KEY TAKEAWAY:

--Insurance products that are embedded through design facilitate adaptive systems by being a part of the network as opposed to a bolt-on feature. For instance, smart hot water systems that include tailored insurance protection may also include “over the air” software adjustments, informed by data shared across all other units, and thereby mitigate risk directly or by triggering on-site maintenance requests.

----------

P&C insurance is an extension of our desire to overcome nature. Our experience is defined by randomness and chance, and P&C insurance helps to mitigate the effects of (select) adverse random events. It facilitates a return to a pre-loss state or supports resilience understood as a “return to the same.” In this article, we argue that there are other forms of insurance fulfilment that may support adaptation rather than resilience alone – and that these are made possible by what we call Embedded Insurance at the Point of Design.

Most of us are familiar by now with the concept of embedded insurance. Often, this is framed as a traditional insurance product that is offered when an insurable product is sold. Embedded Insurance at the Point of Design is different and is based on the premise that we can better tailor insurance products by co-designing them with assets and offering them as a bundled package with a single value proposition rather than offering a standardized “bolt on” coverage. The benefit of including insurance product development within the asset design process is that it allows for the development of a single value proposition and increases transparency and affinity between the insurer, designer and manufacturer. It may also create opportunity for new insurance product features focused on adaptation and risk mitigation.

Consumers have a need for insurance to protect against unexpected and strongly negative events and are prepared to pay a premium now to avoid possible (and perceived greater) pain of loss later. Traditional P&C insurance products respond to this need by pricing risk and replacing the asset or settling to its fair value as determined at the time of loss. P&C Insurance products place the consumer back where they were pre-loss but do little to position the consumer to mitigate future losses. That is, these products focus on resilience, which we define here as a "return to the same."

See also: Time to Raise Your Embedded Insurance Game

When we think about resilience as a "return to the same," we might think of an analogy such as stretching a rubber band and releasing it. When we do this, the rubber band returns to its pre-stretched state. This synthetic resilience is a positive feature if we wish to re-use it as it was, and the same may be true for many insured assets. In other cases, there is value, both for the consumer and for the insurer, to repair or replace assets with updated features that improve their longevity or mitigate the risk of future loss or damage. When we think in these terms, we consider a shift from resilience to adaptation. Muscle damage and repair provides an analogy.

The process of human muscle strengthening involves a cycle of damage, inflammation, repair and adaptation. After a workout, our nervous system responds through inflammation and the activation of satellite cells around the muscles that fuse with the damaged tissue and support the repair process. As we continue with intervals of exercise and rest, a process of muscle strengthening occurs (called hypertrophy) alongside iterative improvements in the nervous system's ability to co-ordinate and synchronize muscle fibers in aid of repair. This is a learning system that adapts to events and becomes more proficient over time. Our muscles become stronger as a result.

Insurance products embedded in the asset design process may serve a similar function to the body's nervous system in this example if they are complemented by connected product systems.

