The nation’s medical overbilling epidemic is literally sickening for businesses and individuals alike. In fact, many analysts lay the blame on egregious provider billing practices as a key contributor to: 1) participants with outstanding medical bills, 2) participants who forgo care due to anticipated out-of-pocket costs and 3) the exploding cost of health coverage, where participant contributions have a significant impact on take-home pay and where employer costs represent the largest P&L expense other than wages in many organizations. These issues spark runaway spending that erodes take-home pay, household wealth and corporate profits.

Medical overbilling diminishes wages, lowers take-home pay, and increases cost sharing, causing scores of average working Americans to delay or forgo important medical care or ration medicine – damaging health. That undercuts the ability of households to save for emergency expenses and undermines productivity.

There is an urgent need for clear and accurate price transparency in healthcare to avoid medical overbilling. The task is twofold: securing the right administrative capabilities and plan design.

Role of TPAs

Employers must be able to confirm a third-party administrator’s (TPA) process for ensuring that it receives accurate pricing where there is a preferred provider organization (PPO) network in place, as well as processes for identifying upcoding, billing errors or other inaccuracies. This is accomplished through auditing a sampling of claims from a third-party auditor that typically is performed annually. Many health plan sponsors also have long crafted performance-based TPA agreements where additional compensation may be earned.

Reference-Based Pricing (RBP)

Reference-based pricing (RBP) is another key step to consider along the way to achieving accurate price transparency and avoiding egregious medical bills. Employers must confirm that where designs or provisions are in place, the processing to ensure accurate pricing may only require the TPA to confirm the accuracy of the coding and location of services. Once accuracy and location are confirmed, the TPA will reprice as necessary to the reference schedule adopted by the plan.

See also: Using Data Science to End Surprise Billing

Plan Design

Plan design in and of itself is also critically important to remedying medical overbilling. Employers must consider that open negotiation and independent dispute resolution (IDR) procedures may trigger a new risk for health plans – even those that apply RBP to non-network providers or plans that directly contract with providers and facilities.

Adopting a “pure” RBP plan that does not contract with providers will generally avoid the IDR process. Because there are no out-of-network claims or direct-contracting fees, and becausee there is no need to determine a median in-network rate, these plans are generally not hurt by the No Surprises Act.

Further, because in-network charges also tend to vary substantially, pure RBP ensures the suggested reference price (or billed amounts, where lower) applies in every situation.

Other than determining the accuracy of pricing, price transparency is typically only a consideration when it is part of the purchase decision. So, the following points must be highlighted:

- First, “accurate” suggests multiple prices for the same procedure, including variance among providers in the same PPO network, likely varying by contract provision. Individual providers may also vary their pricing for certain procedures. This is why it is so important to confirm that the patient received the correct price as stipulated in the contract.

- Second, a price comparison is best accomplished prior to the provision of services. When done correctly, it would be an important component of an advanced explanation-of-benefit process.

- Third, the difference in price may not be as important to consumers as the difference in their out-of-pocket (OOP) expense. Therefore, side-by-side comparisons may have a more noteworthy impact on the cost to the plan.

Experience has shown that when people are spending their own money, they’re more circumspect about those purchasing decisions. Therefore, the goal is to encourage wise consumer behavior. Health Savings Account (HSA)-capable coverage is one smart choice that often encourages consumer behavior in medical services decision making. By participating in an HSA-capable plan, consumers have a say in selecting medical services and incurring out-of-pocket (OOP) costs – where those OOP expenses can be paid with tax-preferred HSAs assets.

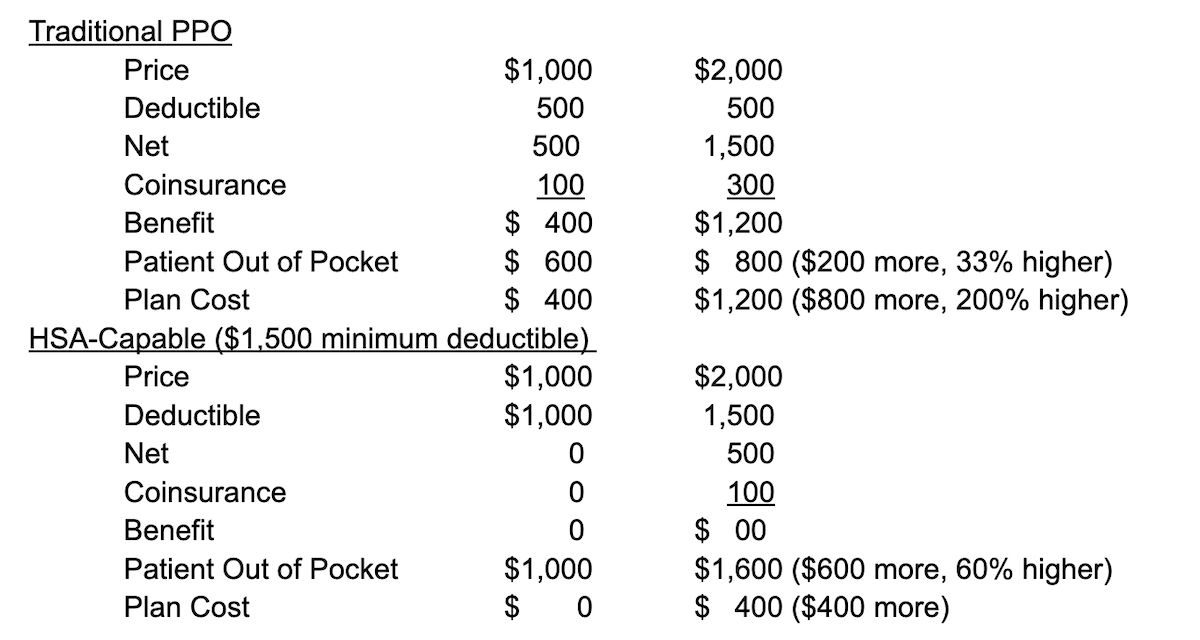

HSA-capable coverage will generally lower the initial cost of coverage and help the participant prepare for years when they have out-of-pocket spending. The example below, involving a typical PPO with a $500 annual deductible and 80/20% coinsurance, shows what happens if the same service is priced at $1,000 and $2,000 under two different health plan models:

As previously suggested, transparency in pricing is much more important to the consumer if they are actually spending their own dollars. So, when seen in the same example, a side-by-side comparison of a traditional PPO and an HSA-capable PPO identifies the incentive to check on the price. This recognizes that where a worker has a choice between the traditional and HSA-capable PPO, where the employer contribution is typically the same dollar amount (for coverage and employer contributions to the HSA), the worker and the plan both spend less – benefitting from consumerism.

See also: The Need for Transparency in Underwriting

Empowering Consumers to Make Informed Decisions

Ensuring that health plan members have more of an ownership stake in their healthcare choices is a vital piece of the puzzle in combatting medical overbilling. Consider that just 43% of healthcare expenses have been traced to services that may have been shopped for by a motivated employee, according to the Health Care Cost Institute.

Influencing consumer behavior is predicated on improving healthcare literacy through helpful educational materials, meaningful communication campaigns and decision-supporting tools. Arming healthcare consumers with the right knowledge will help them make healthier lifestyle choices, as well as select more appropriate coverage options and address cost concerns. By making more informed decisions about their healthcare, health plan members will improve their health outcomes and, by association, do their part to help remedy the nation’s medical-overbilling epidemic.