Insurance is ripe for disruption, and, given the conservative nature of the reigning carriers and large brokers, it is a fair guess that a lot of innovation will come from outside the industry. A few weeks ago,

this article touched on how innovation is affecting the financial services industry, but the focus was very much on banking and investing. Today, we aim to expand on this author’s work by focusing on new entrants that are working on disrupting the insurance industry.

It is far too early to call who the big winner(s) will be, so we are not yet ready to crown an Uber of insurance, but here are a few of the candidates that we think might be in the winner’s circle when the dust settles:

1.

Zenefits: Founded in 2013, this cloud-based HR management company shouldn’t be on a list of companies changing the insurance industry, but it is, because of its innovative approach to selling benefits. According to Forbes, Zenefits was one of the hottest startups in 2014 and look poised for success in 2015. Its focus is on the more than 5 million employers with fewer than 1,000 employees. Zenefits gives the HR software away and makes money on broker commissions for health insurance sold through the software.

The benefits industry was blindsided by this model, and Zenefits is facing lawsuits in multiple states but assuming it survives them, it will be in position to upend the traditional way benefits are marketed. The software looks great, and the company claims 10,000 companies with 100,000 employees are already using it. Whether or not Zenefits survives the legal and regulatory onslaught, we love its innovative free-software approach. It’s also interesting that the company started in the Y Combinator startup accelerator. We expect more and more insurance and risk management start-ups to come from start-up accelerators in the next few years as the tech crowd is waking up to the opportunities to disrupt our industry.

2.

BizInsure: Founded and owned by San Francisco-based broker

Woodruff-Sawyer, BizInsure brought in software from

Australia to essentially automate the sales and service process for small commercial insurance. The company started with professional liability and has since expanded to also offer business owner policies (BOPs). The whole business model is based on being able to quote online, buy in seconds and have a declarations page in your inbox in minutes, all while retaining the ability to chat with a licensed agent by phone at any time for either sales or service.

The company has been growing slowly by choice, only signing up the carriers that have made their systems completely compatible so there are no manual or overnight batch processes. The company has a decent stable of carriers available, including

CNA,

Hiscox,

Liberty International,

Philadelphia and

USLI. It looks like BizInsure will now push growth harder, and the question is whether it will be able to hit an exponential growth curve allowing it to disrupt how small business insurance gets sold.

3.

MetroMile: The first and thus far only company offering by-the-mile auto insurance in the U.S. Metromile takes a similar approach to Zenefits in that the service is free to everybody, and then the company tries to convert you into a paying customer by offering by-the-mile insurance. Thus far, it's only available in a few states: California, Illinois, Washington and Oregon. But the company is starting to advertise heavily that it can save you money if you drive less than 10,000 miles per year.

The free service gives you a free Bluetooth device to install in your car and an app that gives you diagnostics of your vehicle’s performance. For those not ready to fully utilize telematics, this innovative company will still allow you to stay informed about your driving behavior with Metromile Tag., which can track mileage for expenses and driving trends and provide parking location and commute optimization.

Another reason the company is a potential disruptor to the industry is because, since January 2015, it has partnered with Uber to offer insurance to drivers, essentially guaranteeing that Uber drivers don’t have a gap in coverage when the Uber policy isn’t covering them. If you think about it, consumers are very used to the pay-for-usage model in other areas, like electricity, water and gas, and MetroMile’s marketing makes the connection explicit. Technically, the company is an agency, not a carrier, and the product is underwritten by

National General Insurance Group.

4.

Evosure: Currently on invitation-only beta, Evosure’s goal is to reduce the 60% of unwanted quote requests that commercial carriers receive. Evosure simplifes the communication of constantly changing underwriter appetites; a web platform allows brokers to describe the type of risk they have and finds a matching underwriter. The management team has some insurance chops (unlike a lot of other insurance start-ups, which are heavy on tech people): Matt Foran, former director of strategy for Zurich Specialty Products; Brian Wood, former SVP for Marsh & McLennan; and Brett McKenzie, former director of marketing at Fireman’s Fund. We also really love their “Commercial Insurance Is Sexy” T-shirts; we completely agree!

5.

