Connected insurance is the next “big thing." It will be enabled by the IoT, big data and artificial intelligence. Health, home and motor insurance are three pillars of this connected, evolving landscape. Microinsurance comes as a transversal opportunity that can help close the protection gap while allowing carriers to propose customer-centric products and services.

But connected insurance is mainly about people: how to reach and engage with them in an efficient way while connecting their risks with their insurance cover. I refer to connected insurance as: any insurance solution based on sensors for collecting data on the state of an insured risk and of telematics for remote transmission and management of the data collected. This definition can be applied in all the sectors from motor, house and health to life and industries. So you have this great capacity to register, deposit and analyze data that comes directly from the users, giving the insurer new insight into actual behaviors and lifestyles:

- You have the impact on the insurance bottom line that comes as a result of specialization.

- You’ve got frequency of interaction with the customer that puts the insurer much closer but is less invasive than before. In other words a new, customized and more efficient digital customer experience.

- You create knowledge, a key issue for insurers, which have more data on risks and their customer base.

- You get to improve lifestyles in the long run, with positive externalities for a sustainable society.

See also: 5 Innovations in Microinsurance

In this innovative landscape, microinsurance is a transversal opportunity for insurers to get closer to their clients, offering the right coverage at the right time.

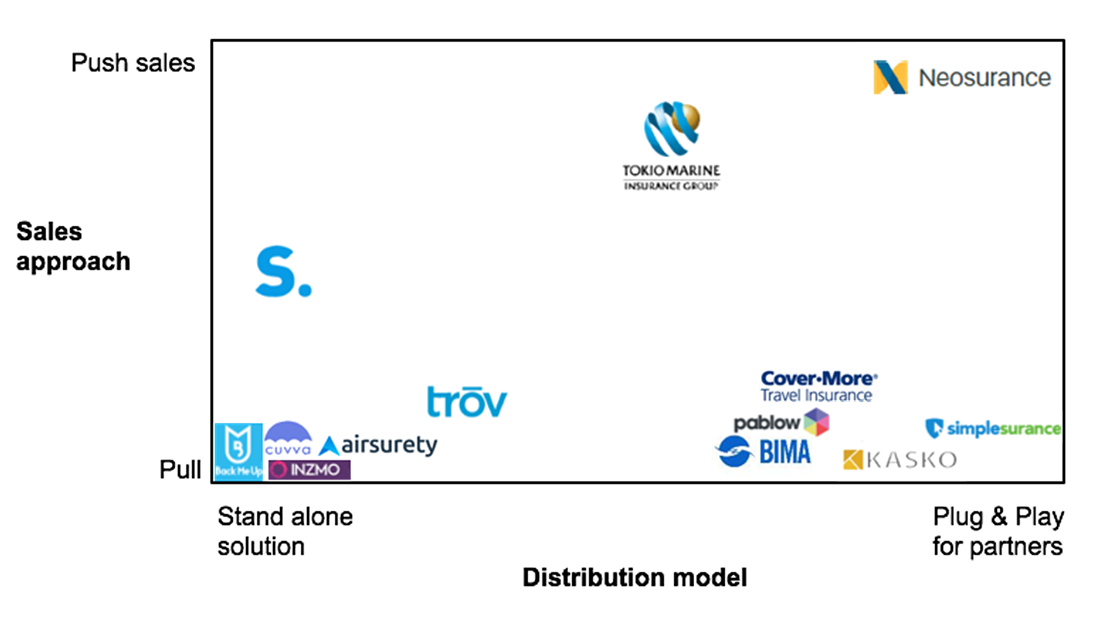

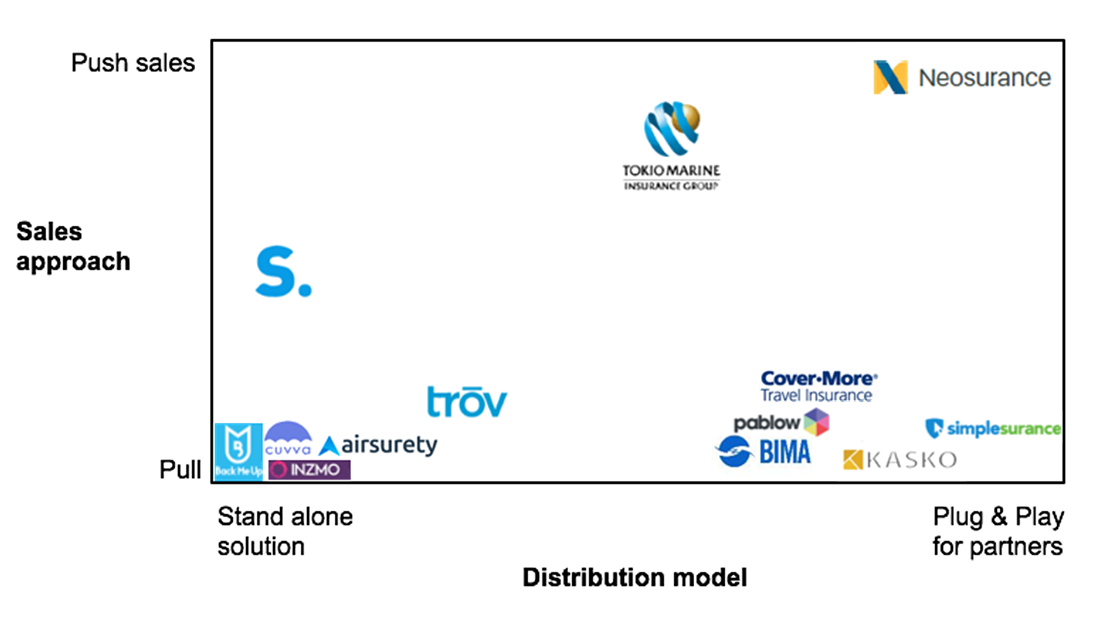

Above, you can see a good matrix that shows how some of the players are positioned on the market based on their sales approach and their distribution model. You’ve got the group in the lower left corner that has more of a standard pull approach regarding their customers and has stand-alone solutions, in most cases based on their own mobile app solutions. I am of the opinion that integration with partners in a plug-and-play approach is much more efficient in reaching potential customers out there.

By looking at the lower right corner, you can see how there are many solutions of this type but still using a pull commercial approach. Now the interesting part is when you start to mix the two sales approaches (between pull and push) and you get the well-known Asian insurer Tokio Marine, which has been on the market with its microinsurance solutions since 2010.

And finally we get to the upper right corner, where you can see the logo of Neosurance, the insurtech startup that I co-founded a little over a year ago. I personally believe that it’s really well-positioned based on the criteria that I find to be particularly relevant on the market today: selling microinsurance via push notifications that are sent to the user in an intelligent way thanks to an artificial intelligence machine learning system. Plus you’ve got great reach through the use of existing communities (they have their own mobile applications) with users that have homogenous interests.

We must consider a statement regarding the industry that has proven true for the last decades: “Insurance purchase is not exciting; insurance is sold not bought!”

