For insurers to most effectively understand flood risk, they must have access to data that provides a full picture of the hazard, including the different flood types that might affect a property: fluvial, pluvial and storm surge. Although it may seem that flood is just flood, different types can produce various impacts on a property, causing different levels of damage.

Fluvial, pluvial and storm surge: Why it matters

Much of the U.S. is prone to both fluvial flooding (when rivers overtop their banks) and pluvial flooding (when water accumulates across the surface of the ground as a result of heavy rainfall). However, many coastal regions also experience storm surge flooding, which is a result of increased sea levels caused by weather events.

Storm surge flooding is extremely damaging due to the salinity of the water, while pluvial flooding is typically cleaner and quick to recede, likely resulting in lower-cost claims.

Without a view of these different drivers of flooding, insurers cannot understand the full exposure to their portfolios or fully engage with the private flood insurance market.

Use case: Jacksonville, Fla.

The need to understand all the drivers of flood can be illustrated using a residential property on 2nd Avenue, Jacksonville, Fla. Jacksonville is one of the five most vulnerable cities to hurricanes on the U.S. East Coast and at high risk from flooding, experiencing widespread storm surges and flooding during hurricanes Irma and Matthew.

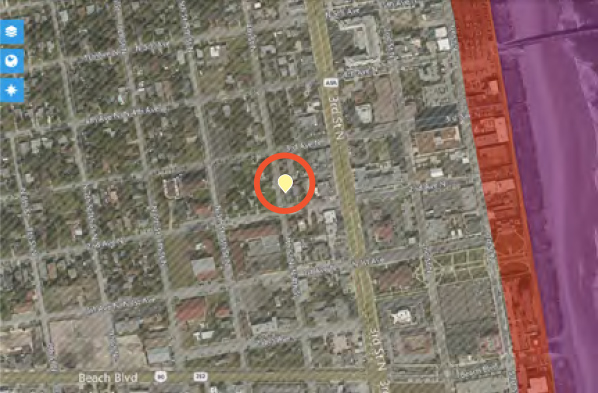

The residential property shown in Figure 1 originally fell into a FEMA Zone X (designated as minimal flood risk).

Figure 1: Contains data from the FEMA National Flood Hazard Layer.

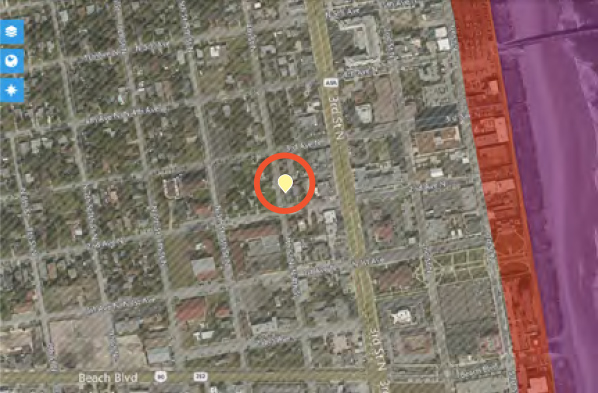

However, when we look at its location on the JBA flood map, we can see some differences in analysis. The JBA flood map identifies this location as at very severe risk to flood (Figure 2, below), from both fluvial and storm surge flooding, whereas using FEMA data alone would not account for either flood type or differentiate between fluvial and pluvial flood. Accessing data sources in addition to FEMA helps provide a more comprehensive understanding of the risk.

Figure 1: Contains data from the FEMA National Flood Hazard Layer.

However, when we look at its location on the JBA flood map, we can see some differences in analysis. The JBA flood map identifies this location as at very severe risk to flood (Figure 2, below), from both fluvial and storm surge flooding, whereas using FEMA data alone would not account for either flood type or differentiate between fluvial and pluvial flood. Accessing data sources in addition to FEMA helps provide a more comprehensive understanding of the risk.

Figure 2

The complex interplay between flood types

The risk is particularly high for hurricane-prone areas like Jacksonville, where storm surges often coincide with inland flooding. It’s important to represent this complex interplay during the mapping process instead of tackling each flood type separately. JBA’s storm surge mapping has been developed in partnership with leading hurricane modelers Applied Research Associates, ensuring that hurricane activity is fully accounted for. Additionally, surge data has been used to modify JBA’s inland flood mapping process to reflect the fact that, during a hurricane, rivers can’t flow out to sea as they can in normal conditions. Flood waters then back up, exacerbating fluvial flooding. For insurers to obtain a complete understanding of the hazard, flood maps must fully represent this relationship.