Friendsurance (Germany): Combining social networking with personal lines insurance in a very interesting way creating a peer-to-peer (P2P) insurance solution. You create a group of friends needing the same type of insurance and pool your money and insure the pool’s risks with a carrier. If money is left over at the end of the policy period because of good claims experience, you get a refund, or your next term’s premium is cheaper. You never have to pay more than your premium, even if losses are bad because of a stop-loss. Friendsurance works because insuring with friends reduces fraud and results in better risk selection. Small claims are paid from the pool without the expensive process at the carrier, and the pool grows virally without the need to pay a sales force. We really hope that this works and that somebody tries it in the U.S. soon. After all, if you think about it, this would be a natural 21st century extension to the age-old idea of mutual insurance.

6.

SocialIntel.com: Getting credit history, driving history and other background information to underwrite personal lines accounts is expensive. What if we could underwrite equally effectively by analyzing a person’s social media posts? It’s kind of a crazy idea, but that’s what SocialIntel.com is selling. If it works, it could be a game changer. The company aims to help carrier underwriters without using expensive data from the usual databases. Our guess is that it wouldn’t work too well for the over-40 crowd, but it probably works great on my generation because we have a tendency of posting everything on social media. The coolest part of it is that the company continually re-evaluates the risk, not just at underwriting, claim and renewal time.

7.

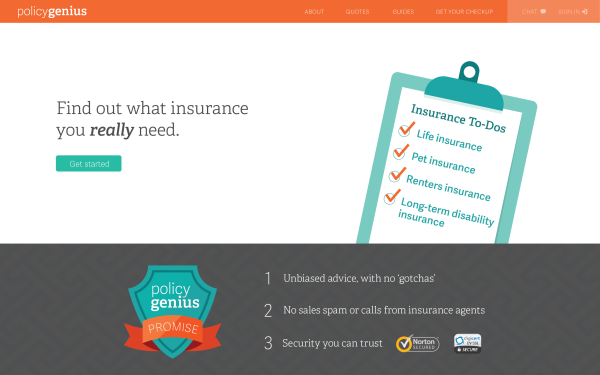

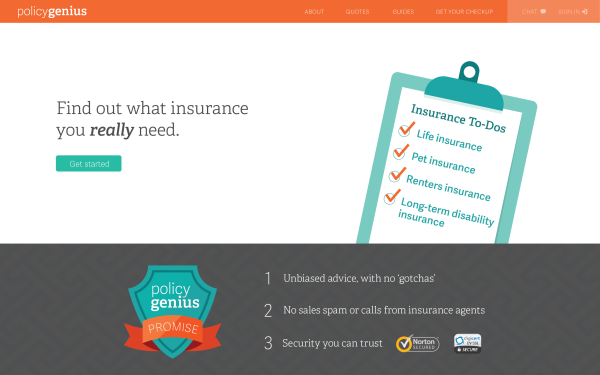

Policy Genius: Started by two former

McKinsey consultants who were astonished at the backwardness of the insurance industry. They are focused on life and disability insurance and trying to disprove the idea that insurance is “sold and not bought.” They believe that if you educate consumers with the right system, they will buy the right product without a hard sell. Aimed squarely at the Millennial buyer, the friendly insurance checkup takes five minutes and walks you through the different risks in your life. Then it shows you what “People Like You” usually need coverage for and explains why. At the end, you get an insurance to-do list, which recommends the insurance you need in simple language. Interestingly, it points out even home and auto insurance, which, currently, the company doesn’t sell. We really like that the company also tell you what kinds of insurance you don’t need, which builds trust.

The company recommended that, at 32 years old, I don't need to buy long-term care yet. If they expand to do all insurance products and do it well, they could become the new way to buy personal lines insurance. One minor thing that’s a turnoff: The company doesn’t currently have an app, so you have to do everything at the website.

We are excited to watch these seven companies develop. The insurance industry is ripe for disruption, and innovative ideas that approach opportunities from a different perspective and complement policyholder demographics are bound to put new life in an old business. Comment below: What other companies or products do you have your eye on?

This article originally appeared on

InsNerds.com.