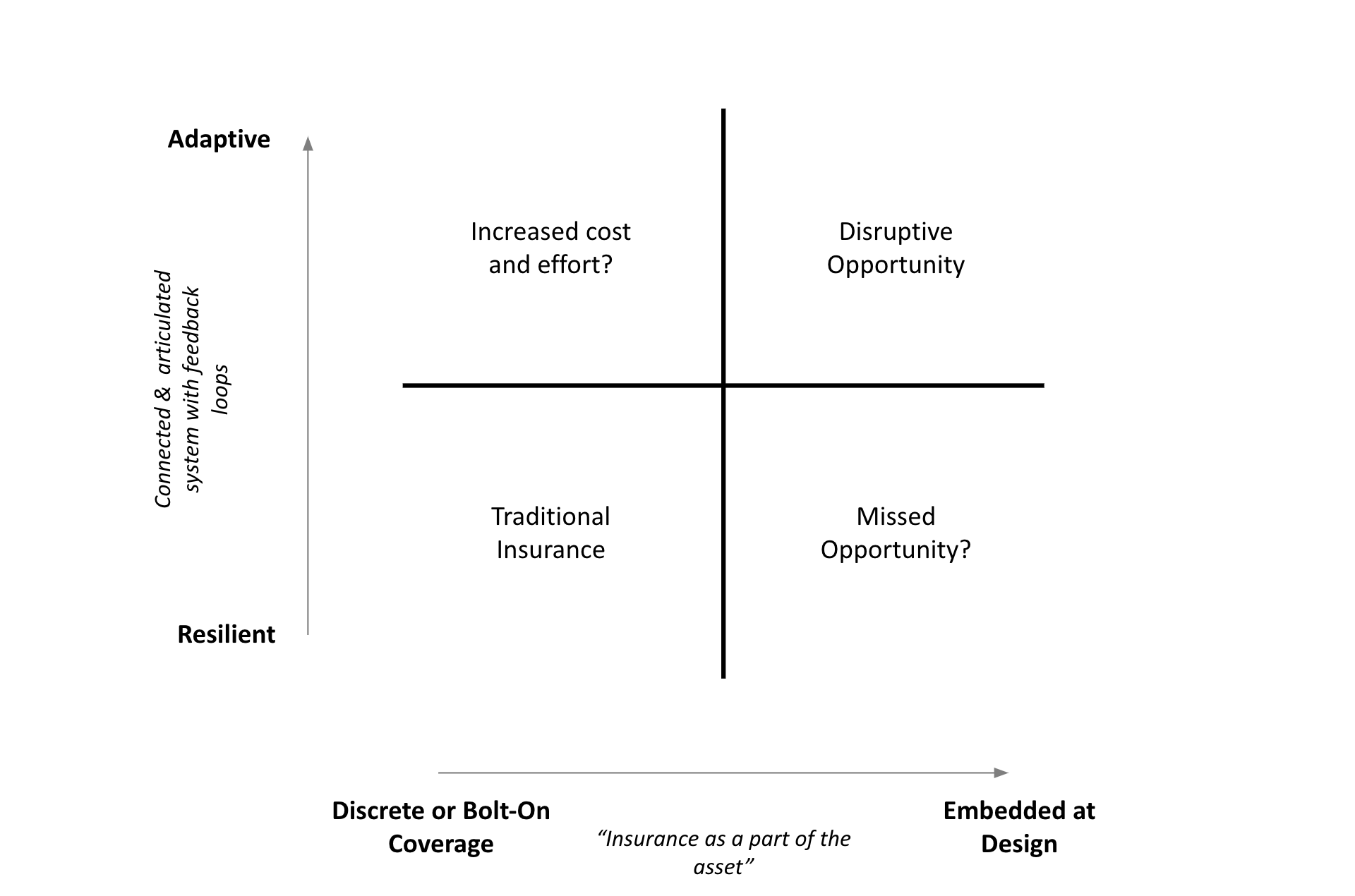

In this diagram, we highlight both the proposition to explore insurance embedded at the point of design (X-axis) and complementary connected product systems (Y-axis). The two concepts together make possible assets with built-in and tailored protection plus a means of updating the asset (either through software update or re-release and replacement through an insurance claim process) to adapt to environmental conditions and risks.

The key to thinking differently about the role that P&C insurance can play is the concept of connected and articulated systems that incorporate feedback loops. These systems may make meaningful adaptation possible. Assets that are connected and provide data to the manufacturer and insurer allow for a deeper understanding of the conditions in which the asset exists and how it is used and create a basis for understanding how the asset may be improved to be more effective in these environments.

When we say these systems ought to be "articulated," we mean that the connectivity ought to also extend to other assets of the same class such that data may be shared not only with manufacturer and insurer but also with other products at the same time. Articulated and connected systems make possible meaningful feedback loops. Tesla's "over the air" updates are one example of a system like this that can facilitate product adaptation and evolution. If not live, updates may be delivered release by release.

See also: Is Embedded Insurance the Wrong Idea?

Insurance products that are embedded through design facilitate adaptive systems by being a part of the network as opposed to a bolt-on feature. The participation of insurers in product and system design allows for risk management-specific updates to inform either real-time or per-release modifications. The participation of manufacturers allows for transparency around timing of updates, of new releases and importantly of changes to cost that will inform insurance premiums. The relationship between parties highlights the strategic nature of designing connected and articulated systems.

An example of how an adaptive system supported by Embedded Insurance at the Point of Design may be realized is connected vehicles. Vehicles that are co-designed between auto manufacturers and insurers may offer tailored insurance solutions specific to the car and its target market. They may allow for data-sharing and a learning system across the network of vehicles. Feedback from the system may inform design enhancements to mitigate risk for subsequent models, and the replacement cost (or repair upgrade) may be factored into existing premium renewals in the case that the vehicle is damaged or destroyed and is repaired or replaced with an upgrade.

An alternative example for property could include the manufacture and maintenance of residential hot water systems. Hot water system bursts represent a relatively infrequent but high-cost insurance claim category. Smart hot water systems that include tailored insurance protection may also include “over the air” software adjustments, informed by data shared across all other units, and thereby mitigate risk directly or by triggering on-site maintenance requests. The insurance premium may be priced to allow for replacement with updated models should the existing unit burst.

Embedded Insurance at the Point of Design makes possible innovative forms of insurance by, firstly, allowing insurers to establish clear and close alignment with asset designers and manufacturers and, secondly, by supporting the development of connected and articulated product systems that may help to mitigate risk.

Whereas traditionally conceived insurance models seek to overcome nature, a truly embedded insurance model coupled with a connected system design may help consumers to better adapt and evolve in response to adverse events.