It sounds like a riddle, and in some ways it is. When it comes to insurance customers:

If they don’t “get it,” they won’t get it.

If they don’t see the need, they won’t need it.

We can’t value our experience if they can’t experience our value.

Let’s dig a little deeper.

Much has been said recently about the customer experience. It’s a board-level topic. Everyone knows that it is important. We are busy transforming experiences, journey mapping and “digitizing” our organizations.

Too much of what we are doing, however, is a frenzied reaction to a market scare instead of a thoughtful reaction to reality. We are afraid that new generations aren’t interested in insurance, and we are petrified that if they do see the need they won’t reach us through our pre-digital age channels.

This is all true and valid.

But if we operate solely upon these premises, we’re going to miss the meat of the issue. The customer experience is important, but it works hand in hand with a general understanding about the need for insurance and how insurance works. As attention spans narrow, demographics shift and insurance needs morph into new risk areas, the customer experience must include thoughtful ways of injecting insurance precepts into new methods for consumers to research and learn about what insurance does.

If they “get it,” they’ll get it. If they see the need, they’ll need it. And they will value our experience if we can help them experience the value.

Because technology now plays a role in all facets of insurance experience and education, it may be helpful for insurers to have their own deeper understanding of the shifting nature of insurance researching, buying and servicing.

For our lesson, we’re going to turn to the customer so that we can grasp the customer perspectives on purchasing insurance within the context of the full customer experience. As we step into the digital age, we want to be walking in their shoes.

See also: Is Insurance Like Buying Paper Towels?

Perspectives

Majesco conducted some primary research last year with consumers and small to medium-sized businesses, to find out where the insurance industry stands in their eyes. The goal was to document their perceptions so insurers could use the insights to craft new experiences that would meet and exceed expectations. One of our key findings was that insurance is perceived as too confusing.

Did insurance just become confusing, or did we lose sight of the customer? Who moved?

Insurers’ primary focus has been on the product. Services were those things we did to support the product, such as underwriting, billing, and claims. A few services might be offered with the product, like roadside assistance, but for most products that has been rare. As a result, insurance is an intangible, and, to the customer, intangible can be unintelligible. In insurance, customers pay for a protective concept, not a physical asset.

Traditionally, the agent or broker’s job was to explain and reinforce the value of insurance to the insured, helping him to “get it.” Peace of mind was sold as an actual product. You could have peace of mind that insurers would make you “whole” if your home was damaged, you were in an accident or if a death occurred, to help cover the needs of the family. Majesco found in its survey that the greatest understanding in insurance was among those in the Silent Generation – many who bought into the traditional “peace of mind” product. But confusion rapidly grew in the younger generations.

Many have predicted the demise of the agent and broker channel. Many other industries have eliminated that layer and are seeing success. Retail sales, for example, are shifting and thriving online. Banks are still relevant, driven by apps that keep customers in touch with their money. But insurance, the way it was designed, sold, serviced and understood by the Silent generation, doesn’t resonate with Millennial and Gen Z — generations that may value the concept of insurance protection but don’t understand how it works or why it is so difficult to research, buy and service.

Businesses and insurance have their own corresponding issue. Small and medium-sized businesses (SMBs), increasingly led by Millennials and Gen X, don’t necessarily see or understand how insurance companies can best serve them. They also see the insurance process as confusing and lacking in value.

For both individuals and businesses, there is a double-whammy — they are legally bound to carry home, auto and property insurance (and other lines in the case of SMBs). Right or wrong, they may resent being forced to pay for intangibles that provide little perceived value and have a not-so-great experience. A successful claims experience can change that perceived value, helping them grasp the benefits of adequate protective cover. But that may not happen for a long time … so the quest for value and relevance stays alive. Today’s customers are looking for organizations that give them a product that makes sense in light of the measures that they may take to protect themselves.

In both cases, consumer and SMBs, business models, products, processes and systems were built for earlier times – for the Silent and Baby Boomer generations. But the generations coming up behind them need something that is relevant in the digital age, where there is a vast difference in needs, demographics and expectations.

Improving the experience — What goes around, sometimes falls off

The cycle of insurance, where we met each new generation with a simple variation on the products of the last generation isn’t going to work. Majesco found that none of the three categories (Researching, Buying & Renewing and Service) could claim to produce great insurance experiences across the industry.

See also: Are You Buying the Wrong Leads?