It is far too early to call who the big winner(s) will be, so we are not yet ready to crown an Uber of insurance, but here are a few of the candidates that we think might be in the winner’s circle when the dust settles:

1. Zenefits: Founded in 2013, this cloud-based HR management company shouldn’t be on a list of companies changing the insurance industry, but it is, because of its innovative approach to selling benefits. According to Forbes, Zenefits was one of the hottest startups in 2014 and look poised for success in 2015. Its focus is on the more than 5 million employers with fewer than 1,000 employees. Zenefits gives the HR software away and makes money on broker commissions for health insurance sold through the software.

The benefits industry was blindsided by this model, and Zenefits is facing lawsuits in multiple states but assuming it survives them, it will be in position to upend the traditional way benefits are marketed. The software looks great, and the company claims 10,000 companies with 100,000 employees are already using it. Whether or not Zenefits survives the legal and regulatory onslaught, we love its innovative free-software approach. It’s also interesting that the company started in the Y Combinator startup accelerator. We expect more and more insurance and risk management start-ups to come from start-up accelerators in the next few years as the tech crowd is waking up to the opportunities to disrupt our industry.

It is far too early to call who the big winner(s) will be, so we are not yet ready to crown an Uber of insurance, but here are a few of the candidates that we think might be in the winner’s circle when the dust settles:

1. Zenefits: Founded in 2013, this cloud-based HR management company shouldn’t be on a list of companies changing the insurance industry, but it is, because of its innovative approach to selling benefits. According to Forbes, Zenefits was one of the hottest startups in 2014 and look poised for success in 2015. Its focus is on the more than 5 million employers with fewer than 1,000 employees. Zenefits gives the HR software away and makes money on broker commissions for health insurance sold through the software.

The benefits industry was blindsided by this model, and Zenefits is facing lawsuits in multiple states but assuming it survives them, it will be in position to upend the traditional way benefits are marketed. The software looks great, and the company claims 10,000 companies with 100,000 employees are already using it. Whether or not Zenefits survives the legal and regulatory onslaught, we love its innovative free-software approach. It’s also interesting that the company started in the Y Combinator startup accelerator. We expect more and more insurance and risk management start-ups to come from start-up accelerators in the next few years as the tech crowd is waking up to the opportunities to disrupt our industry.

2. BizInsure: Founded and owned by San Francisco-based broker Woodruff-Sawyer, BizInsure brought in software from Australia to essentially automate the sales and service process for small commercial insurance. The company started with professional liability and has since expanded to also offer business owner policies (BOPs). The whole business model is based on being able to quote online, buy in seconds and have a declarations page in your inbox in minutes, all while retaining the ability to chat with a licensed agent by phone at any time for either sales or service.

The company has been growing slowly by choice, only signing up the carriers that have made their systems completely compatible so there are no manual or overnight batch processes. The company has a decent stable of carriers available, including CNA, Hiscox, Liberty International, Philadelphia and USLI. It looks like BizInsure will now push growth harder, and the question is whether it will be able to hit an exponential growth curve allowing it to disrupt how small business insurance gets sold.

2. BizInsure: Founded and owned by San Francisco-based broker Woodruff-Sawyer, BizInsure brought in software from Australia to essentially automate the sales and service process for small commercial insurance. The company started with professional liability and has since expanded to also offer business owner policies (BOPs). The whole business model is based on being able to quote online, buy in seconds and have a declarations page in your inbox in minutes, all while retaining the ability to chat with a licensed agent by phone at any time for either sales or service.

The company has been growing slowly by choice, only signing up the carriers that have made their systems completely compatible so there are no manual or overnight batch processes. The company has a decent stable of carriers available, including CNA, Hiscox, Liberty International, Philadelphia and USLI. It looks like BizInsure will now push growth harder, and the question is whether it will be able to hit an exponential growth curve allowing it to disrupt how small business insurance gets sold.

3. MetroMile: The first and thus far only company offering by-the-mile auto insurance in the U.S. Metromile takes a similar approach to Zenefits in that the service is free to everybody, and then the company tries to convert you into a paying customer by offering by-the-mile insurance. Thus far, it's only available in a few states: California, Illinois, Washington and Oregon. But the company is starting to advertise heavily that it can save you money if you drive less than 10,000 miles per year.

