From “I thought homeowners insurance covered that,” to “I’m in a low risk flood zone, so I don’t need flood insurance,” flood insurance agents have heard all the myths about why homeowners don’t need flood insurance. Unfortunately, these myths often undercut the true dangers of flooding and leave home and business owners across the country woefully underprepared if a flood event does occur.

In 2017 alone, the

National Oceanic and Atmospheric Administration reported 16 separate disasters in the U.S., each with damages exceeding $1 billion, which generated total record losses in excess of $306 billion. A large percentage of these damages were caused by flooding, including damages associated with Hurricane Harvey in Texas and Louisiana, and record high water levels in

Missouri, Arkansas and Illinois. While this devastation has certainly brought the conversation about flooding and flood damage back to the forefront, it also may have relayed a subtle, worrisome message to others: Flooding events only affect certain regions at certain times of the year, and 2017 was an anomaly.

The reality is quite the opposite.

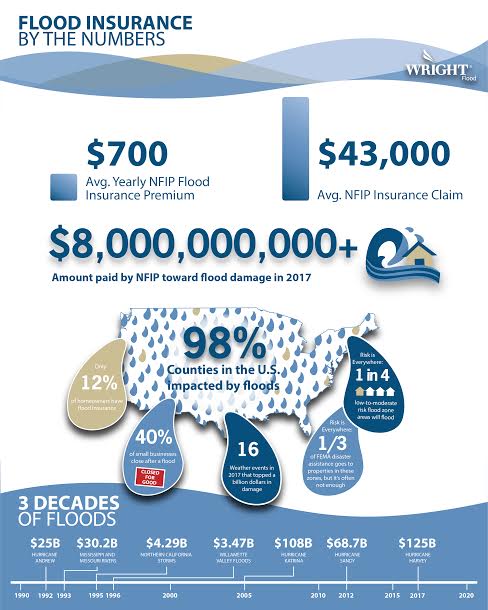

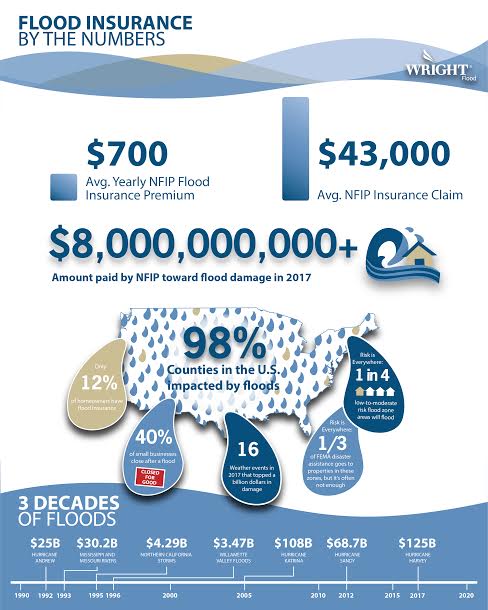

When it comes to flooding, these disasters can happen any time of the year, anywhere across the country. In fact, 25% of all flood damage in the U.S. occurs in what are classified as low- to moderate-risk flood zones by the National Flood Insurance Program (NFIP), and destructive flood events have occurred in 98% of counties across the country. This is especially troubling when, as the NFIP estimates, just one inch of water intrusion can cause more than $20,000 in damages, and the average NFIP claim is around $43,000. In addition, one-third of FEMA disaster assistance goes to properties in these low- to moderate-risk zones, but it’s rarely enough to cover the damages.

The data from these costly flood events reveals a story of loss and hardship that needs to be more widely understood, and now—with the bevy of new private flood insurance options in place—is the perfect time for agents and organizations to research the facts and widely broadcast the message to the home and business owners they protect.

What Agents Need to Know

Flooding is not restricted to heavy tropical storms. It takes multiple forms that can affect other regions in the U.S., including rapid rainfall or structural failure leading to flash floods, spring snowmelt, changing weather patterns, clogged rainwater systems and new building development. Flooding can even be triggered by drought and wildfires. Why? Because wildfires and droughts alter soil conditions, leading to reduced absorption and increased runoff during any heavy rain that follows.

