Have you ever gotten frustrated filling out a paper form? It’s a slow, painful and error-prone process. Despite the ubiquity of digital interactions today, many forms-based interactions remain antiquated.

Think back to the last time you were at your doctor’s office or local bank: To obtain service, you likely had to fill out a multi-page paper form. This problem is exacerbated in certain industries, such as insurance, where a claimant may be required to fill out numerous claim forms.

Advances in technology stacks across artificial intelligence and process automation are changing things for the better, and it's about time. In this era of digital transformation, a streamlined and convenient forms-driven communication experience isn’t just a “nice to have” — it’s a must.

Complex industries need automation

The process of filling out forms is often overwhelming and redundant. Take disability insurance claims. For every form a customer fills out, they are repeatedly asked for the same basic information: name, address, date of birth, date of injury and more. This redundancy is commonplace across many forms, making the process cumbersome for the injured policyholder from the start.

In almost every case, insurance companies have this information, yet policyholders are required to provide it repeatedly. This leads to dissatisfaction at best and abandonment at worst. When policyholders abandon forms, insurance company employees must manually follow up with them through emails, phone calls or duplicate paper mailings — leading to increased costs for the insurer.

Even when the forms are completed, there’s still the issue of opaqueness. Policyholders (not to mention agents) have little insight into the process. There’s usually the lingering feeling that something fell through the cracks, or that some error will send the policyholder back to square one to start the process anew. Stakeholders don’t often have insights as to the status of a claim after requisite documents have been distributed or completed.

Streamlining and digitalizing this traditionally paperwork-intensive process is crucial. Doing so reduces the burden for both policyholders and insurance companies. The industry is rife with automation opportunities that support a more efficient and transparent communication channel between policyholders and insurers, ultimately fostering trust and satisfaction.

See also: Why Are We Still Talking About Digital Transformation?

Obstacles create opportunities

The disability claims space offers another example of the industry’s complexity. There are claims forms that need to be signed by multiple stakeholders, such as lawyers, doctors and injured claimants. If just one of these individuals overlooks a necessary signature, the entire process stalls.

