased revenue for businesses. Customer segmentation tools help identify areas of improvement in business marketing strategies and inform you what strategies are working and what aren’t. Segmentation can also help increase conversion rates along every step. You can segment your customers based on several attributes based on demographic, geographical, psychographic and behavioral data and tailor your services accordingly.

Understand your business DNA with data segmentation

According to market analysis, customer (data) segmentation generates increased revenue for businesses. Customer segmentation tools help identify areas of improvement in business marketing strategies and inform you what strategies are working and what aren’t. Segmentation can also help increase conversion rates along every step. You can segment your customers based on several attributes based on demographic, geographical, psychographic and behavioral data and tailor your services accordingly.

Design simple and memorable graphics with data visualization

Data Visualization involves presenting complex data in simple graphs and charts, making it easy to understand. Gone are the days of long spreadsheets or databases! Data visualization tools make data user-friendly and interactive with no need for formal training. InsuredMine has developed some of the best tools to help agents convert their precious reports into attractive and simple visuals to understand data better.

See also: The Future of the Agency Channel

Develop intelligent processes with data automation

Data automation is performing high frequency, low-value touches with real-time actionable data designed with a mix of business intelligence, micro-customization and user response to the communication. Intelligent processes also lead to improved decision-making and provide for easy governance of processes. Data automation reduces human errors in handling large amounts of data and frees up support time. Data automation provides faster results and insights into analytics. For starters, it can be as simple as automating birthday wishes or renewal reminders. For more sophisticated users, it can be sending out a prospect drip email or client welcome drip email, with continued fine-tuning and segmentation to hyper-target for best outcomes.

Humanize engagement with data experience

Making effective engagements with clients is valued in this era of automation and robotics. Yes, you can experience data! That can happen through AI-driven chatbots and analytics-powered mobile apps. Both approaches provide a highly contextualized, data-driven experience for clients and reduce the frustration that comes with arranging to meet an agent by resolving non-material issues at the convenience of the client. Data tools help businesses analyze and explore opportunities to provide improved services. When clients experience the difference, they are sure to come back for more.

Conclusion: I believe this blog provides a perspective on how an independent insurance agent can leverage internal, external, structured, and unstructured data to augment their efforts at engaging clients and providing them an extraordinary experience. Having a 360-degree understanding of clients will help the agent engage and segment clients at different stages of their insurance journey. These efforts show multiplied results through the use of data automation and data visualization and allow the customers to have the last say with their data experience. Adding in digital tools like a chatbot or a mobile app not only adds to it but will keep your clients coming back just for the experience. So what’s the delay? No matter how and where you start your story, we will help you end it with ‘happily ever after!’

Design simple and memorable graphics with data visualization

Data Visualization involves presenting complex data in simple graphs and charts, making it easy to understand. Gone are the days of long spreadsheets or databases! Data visualization tools make data user-friendly and interactive with no need for formal training. InsuredMine has developed some of the best tools to help agents convert their precious reports into attractive and simple visuals to understand data better.

See also: The Future of the Agency Channel

Develop intelligent processes with data automation

Data automation is performing high frequency, low-value touches with real-time actionable data designed with a mix of business intelligence, micro-customization and user response to the communication. Intelligent processes also lead to improved decision-making and provide for easy governance of processes. Data automation reduces human errors in handling large amounts of data and frees up support time. Data automation provides faster results and insights into analytics. For starters, it can be as simple as automating birthday wishes or renewal reminders. For more sophisticated users, it can be sending out a prospect drip email or client welcome drip email, with continued fine-tuning and segmentation to hyper-target for best outcomes.

Humanize engagement with data experience

Making effective engagements with clients is valued in this era of automation and robotics. Yes, you can experience data! That can happen through AI-driven chatbots and analytics-powered mobile apps. Both approaches provide a highly contextualized, data-driven experience for clients and reduce the frustration that comes with arranging to meet an agent by resolving non-material issues at the convenience of the client. Data tools help businesses analyze and explore opportunities to provide improved services. When clients experience the difference, they are sure to come back for more.

Conclusion: I believe this blog provides a perspective on how an independent insurance agent can leverage internal, external, structured, and unstructured data to augment their efforts at engaging clients and providing them an extraordinary experience. Having a 360-degree understanding of clients will help the agent engage and segment clients at different stages of their insurance journey. These efforts show multiplied results through the use of data automation and data visualization and allow the customers to have the last say with their data experience. Adding in digital tools like a chatbot or a mobile app not only adds to it but will keep your clients coming back just for the experience. So what’s the delay? No matter how and where you start your story, we will help you end it with ‘happily ever after!’