It sometimes seems that all we hear about are the complaints, when something goes wrong for a policyholder dealing with an insurance company, especially when a claim is involved. So we thought we’d bring you a story where everybody did the right thing – even beyond right, because the client couldn’t have expected to be treated as well as it was.

It happens that we know this story because our founder, Dave Dias, was involved. But we’d happily share other stories on an occasional basis if you email them to me at jared@insurancethoughtleadership.com.

This story begins in the first week of September 2014, when the Folsom, CA, campus of Bayside Church was burglarized. Bayside, a “mega-church” based in Granite Bay, CA, has campuses throughout the Sacramento area and has been holding services at a middle school in Folsom. During the week, someone broke into a steel container at the school and stole much of the audio-visual equipment that Bayside stored there. Dave Hanson, the CFO of Bayside, says the equipment was valued at $75,000 to $100,000.

The case quickly went cold. The thieves had known what they were doing – for instance, they broke only into the container with the valuable equipment, not into containers with, say, materials for the children’s ministry – and didn’t leave clues behind. There were no witnesses and no security video.

This is where the insurers swept in. Hanson says, “Dave [Dias, a former police officer who is the InterWest broker on the Bayside account] was thoroughly frustrated that someone would steal from a church, and Folsom PD had zero leads. So, in an attempt to help the police department, he said, ‘Let’s put up a reward.’”

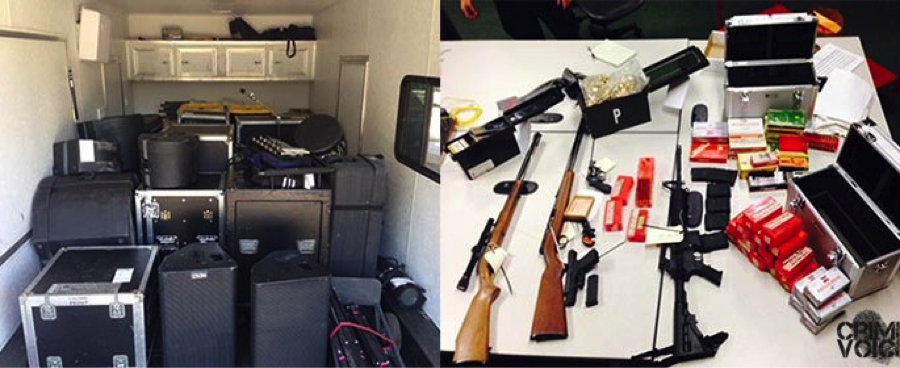

InterWest, a Sacramento-based broker, and Philadelphia Insurance, the carrier, offered a $10,000 reward for information leading to the return of the equipment. Within days, someone came forward with information, and police raided a house in nearby Carmichael. They not only found all the Bayside equipment but also recovered two stolen vehicles, an enclosed trailer, a watercraft, small amounts of drugs and numerous weapons, including three handguns, two rifles, an assault rifle and more than 3,000 rounds of ammunition. The owner of the house, a convicted felon, was arrested and is awaiting trial.

“He had guns, ammunition, money, lots of acetylene torches, power tools; it was obvious he had stolen stuff from construction sites,” Hanson says.

Recovering the equipment obviously saved Philadelphia Insurance from having to pay a large claim. But it also saved Bayside from having to pay the deductible and from the hassle of having to locate and rent equipment each week, until its claim was paid.

“The partnership aspect of client, broker and carrier is the most important aspect here,” Hanson says.

He notes that the Folsom police department, which had never worked a rewards case, got a high-profile win and says the main winner was the community. It no longer has to worry about a big-time, professional thief.

Isn’t this sort of story better than what you usually hear when you tell someone you’re involved in the insurance industry?

When Everybody Does the Right Thing

Following a burglary at a church, a reward leads to the recovery of a huge cache of stolen goods, providing a feel-good story about insurance.