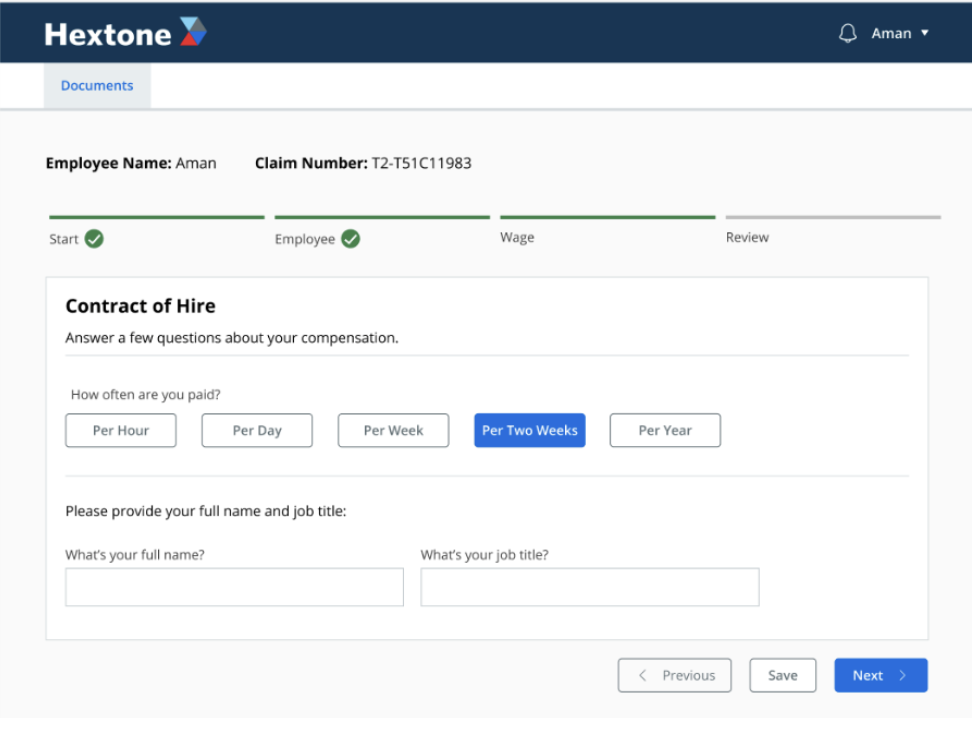

Another potential landmine is filling out wage statement forms, which are critical in compensation claims. Traditional wage forms make it difficult for policyholders to know if they’re filling them out correctly. For example, a form might ask how much an injured claimant earns on a daily or weekly basis, but many claimants aren’t used to thinking about their wages at these frequencies. They are often more familiar with their bi-weekly or annual salary and need to calculate their wages to align to the form’s formats.

Barriers like these led to the development of our forms-driven communications solution. It auto-populates information, making it easier for the policyholder to complete forms. It also offers a multitude of pay frequency options and calculates the correct wages for the time period of the injury.

This solution embodies best customer experience practices because it’s more conversational and less cumbersome. We term these automated interactions as “conversational entries” because these digital experiences simulate the efficiency of an in-person interaction. If a recipient answers “yes” to a question, the workflow could then ask for additional information. Answering “no” to a question would prompt the workflow to move on, which is what we would expect when conversing with a human.

Similarly, in dynamic forms platforms, information already known about the customer is not redundantly solicited, thus avoiding frustration on the customer side. Digital forms are built to dynamically react to the individual customer’s payload, presenting a user interface that only asks for net-new information. This approach results in fewer errors, less redundancy, improved accuracy and faster processing speeds.

See also: Digital Self-Service Is Transforming Insurance

A better experience for insurers

Claimants are not the only stakeholders who benefit from automation opportunities — insurance companies can also reap efficiencies. Insurers have to maintain libraries of documents, making sure every change to a form is stored and reflected as a new version. As a result, the library of forms an insurance company maintains is well into the thousands. Insurance employees have the arduous task of determining which are pertinent to a particular claimant or stakeholder.

Translating forms can also create inefficiencies. In many cases, documents filled out by claimants are manually translated to state-specific forms per local regulation. Because disability coverage varies by state, it’s critical that claims agents present policyholders with the appropriate state-specific form. Existing composition processes often require an agent to manually select the state from a library of state-specific forms.

Automated form processing eliminates the issues of translation and sprawling forms libraries entirely. With “document rationalization,” insurers can review their existing documents and consolidate hundreds of state-specific forms variants into a single document driven by business rules. These business rules can use an automated data payload to determine the appropriate state-specific form to distribute, saving the claims agent time and freeing them for more complex tasks. Similarly, modernized data intake processes can embed customer-provided data onto their state-specific form equivalents, eliminating the need for them to get involved.

Additionally, stakeholder follow-ups can be completed seamlessly through business-driven logic, which also enhances the user experience by reducing the number of manual steps in the process. For example, automated follow-up email reminders can be sent to an insured individual if they have not responded within a certain number of days. Decreasing reliance on manual data processes can lead to significant cost savings in terms of personnel and administrative overhead.

See also: Digital Underwriting Now a No-Brainer

Harnessing the power of automation

The benefits of forms-driven communications go well beyond mere convenience. They indicate a pivotal shift toward a more customer-centric and efficient industry that recognizes customers’ need for personalized experiences. Automation opportunities in print and digital composition suites provide a level of customization not possible with paper-centric systems. This gives customers the confidence of knowing that their claim is being processed accurately.

The days of insurance customers wading through mountains of redundant paperwork, feeling lost in a sea of irrelevant forms and experiencing uncertainty about the status of their claims are becoming a thing of the past. Thanks to cutting-edge technology and automation, insurers are on the brink of a transformative era of efficiency and improved customer experience. As artificial intelligence continues to permeate through the industry, we will continue to see significant enhancements with forms-based experiences.

This transformation is about more than insurance forms. Ultimately, it’s about creating connections and building a communications ecosystem that leads to a positive customer, user and brand experience.