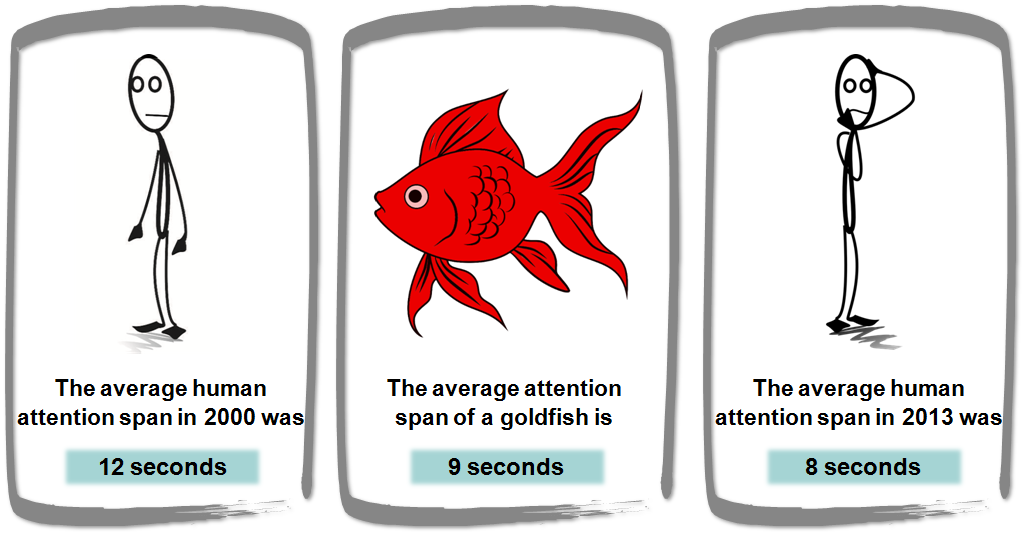

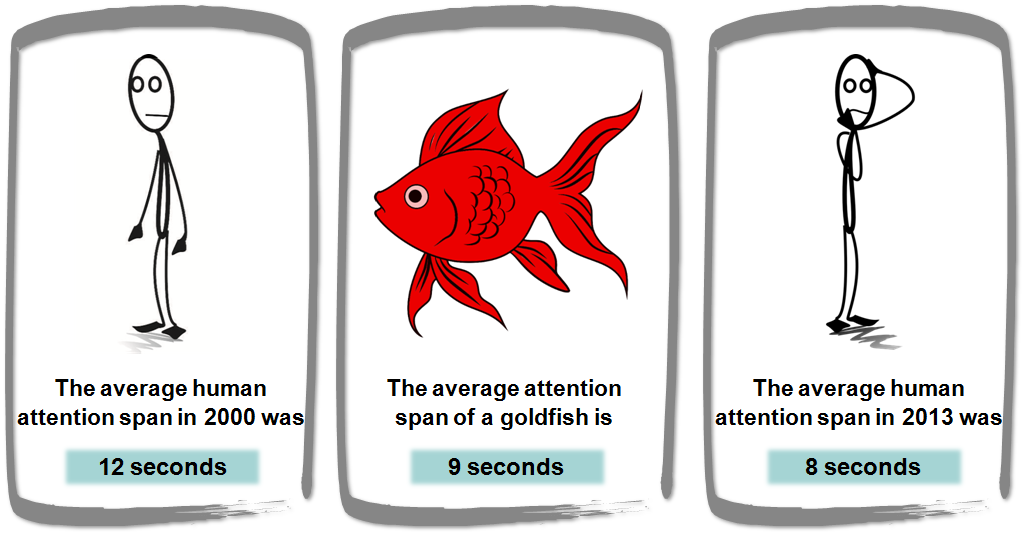

The average attention human span has been dropping: from 12 seconds in 2000, to 8 seconds in 2013. We’re slowly transforming into pretty goldfish, happily living in our bowls.

So the insurer has to address the current context, which has dramatically changed with the arrival of mobile and then smartphone technology. Get the customer’s attention by using the same channels that they use and talk to them in their language.

Insurance should adapt to the customer’s habits and environment. The best way to do that in my opinion is by selling microinsurance that has a short duration with a push approach. Know what the customer needs before he or she does! Then you’ll be able to give the right insurance coverage, when the clients need it, directly on their smartphones. The trick here is being able to avoid annoying the customers with offers that do not interest them directly, in the wrong moments. To avoid that ,you would need to use a system that can give you insight into the lifestyle and preferences of the users.

A good microinsurance solutions has to be able to create a seamless digital customer experience by reading and interpreting customer behaviors and emotions. The aim here is to create a win-win situation for customers and insurers alike. And push microinsurance has just what it takes. For customers: always close at hand when they need to be protected, with the possibility of buying personalized microinsurance on the spot directly from the smartphone. For the insurer, it’s still very much uncharted territory to be explored but can also raise profitability levels significantly while avoiding moral hazard. This comes as a consequence of having a digital salesforce that sells insurance in a smart way because of AI and machine-learning capabilities and can reach the connected generation right where they like to spend most of their time: on their smartphones.

