Because of the recent and hugely public spate of cyber "events," the world of cyber security and subsequently cyber insurance is firmly in overdrive. According to the UK Department for Innovation & Skills, 81% of large businesses and 60% of small businesses suffered a cyber-security breach in the last year, and the average cost of breaches to business has nearly doubled since 2013.

We have all seen the headlines, from Sony last year to British Airways earlier this month to the French TV Channel TV5Monde. The severity and importance of each of these has material impacts on not only their ability to do business but also their brand and reputation as a customer, employee and partner.

Sony was clearly hugely public, by far one of the biggest and most public I have seen hit the news for a long time. It was all over most news channels, causing outcry from customers and employees, some of whom threatened to sue their employer or former employer for failing to protect their data. Sony, of course, has had many attacks, including one taking down its PlayStation online platform for days on end. As for BA, the first I heard of this was an email saying, "Someone has accessed your account." Please come change your password! This is the brand that I trust with my personal details, my location and much more.

Finally, TV5Monde seems to be particularly worrying to me. In a scene that reminded me of the wonderfully played Elliot Carver from 007's "Tomorrow Never Dies," the media giant was quite simply disabled, their TV taken off air, their public online presence taken over and more. An attack of this scale and power to me simply highlights what Hollywood has been portraying for years (remember "Die Hard," where the bad guys take over the airport by hot wiring a few cables nearby?). Interestingly, subsequent reports again point to human error here – for instance, a TV interview showed passwords stuck to Post-It notes.

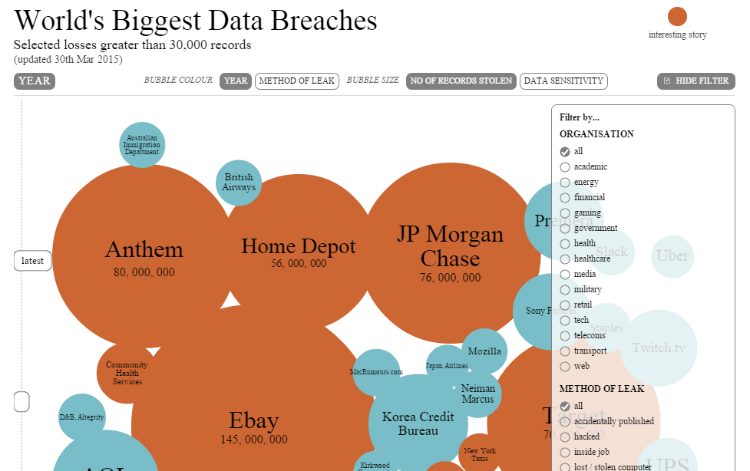

If we are under any doubt by the frequency, scale and impact of attacks, I found a great website (www.informationisbeautiful.net) recently that visualizes some of the data breaches by year, industry and size, reason and more; see here for the full interactive chart.

Cyber threats have been defined by many; however, as with many other critical business issues, lots of other things are being added to the overall "cyber" definition. The recent report from the UK Government on UK cyber security: the role of insurance talks through both the threat and, importantly, the opportunity for insurers.

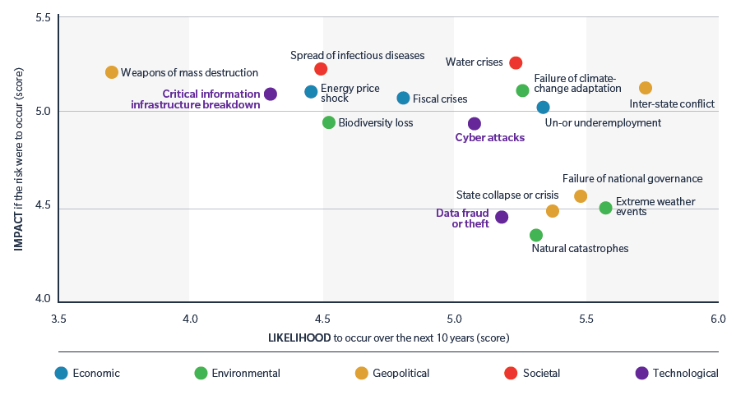

The World Economic Forum in its 10th Annual Global Risks Report has cyber risks up with water crisis and natural catastrophe and ahead of WMD, infectious disease and fiscal crisis (in terms of likelihood of occurrence). Given what we have all experienced in the last recession, I don't think we could have a stronger wake up call.

