Following Lemonade’s first anniversary, I’m thrilled to announce a new product that could change the way people use their insurance. We call it Zero Everything.

With Zero Everything, Lemonade customers will no longer need to pay deductibles and have their rate increased when filing claims. That’s right: No deductibles. No increase in pricing. Nothing.

If you ever had to file an insurance claim, you probably thought well and hard before doing so. You’re in good company. Many people experience anxiety before filing a claim, and in many cases just give up altogether. Filing claims should be a pleasant and reassuring experience. After all, claims are the reason why we all get insurance in the first place.

Reading some of the negative feedback that insurance companies receive highlights just how serious this phenomenon is. Ask agents, and they will tell you that customers are reluctant to file claims, mostly because of two reasons:

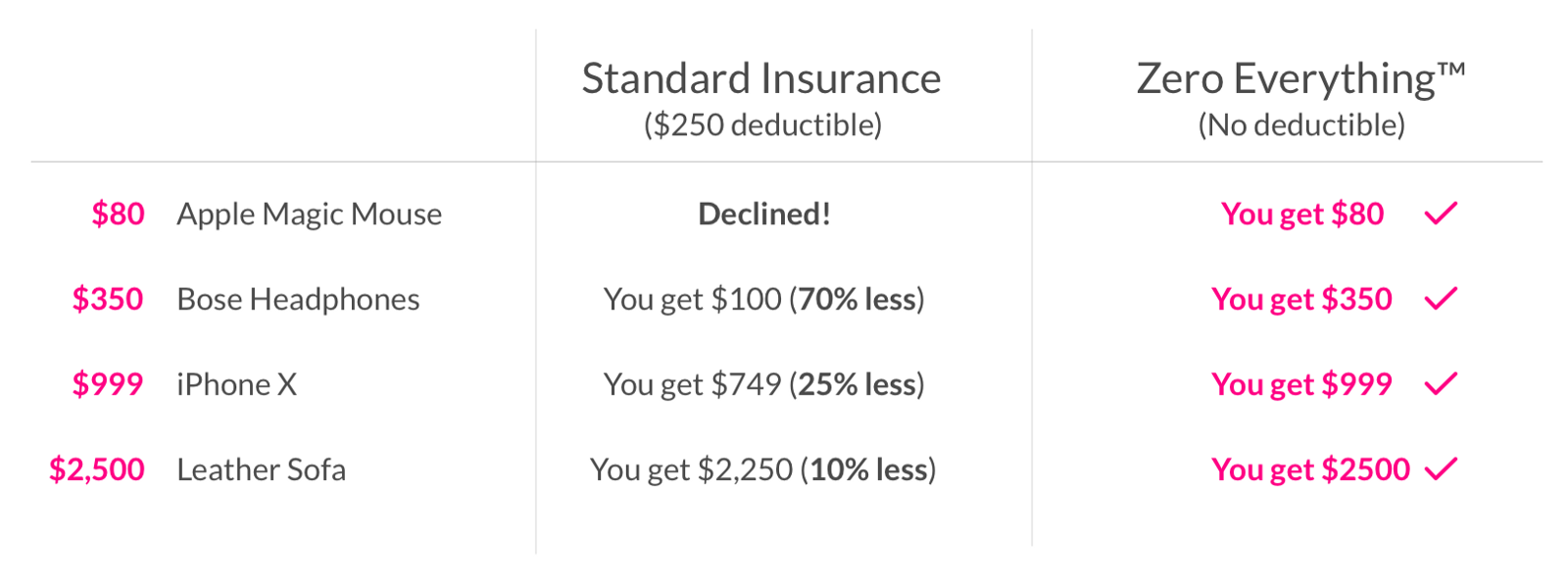

The claim is below the deductible. For example, your policy’s deductible is set to $500, and your $450 headphones just got snatched. Tough luck. You’re not going to get a dime out of your insurance. Because the deductible is an amount that’s deducted from the value of the claim, there’s no sense claiming anything below it. In fact, claims that are lower than the deductible will be immediately declined.

Fear of having rates increased. There’s a famous saying -- “past claims are the best predictor of future ones.” This leads insurers to increase the rates for customers who file claims. They see it as a measure to make up for future potential losses from these customers.

See also: Lemonade: World’s First Live PolicyZero Everything provides the perfect peace of mind - never worry about paying deductibles or increased policy prices again (as long as there's no abuse, of course).

.@lemonade_inc Zero Everything is the closest thing to having an UNDO button for real life! #GoLemonade

But there’s more. Regardless of the value of your claim, with Zero Everything, you’ll get the full amount needed to replace your items with new ones! Someone stole your $500 bike? We’ll pay you $500 to get a new one!