The goal, then, is to build compelling customer experiences and to let some of the old fall off. There will be parts of the customer experience and process chain that will no longer be needed. There will be others that you cannot live without. In the coming weeks, we are going to have multiple blogs on customer journey improvement. You’ll want to listen in on these because they come from some of Majesco’s top experts on insurance experience. But for now, we’ll leave you with four overarching themes.

- As you answer the technical questions of customer experience development and digital transformation, don’t forget to ask the basic questions, such as, “How can we illustrate and model insurance value to generations that may not grasp insurance?” Remember, when they “get it,” they’ll buy it.

- Make sure all the different parts of your company that serve the same customer work together to create an experience that is easy, compelling, consistent and satisfying across all of the components. It requires a shift to journey thinking … not functional thinking and will require new teams and collaboration.

- Younger generations may not understand insurance, but they definitely understand technology. Don’t just meet them where they are, but speak their language. They are living with a new set of experiences across an alternate universe of risks. Use the technology to instruct and protect, and you’ll be reinforcing the value of the relationship, not just the value of the product.

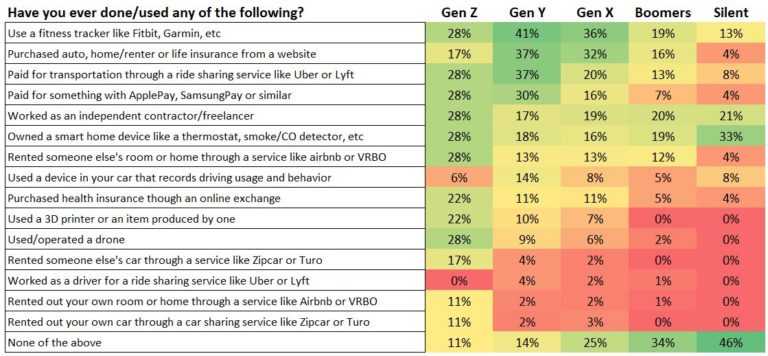

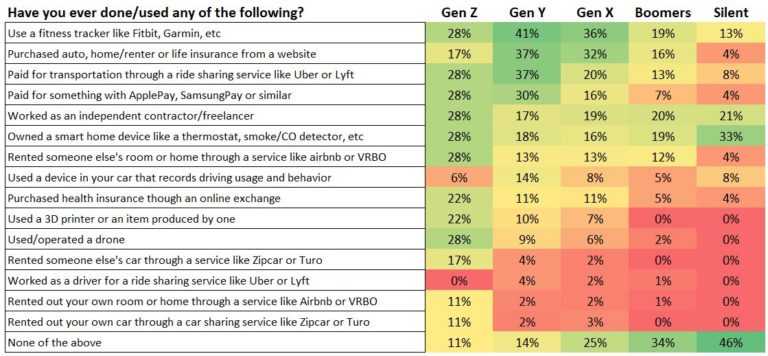

If you want to get a glimpse into the use of technology within age groups, see the generational chart below.

- You can’t rebuild your customer experiences in a day. Review your customer satisfaction data to find the parts of your experience that are high in importance but lower in performance to help you prioritize where to begin. Then work on these areas, but make sure you have a plan for improving all of the other parts of the experience as well.

For a deeper look at consumer and SMB perceptions regarding insurance, download the Majesco’s research reports, The Rise of the New Insurance Customer: Changing Views and Expectations and The Rise of the Small-Medium Business Insurance Customer: Changing Views and Expectations. Insurers’ primary focus has been on the product. Services were those things we did to support the product, such as underwriting, billing, and claims. A few services might be offered with the product, like roadside assistance, but for most products that has been rare. As a result, insurance is an intangible, and, to the customer, intangible can be unintelligible. In insurance, customers pay for a protective concept, not a physical asset.

Traditionally, the agent or broker’s job was to explain and reinforce the value of insurance to the insured, helping him to “get it.” Peace of mind was sold as an actual product. You could have peace of mind that insurers would make you “whole” if your home was damaged, you were in an accident or if a death occurred, to help cover the needs of the family. Majesco found in its survey that the greatest understanding in insurance was among those in the Silent Generation – many who bought into the traditional “peace of mind” product. But confusion rapidly grew in the younger generations.

Many have predicted the demise of the agent and broker channel. Many other industries have eliminated that layer and are seeing success. Retail sales, for example, are shifting and thriving online. Banks are still relevant, driven by apps that keep customers in touch with their money. But insurance, the way it was designed, sold, serviced and understood by the Silent generation, doesn’t resonate with Millennial and Gen Z — generations that may value the concept of insurance protection but don’t understand how it works or why it is so difficult to research, buy and service.