See also: Microinsurance Has Macro Future

Recent studies reported that millennials are currently the most underinsured generation and are the least likely to have health, rental, life and disability insurance.

So, what’s the magical combination for winning their attention? The key is to reach them with the right message, at the right time, on a device where they swipe, tap and pinch 2,617 times a day: their smartphone. Moreover, millennials are just the tip of the iceberg: The "connected generation" is the single most important customer segment. Empowered by technology, they search out authentic services that they use across platforms and screens, whenever and wherever they can.

We believe in a new distribution paradigm for the insurance sector: to stimulate the emotional need of protection, when the insurance coverage is not compulsory. Our artificial intelligence engine delivers a push suggestion at the right time with the right offer to provide a simple solution to this protection need, a promise easy to understand and convenient to purchase. We work with insurers and reinsurers to create insurance propositions while developing a streamlined purchasing process.

Above, you can see a good matrix that shows how some of the players are positioned on the market based on their sales approach and their distribution model. You’ve got the group in the lower left corner that has more of a standard pull approach regarding their customers and has stand-alone solutions, in most cases based on their own mobile app solutions. I am of the opinion that integration with partners in a plug-and-play approach is much more efficient in reaching potential customers out there.

By looking at the lower right corner, you can see how there are many solutions of this type but still using a pull commercial approach. Now the interesting part is when you start to mix the two sales approaches (between pull and push) and you get the well-known Asian insurer Tokio Marine, which has been on the market with its microinsurance solutions since 2010.

And finally we get to the upper right corner, where you can see the logo of Neosurance, the insurtech startup that I co-founded a little over a year ago. I personally believe that it’s really well-positioned based on the criteria that I find to be particularly relevant on the market today: selling microinsurance via push notifications that are sent to the user in an intelligent way thanks to an artificial intelligence machine learning system. Plus you’ve got great reach through the use of existing communities (they have their own mobile applications) with users that have homogenous interests.

We must consider a statement regarding the industry that has proven true for the last decades: “Insurance purchase is not exciting; insurance is sold not bought!”

The average attention human span has been dropping: from 12 seconds in 2000, to 8 seconds in 2013. We’re slowly transforming into pretty goldfish, happily living in our bowls.

Above, you can see a good matrix that shows how some of the players are positioned on the market based on their sales approach and their distribution model. You’ve got the group in the lower left corner that has more of a standard pull approach regarding their customers and has stand-alone solutions, in most cases based on their own mobile app solutions. I am of the opinion that integration with partners in a plug-and-play approach is much more efficient in reaching potential customers out there.

By looking at the lower right corner, you can see how there are many solutions of this type but still using a pull commercial approach. Now the interesting part is when you start to mix the two sales approaches (between pull and push) and you get the well-known Asian insurer Tokio Marine, which has been on the market with its microinsurance solutions since 2010.

And finally we get to the upper right corner, where you can see the logo of Neosurance, the insurtech startup that I co-founded a little over a year ago. I personally believe that it’s really well-positioned based on the criteria that I find to be particularly relevant on the market today: selling microinsurance via push notifications that are sent to the user in an intelligent way thanks to an artificial intelligence machine learning system. Plus you’ve got great reach through the use of existing communities (they have their own mobile applications) with users that have homogenous interests.

We must consider a statement regarding the industry that has proven true for the last decades: “Insurance purchase is not exciting; insurance is sold not bought!”

The average attention human span has been dropping: from 12 seconds in 2000, to 8 seconds in 2013. We’re slowly transforming into pretty goldfish, happily living in our bowls.

So the insurer has to address the current context, which has dramatically changed with the arrival of mobile and then smartphone technology. Get the customer’s attention by using the same channels that they use and talk to them in their language.

