In any given year, approximately 5% to 7% of U.S. auto and homeowners will file an insurance claim. For both customers and the insurance company, the claims process becomes a moment of truth. A satisfactory settlement is the ultimate deliverable that may ensure customer loyalty and retention. To work through the claims process efficiently and painlessly, a well-established and trusting relationship with customers is a must, and that begins with ensuring you are reaching policyholders with relevant, accurate and consistent communications. However, considering the many options available for how customers prefer to receive their communications, producing timely, clear and consistent communications can be more complicated than ever before.

One area that complicates things is that definition of “the customer” is much broader today; it isn’t limited to the end consumer exclusively. Now, an insurer’s customer can be any individual who interacts with the policyholder, including claims representatives and other employees, the external partner network and the agents and brokers, who often own the relationship with the policyholder.

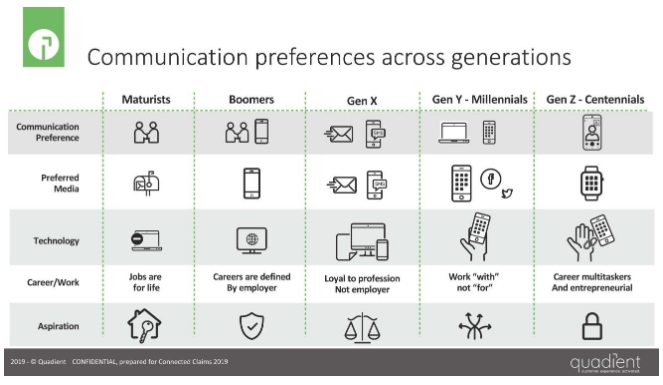

Add to that the fact that we are now communicating with five very different generations of consumers, each with significantly different communications preferences. [See “Communication Preferences Vary by Generation of Insurance Consumer,” below.] The older generation of “maturists” prefers engaging in person, while centennials now entering the workforce grew up with the Internet of Things and prefer connected devices. Also, each generation tends to favor a certain set of channels or devices—and perhaps no one device exclusively. As their needs and lives change, so do their preferences. Many consumers want communications to move fluidly across several devices, and they want every channel to be able to provide the information they’re looking for, along with the ability to resolve any issue in a timely manner.

From the perspective of the insurance carrier, the current state of customer communications has been complicated by the proliferation of communication devices and channels over recent years. As technologies have evolved, so have the methods of engagement, from face-to-face communications, to phone and fax, and now SMS text, email, mobile apps, social media and push notifications. While today’s options provide a range of choices, this evolution has hurt many organizations. To accommodate multichannel preferences, many insurers simply added specialized teams, so that they now have a web team, a mobile team, an app team—and all of them operating separately.

While adopting a multichannel approach means an organization can deliver communications through multiple channels, it can also mean a lot of redundant work, resulting in inconsistent messaging across all channels and lines of business. For customers, this lack of integration and coordination means they may receive what appears to be conflicting or sometimes redundant information. Insurers may not know exactly what message a customer is receiving at any given time, which also limits the company’s ability to effectively track responses and achieve a true 360-degree view of the customer.

This version of multichannel communication is different from omni-channel communications, which is an approach for sending customers consistent, centrally managed messages across all channels. Ideally, implementing an omni-channel approach lets you build a communication template once that you can then use across any channel to reach any destination device. This ensures a level of control over outgoing communications and consistency in messaging, allowing an insurer to present itself as “one company” in the eyes of its customers. Such technology also provides visibility into what is being sent and when to engage with customers according to their preferences. You can then further optimize customer communications by measuring and monitoring customer engagement and behaviors and adjust the touchpoints as needed.

See also: Who Is Your Customer; How Is the Experience?

To provide a positive customer experience, insurers need to implement all the available channels to engage with customers and to understand the customer’s journey through the organization. One way to think about such a strategy is: Digital first, but not digital only. Continuing to invest in traditional channels is just as important for elevating the customer experience as it is to develop and use the newer channels. And, in both cases, it is important to gather data and insights along the way to understand each client’s individual needs and goals to continuously improve the customer experience within and outside of the claims process.

