- What is the claims payment error rate by your insurance company, health maintenance organization (HMO) or third-party administrator (TPA)? What’s the impact when 3% to 10% of plan expenses are errors?

- How much does spread pricing by the pharmacy benefits manager (PBM) cost the health plan participant?

- Which physicians are the bad actors whose practice patterns are more than 300% outside established medical evidence protocols?

- Which hospitals charge 1000%-plus above Medicare payment rates?

- How much did iatrogenic disorders cost the plan?

- What percentage of readmissions were preventable?

- How much are labs, urgent care, MRIs and Emergency Departments upcoding and overcharging the health plan? What happens when you are accountable because your health plan and participants are paying four to 10 times more for the exact same services?

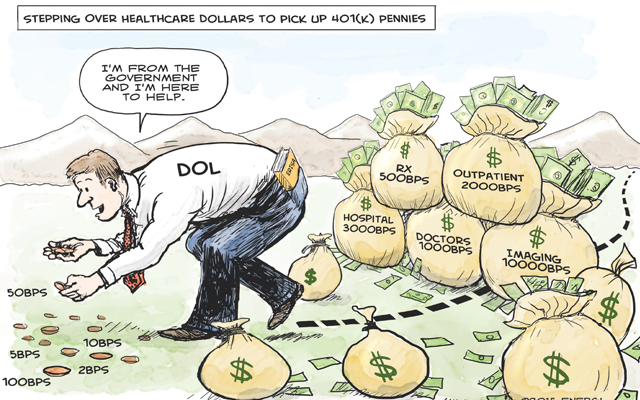

Stepping Over Dollars to Pick Up Pennies

Regulators worry about overcharges on investment plans but ignore issues with healthcare that can be 10 times as bad. That will change.