Insurance should adapt to the customer’s habits and environment. The best way to do that in my opinion is by selling microinsurance that has a short duration with a push approach. Know what the customer needs before he or she does! Then you’ll be able to give the right insurance coverage, when the clients need it, directly on their smartphones. The trick here is being able to avoid annoying the customers with offers that do not interest them directly, in the wrong moments. To avoid that ,you would need to use a system that can give you insight into the lifestyle and preferences of the users.

A good microinsurance solutions has to be able to create a seamless digital customer experience by reading and interpreting customer behaviors and emotions. The aim here is to create a win-win situation for customers and insurers alike. And push microinsurance has just what it takes. For customers: always close at hand when they need to be protected, with the possibility of buying personalized microinsurance on the spot directly from the smartphone. For the insurer, it’s still very much uncharted territory to be explored but can also raise profitability levels significantly while avoiding moral hazard. This comes as a consequence of having a digital salesforce that sells insurance in a smart way because of AI and machine-learning capabilities and can reach the connected generation right where they like to spend most of their time: on their smartphones.

See also: Microinsurance Has Macro Future

Recent studies reported that millennials are currently the most underinsured generation and are the least likely to have health, rental, life and disability insurance.

So, what’s the magical combination for winning their attention? The key is to reach them with the right message, at the right time, on a device where they swipe, tap and pinch 2,617 times a day: their smartphone. Moreover, millennials are just the tip of the iceberg: The "connected generation" is the single most important customer segment. Empowered by technology, they search out authentic services that they use across platforms and screens, whenever and wherever they can.

We believe in a new distribution paradigm for the insurance sector: to stimulate the emotional need of protection, when the insurance coverage is not compulsory. Our artificial intelligence engine delivers a push suggestion at the right time with the right offer to provide a simple solution to this protection need, a promise easy to understand and convenient to purchase. We work with insurers and reinsurers to create insurance propositions while developing a streamlined purchasing process.

So the insurer has to address the current context, which has dramatically changed with the arrival of mobile and then smartphone technology. Get the customer’s attention by using the same channels that they use and talk to them in their language.

Insurance should adapt to the customer’s habits and environment. The best way to do that in my opinion is by selling microinsurance that has a short duration with a push approach. Know what the customer needs before he or she does! Then you’ll be able to give the right insurance coverage, when the clients need it, directly on their smartphones. The trick here is being able to avoid annoying the customers with offers that do not interest them directly, in the wrong moments. To avoid that ,you would need to use a system that can give you insight into the lifestyle and preferences of the users.

A good microinsurance solutions has to be able to create a seamless digital customer experience by reading and interpreting customer behaviors and emotions. The aim here is to create a win-win situation for customers and insurers alike. And push microinsurance has just what it takes. For customers: always close at hand when they need to be protected, with the possibility of buying personalized microinsurance on the spot directly from the smartphone. For the insurer, it’s still very much uncharted territory to be explored but can also raise profitability levels significantly while avoiding moral hazard. This comes as a consequence of having a digital salesforce that sells insurance in a smart way because of AI and machine-learning capabilities and can reach the connected generation right where they like to spend most of their time: on their smartphones.

See also: Microinsurance Has Macro Future

Recent studies reported that millennials are currently the most underinsured generation and are the least likely to have health, rental, life and disability insurance.

So, what’s the magical combination for winning their attention? The key is to reach them with the right message, at the right time, on a device where they swipe, tap and pinch 2,617 times a day: their smartphone. Moreover, millennials are just the tip of the iceberg: The "connected generation" is the single most important customer segment. Empowered by technology, they search out authentic services that they use across platforms and screens, whenever and wherever they can.

We believe in a new distribution paradigm for the insurance sector: to stimulate the emotional need of protection, when the insurance coverage is not compulsory. Our artificial intelligence engine delivers a push suggestion at the right time with the right offer to provide a simple solution to this protection need, a promise easy to understand and convenient to purchase. We work with insurers and reinsurers to create insurance propositions while developing a streamlined purchasing process.