After 9/11, a revolution happened in airline travel. Airline security tightened far beyond what we had previously known. In addition to new carry-on guidelines, travelers were subjected to more frequent individual screenings. More items had to be removed from our bags and examined. Electronics had to be turned on. Our shoes started coming off. The TSA needed to know us personally before we were allowed to fly.

The revolution, of course, created lines. We had to get up earlier to get to the airport to account for two hours in security. Shorter flights were no longer worth it. “I can drive there in less time.”

So, in 2019, the TSA, doing anything it could to improve the line situation, began using computed tomography (CT) scans in many busy airports. CT scans would change 2D baggage scans into 3D scans, allowing the operator to look at an item in greater detail without tagging a bag to be opened and checked by hand. The ability to “see” the hidden information would shorten lines and streamline the travel experience.

When COVID hit, lines evaporated. Air travel hit rock bottom. Lines are mostly not an issue right now, but public safety is now an even greater issue. In China, for example, large scanners are being used to check human temperatures on anyone traveling. Those with high temperatures are tagged and removed for further screening.

This concept bears a close look for all insurers, and especially for life insurers. In what ways can we use technology to know applicants and policyholders instantly, using that information to protect them and our level of risk in the process? Can we build flexible frameworks for accelerated and fluidless underwriting that will allow us to tackle new issues as they arise and capitalize on new data as it becomes available? Life insurers, group providers and voluntary benefits carriers are entering new regions of opportunity through new doors of data capability.

In Majesco’s latest thought-leadership report, Rethinking Life Insurance: From a Transaction to a Life, Health, Wealth and Wellness Customer Experience, we examine the nature of the purchase experience. Our recent survey across all age groups segmented into two groups – younger (millennial and Gen Z) and older (Gen X and Boomer) generation - painted a picture of a population that is growing in its desire to buy, growing in its goals to stay healthy and wanting the purchase to happen.

Every experience holds data

Today, nearly every aspect of the B2B, B2B2C and B2C customer experience has a level of intelligence that has created a wealth of data about customer activity, behavior and preference. From smart speakers to smart watches, phones, appliances, outlets and more — sensors and signals are everywhere. And, with customers' permission, sensors are measuring nearly every aspect of their lives. The result is that we now have the data to capture the instantaneous 3D view instead of the 2D view. But insurers must strategically invest in ways to capture and master this data to transform customer experiences in an age of instant digital engagement, delivery and satisfaction.

The use of data for life insurance is crucially important. Interestingly, the insurance industry has been capturing behavioral insights from customer interactions—offline—for many decades, before technology simplified managing customer relationships. Companies unfortunately didn’t know how to optimize their use of the data before now. That must change if insurers are to survive.

See also: Key Advantage in Property Underwriting

Can data improve the experience?

To meet the needs and expectations of today’s customers, insurers must create a radically different insurance experience, moving from a reactive approach to using real-time data, artificial intelligence (AI), machine learning (ML) and behavioral science to make processes and transactions simple, convenient, transparent and fast, like in other businesses. Encouragingly, our research found that the younger generation is ready and willing to use and share most new data sources for buying and rating life insurance. This willingness will be a key to unlocking sales.

Adding to this market opportunity, Majesco’s survey data showed that even those Gen Z/Millennials who currently DON’T have life insurance are open to these new data sources being used, nearly the same as their peers who DO have life insurance.

Insurers that are not actively planning and building capabilities to use new sources of data will be rapidly left behind.

MIB’s February 2020 activity report highlighted that pandemic-related demand for life policies pushed application activity to its highest level for the period since 2015. As noted previously, online, “fluidless” life insurance has dramatically increased during the first three months of 2020.