A better and more satisfactory claims process depends in large part on the strength of customer relationships developed through interactions with your organization. Building long-term, trusting relationships lies in having the ability to communicate clearly and effectively. To achieve this, insurers must look for ways to integrate all communication channels to better understand and improve the customer experience. Organizations that have invested in a solid omni-channel engagement strategy have been shown to enjoy more customer loyalty and retention. And in the insurance industry, in areas where price and product may be largely the same among competitors, customer experience will always be a key differentiator in gaining and retaining business.

Communication Preferences Vary by Generation of Insurance Consumer

Here are the varied communication preferences of the five generations currently making insurance purchasing decisions. Keep these in mind when creating your customer communications:

Maturists (technology non-users), who are now 75-plus years old, have always had a preference for face-to-face communications. For this generation, home ownership is a life goal, and they have often only worked for a single organization, likely focusing on specializing in a single career or job area. As they prefer to engage in conversation in person, their second channel preference is mail.

Boomers (technology early adopters) came next and appreciate the value of a face-to-face conversation. However, they are more practical and understand this might be difficult to do consistently. This generation prefers phone calls if they are not able to communicate in person and are very comfortable making or taking calls from home or work. This generation saw economic growth, so it is no surprise they aspired to save, save, save and secure a financial future. They, too, were also quite loyal to their employer, but not to the job or career, often switching to different roles within an organization.

Gen X (digital immigrants), born between 1964 and 1980, remembers the world before computers and cell phones and then, as adults, experienced the transition. They have adopted technology well and typically prefer SMS text messages and email over any other communication channel, using their computer or cell phone most frequently. Interestingly, from an employment perspective, this generation begins to move away from company loyalty to a loyalty to self, meaning they follow their career aspirations to whichever organization suits them best, often struggling to find the balance between work and life.

Gen Y or millennials (digital natives) were born between 1980 and the mid-1990s. Having grown up with technology and lived through technology’s rapid advancement, they are keen to use social media and mobile apps on their personal devices to get information at a moment’s notice. They also move further away from the being loyal to brands or companies, from a work and consumer perspective, and they seek to feel connected to the organization they work with, not for…as well as with the brands they consume. They tend to make it known that they seek a connection to a brand’s mission, values and purpose.

See also: How to Leverage Tech in Customer Communications

The youngest of generations—Gen Z or centennials (digital dependents)—are now entering the workforce. Currently ages nine to 23, this generation only knows the connected world, or the Internet of Things (IoT). Their communication preference isn’t just an app or device, but rather the connectedness of all of their devices—from wearables to smart home devices and smart phones. This generation understands the value of 3D printing, blockchain and more. Only a little is known about this generation as they are still young and studies are still underway, but generally they lean toward starting their own businesses and testing new ideas, while working several other jobs. And because they always have had access to technology and immediate access to information, they unsurprisingly aspire to retain and value privacy.

What are the commonalities between the generations upon which insurers can rely? You will find customer-centricity is key to success, across your client base. This is done by adapting to the changing communication preferences and channels of insureds and claimants, enabling two-way communications and delivering a seamless experience. A communication approach that meets these goals can mean the difference between success and failure with today’s wide range of customers.

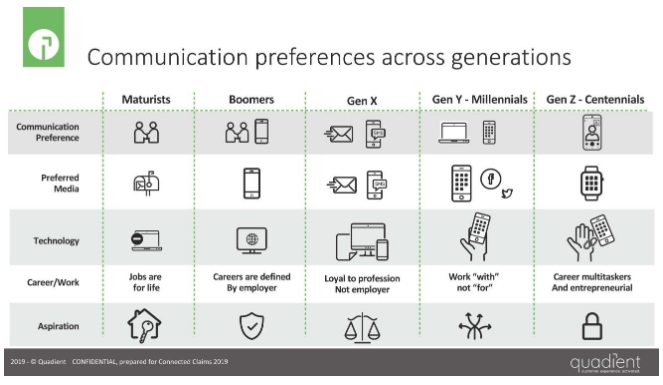

Communication Preferences Vary by Generation of Insurance Consumer

Here are the varied communication preferences of the five generations currently making insurance purchasing decisions. Keep these in mind when creating your customer communications:

Maturists (technology non-users), who are now 75-plus years old, have always had a preference for face-to-face communications. For this generation, home ownership is a life goal, and they have often only worked for a single organization, likely focusing on specializing in a single career or job area. As they prefer to engage in conversation in person, their second channel preference is mail.