The free service gives you a free Bluetooth device to install in your car and an app that gives you diagnostics of your vehicle’s performance. For those not ready to fully utilize telematics, this innovative company will still allow you to stay informed about your driving behavior with Metromile Tag., which can track mileage for expenses and driving trends and provide parking location and commute optimization.

Another reason the company is a potential disruptor to the industry is because, since January 2015, it has partnered with Uber to offer insurance to drivers, essentially guaranteeing that Uber drivers don’t have a gap in coverage when the Uber policy isn’t covering them. If you think about it, consumers are very used to the pay-for-usage model in other areas, like electricity, water and gas, and MetroMile’s marketing makes the connection explicit. Technically, the company is an agency, not a carrier, and the product is underwritten by National General Insurance Group.

3. MetroMile: The first and thus far only company offering by-the-mile auto insurance in the U.S. Metromile takes a similar approach to Zenefits in that the service is free to everybody, and then the company tries to convert you into a paying customer by offering by-the-mile insurance. Thus far, it's only available in a few states: California, Illinois, Washington and Oregon. But the company is starting to advertise heavily that it can save you money if you drive less than 10,000 miles per year.

The free service gives you a free Bluetooth device to install in your car and an app that gives you diagnostics of your vehicle’s performance. For those not ready to fully utilize telematics, this innovative company will still allow you to stay informed about your driving behavior with Metromile Tag., which can track mileage for expenses and driving trends and provide parking location and commute optimization.

Another reason the company is a potential disruptor to the industry is because, since January 2015, it has partnered with Uber to offer insurance to drivers, essentially guaranteeing that Uber drivers don’t have a gap in coverage when the Uber policy isn’t covering them. If you think about it, consumers are very used to the pay-for-usage model in other areas, like electricity, water and gas, and MetroMile’s marketing makes the connection explicit. Technically, the company is an agency, not a carrier, and the product is underwritten by National General Insurance Group.

4. Evosure: Currently on invitation-only beta, Evosure’s goal is to reduce the 60% of unwanted quote requests that commercial carriers receive. Evosure simplifes the communication of constantly changing underwriter appetites; a web platform allows brokers to describe the type of risk they have and finds a matching underwriter. The management team has some insurance chops (unlike a lot of other insurance start-ups, which are heavy on tech people): Matt Foran, former director of strategy for Zurich Specialty Products; Brian Wood, former SVP for Marsh & McLennan; and Brett McKenzie, former director of marketing at Fireman’s Fund. We also really love their “Commercial Insurance Is Sexy” T-shirts; we completely agree!

4. Evosure: Currently on invitation-only beta, Evosure’s goal is to reduce the 60% of unwanted quote requests that commercial carriers receive. Evosure simplifes the communication of constantly changing underwriter appetites; a web platform allows brokers to describe the type of risk they have and finds a matching underwriter. The management team has some insurance chops (unlike a lot of other insurance start-ups, which are heavy on tech people): Matt Foran, former director of strategy for Zurich Specialty Products; Brian Wood, former SVP for Marsh & McLennan; and Brett McKenzie, former director of marketing at Fireman’s Fund. We also really love their “Commercial Insurance Is Sexy” T-shirts; we completely agree!

5. Friendsurance (Germany): Combining social networking with personal lines insurance in a very interesting way creating a peer-to-peer (P2P) insurance solution. You create a group of friends needing the same type of insurance and pool your money and insure the pool’s risks with a carrier. If money is left over at the end of the policy period because of good claims experience, you get a refund, or your next term’s premium is cheaper. You never have to pay more than your premium, even if losses are bad because of a stop-loss. Friendsurance works because insuring with friends reduces fraud and results in better risk selection. Small claims are paid from the pool without the expensive process at the carrier, and the pool grows virally without the need to pay a sales force. We really hope that this works and that somebody tries it in the U.S. soon. After all, if you think about it, this would be a natural 21st century extension to the age-old idea of mutual insurance.

