Mergers and acquisitions in the second half of 2017 ended on a strong note, and activity should see further acceleration in 2018.

Executive Summary

The U.S. insurance sector announced deal value reached $9 billion in the second half of 2017, down from $24.2 billion in the second half of 2016.

Activity remains robust in the brokerage sector, with 232 announced deals, which was 3% higher than in the same period in 2016.

Among insurers, megadeals have been limited by uncertainty in terms of the direction of tax and regulatory reforms. Nevertheless, the passing of tax reform at the end of 2017 and postponement of the implementation of the Department of Labor’s fiduciary rule until 2019 will likely improve clarity for deal making in 2018.

Insurers are expected to continue to divest capital-intensive or underperforming businesses. Private equity will no doubt continue to pursue U.S. insurance sector assets, which are now more attractive due to a lower corporate tax rate.

Trends and highlights

- 271 insurance deals were announced for a disclosed $9 billion deal value in 2H 2017 (of which 248 deals had undisclosed deal values)

- Insurance broker deals remained the most active, composing 86% of deal volume

- For insurance underwriter deals, the life and property/casualty sectors each contributed more than $4 billion in disclosed deal value while property/casualty led in deal volume

Highlights of 2017 deal activity

Robust deal activity in 2H 2017

There were four announced deals valued in excess of $1 billion, for a total of $6.1 billion, in the second half of 2017.

See also: U.S. Insurance Deals: Insights on First Half

Key transactions and themes

The Hartford agreed to two major deals in the last quarter of 2017, including an acquisition and divestiture:

- Hartford Financial Services Group unit Hartford Life and Accident Insurance agreed to acquire Aetna’s U.S. group life and disability business for $1.45 billion.

- An investor group, including Pine Brook Partners, TRB Advisors, Atlas Merchant Capital, Cornell Capital, Basel, J. Safra Sarasin Holding and Hamilton, Global Atlantic Financial Group and Hopmeadow Holdings GP, agreed to acquire Talcott Resolution, a run-off life and annuity business, from Hartford Financial Services Group for $1.6 billion.

Private equity consortiums are exhibiting interest in runoff variable annuity platforms as insurers focus on new risks:

- In December, an investor group, including Apollo Global Management, Reverence Capital Partners Crestview Advisors and Athene Holding, agreed to acquire the closed block variable annuity and fixed annuities businesses from Voya Financial for $1.1 billion.

The other notable deal announced in 2H 2017 of more than $1 billion in deal value was:

- Assurant’s November agreement to acquire Warranty Group from TPG Capital Management for $1.9 billion. Warranty Group provides underwriting, claims administration and marketing expertise to manufacturers, distributors and retailers of consumer goods including automobiles, homes, consumer appliances, electronics and furniture, as well as specialty insurance products and services for financial institutions.

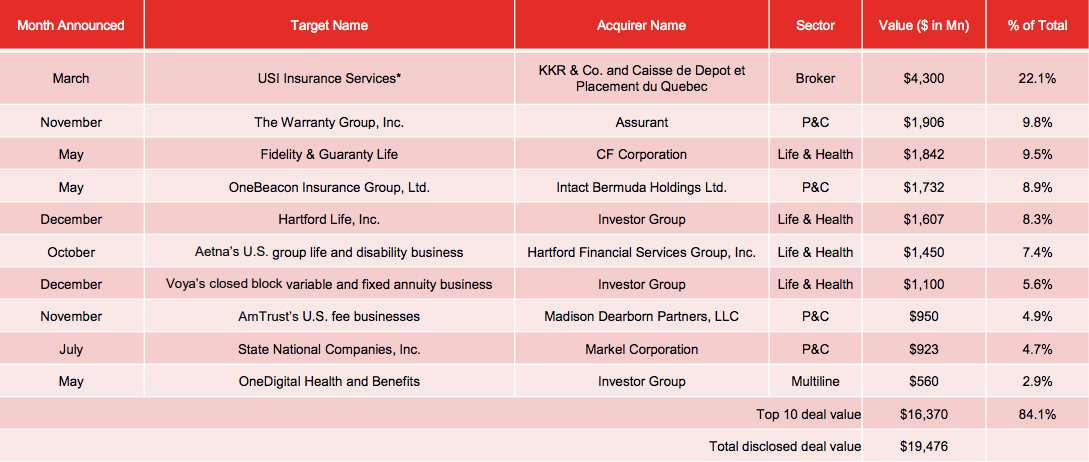

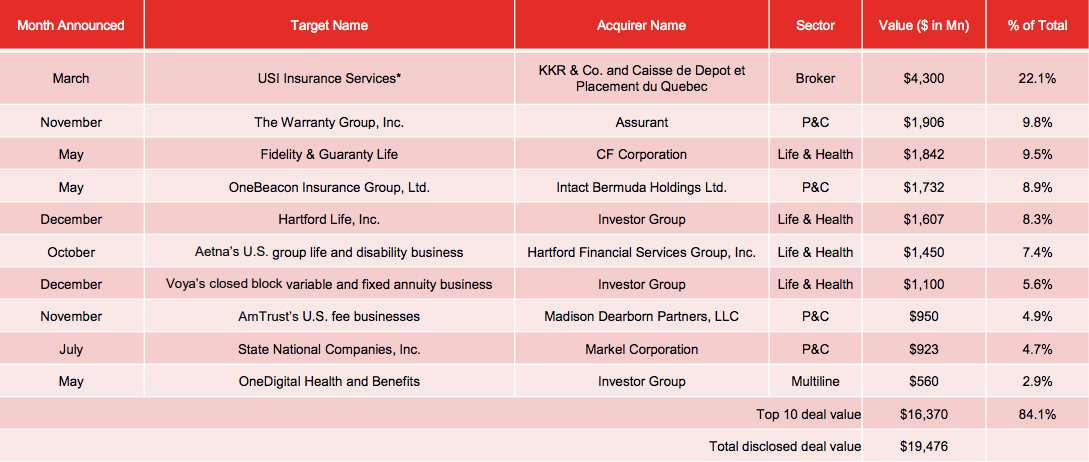

Top 10 US Insurance and Bermuda Deals Announced in 2017 (by value)

