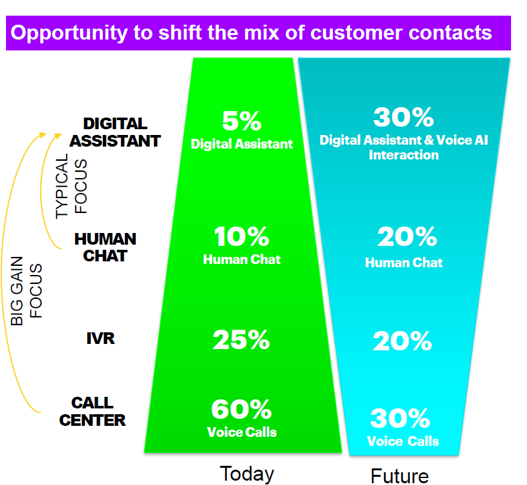

How can insurers meet increased customer expectations at a lower cost? AI-powered care delivers on a future vision of customer service with an opportunity for savings of 30% by, for example, driving customers to digital experiences. In this post, I will explore how to apply AI using an intelligent customer engagement (ICE) framework.

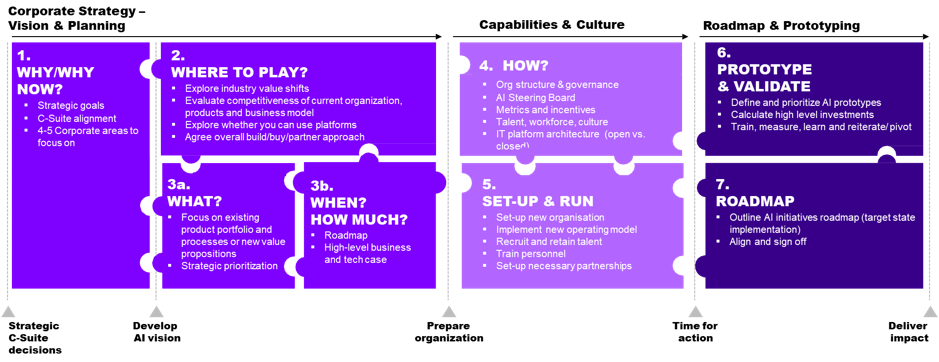

How can your insurance company increase its artificial intelligence quotient (AIQ) with a balanced innovation strategy? In this blog series, I’m exploring the myriad ways in which AI adds value to financial services in general and the insurance value chain in particular. In my previous post, I defined the term AIQ and revealed and discussed three key ingredients to building a strong AIQ: technology, data and people. In this post, I’ll take a close look at one of the key areas in the insurance value chain—sales and distribution—and explain how AI-related technologies can add value to this function. But first, I want to reiterate the value of AI and why it’s important to transform your business into an AI business. Why a strong AIQ is vital for your business—and why you need a strategy first. Most of what’s written about AI relates to cost-cutting and job losses, but as we saw with the example given with regard to the health industry in the previous post, AI is a much more optimistic story. Its greatest benefits are not only efficiency and productivity but innovation, improved customer and employee experiences and the development of new sources of value and growth, especially when they augment human capabilities. However, to gain these benefits and to identify relevant use cases, it is necessary to develop a cross-enterprise AI strategy that clarifies the strategic goals: the whys, the hows and the whats of the business model leveraging our “AI strategic approach,” as outlined below. See also: 3 Steps to Demystify Artificial Intelligence

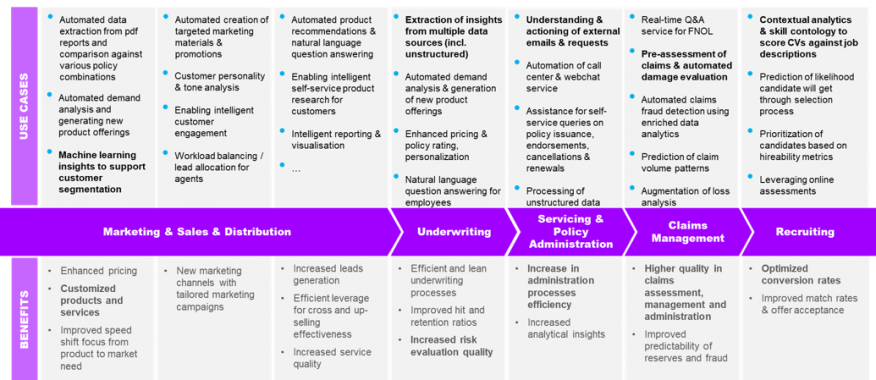

Once the strategic goals have been clarified, the potential use cases for AI can be identified and prioritized according to the impact and estimated implementation effort they have on supporting the achievement of these goals (such as enhanced operational efficiency or improved customer experience) along the insurance value chain:

See also: 3 Steps to Demystify Artificial Intelligence

Once the strategic goals have been clarified, the potential use cases for AI can be identified and prioritized according to the impact and estimated implementation effort they have on supporting the achievement of these goals (such as enhanced operational efficiency or improved customer experience) along the insurance value chain:

How can insurers use AI in sales and distribution?

As mentioned in my previous post, there are numerous use cases of AI that can be applied along the insurance value chain. In this post, we focus on AI in marketing, sales and distribution, including:

How can insurers use AI in sales and distribution?

As mentioned in my previous post, there are numerous use cases of AI that can be applied along the insurance value chain. In this post, we focus on AI in marketing, sales and distribution, including:

- Enabling intelligent customer engagement

- Workload balancing/lead allocation for agents

- Machine learning insights to support customer segmentation

- Automated data extraction from PDF reports and comparison against various policy combinations

- Automated demand analysis and generation of new product offerings

- Intelligent reporting and visualization

- Customer personality and tone analysis

- Automated creation of targeted marketing materials and promotions

- Enablement of intelligent self-service product research for customers

- Automated product recommendations and natural language question answering

- Increased lead generation — data analytics helps insurers identify and reach potential customers. The insight derived from data analytics can drive and constantly improve the sales team’s effectiveness at generating leads.

- Efficient leverage for cross- and up-selling — AI such as data analytics and VA gives insurers invaluable knowledge about their customers, making it easier to convince them to buy a comparable higher-end product (up-selling) or a product that is related to the ones they already have (cross-selling).

- Increased service quality — self-learning virtual advisers like Cathy interact with customers and absorb information about their needs. This valuable feedback drives personalization of products and improves the quality of services.

- Driving customers to digital experiences;

- Providing conversational interactions that increase digital adoption and containment;

- Leveraging AI to automate and deliver consistency across channels.

It’s time to put your AIQ to work

When you combine human ingenuity with AI—such as data analytics, virtual assistance and machine learning—to improve the sales and distribution function, you will see results improving.

AI presents the opportunity for business transformation by enabling intelligent processes in the value chain and intelligent products and services in the market. Success will depend on how well your organization can harness the combined power of technology, data and people.

In my next post, I’ll look at how you can use AI to augment underwriting and service management. Get in touch to find out how you can boost your company’s sales and distribution function, as well as others within the insurance value chain, or download our report on How to boost your AIQ.

It’s time to put your AIQ to work

When you combine human ingenuity with AI—such as data analytics, virtual assistance and machine learning—to improve the sales and distribution function, you will see results improving.

AI presents the opportunity for business transformation by enabling intelligent processes in the value chain and intelligent products and services in the market. Success will depend on how well your organization can harness the combined power of technology, data and people.

In my next post, I’ll look at how you can use AI to augment underwriting and service management. Get in touch to find out how you can boost your company’s sales and distribution function, as well as others within the insurance value chain, or download our report on How to boost your AIQ.