As the first quarter of 2024 winds down, the insurance industry is embracing digitization and recognizing AI’s great promise for improving and simplifying what we do. It’s exciting to contemplate all the potential that technology affords. Yet we can’t lose sight of the fact that technology will never fully replace human connection.

Finding the best ways to use technology is understandably a focus for our industry, but the key to success lies in finding ways for technology, soft skills and empathy to work together. This is best done by investing in technologies that automate lower-level tasks and make employees’ jobs easier, which helps to clear the way for more high-quality interactions with clients and customers.

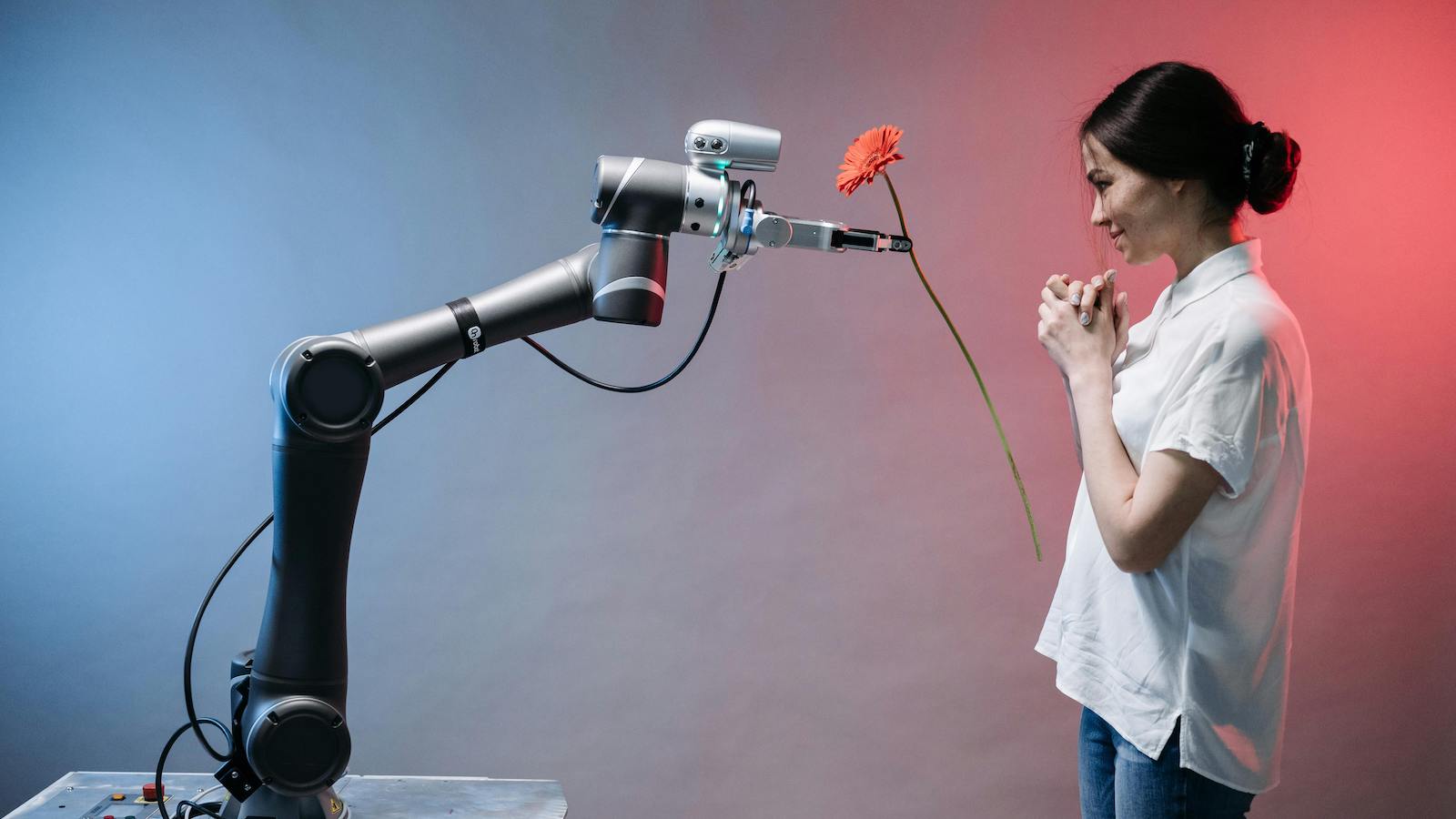

Equally important is finding ways technology can be used to cultivate a culture of empathy internally. A workplace empowered by empathy and efficiency allows employees to build strong relationships with both clients and policyholders. By combining human connection with technology-enabled solutions, claims professionals will have more time for fully engaged customer experiences. Think of this as human intelligence supported by artificial intelligence, not as artificial intelligence replacing human intelligence.