Boomers (technology early adopters) came next and appreciate the value of a face-to-face conversation. However, they are more practical and understand this might be difficult to do consistently. This generation prefers phone calls if they are not able to communicate in person and are very comfortable making or taking calls from home or work. This generation saw economic growth, so it is no surprise they aspired to save, save, save and secure a financial future. They, too, were also quite loyal to their employer, but not to the job or career, often switching to different roles within an organization.

Gen X (digital immigrants), born between 1964 and 1980, remembers the world before computers and cell phones and then, as adults, experienced the transition. They have adopted technology well and typically prefer SMS text messages and email over any other communication channel, using their computer or cell phone most frequently. Interestingly, from an employment perspective, this generation begins to move away from company loyalty to a loyalty to self, meaning they follow their career aspirations to whichever organization suits them best, often struggling to find the balance between work and life.

Gen Y or millennials (digital natives) were born between 1980 and the mid-1990s. Having grown up with technology and lived through technology’s rapid advancement, they are keen to use social media and mobile apps on their personal devices to get information at a moment’s notice. They also move further away from the being loyal to brands or companies, from a work and consumer perspective, and they seek to feel connected to the organization they work with, not for…as well as with the brands they consume. They tend to make it known that they seek a connection to a brand’s mission, values and purpose.

See also: How to Leverage Tech in Customer Communications

The youngest of generations—Gen Z or centennials (digital dependents)—are now entering the workforce. Currently ages nine to 23, this generation only knows the connected world, or the Internet of Things (IoT). Their communication preference isn’t just an app or device, but rather the connectedness of all of their devices—from wearables to smart home devices and smart phones. This generation understands the value of 3D printing, blockchain and more. Only a little is known about this generation as they are still young and studies are still underway, but generally they lean toward starting their own businesses and testing new ideas, while working several other jobs. And because they always have had access to technology and immediate access to information, they unsurprisingly aspire to retain and value privacy.

What are the commonalities between the generations upon which insurers can rely? You will find customer-centricity is key to success, across your client base. This is done by adapting to the changing communication preferences and channels of insureds and claimants, enabling two-way communications and delivering a seamless experience. A communication approach that meets these goals can mean the difference between success and failure with today’s wide range of customers.

Communication Preferences Vary by Generation of Insurance Consumer

Here are the varied communication preferences of the five generations currently making insurance purchasing decisions. Keep these in mind when creating your customer communications:

Maturists (technology non-users), who are now 75-plus years old, have always had a preference for face-to-face communications. For this generation, home ownership is a life goal, and they have often only worked for a single organization, likely focusing on specializing in a single career or job area. As they prefer to engage in conversation in person, their second channel preference is mail.

Boomers (technology early adopters) came next and appreciate the value of a face-to-face conversation. However, they are more practical and understand this might be difficult to do consistently. This generation prefers phone calls if they are not able to communicate in person and are very comfortable making or taking calls from home or work. This generation saw economic growth, so it is no surprise they aspired to save, save, save and secure a financial future. They, too, were also quite loyal to their employer, but not to the job or career, often switching to different roles within an organization.

Gen X (digital immigrants), born between 1964 and 1980, remembers the world before computers and cell phones and then, as adults, experienced the transition. They have adopted technology well and typically prefer SMS text messages and email over any other communication channel, using their computer or cell phone most frequently. Interestingly, from an employment perspective, this generation begins to move away from company loyalty to a loyalty to self, meaning they follow their career aspirations to whichever organization suits them best, often struggling to find the balance between work and life.