Businesses and insurance have their own corresponding issue. Small and medium-sized businesses (SMBs), increasingly led by Millennials and Gen X, don’t necessarily see or understand how insurance companies can best serve them. They also see the insurance process as confusing and lacking in value.

For both individuals and businesses, there is a double-whammy — they are legally bound to carry home, auto and property insurance (and other lines in the case of SMBs). Right or wrong, they may resent being forced to pay for intangibles that provide little perceived value and have a not-so-great experience. A successful claims experience can change that perceived value, helping them grasp the benefits of adequate protective cover. But that may not happen for a long time … so the quest for value and relevance stays alive. Today’s customers are looking for organizations that give them a product that makes sense in light of the measures that they may take to protect themselves.

In both cases, consumer and SMBs, business models, products, processes and systems were built for earlier times – for the Silent and Baby Boomer generations. But the generations coming up behind them need something that is relevant in the digital age, where there is a vast difference in needs, demographics and expectations.

Improving the experience — What goes around, sometimes falls off

The cycle of insurance, where we met each new generation with a simple variation on the products of the last generation isn’t going to work. Majesco found that none of the three categories (Researching, Buying & Renewing and Service) could claim to produce great insurance experiences across the industry.

See also: Are You Buying the Wrong Leads?

The goal, then, is to build compelling customer experiences and to let some of the old fall off. There will be parts of the customer experience and process chain that will no longer be needed. There will be others that you cannot live without. In the coming weeks, we are going to have multiple blogs on customer journey improvement. You’ll want to listen in on these because they come from some of Majesco’s top experts on insurance experience. But for now, we’ll leave you with four overarching themes.

Insurers’ primary focus has been on the product. Services were those things we did to support the product, such as underwriting, billing, and claims. A few services might be offered with the product, like roadside assistance, but for most products that has been rare. As a result, insurance is an intangible, and, to the customer, intangible can be unintelligible. In insurance, customers pay for a protective concept, not a physical asset.

Traditionally, the agent or broker’s job was to explain and reinforce the value of insurance to the insured, helping him to “get it.” Peace of mind was sold as an actual product. You could have peace of mind that insurers would make you “whole” if your home was damaged, you were in an accident or if a death occurred, to help cover the needs of the family. Majesco found in its survey that the greatest understanding in insurance was among those in the Silent Generation – many who bought into the traditional “peace of mind” product. But confusion rapidly grew in the younger generations.

Many have predicted the demise of the agent and broker channel. Many other industries have eliminated that layer and are seeing success. Retail sales, for example, are shifting and thriving online. Banks are still relevant, driven by apps that keep customers in touch with their money. But insurance, the way it was designed, sold, serviced and understood by the Silent generation, doesn’t resonate with Millennial and Gen Z — generations that may value the concept of insurance protection but don’t understand how it works or why it is so difficult to research, buy and service.

Businesses and insurance have their own corresponding issue. Small and medium-sized businesses (SMBs), increasingly led by Millennials and Gen X, don’t necessarily see or understand how insurance companies can best serve them. They also see the insurance process as confusing and lacking in value.

For both individuals and businesses, there is a double-whammy — they are legally bound to carry home, auto and property insurance (and other lines in the case of SMBs). Right or wrong, they may resent being forced to pay for intangibles that provide little perceived value and have a not-so-great experience. A successful claims experience can change that perceived value, helping them grasp the benefits of adequate protective cover. But that may not happen for a long time … so the quest for value and relevance stays alive. Today’s customers are looking for organizations that give them a product that makes sense in light of the measures that they may take to protect themselves.

In both cases, consumer and SMBs, business models, products, processes and systems were built for earlier times – for the Silent and Baby Boomer generations. But the generations coming up behind them need something that is relevant in the digital age, where there is a vast difference in needs, demographics and expectations.

Improving the experience — What goes around, sometimes falls off

The cycle of insurance, where we met each new generation with a simple variation on the products of the last generation isn’t going to work. Majesco found that none of the three categories (Researching, Buying & Renewing and Service) could claim to produce great insurance experiences across the industry.

See also: Are You Buying the Wrong Leads?

The goal, then, is to build compelling customer experiences and to let some of the old fall off. There will be parts of the customer experience and process chain that will no longer be needed. There will be others that you cannot live without. In the coming weeks, we are going to have multiple blogs on customer journey improvement. You’ll want to listen in on these because they come from some of Majesco’s top experts on insurance experience. But for now, we’ll leave you with four overarching themes.