- Top Global Risks According to the World Economic Forum

- Top Global Risks According to the World Economic Forum

For now, and certainly as I write today, there is a small correlation between cyber-attacks and loss of human life. However, as we become ever more connected with IoT (Internet of Things) or IoE (Internet of Everything), future devices will all be connected. In the latest report, the government said that 14 billion objects are already connected to the Internet, 40 million of them in the UK. By 2020, it could be as many as 100 billion worldwide.

The upside of being able to monitor your heart pacemaker or your insulin levels from an app are already upon us; "wearables" is the buzzword for 2015. When these devices move from monitoring to controlling, the threat just increases. A cyber-attack at a local level, shutting down a hospital, airport, city traffic system, taking over a driverless car or airplane – it's far too easy to paint a picture here.

What's the role of the insurer in all of this?

The insurance provider has a huge role in this, not only to pick up the pieces when an event occurs, but also across the entire lifecycle. At the outset, we have an opportunity to better educate the market on cyber risks in general, in creating insurance capacity for the event and ultimately better prepare ourselves for the continuing advancement and frequency of attacks.

This goes far beyond the cyber essentials to better prepare small and medium-sized businesses (SMEs) and large enterprises alike. This is not collecting a badge; this is time to get ready for a battle. Not just a battle against cyber threats, but a battle for your reputation and brand. A brand that says to your employees, customers and partners, you can trust me with your information – I have a plan in place that's tried and tested! The government scheme has covered the bare minimum essentials, which is like passing your driving theory test. We need expert drivers here to navigate roads no one has previously seen.

The UK, and London market specifically, is already well-placed given its deep experience in insuring against specialty risks, but capacity in the market will continue to increase as the threats and frequency of events increases, giving rise to new, more tailored products and opportunities for the entire market. How long will it be before we all have our own personal cyber Insurance policy?

Move to prevention rather than cure

We need to better help organizations truly understand the cost of putting this right after the event. As an example, some estimate that the cost of the Target breach in the U.S. has cost them north of $100 million to correct. In the early earnings call post the event, Target executives said, "The breach resulted in $17 million of net expenses in the fourth quarter..., with $61 million of total expenses partially offset by the recognition of a $44 million insurance receivable."

Hindsight is wonderful, but perhaps a fraction of this upfront would have saved this money and, importantly, provided time to focus on the business strategy, not remedial work.

Reputation, Reputation, Reputation

It's already been widely discussed, but insuring an organization's reputation is challenging for a number of reasons. Of course, almost anything can be insured, but defining what the impact is and then working out what you need to be covered for will no doubt bring additional challenge for something that most would describe as intangible. The Insurance Times has a good piece here on this.

More importantly, what's the short-, medium- or long-term impact and value on the reputational damage? Take your favorite or most-used retailer, give it all your personal financial data and shopping habits. It then suffers a breach – how likely are you to use or recommend the retailer again? Maybe you would forgive it for one breach; what if it happened again? It's too easy to move. I read that in the UK you are more “likely to suffer a theft from your bank than a physical burglary” these days.

Does this affect your future choice? How long does it take you to re-establish trust with your customers, employees and partners?

Typically, reputation risk is around 5% to 20% of cyber cost. However, in reality, it's the gift that can keep on giving, that no one really wants.

What if you are an online-only business? What if you were the ones who disrupted your market through technology and now that has been taken away from you. You don't have the luxury of physical outlets as a backup or alternative part of your business plan. Dealing with other breaches such as shoplifting has been an occurrence since retail began, but these were isolated to the individual locations.

SMEs, especially, are not as well-equipped. On one hand, digital makes access open to anyone to create a new business, but on the other hand we must now factor in the cost of doing business online, of which cyber is a now business-critical.

What do you think?

Are we prepared and doing enough across the sector? Is this at the forefront of your business continuity strategy? Have you a plan in place to protect your employees, customers and partners? Do you have adequate cover that is well-enough defined? Are you investing ahead of the curve to prevent it?