[caption id="attachment_30075" align="alignnone" width="650"]

Source: S&P Global Market Intelligence[/caption]

Sub-sector highlights and outlook

- Life and Annuity — This sector has been suffering through the persistent low-interest-rate environment that has weighed on insurers’ investment portfolios. Nevertheless, the U.S. Federal Reserve raised the fed funds rate three times in 2017, and there are expectations of additional increases in 2018. Opportunities remain for insurers to exit capital-intensive or non-core businesses, with investor interest in closed blocks and narrow concentrations. In a recent deal, an Apollo-led investor group purchased the closed block variable annuity and fixed annuity businesses of Voya Financial for $1.1 billion. Also, The Hartford agreed to sell its runoff life and annuity business, Talcott Resolution, for $1.6 billion to an investor group.

- Property/Casualty — Deal activity increased in the sector during the second half of 2017. In addition to traditional M&A, the P&C sector has seen mega insurance legacy transfer transactions, headlined by AIG’s $9.8 billion reinsurance, excluding interest, with National Indemnity to take on long-term risks from legacy commercial policies announced in January 2017.

- Insurance Brokers — The segment continued to be the most active in terms of deal volume in 2H 2017. The most activity came from several serial acquirers buying regional brokers, further consolidating the market. The five most active acquirers were Acrisure, Hub International, National Senior Insurance, Alera Group and NFP.

See also: Insurance 2025: Smart Contracts

Conclusion and outlook

Deals in the second half of 2017 ended on a strong note and activity should see further acceleration in 2018 as insurers continue to focus on cutting costs, achieving scale, and enhancing and streamlining or consolidating dated technologies.

- Macroeconomic environment: The economic environment improved in the second half of 2017, although persistently low interest rates and geopolitical uncertainty continue to constrain insurers’ revenues and profitability. Life insurers have used both divestitures and acquisitions to manage the low-return environment and transform business models.

- Regulatory environment: Increased oversight and uncertainty have heavily influenced insurers’ business models and strategies, forcing many to exit businesses, often through divestiture. The current presidential administration favors easing regulation, and the U.S. Department of Labor Fiduciary Rule enforcement has been delayed until July 2019, which may mitigate near-term implications for insurers that use exclusive agents.

- Tax Reform: The passage of the Tax Cuts and Jobs Act is expected to be a mixed bag for insurers. Changes to the corporate tax rate, special insurance company provisions and the switch to a territorial system with anti-base erosion provisions significantly affect insurance companies (including reinsurers), both U.S.-based and companies based elsewhere that do business in the U.S. For some companies, life insurance products and taxation of international transactions changes are costly and outweigh the benefit of reduced tax rates. For other companies (e.g., issuers of short-tail products), changes in the computation of taxable income are more modest. In addition, companies that were chronically subject to AMT under current law may now look forward to an eventual refund of minimum tax credits. The companies that stand to gain the most from reduced tax rates would be U.S.-based multinational companies. See Tax reform insurance alert and Tax reform impact on private equity for additional discussion on the impacts from the Tax Cuts and Jobs Act.

- Technology: Insurers have been slower than many other industries to adopt new technologies, but they are increasing investment in technology and innovative platforms. According to CB Insights and Willis Towers Watson, insurtech funding volume increased 38% year over year in 3Q 2017. In a headline-grabbing deal, Lemonade raised a $120 million Series C funding round led by SoftBank.

- Canada interest: Closer to home, there is evidence of an increasing appetite from Canadian buyers. In the second half of 2017, there were three announced deals in which the acquiring company was Canada-based. The largest deal was Quebec-based Industrial Alliance Insurance agreeing to acquire Columbus, Ohio-based Dealers Assurance and Albuquerque, N.M.-based Southwest Reinsurance for $135 million. Also, Toronto-based Intact Financial completed its acquisition of Bermuda-based OneBeacon Insurance Group from Hanover, NH-based White Mountains Insurance Group for $1.7 billion.

- Public offerings: Several major global insurers have responded to the low-growth environment in the U.S. with significant divestitures or restructuring. MetLife successfully completed the spinoff its U.S. retail business, Brighthouse Financial, in August. AXA also filed preliminary documents for an IPO of its U.S. operations this past November. It seems likely that other large insurance companies will have similar divestiture or restructuring plans.

- Asian inbound interest: The past several years have seen Asian firms expand their global footprint in the U.S. insurance market. While Asian investors maintain a global appetite, regulatory and shareholder skepticism remains a hurdle. A bid by Anbang to acquire Fidelity and Guaranty fell through in April. China Oceanwide’s acquisition of Genworth has yet to close and is still under CFIUS review.

You can find the full report here.

Source: S&P Global Market Intelligence[/caption]

Sub-sector highlights and outlook

Source: S&P Global Market Intelligence[/caption]

Sub-sector highlights and outlook