Embedded insurance (also known as IaaS, Insurance-as-a-Service) in the U.S. market is gaining popularity in the age of information and rising consumer expectation of convenience. Insurance products previously purchased in a standalone fashion are now available as an integrated experience. Mature insurance application programming interfaces (APIs) and accelerated underwriting have enabled the integration of insurance with non-insurance digital products, platforms and services.

Embedded technologies allow customers to purchase insurance as part of a process they are familiar with instead of being an ad-hoc event, bringing convenience and ease of use. Embedded insurance is fundamentally changing how consumers engage with insurance and the mode of insurance sales.

However, the conversation about embedded insurance has largely remained within the P&C space over the past years, and for a good reason. In comparison with P&C products, such as warranties, rent insurance, jewelry insurance and even homeowner/auto insurance, personal life and supplemental health insurance are non-compulsory, mostly not use-case specific, require a decades-long financial commitment and are much more complex.

These headwinds make it challenging to embed life and supplemental health products in a way that would attract consumers, and most embedded partnerships for L&H products did not last long.

The first principle of embedded insurance

Before we lose all hope, let's go back to the first principle of embedded insurance. Despite common misconceptions, embedded distribution complements brokers' and agents' channels with the goal of reaching customers inaccessible from the traditional channels, and selling simple digital products may not provide incentives to brokers and agents. Strategically, embedded insurance is about partnering with third-party service providers with lead-gen capabilities that have a large customer base and brand equity.

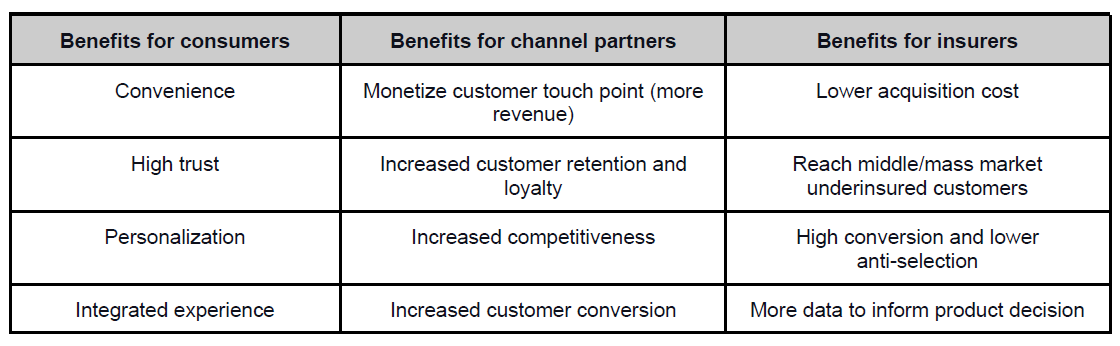

Embedded enablers, therefore, offer relevant, simple life and supplemental health insurance products digitally through the service providers' digital journey to help their consumers purchase insurance in a frictionless way. Implemented correctly, embedding could help insurers lower acquisition costs and help third-party service providers increase revenue and retention, and ultimately, help end users get protection before they need it.

The foundation of embedded insurance is to create a win-win-win solution by opening up new distribution channels and delivering insurance products in a more economical way.

See also: Riding the Insurance Roller Coaster

Why is embedded insurance different for personal life and supplemental health products?

Embedded distribution touches on many aspects of the insurance tech stack. The following is a simplified framework with a premise of a basic understanding of digital insurance distribution in the U.S. market.

Let's start with the similarity between embedded insurance for personal L&H products and P&C products. Effective solutions on both sides consist of similar basic building blocks and offer a similar value to consumers and partners. Specifically, modern technologies and insurance stacks are required to make the embedding process practical and achievable. API connectivity is highly preferred, and the ability to offer a white-labeled solution quickly is a must. The embedded process also has to be context-relevant.

The insurance product needs to bundle with the embedded offering well, and the underwriting process needs to align with customers' expectations. Also, various degrees of access to the existing data are key drivers to a successful embedded solution.

The similarities between embedding L&H products and P&C products stop here.

Unlike P&C products that have gone through many years of digital transformation, L&H products have just started the transformation processes with a headwind of significant legacy burdens. Few products beyond SI term life insurance have developed the API connectivities required for embedding purposes.

Unlike the existing embedded P&C products with little or no underwriting involved, L&H products' underwriting is still much more involved, even with the options of SI and instant-issued products. Furthermore, the placement ratio is one of the key concerns. Unlike most P&C products that are short-term, compulsory, simple and have a distinct use case, L&H products are non-compulsory and more complex, and consumers often struggle to fully understand their value in making such a long-term commitment.

Unlike with the advent of neo-insurers like Lemonade or Root, which own the end-to-end distribution with the ability to develop their own embedded solution, L&H carriers outsource distribution and are unlikely to develop their own embedded solution, given the operational and logistical limitations. Therefore, there is a higher need for third-party embedded enablers in the L&H space.

By now, it is self-evident that despite the similarities, the difference in L&H products mandates unique ways of implementing an embedded strategy.