Gen Y or millennials (digital natives) were born between 1980 and the mid-1990s. Having grown up with technology and lived through technology’s rapid advancement, they are keen to use social media and mobile apps on their personal devices to get information at a moment’s notice. They also move further away from the being loyal to brands or companies, from a work and consumer perspective, and they seek to feel connected to the organization they work with, not for…as well as with the brands they consume. They tend to make it known that they seek a connection to a brand’s mission, values and purpose.

See also: How to Leverage Tech in Customer Communications

The youngest of generations—Gen Z or centennials (digital dependents)—are now entering the workforce. Currently ages nine to 23, this generation only knows the connected world, or the Internet of Things (IoT). Their communication preference isn’t just an app or device, but rather the connectedness of all of their devices—from wearables to smart home devices and smart phones. This generation understands the value of 3D printing, blockchain and more. Only a little is known about this generation as they are still young and studies are still underway, but generally they lean toward starting their own businesses and testing new ideas, while working several other jobs. And because they always have had access to technology and immediate access to information, they unsurprisingly aspire to retain and value privacy.

What are the commonalities between the generations upon which insurers can rely? You will find customer-centricity is key to success, across your client base. This is done by adapting to the changing communication preferences and channels of insureds and claimants, enabling two-way communications and delivering a seamless experience. A communication approach that meets these goals can mean the difference between success and failure with today’s wide range of customers.

Communication Preferences Vary by Generation of Insurance Consumer

Here are the varied communication preferences of the five generations currently making insurance purchasing decisions. Keep these in mind when creating your customer communications:

Maturists (technology non-users), who are now 75-plus years old, have always had a preference for face-to-face communications. For this generation, home ownership is a life goal, and they have often only worked for a single organization, likely focusing on specializing in a single career or job area. As they prefer to engage in conversation in person, their second channel preference is mail.

Boomers (technology early adopters) came next and appreciate the value of a face-to-face conversation. However, they are more practical and understand this might be difficult to do consistently. This generation prefers phone calls if they are not able to communicate in person and are very comfortable making or taking calls from home or work. This generation saw economic growth, so it is no surprise they aspired to save, save, save and secure a financial future. They, too, were also quite loyal to their employer, but not to the job or career, often switching to different roles within an organization.

Gen X (digital immigrants), born between 1964 and 1980, remembers the world before computers and cell phones and then, as adults, experienced the transition. They have adopted technology well and typically prefer SMS text messages and email over any other communication channel, using their computer or cell phone most frequently. Interestingly, from an employment perspective, this generation begins to move away from company loyalty to a loyalty to self, meaning they follow their career aspirations to whichever organization suits them best, often struggling to find the balance between work and life.

Gen Y or millennials (digital natives) were born between 1980 and the mid-1990s. Having grown up with technology and lived through technology’s rapid advancement, they are keen to use social media and mobile apps on their personal devices to get information at a moment’s notice. They also move further away from the being loyal to brands or companies, from a work and consumer perspective, and they seek to feel connected to the organization they work with, not for…as well as with the brands they consume. They tend to make it known that they seek a connection to a brand’s mission, values and purpose.

See also: How to Leverage Tech in Customer Communications

The youngest of generations—Gen Z or centennials (digital dependents)—are now entering the workforce. Currently ages nine to 23, this generation only knows the connected world, or the Internet of Things (IoT). Their communication preference isn’t just an app or device, but rather the connectedness of all of their devices—from wearables to smart home devices and smart phones. This generation understands the value of 3D printing, blockchain and more. Only a little is known about this generation as they are still young and studies are still underway, but generally they lean toward starting their own businesses and testing new ideas, while working several other jobs. And because they always have had access to technology and immediate access to information, they unsurprisingly aspire to retain and value privacy.

What are the commonalities between the generations upon which insurers can rely? You will find customer-centricity is key to success, across your client base. This is done by adapting to the changing communication preferences and channels of insureds and claimants, enabling two-way communications and delivering a seamless experience. A communication approach that meets these goals can mean the difference between success and failure with today’s wide range of customers.