As the world of risk becomes more complex, the role insurers play in that world also becomes more complex. It’s why we hire and train an army of the best modelers our leading universities can produce. It’s why we’ve seamlessly absorbed — instead of resisted — the best risk insight and efficiency tools the insurtech craze has had to offer. And it's why industry capitalization has grown by almost a third in the past five years.

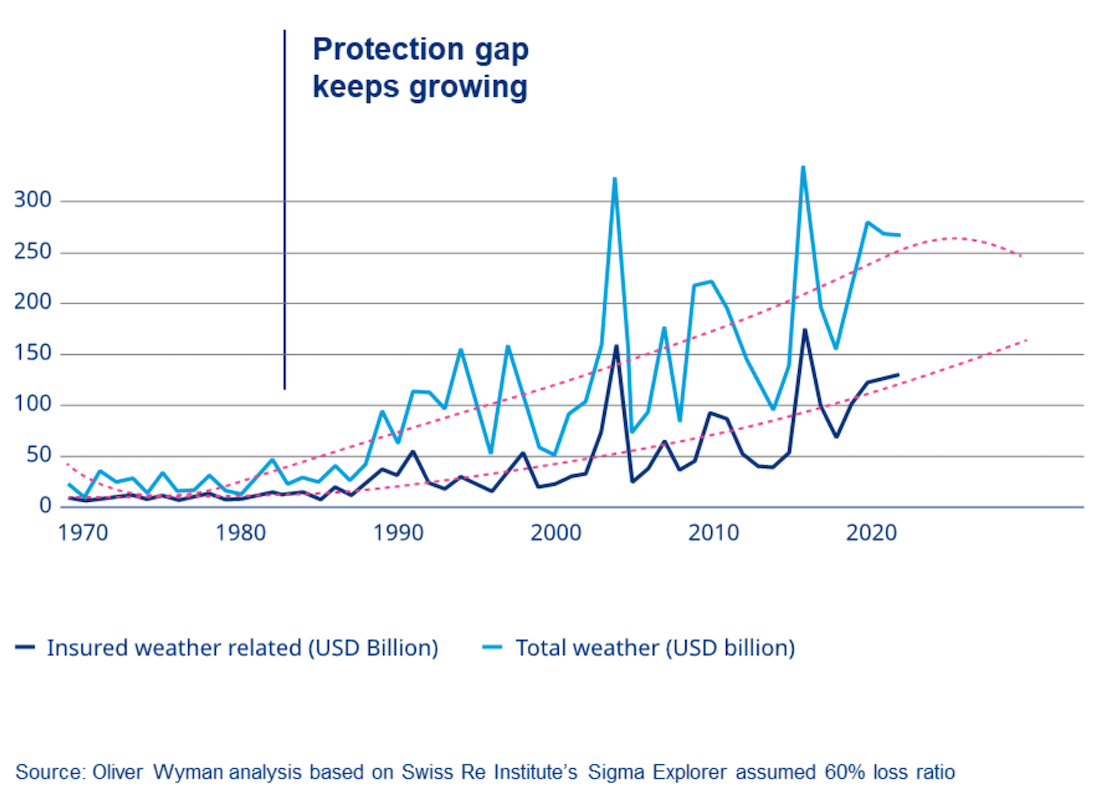

But our ability to maintain pace with that complexity is slipping. It was evident during the pandemic and is becoming increasingly clear as the protection gap—meaning the delta between economic losses and insured losses—continues to grow, both in developing and developed markets.

It’s not totally surprising. While society needs insurers to “see the forests” when it comes to risks, we’re focusing on the microbes left by the beetles burrowing under the bark of individual trees. Put another way, while espousing ambitions to be holistic risk partners, we’ve used our new tools to systematically narrow our roles to the most familiar of our offerings: risk transfer.

This dichotomy—between increasingly sophisticated underwriting and growing societal risk—is particularly evident with climate resilience. Leading insurers have understandably reassessed their market exposures and begun sending the difficult risk signals that reflect the damage posed by rising sea levels, warmer oceans, stronger storms and hotter temperatures (not to mention rising claims inflation, continued development in high-risk areas and regulatory pressures).

But there was a time when our industry focused on risk whether it was on our balance sheets or not. In the 1890s, that spirit drove insurance leaders to see electricity for what it was—a step change in modern civilization—not simply as an underwriting factor. So instead of focusing only on how to price the risk, they harnessed knowledge to reduce the risk.

Voila! There came Underwriters Laboratory, which William Henry Merrill founded to help make electricity safe for the world and allow insurers to manage the residual risk of electrical fire.

Compare that with how we are handling climate challenges now. Can we honestly tell ourselves that we’re behaving as if confronting a “step change in modern civilization”? Just as we look back at Merrill today, future generations will study what we did when the planet faced the most wicked of risk problems. Did we fall prey to short-term pressures? Did we battle over a shrinking amount of properly priced weather-related risk? Or, given our risk-bearing role in society, did we intentionally leverage our industry’s unique knowledge and insights to help communities thrive while confronting heightened risks?

Since beginning a climate residency at Duke’s Nicholas Institute for Energy, Environment and Sustainability earlier this year, I’ve had opportunities to exchange ideas with leading experts on climate and its impacts. What I’ve discovered is that the knowledge and tools of the insurance sector are deeply relevant to some of the thorniest climate challenges and their potential solutions.

During a recent visit to campus, I had conversations with brilliant people—none of whom had in-depth insurance knowledge—about derisking carbon offsets, creating money for adaptation, promoting eco-tech wildfire hubs, deploying the IN-CORE computational resilience tool, understanding community data needs, advancing ESG in the C-suite, reducing occupational exposure to extreme heat and more—lots more. One mind-bending conversation even challenged the term “climate change,” suggesting that the problem is really about humans’ impact on planetary water systems, not the weather.

So much creative thinking is happening on climate issues that are fundamentally about risk—our industry’s domain. Insurers could create—and accrue —immense value if we systematically leaned into these issues with scale.

That’s why I’m proud to be working with leaders at Duke and the University of Georgia to launch the Center for Innovation in Risk Analysis for Climate Adaptation and Decision-making (CIRCAD). In response to a National Science Foundation RFP focused on improving collaborative efforts around climate modeling, CIRCAD aims to develop a dynamic platform for leading thinkers in the insurance world to engage directly with top academic researchers to define an action plan for impact.

But that’s not all. CIRCAD also seeks to create a platform for our industry to quickly prototype, pilot and scale new risk reduction and risk management concepts. A platform that improves decision-making amid future uncertainty. A platform that repurposes our industry’s most fundamental role—risk modeling—to capture and monetize the value of the resilience dividend. And a platform that, by virtue of its size and impact, can allow our industry to approach decision-makers as partners, not supplicants.

In other words, CIRCAD is a collaboration that seeks to do for climate risk what Underwriters Laboratory did for electrical risk.

What’s next? This fall, Duke University and the University of Georgia will convene leaders from the insurance industry and academia, facilitating what may be the most advanced and significant conversations our industry has ever had on climate issues. The aim is for CIRCAD to begin defining a climate resilience agenda that reflects the full breadth of our industry’s societal risk management role.

Interested in joining the dialogue? The event will be invite-only, but please watch this space for registration materials.

The time to act is now. Because as Hamilton reminds us, “History has its eyes on you.” Let’s make sure we’re proud of the view.