No one wants to deal with a property claim. Unfortunately, claims do happen, and that is why you buy insurance. There are right ways and wrong ways to manage a claim -- here are three common mistakes and how to avoid making them:

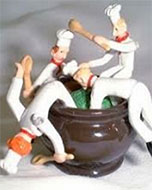

Too many cooks...One of the first things you should do after a loss is assign a point person to handle communication and dissemination of information to the insurance company. Oftentimes, this role defaults to the risk manager, but she is not always the best choice. Obviously, the risk manager needs to be part of the team, but you need someone who can dedicate a substantial amount of time to the claim. This ensures consistent communication and avoids the insurance team's relying on information that has not been vetted.

Not controlling the schedule...

As with most projects, planning and execution are necessary for a successful outcome. It is critical in the claims process to assign responsibility to the team members at the policy holder and require that they provide information in a timely manner. This compels the insurance company to provide feedback in a similar fashion. A timeline should be established early on, and the parties should be held to it. For example, claims will be submitted by the fifth day of the month; feedback will be provided by the 15th day of the month; and payment will be received by the end of the month. Scheduling like this can improve cash flow and ensure progress on the claim. Get the parties to commit to this early!

Unreasonable expectations...

It's true that the insurance company is not likely to accept your entire claim, but building up your claim to unrealistic expectations is not the answer. By claiming a "pie-in-the-sky" number, you can hurt your credibility and dramatically slow down or prevent a reasonable settlement. The better approach is to present a reasonable claim that is fully documented. This prepares you to counter the insurance company's rebuttal with confidence. It's reasonable to be aggressive, and, by all means, do not lower you claim in anticipation of pushback from the insurer. Just do not build up the claim to unrealistic totals with the plan to fall back to a lower position -- this gives all the credibility to the insurance company.