5. Friendsurance (Germany): Combining social networking with personal lines insurance in a very interesting way creating a peer-to-peer (P2P) insurance solution. You create a group of friends needing the same type of insurance and pool your money and insure the pool’s risks with a carrier. If money is left over at the end of the policy period because of good claims experience, you get a refund, or your next term’s premium is cheaper. You never have to pay more than your premium, even if losses are bad because of a stop-loss. Friendsurance works because insuring with friends reduces fraud and results in better risk selection. Small claims are paid from the pool without the expensive process at the carrier, and the pool grows virally without the need to pay a sales force. We really hope that this works and that somebody tries it in the U.S. soon. After all, if you think about it, this would be a natural 21st century extension to the age-old idea of mutual insurance.

6. SocialIntel.com: Getting credit history, driving history and other background information to underwrite personal lines accounts is expensive. What if we could underwrite equally effectively by analyzing a person’s social media posts? It’s kind of a crazy idea, but that’s what SocialIntel.com is selling. If it works, it could be a game changer. The company aims to help carrier underwriters without using expensive data from the usual databases. Our guess is that it wouldn’t work too well for the over-40 crowd, but it probably works great on my generation because we have a tendency of posting everything on social media. The coolest part of it is that the company continually re-evaluates the risk, not just at underwriting, claim and renewal time.

6. SocialIntel.com: Getting credit history, driving history and other background information to underwrite personal lines accounts is expensive. What if we could underwrite equally effectively by analyzing a person’s social media posts? It’s kind of a crazy idea, but that’s what SocialIntel.com is selling. If it works, it could be a game changer. The company aims to help carrier underwriters without using expensive data from the usual databases. Our guess is that it wouldn’t work too well for the over-40 crowd, but it probably works great on my generation because we have a tendency of posting everything on social media. The coolest part of it is that the company continually re-evaluates the risk, not just at underwriting, claim and renewal time.

7. Policy Genius: Started by two former McKinsey consultants who were astonished at the backwardness of the insurance industry. They are focused on life and disability insurance and trying to disprove the idea that insurance is “sold and not bought.” They believe that if you educate consumers with the right system, they will buy the right product without a hard sell. Aimed squarely at the Millennial buyer, the friendly insurance checkup takes five minutes and walks you through the different risks in your life. Then it shows you what “People Like You” usually need coverage for and explains why. At the end, you get an insurance to-do list, which recommends the insurance you need in simple language. Interestingly, it points out even home and auto insurance, which, currently, the company doesn’t sell. We really like that the company also tell you what kinds of insurance you don’t need, which builds trust.

The company recommended that, at 32 years old, I don't need to buy long-term care yet. If they expand to do all insurance products and do it well, they could become the new way to buy personal lines insurance. One minor thing that’s a turnoff: The company doesn’t currently have an app, so you have to do everything at the website.

7. Policy Genius: Started by two former McKinsey consultants who were astonished at the backwardness of the insurance industry. They are focused on life and disability insurance and trying to disprove the idea that insurance is “sold and not bought.” They believe that if you educate consumers with the right system, they will buy the right product without a hard sell. Aimed squarely at the Millennial buyer, the friendly insurance checkup takes five minutes and walks you through the different risks in your life. Then it shows you what “People Like You” usually need coverage for and explains why. At the end, you get an insurance to-do list, which recommends the insurance you need in simple language. Interestingly, it points out even home and auto insurance, which, currently, the company doesn’t sell. We really like that the company also tell you what kinds of insurance you don’t need, which builds trust.

The company recommended that, at 32 years old, I don't need to buy long-term care yet. If they expand to do all insurance products and do it well, they could become the new way to buy personal lines insurance. One minor thing that’s a turnoff: The company doesn’t currently have an app, so you have to do everything at the website.

We are excited to watch these seven companies develop. The insurance industry is ripe for disruption, and innovative ideas that approach opportunities from a different perspective and complement policyholder demographics are bound to put new life in an old business. Comment below: What other companies or products do you have your eye on?

This article originally appeared on InsNerds.com.

We are excited to watch these seven companies develop. The insurance industry is ripe for disruption, and innovative ideas that approach opportunities from a different perspective and complement policyholder demographics are bound to put new life in an old business. Comment below: What other companies or products do you have your eye on?

This article originally appeared on InsNerds.com.