Since the onset of the COVID-19 pandemic, consumers have had higher demand for goods fulfilled largely through the trucking industry. This shift in the U.S. economy ran headlong into an industry already feeling a labor pinch before the pandemic as the previous generation of truck drivers started leaving the road. The resulting mismatch was part of the widespread story of supply chain bottlenecks and inflation that marked the economy throughout 2021 and 2022.

The transportation industry and the U.S. government have addressed this aspect of the supply chain, working on getting more drivers into commercial trucking. Due in part to these actions, including higher wages and benefits, the commercial driver labor market expanded, with more than 50,000 commercial driver’s licenses (CDLs) and learner’s permits issued each month in 2021, according to the White House’s Federal Trucking Action Plan. The 2021 numbers are 72% higher than the 2020 volume and 20% higher than the 2019 volume.

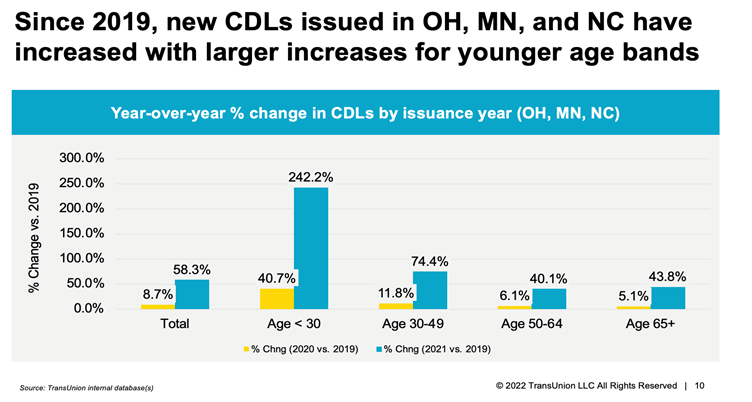

Internal TransUnion data from a few representative states shows younger CDL drivers are increasing faster than older CDL drivers, with the most significant year-over-year increase among drivers less than 30 years old. This shift came before the enactment of the pilot program to lower the federal CDL age limit for interstate commerce, which became operational earlier this year and could further accelerate shifts by age group.

A strong labor market for commercial drivers has created additional growth opportunities for commercial auto insurers. Still, it comes with a tradeoff of the potential for deteriorating profitability as younger and less experienced drivers come with additional risk.

Increasing Commercial Driver Risk

In light of macroeconomic pressures on transportation companies, TransUnion studies show that new commercial drivers who entered the labor market post-COVID have displayed signs of higher driver risk. This sudden change in the risk profile of commercial drivers can make it challenging for underwriters to underwrite and price new and existing policies correctly.

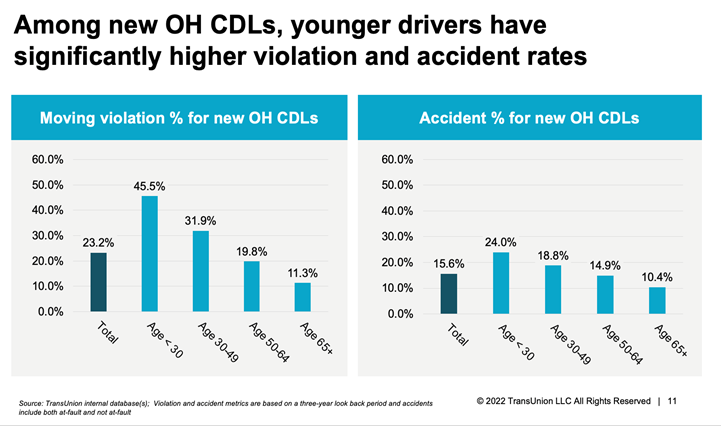

To quantify this change, internal TransUnion data for Ohio shows that, among new CDLs in the state, younger drivers have significantly higher moving violations and accident rates. Some key findings:

- Across all age cohorts, 23% of new CDLs had moving violations, and 16% of new CDLs had accidents.

- The results by age show both moving violations and accident rates correlate very closely with age. As the CDL driver's age decreases, violation and accident rates increase.

- For drivers under 30, the violation rate is almost double the rest of the new CDL population.

Younger commercial drivers — the fastest-growing age group — also represent the highest risk, and new CDLs are becoming riskier based on distributional shifts to younger ages. Additionally, across most ages, TransUnion internal data revealed that new CDL holders have higher-than-average moving violation rates for commercial drivers within their age group. Given the changing risk profile of new CDLs, insurers should review their processes for monitoring driving record history for new and existing commercial auto policies.

See also: 3 Practical Uses for AI in Risk Management

Greater Violation Insight Through Court Records

The state motor vehicle report (MVR) has traditionally been viewed as the gold standard for verifying driving record activity; however, it often comes with high costs and potential blind spots. Some commercial insurers may elect to mitigate MVR costs by underwriting fleet policies based on a random sampling of drivers, which introduces additional risk to the insurer. Traffic court record data offers a powerful alternative to the state MVR that's more affordable and captures further violation insight.

Based on TransUnion's internal research using its DriverRisk court record database, 34% of CDL moving violations occurred outside the license state, or roughly two times higher than non-CDLs. These out-of-state and prior license state tickets found with court records are often not captured on the state MVR due to reciprocity rules and other DMV challenges with sharing violations across state lines.

TransUnion took a deeper dive into moving violations identified within its court record database that do not appear on the state MVR. Internal TransUnion research found that more than 10% of CDL drivers had guilty moving violations identified within TransUnion’s court record database and a “clean” state MVR. As an example of additional activity identified by court records, 28% of all guilty DUIs found in TransUnion's court record database were for commercial drivers with a "clean" MVR. This is information that, if it had come to light, could’ve affected policy pricing and eligibility — and likely would have affected the driver’s CDL eligibility in the first place.

A Safe Drive to Profitability

As the transportation industry works to hire and onboard the next generation of commercial drivers, commercial auto insurers need to deploy a comprehensive driving record strategy to fully evaluate driving risk exposures and more accurately rate and underwrite policies. Such actions will be critical for commercial insurers to achieve their profit and growth targets for 2023 and beyond.