For most of 2015 I have been banging on about disrupting insurance (or Instech, if you like that kind of jargon). I'd like to use this blog post to talk about why I find it exciting.

1. Insurance is an enormous market

Life insurance premiums are $2.3 trillion globally. Non-life insurance premiums are $1.4 trillion globally. (Both numbers are from 2012, from a McKinsey report.) I don't get to write the word "trillion" often when looking at market sizes.

Importantly for a European venture capitalist, Europe is a disproportionately large chunk of the market, coming in at $700 billion of life and $400 billion of non-life. And London, as the place insurance was invented, remains its biggest global hub.

2. Incumbents face a number of challenges

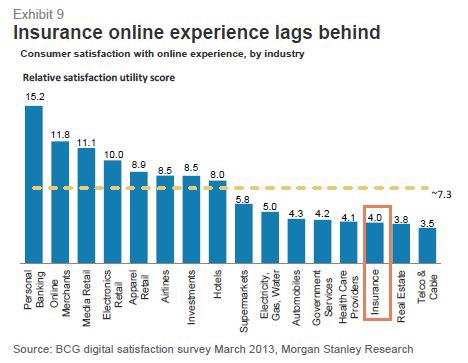

The insurance industry in Europe and the U.S. is mostly composed of large traditional insurers that have been operating for decades or centuries. They have struggled to adapt to a digital age, as shown by the graph from BCG below. As with banks, their back-end software and underwriting is tied into legacy software from previous decades, with major system integration challenges.

Insurers also have very little contact with their customers, contributing to low brand loyalty and retention.

In many countries and verticals, insurance is still mostly distributed via expensive offline broker networks. Insurers are often tied to these networks, making it very hard for them to move to direct/online distribution. For a typical insurer, distribution costs are significantly higher than all their other non-claims costs combined. Regulatory change in some countries is forcing insurers to make brokerage costs more explicit, which could well lead to customer backlash.

3. Technology can be highly disruptive in insurance

Technology can have a huge impact on every important aspect of insurance. Distribution was the first part of insurance to be disrupted, with insurance comparison engines such as Moneysupermarket and Check24. Further disruptive mobile-first distribution models are emerging. On the underwriting side, there is a huge volume of new data available (telematics, mobile phone, health tracking, etc.) with which to make decisions. And there are new machine-learning techniques to work with existing data. Smartphones allow a much more efficient and pleasant claims experience. Personalization software and machine learning enable :segment of one" insurance. The list goes on. (You can download a good report on this from BCG here.)

4. There are obstacles to entering the industry

It wouldn't be an achievement if it was too easy. Insurance presents start-ups with a number of barriers to entry, of which the most significant are:

- Regulation. Insurance is (with good reason) a highly regulated industry, and regulations vary by country (and by state in the U.S.). To get going in the UK, for example, you need to get into the nitty gritty of brokers, MGAs, reinsurers, Solvency II, warehousing, etc., etc. You also need to understand a different set of accounting standards and terminology.

- Balance sheet. Once you get through the regulation, you need to prove that you have the balance sheet to be able to pay up for claims in any eventuality. This requires serious capital before you can write your first policy.

- Partnering with incumbents. Both of the above make it near-impossible to start fresh, unless you can raise an Oscar-like $100 million-plus. Any other Instech start-up is going to need to partner with existing insurers. This presents a number of challenges and limits flexibility. Some insurers are trying to encourage innovation (e.g., axastrategicventures.com), but good intentions are confronted by big-company politics, vested interests and "not invented here" syndrome.

- Historical data. If you are going to get into underwriting insurance, you need historic claims data on which to base your decisions. However, this data is privately held by insurers. Building up enough data over a long enough time frame (given that claims are infrequent events) is a real challenge. Without it, there is a danger of start-ups mispricing risk.

5. These obstacles put off the big tech players

For the likes of Alphabet/Google, Facebook and Amazon, insurance is too hard and too boring. When you have a huge war chest, self-driving cars and drones are much more interesting areas to explore. In the war for engineering talent, it is hard to get your best developers to work on financial services. When I was with Google in 2007-09, I worked on the early days of Google Compare. Despite much hand-wringing in the insurance industry, this hasn't gone anywhere. It's just not high enough up Google's priority list.

6. Despite the obstacles, there are success stories

Ping An is one of the most impressive growth stories of any company globally. It was founded in 1988 in Shenzhen and was the first insurance company in China to adopt a shareholding structure. It took the nascent Chinese insurance industry and put a rocket under it, going IPO in 2004 at a $10 billion valuation. It is now valued at $100 billion. Ping An has always been a technology-led company and continues to lead the way in tech-led innovation.

Moneysupermarket was the first player to really crack insurance comparison, allowing users to type in their details once and receive competing quotes from dozens of insurers. It was quickly copied, leading to a fierce TV and Google ad spending war with Comparethemarket, Confused and Gocompare that continues to this day. Despite this, Moneysupermarket is still valued at almost $3 billion.

esure was founded in 2000, went public in 2013 and is now valued at $1.5 billion. Its success has been built on efficient, low-cost operations and building brands (both esure and Sheilas’ Wheels ). esure also owns Gocompare, one of the players in the UK comparison market.

7. There are a number of impressive start-ups emerging, but there is room for plenty more

Over the last year, I have seen a step change in the number of startups going after insurance. But this change has been from "almost none" to "a trickle." Tiny in comparison to the huge number of start-ups going after the similar-sized fintech market.