Opportunities to improve claims process efficiency with technology should not come at the expense of the human element.

Insurance is a product that nobody ever wants to use. But claims are inevitable, and when they do occur it’s important that policyholders feel that their insurer is there for them on a human level. If your home or your car is damaged, or if your business operations are on the line, you may not want a robot or an automated text message telling you that everything will be okay. Rather, you want a person to reassure you and give you confidence that things will be taken care of. For a policyholder or claimant who’s just gone through potentially one of the most terrible days of their life and wants to be shown empathy, reassurance is part of the product – and that reassurance needs to come from a person, not a bot.

In contrast to claimants looking for the human touch, technology enablement is perfect for the policyholder primarily looking for simplified self-service solutions or higher degrees of digital engagement in their claim experience. We must be careful, however, not to miss the mark by assuming that we know what someone needs or wants. A claim is a personal experience for everyone, and our role as claims professionals is to meet each customer where they are. With technology, we are better equipped to tailor the approach down to the individual preferences or needs of the customer and their circumstances. The integration of self-service interfaces to the claims process gives each insured the ability to define their own journey – and their claims team the ability to deliver the experience each customer needs and expects.

See also: Adding Humanity to Life Insurance

Beyond process efficiency, empathetic claim management can also help avoid large jury awards and nuclear verdicts.

Just as the impact of biases can work against businesses, a good claims experience can work in an organization’s favor. With social inflation and nuclear verdicts currently creating challenges for the insurance industry, it’s worth noting that a little bit of compassion can have a significant impact in combatting the anger and fear driving these trends. Claims organizations can avoid litigation and achieve quicker, less costly settlements when they take an advocacy-based approach that prioritizes care for injured parties. It stands to reason that jurors who see the insurance company as caring and empathetic may be less likely to punish them.

Critical components of an advocacy-based model include ensuring early outreach, offering empathy and support regardless of fault and going above and beyond to demonstrate care. Each of these “human” behaviors can go a long way toward mitigating confrontational litigation. This is all the more reason to resist the urge to over-automate larger value claims processes and to keep empathetic personal connections.

Empathy can be more profoundly extended to clients if it is first demonstrated to employees.

Not only should we look to balance automation with human support for policyholders, but as employers, we must also strive to provide empathy to our own people. Adjusters’ behaviors can change depending on what’s going on in their personal circumstances, and we as an industry must respond to these shifts by showing empathy to our own people, as we ask them to show empathy to others.

Creating a workplace empowered by empathy is essential to building a resilient workforce. Using human connection as a lens through which day-to-day business practices are viewed and implementing technology that frees up more time for relationship building are two key ways that organizations can sustain and improve empathy in the workplace. Workers aren’t going to be able to focus on empathy when they’re struggling, so it’s essential to prioritize holistic health and ensure that employees can manage the stress that accompanies helping customers in difficult circumstances.

See also: 4 Key Questions to Ask About Generative AI

The goal for 2024: Make empathy and technology work together to empower employees and drive client satisfaction.

As technology matures, it offers increasing opportunities to streamline workloads, allowing employees to focus on clients' claims with more attention and empathy to deliver personalized customer experiences.

The newest tools offer even more promise for blurring the lines between technology and empathy. AI algorithms can now identify and categorize emotions by analyzing text, speech and other data sources, and this information can be used to increase empathy even in tech-driven interactions. AI-powered sentiment analysis can help organizations to analyze and understand customer emotions, attitudes and opinions, as well as to monitor social media feeds, customer service interactions and customer feedback surveys to identify issues requiring additional response. These tools can also be leveraged to help companies identify bias in their customer interactions. And new call center tools are available that provide real-time coaching and flag potential issues, allowing the agent to focus on the caller, not the script. These tools could also flag the agent to signs of anger, frustration or confusion with the caller so they can course correct during a call.

When human connection is combined with technology-enabled solutions, claims professionals have more time for fully engaged customer experiences. And when employees are feeling their best, they will have the patience and soft skills necessary to be present and thoughtful with clients and customers. Technology that supports and builds time for human interaction should be the priority for the claims industry and will be what drives the industry’s continued success in the coming year.