See also: Future of Flood Insurance

Simply put, flooding is the

costliest and most common natural disaster in the U.S., especially considering that it can strike any time of year. Ultimately, a single flood event can destroy a property and wreak irreparable damage on the finances of uninsured home and business owners. Yet, despite these dangers,

only 12% of homeowners have flood insurance. For those in low-risk areas or those without mortgage loans not required by their lenders to purchase NFIP policies, this is a huge problem. Consider the following:

- A March 2017 survey by InsuranceQuotes found that 56% of respondents mistakenly believed that a standard homeowners policy covers flood damage.

- Most business insurance policies exclude flood damage.

- FEMA flood maps may be outdated, and flood risks are changing rapidly. Some research suggests that current maps vastly underestimate those in the high-risk, 1-in-100-year floodplain, with one study suggesting that 40 million Americans, instead of the current estimate of 13 million, are at high risk.

- Hurricane Harvey hit low-risk flood areas, and fewer than 20% of homes damaged in Hurricane Harvey were flood-insured. In total, just 15% of all the 1.8 million homes in Harris County (Houston) had flood insurance, including only 28% of the homes in high-risk areas.

- NFIP policies in low-risk, preferred risk areas are as low as $500 a year, while a flood claim averages $43,000.

Collectively, these statistics highlight the importance of flood insurance for all Americans, no matter where they live. As agents, it’s our job to understand the potential risks in our communities and educate clients—and potential clients—on their flood risk to advise them in the best possible way.

What Are the Solutions?

For agents and others in the insurance industry, spreading the flood risk message requires perseverance and a keen understanding of the different insurance products that are available. While it’s important that owners and tenants know their FEMA-assigned flood risk, it’s also key that they understand the shifting nature of flood risk: that the dangers are changing, and every property is at risk at any time of year. Additionally, while government-backed NFIP policies are a critical way for many Americans to secure coverage, they are not the only option. Some homes and businesses may need excess coverage to cover up to replacement cost, and still other eligible properties may benefit from the array of coverage options available with private insurance products instead of an NFIP plan.

That’s why it’s critical for agents to analyze the true needs of our clients and regularly communicate any changes or updates that may be necessary.

The NFIP provides coverage limits up to $250,000 for the structure of a home, and up to $100,000 for personal possessions. For business owners, coverage limits are up to $500,000 for a structure and $500,000 for contents. Depending on the value of their structure and belongings, some home and business owners may need excess coverage, provided by private insurers to supplement their NFIP policies and provide additional coverage options. For example, NFIP policies do not cover additional living expenses—like the rental of a hotel room if a family is displaced from their home—or coverage for basements and pools. Private flood insurance policies, however, may provide coverage for these things and more, to better serve consumers.

Homeowners and renters aren’t the only ones who can be helped by private flood insurance options. Often, much of the focus during catastrophic flood events is on homes and families, but the effect on businesses is just as devastating. Buildings and inventories have been destroyed, computer equipment wiped out and workers left with nowhere to go—and no job left to do. Often, the cost of recovery from a flood is too much for a business to manage, with 40% of small businesses never re-opening their doors after a disaster.

See also: Hurricane Harvey: A Moment of Truth

The fact is, whether a tenant or building owner, an uninsured company can lose everything in an instant when the water rises. The message agents deliver to business owners needs to mirror the one delivered to homeowners: The risks of flooding are high, and the cost of inaction could be financially unbearable. Agents need to make a special effort to educate business owners on the topic. After all, a company that is willing to invest in anti-theft measures, IT protection and liability insurance should recognize the real financial dangers that floods can deliver.

At the end of the day, private flood insurance options will only be embraced if agents and their clients are fully educated about the risk of flood, the limits of NFIP and all the changing options available. The bottom line is: Flood insurance options are expanding, and we as agents need to understand the full array of flood coverage possibilities available to ensure that those we serve have the opportunity to choose the coverage that will best protect their homes, their families and their businesses.