Here are a few of the areas in which I see Instech start-ups emerging:

Insurance distribution beyond comparison

This is the most obvious area for start-ups to address, as it is not subject to many of the challenges above (less regulated, no balance sheet, no underwriting). A few interesting new players:

- Knip. Mobile-first insurance concierge. Initial proposition for users is to remove administrative pain: Have all of your insurance policies in one place. Over time, there is the potential to be a user's trusted insurance adviser, recommending where he should increase/decrease cover and who he should insure with. Started in Switzerland, now taking on German market with competition from Safe and Clark. PolicyGenius in the U.S. is a different twist on the insurance concierge concept.

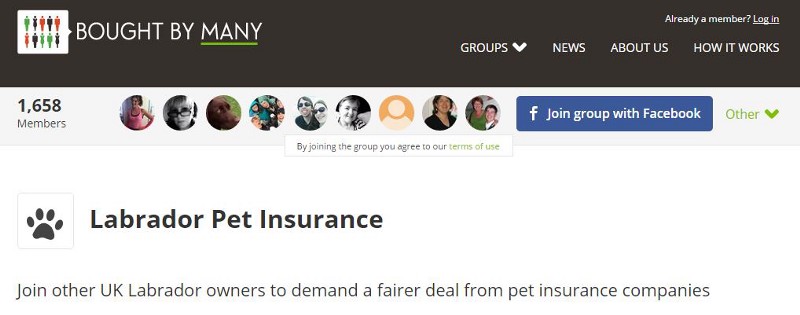

- Boughtbymany. Social distribution for niche insurance. Boughtbymany finds niche groups who have challenges finding good insurance today (e.g., diabetics, young drivers). It plugs into these affinity groups to push specially designed insurance products to them.

- Simplesurance. Seamless insurance cross-sell at checkout. The idea of selling insurance for high-value items at point of purchase is not a new one. Simplesurance's innovation is to make it as frictionless as possible for users and online retailers.

New forms of capital provision/peer-to-peer

In our persistent, low-interest-rate environment, new capital is flowing into the insurance industry in search of returns. One manifestation of this is hedge funds getting into reinsurance.

As a start-up, one opportunity is peer-to-peer insurance, where a group of members cover some or all of claims made by the group. In some ways, this goes back to the original concept of cooperative insurance. The advantages should be less fraud, lower acquisition costs (through referrals/social), greater loyalty and, over time, better pricing.

- Friendsurance in Berlin was the first company with this approach.

- Guevara in London is a different take on the P2P concept.

New sources of data

Connected devices and other online data offer insurers a huge amount of additional data on their insured risks. The first success story has been telematics for car insurance, where your driving behavior affects your premium. A number of good businesses have been created, such as Insurethebox, which sold 75% of the business at a valuation of around $200 million earlier this year. However, so far, telematics has remained a niche product, in particular addressing young drivers. Connected cars and ubiquitous smartphones will take it to the mass market.

Going forward there are many more opportunities to use connected hardware to refine insurance: wearable devices for healthcare, smart homes for home insurance, mobile phones for almost anything. There is also the opportunity to use people's online presence and social networks to reduce fraud and (possibly) improve underwriting.

A few examples in this area:

- Climate Corp. Collecting weather data with high precision, offering farmers crop insurance and in depth analytics.

- Metromile. In the car insurance telematics space, but using your smartphone to collect data, and a new pricing approach (pay per mile).

- Vitality. Keeping fit and healthy reduces your health insurance costs. Data taken in from partners and wearable devices. Has grown to 5.5 million members. Oscar is also using data from wearable devices for its insurance.

Reinventing the insurance experience

This is a broad category, including changing how claims are handled, how insurance is sold and how it is bundled with other services.

- Oscar is the best example of this, reinventing U.S. medical insurance from the bottom up. It has been well-covered by the tech press, so I won't go into it further here.

- Aircare is part of Berkshire Hathaway but worth a quick mention as it eliminates claims completely - it automatically pays out if your flight is delayed. Claims management is the most painful part of dealing with an insurer, with expensive offline measures to try to combat fraud. As everything we do becomes connected (starting with our car) the concept of "claiming" may become an anachronism.

New verticals

There is always a new category emerging for insurance. Smartphone insurance has seen huge growth. Cyberinsurance is a current hot topic. However, addressing these new lines of business is something that insurance insiders are pretty good at. Unless a start-up can come in with a real tech advantage (which in cyberinsurance might be possible), the worry is that new segments quickly become competitive.

New markets

The insurance market is still in its early stages in much of the developing world, offering opportunity for land grab. Compare Asia is an example of one company addressing this. DirectAsia, acquired by Hiscox, is another.

SaaS to help the insurance industry keep up

The insurance industry is more than big enough for a SaaS provider focused on the industry to build a billion-dollar business. There is a lot of Excel still being used. The question is which parts of insurance require unique software, as opposed to a slight customization of generic business intelligence, CRM or machine-learning SaaS packages. A couple of insurance-specific SaaS companies are Quantemplate, offering business intelligence and data warehousing, and Shift Technology in fraud detection. Balderton’s portfolio company InterResolve is a different sort of B2B insurance company, with a technology-led approach to insurance claims mediation.

What I am looking for as a VC in insurance

Finally, a quick summary of what I look for as a VC in insurance start-ups:

- Founding team who combine deep understanding of the insurance industry with an external, tech-led DNA. This probably means two founders, or a truly exceptional founder who can combine both. This is not an industry you can bluff your way through. On the flip side, I worry that a team of insurance industry insiders will struggle to break from industry norms.

- Real tech DNA in the company (something I look for in any sector).

- A clear focus on the customer, not the insurer/partner.

- Simplicity: an ability to take a complex industry and present it in a beautiful way using plain language.

- Mobile-first.

If you are an insurance start-up in Europe than I haven't spoken to before, please contact me!