[caption id="attachment_27885" align="alignnone" width="570"] Zero Deductible, Zero Rate Hikes, Zero Worries — Here’s how it works[/caption]

Zero Deductible, Zero Rate Hikes, Zero Worries — Here’s how it works[/caption]

How it works

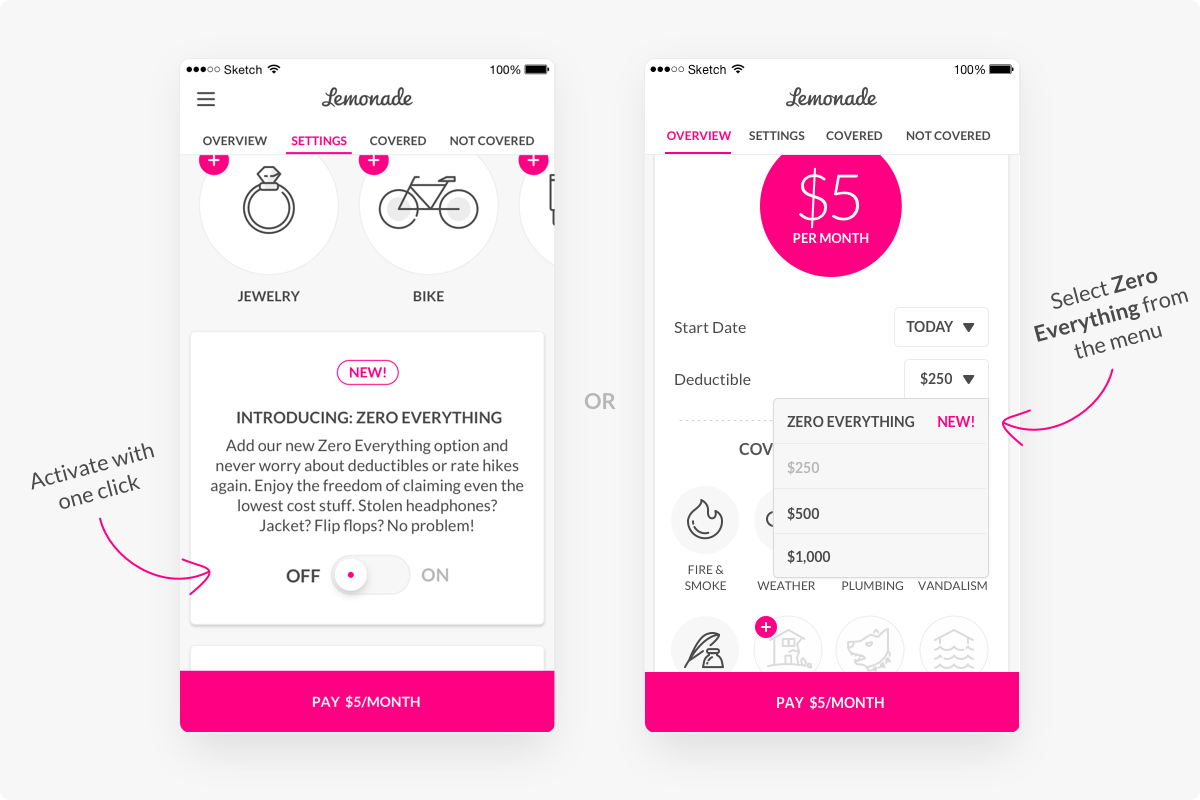

When signing up for a new Lemonade policy, look for the Zero Everything section under the settings tab in our quote page. If you already have a renters policy with us, just use our app to edit your Live Policy, go to the settings tab and look for the Zero Everything box. Condo policyholders, Live Policy is coming soon, so just open the app and tap on Ask Us Anything, and we’ll sort you out.

Why zero deductibles do not exist in home insurance today

In the U.S., home insurance companies spend more than $10 billion each year on the bureaucracy of claim handling alone. All of the endless paperwork, faxes and phone calls you hate? Someone has to pay for them.

In fact, small claims often cost incumbents more to process than the size of the claim itself. So, they brand small claims "nuisance claims" and use the deductible as a deterrent, to discourage you from ever filing them.

It’s important to note that there are no bad intentions behind this mechanism; it’s just an unfortunate consequence of the way insurance works.

How AI changes everything

But that’s where AI Jim, our claims bot, changes the game. AI Jim loves small claims; they’re his favorite. He settles them on the spot, with zero hassle and at zero handling costs. That’s because there’s no such thing as a nuisance claim for AI Jim. In fact, on a slow day, AI Jim can review, approve and pay 1,000x more claims than an entire team at one of the traditional insurers.

This kind of fundamental change is made possible by the replacement of manual labor with AI and bots!

So, if deductibles and rate increases get you nervous, I suggest you head on over to one of our apps or website (lemonade.com) and get yourself a Zero Everything coverage in a few seconds.

See also: Lemonade’s Crazy Market ShareZero Everything is rolling out in California, Texas and Illinois, where it will first be available for renters and condo policyholders. Follow us for updates on coming availability in NY and NJ and support for homeowners policies.