JULY 2021 FOCUS OF THE MONTH

Customer Experience

FROM THE EDITOR

For maybe the first 15 years of the personal computer revolution, business and even government leaders talked a lot about the need for computer literacy. We were told that the very competitiveness of our nations depended on educating the populace to prepare for the digital age. Then Steve Jobs came along.

It turned out the problem wasn't our lack of education. The problem was that computers were just too hard to use. Once Jobs and Apple brought the graphical user interface to computers, and once processors became powerful enough to handle the demands of GUIs, the talk of computer literacy faded. Then came the iPad and iPhone, making an intuitive experience available on almost any device. If you asked a teenager to define "computer literacy" today, he or she would likely say, "Hey, Siri...."

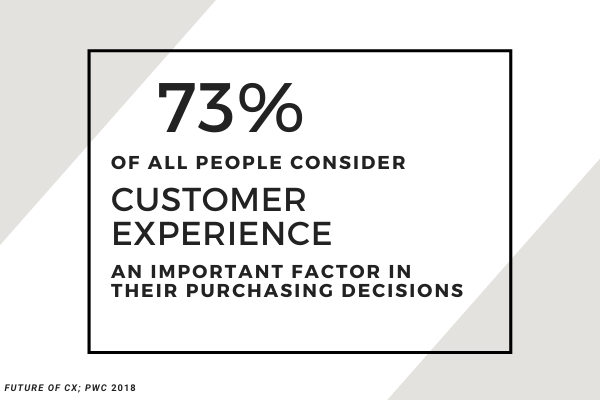

The insurance industry is trying hard to move into a "Hey, Siri" phase, as companies focus on drastically improving the customer experience. Companies are finding that they have to reinvent chunks of their businesses to really get the experience right. Yes, they have to focus on the ways that they touch customers, through agents and brokers, through call centers, through adjusters and through an increasingly broad array of electronic means. But a customer doesn't just experience a company through a direct communication. Customers also experience, for instance, how long and painful an underwriting process or a claim is.

And here's the thing: This emphasis on customer experience requires a revolution for companies but merely an evolution for customers. Insurers have to move heaven and earth to add computing power, to deal with new kinds of data, to come up with new analytical models, to design new processes and so on. Consumers just have to add an app or a phone number so they can text a company, have to e-sign documents rather than printing and mailing them, etc. -- and consumers have already been doing these sorts of things with other companies in other industries.

So, customers may understand at some level all the effort that has to go into changing how they experience an insurance company -- but they don't really care.

As you'll see from this month's interview, from the appended articles and from a host of articles throughout the website, lots of noble efforts are underway, and companies are making progress, but improving customer experience is a marathon, not a sprint. Every January, I publish articles about how this is the year that the industry will figure out the customer experience. Then I publish more of those articles the following January... and the January after that. Despite the undeniable progress, I don't expect to stop publishing those pieces any time soon.

- Paul Carroll, ITL's Editor-in-Chief

ITL FOCUS INTERVIEW

|

An Interview with Scott McArthur, CRO, StatfloWe spoke with Scott McArthur, chief revenue officer, Statflo, about the impact of digitization on customer interactions. |

WHAT TO WATCH

WHAT TO READ

WHO TO KNOW

Get to know this month's FOCUS article authors:

Andi Dominguez |

Tina Hammeke |

Ian Jeffrey |

Renaud Million |

Jon Picoult |

Thiru Sivasubramanian |

Kseniya Yurevich |

Interested in sponsoring ITL Focus or learning about other promotional opportunities? Contact us