The considerations of effective embedded solutions for L&H products

The L&H industry comprises more complex, high-value and low-frequency products, which makes embedding harder.

The implementation of L&H products requires some additional considerations. In addition to the modern and flexible tech stack, L&H embedded enablers also should consider the following:

Generally, the embedded solution enables an insurance delivery as part of a point-of-sale process, such as upon closing a mortgage process, or part of a non-purchase customer journey, such as when consumers are using the digital solutions offered by the embedded (distribution) partners, e.g., neobanks. Each method is distinct in how the insurance value proposition is conveyed to the user and dictates many other embedding elements.

On the one hand, to deliver insurance as part of a POS effectively, the embedded insurance products have to be explicitly tied to the bundled service. Unlike group life and health products on the group chassis, where hard-embedded (opt-out) offering (products are selected by default) could potentially be an option, individual L&H products have to adopt a soft-embedded (opt-in) solution due to regulation. The implication here is that customers have to make an explicit purchase decision when presented with an insurance product when they purchase another product. And the perfect example of such goes back to the use case when airlines present travel insurance just as a customer finishes booking plane tickets and is worrying about logistics problems.

In the scope of personal L&H products, context relevance and simplicity are key. Customers have a split second to make a purchase decision of insurance products in addition to the monetary commitment they have just made. To add insult to injury, the POS embedding process usually occurs in the low-touch business model, implying there is little either party can do to re-engage those customers who opt out of this product.

On the other hand, delivering insurance as part of a customer journey (imagine embedding the insurance offering in a banking app) requires a very different tactic compared with the option of embedding it into the POS process. Now, without a distinct sales motion like in the example before, customers may not "notice" the embedded offerings or have enough awareness to take action. So considerations need to be given to the placement of the solution. The advantage here is that sales could occur in the future as long as customers initiate the journey at a sufficient pace.

Understanding the nuance above is critical in vetting the embedded distribution partners. For the POS embedded partnership, a modern tech stack on both sides is critical to allow seamless integration, and using existing data to pre-populate the offerings also drives conversion. Insurance products need to be simple, low-cost and offer value specific to the underlying purchase.

For the customer journey-focused embedded partnerships, the key to success is to leverage the frequent customer visits and exposure (high customer touch point of the partners' business model) to generate insurance awareness, interest and purchase decisions over time. Engaging customers this way can catch them before they officially start their shopping journey, entering the customer lifecycle economically and addressing different needs when it comes to product offerings.

An effective embedded solution for the L&H products needs to be data-driven, seamless, cost-effective, personalized, transparent and flexible. Although there is no clear boundary of what defines an embedding partnership, embedding a link on the website redirection is not strictly an embedded solution, and it has not yielded the business results we expected from the partnerships we observed in the past three years. A well-executed embedding strategy is the emergence of bancassurance 2.0, where insurance products are embedded into fintech platforms such as challenger banks. As an example, Latin American challenger bank Nubank launched in December 2020 its life insurance offering in partnership with Chubb.

A successful embedding partnership requires deriving value from distribution partners' existing customer-level data as a means to identify customers' needs, pre-underwriting, deliver a hook to attract customer's attention, and continuous engagement for future upsell and cross-sell opportunities. Of course, there are nuances to each point above depending on the types of channel partners, and the details of such are beyond the scope of this paper.

See also: Predictions, Wishes and the P&C Industry in 2025

Why do we need embedded enablers for L&H products?

People's shopping behavior has been changing faster than ever. Despite all the innovation in L&H insurance products and distribution technology, it is not enough. COVID-19 has certainly reminded people of their mortality, but a one-off demand stimulus like that is not sustainable. Based on the LIMRA survey, the L&H insurance gap still hit another high in 2021. Something needs to change, and meeting customers' evolving expectations is the key.

In the L&H space, carriers have played a critical role in pushing the pace of digital transformation, mostly in the space of underwriting innovation, and recently have moved on to the development of digitally friendly products. Given the historical context of outsourcing distributions to various broker-driven channels or the newly emerged digital distribution partners, most L&H carriers are well-aware of the operational and logistical limits to disrupt distribution directly and eager to explore digital distribution through partnership.

Embedded enablers are here to fill this gap. Embedded enablers can take on various shapes and forms, such as MGA, BGA or pure tech play. Overall, embedded enablers are tech-heavy and data-driven. They bridge the gap between the new digital channels and the insurers. Embedded enablers not only distribute insurance products but, more importantly, use data to build a digital relationship with customers over the long term.

The strategic value that embedded enablers bring is the rapid testing of the distribution channels and embedding method, finding a product-channel fit, assessing the market appetite and bringing that knowledge back to the carriers to drive product-level decisions. Different channels have their unique embedding requirements in data privacy, tech and placement models that require drastically different solutions. This also means that the product requirements are no longer driven by the insurance providers but by third parties facilitated by the embedded enablers. Most L&H products today have not been designed to target broad market segments and customers, which makes it increasingly difficult to resonate with customers who are demanding more personalized products. With embedded enablers as a conduit, insurers can finally make this happen.