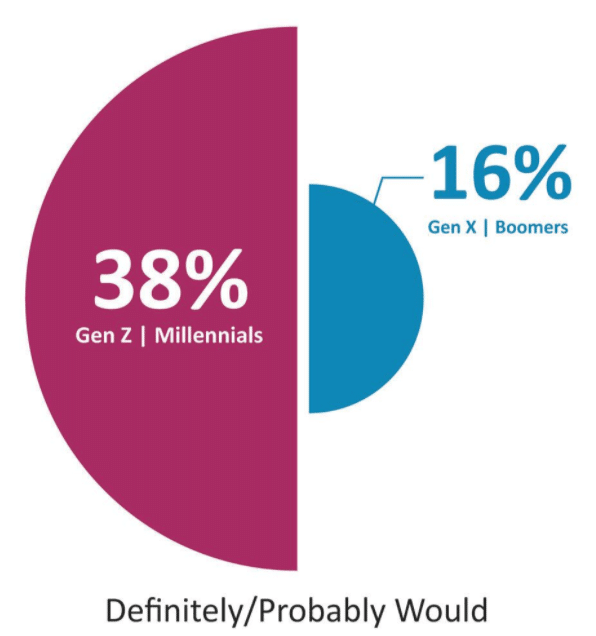

To accomplish this major experience transformation and bring the decision and the purchase into the same moment, insurers are moving from an underwriter-centric view to a digital, data-driven, accelerated and sometimes fluidless underwriting process. Accelerated underwriting is becoming widespread for term insurance. As shown in Figure 1, the interest in products that use dynamic underwriting and pricing is over two times higher in the younger generations – a significant difference that many insurers are unable to react to today. Once again, our data showed the younger generations who DO NOT currently have life insurance are even more interested in this option than their peers who DO have life insurance (41% vs 35%). Market and growth opportunities await for those who accelerate the move to dynamic underwriting and pricing with new data sources.

Figure 1: Interest in products that use dynamic underwriting and pricing

With the proper use of data, we don’t stop people at the checkout counter

In the traditional underwriting model, we ask people to come to the checkout counter for a price check, then send them home until we verify their ability to buy by gathering lots of medical and personal data. Companies are surprised with their level of not-taken policies. But if you put yourself in the customer’s shoes, why do you want to go through the extra hassle and time, particularly when other options are emerging. Using this picture, we can correctly assume that accelerated underwriting is a modern-day non-negotiable capability that will fit the desire for instant gratification at the point of need.

As a start, some insurers are reducing attending physician statements (APS) and paramedical exams (providing bodily fluids) and using more third-party data and predictive analytics-based models to automate and enhance the underwriting process.

Others are bringing in behavioral data from fitness and wellness programs, social media and new sources with AI and machine learning algorithms to create “smart, automated underwriting” that is continuously learning and adapting. All of this is redefining the process and cycle time and is creating a completely different customer experience.

The right ingredients in the right place at the moment of opportunity

Here is where technology acts as the enabler. For life insurers to fit their products into lifestyles and experiences instead of traditional transactions, several components must be in place.

Cloud Use for Digital Enablement: The point of sale (and marketing) must be well-integrated into current life processes. Often, this means partnerships or channel expansion that will require digital integration using application programming interfaces (APIs) and a cloud-based environment.

Data Integration (and AI / ML) for Accelerated and Fluidless Underwriting: Insurers need to create ways to go fluidless and physician-less so they can automate decisions in real time.

Ecosystem Philosophy: Insurers need to ramp up quickly. They can do this by partnering with ecosystem developers that can give them access to the data sources, channels and technology opportunities that will contribute to quick transformation.

Innovate for the Future: Innovate. Replicate. Reach. Learning the lessons from the past, that good data doesn’t necessarily get used effectively, insurers need to place themselves on a course for optimal data usage across the enterprise. They need to innovate how they use data to get a 3D picture for accelerated underwriting. They need to replicate greenfield and startup methodologies that transform data accessibility into improved experiences. And they need to reach growing and untapped markets with products that sell at the point of life experiences, instead of relying on traditional sales tactics.

See also: Underwriting Wildfire Takes Extra Care

Industry status quo is no longer an option. Your customers, particularly the younger generation who will be your dominant buyers, are expecting all of this and more. They want a customer relationship with a broader value to make their lives better across life, health, wealth and lifestyle needs.

How do your strategies align to what customers want? What plans are you taking to improve your odds of success?

Are you ready? Your customers are.

For more insights on how you can end transactional thinking and begin capitalizing on customer life experiences, be sure to download, Rethinking Life Insurance: From a Transaction to a Life, Health, Wealth and Wellness Customer Experience.