Even with FEMA recently re-mapping the area as a FEMA A Zone, demonstrating that the area is at risk to flood, the drivers of the flood are not clear. As such, underwriting against the FEMA map alone could misrepresent the insurance coverage required.

See also: FEMA Flood Maps Aren’t Good Enough

It’s clear that having a view of the different drivers of flood risk is vital for effectively understanding and underwriting the risk, especially in areas where hurricanes can be a major source of flood-driven losses.

Figure 2

The complex interplay between flood types

The risk is particularly high for hurricane-prone areas like Jacksonville, where storm surges often coincide with inland flooding. It’s important to represent this complex interplay during the mapping process instead of tackling each flood type separately. JBA’s storm surge mapping has been developed in partnership with leading hurricane modelers Applied Research Associates, ensuring that hurricane activity is fully accounted for. Additionally, surge data has been used to modify JBA’s inland flood mapping process to reflect the fact that, during a hurricane, rivers can’t flow out to sea as they can in normal conditions. Flood waters then back up, exacerbating fluvial flooding. For insurers to obtain a complete understanding of the hazard, flood maps must fully represent this relationship.

Even with FEMA recently re-mapping the area as a FEMA A Zone, demonstrating that the area is at risk to flood, the drivers of the flood are not clear. As such, underwriting against the FEMA map alone could misrepresent the insurance coverage required.

See also: FEMA Flood Maps Aren’t Good Enough

It’s clear that having a view of the different drivers of flood risk is vital for effectively understanding and underwriting the risk, especially in areas where hurricanes can be a major source of flood-driven losses.

Figure 1: Contains data from the FEMA National Flood Hazard Layer.

However, when we look at its location on the JBA flood map, we can see some differences in analysis. The JBA flood map identifies this location as at very severe risk to flood (Figure 2, below), from both fluvial and storm surge flooding, whereas using FEMA data alone would not account for either flood type or differentiate between fluvial and pluvial flood. Accessing data sources in addition to FEMA helps provide a more comprehensive understanding of the risk.

Figure 1: Contains data from the FEMA National Flood Hazard Layer.

However, when we look at its location on the JBA flood map, we can see some differences in analysis. The JBA flood map identifies this location as at very severe risk to flood (Figure 2, below), from both fluvial and storm surge flooding, whereas using FEMA data alone would not account for either flood type or differentiate between fluvial and pluvial flood. Accessing data sources in addition to FEMA helps provide a more comprehensive understanding of the risk.

Figure 2

The complex interplay between flood types

The risk is particularly high for hurricane-prone areas like Jacksonville, where storm surges often coincide with inland flooding. It’s important to represent this complex interplay during the mapping process instead of tackling each flood type separately. JBA’s storm surge mapping has been developed in partnership with leading hurricane modelers Applied Research Associates, ensuring that hurricane activity is fully accounted for. Additionally, surge data has been used to modify JBA’s inland flood mapping process to reflect the fact that, during a hurricane, rivers can’t flow out to sea as they can in normal conditions. Flood waters then back up, exacerbating fluvial flooding. For insurers to obtain a complete understanding of the hazard, flood maps must fully represent this relationship.

Even with FEMA recently re-mapping the area as a FEMA A Zone, demonstrating that the area is at risk to flood, the drivers of the flood are not clear. As such, underwriting against the FEMA map alone could misrepresent the insurance coverage required.

See also: FEMA Flood Maps Aren’t Good Enough

It’s clear that having a view of the different drivers of flood risk is vital for effectively understanding and underwriting the risk, especially in areas where hurricanes can be a major source of flood-driven losses.

Figure 2

The complex interplay between flood types

The risk is particularly high for hurricane-prone areas like Jacksonville, where storm surges often coincide with inland flooding. It’s important to represent this complex interplay during the mapping process instead of tackling each flood type separately. JBA’s storm surge mapping has been developed in partnership with leading hurricane modelers Applied Research Associates, ensuring that hurricane activity is fully accounted for. Additionally, surge data has been used to modify JBA’s inland flood mapping process to reflect the fact that, during a hurricane, rivers can’t flow out to sea as they can in normal conditions. Flood waters then back up, exacerbating fluvial flooding. For insurers to obtain a complete understanding of the hazard, flood maps must fully represent this relationship.

Even with FEMA recently re-mapping the area as a FEMA A Zone, demonstrating that the area is at risk to flood, the drivers of the flood are not clear. As such, underwriting against the FEMA map alone could misrepresent the insurance coverage required.

See also: FEMA Flood Maps Aren’t Good Enough

It’s clear that having a view of the different drivers of flood risk is vital for effectively understanding and underwriting the risk, especially in areas where hurricanes can be a major source of flood-driven losses.