Florida is the highest-risk state for storm surge, with an estimated 2.8 million single family homes at risk and a replacement value of $581 billion, according to the

2019 Private Flood Insurance Report. Yet, in Florida,

there are only 1.7 million NFIP policies reported in force, suggesting a huge opportunity for private insurers.

Even so, total direct written premium in Florida actually

declined from $84 million in 2017 to $79 million in 2018, largely within the residential market. So what's holding insurers back from engaging in the obvious latent opportunities in markets like Florida? Answer: The inability to fully contextualize individual risks, as well as their subsequent impact on an existing portfolio.

Why is the ability to contextualize risk so critical to evaluating flood risk?

To ensure accurate and confident risk selection, underwriting and pricing decisions, insurers must be able to fully understand flood risk in terms of their own portfolio. However, this is only possible when using high-resolution, granular flood data, which provides details of flood type, severity and extent, such as

JBA flood maps. Without the ability to assess the full granularity of the risk, other flood map providers, such as FEMA, fail to account for all the nuances required in setting premiums and providing coverage.

See also: Using High-Resolution Data for Flood Risk

Using granular flood data alongside a geospatial analytics solution, like SpatialKey, further enables insurers to assess flood risk in line with their own decision-making. JBA

flood assessments within SpatialKey provide a risk score and overall flood rating. The weighted score methodology provides a normalized measure by which insurers can consistently benchmark the risk and use it to inform their rating. Upon review in SpatialKey, and after consulting with JBA where necessary, an insurer can decide whether to write the risk and ensure that it is applying an appropriate deductible.

Use case: Sherwood Park, Palm Shores, Florida

Using a residential property in Palm Shores, FL, as an example, we can see the importance of contextualizing the flood risk in portfolio terms.

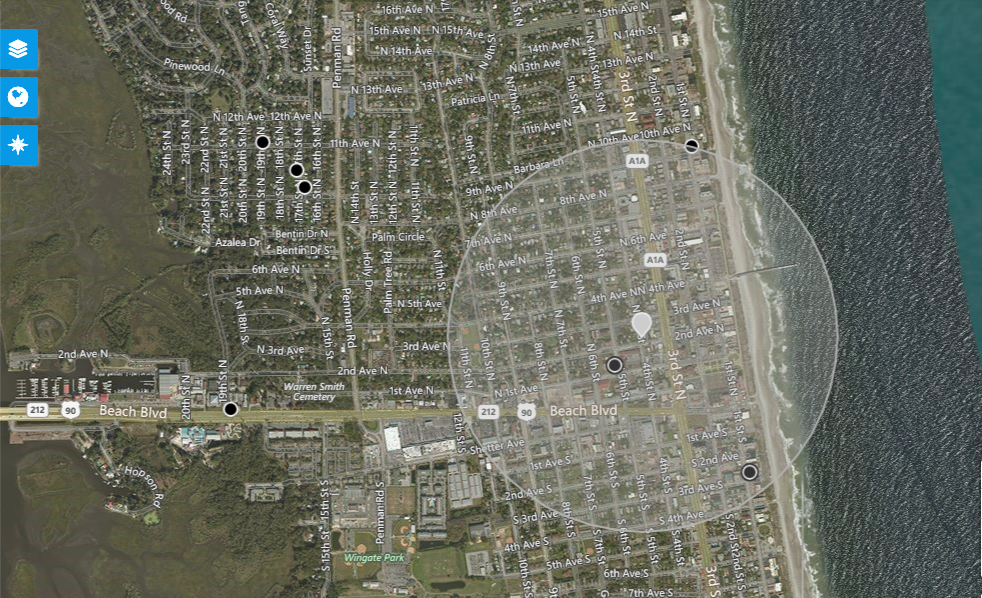

Figure 1: JBA location report within SpatialKey for Palm Shores property across fluvial, pluvial, and coastal flood.

Figure 1: JBA location report within SpatialKey for Palm Shores property across fluvial, pluvial, and coastal flood.

The overall JBA flood rating for the property is medium, based on the likely depth of each flood type at different return periods or probabilities of occurrence. It’s weighted to reflect the fact that different sources of flooding will lead to different amounts of damage; coastal flooding is often more damaging due to the salinity of the water (and therefore has a higher score), whereas pluvial flooding is often cleaner and quick to recede.

The location report in Figure 1 shows that the property under the orange pin has only a 1-in-500-year fluvial flood hazard. This indicates that riverine flooding is likely to be infrequent in the area. There is also minimal coastal (or storm surge) flood hazard. However, there is a pluvial hazard at the 1-in-20-year return period, indicating that flooding from heavy rainfall may be frequent here, to depths of up to nine inches. The flood rating is medium rather than high because pluvial flooding is typically less damaging than the other flood types.

Understanding flood risk in the context of a wider portfolio

To make an informed decision on a policy, the impact of an additional flood risk to an in-force portfolio must also be considered. Decisions cannot be made in isolation. And, while information on the individual hazard is extremely beneficial, accumulations at that location should also drive the decision-making process.

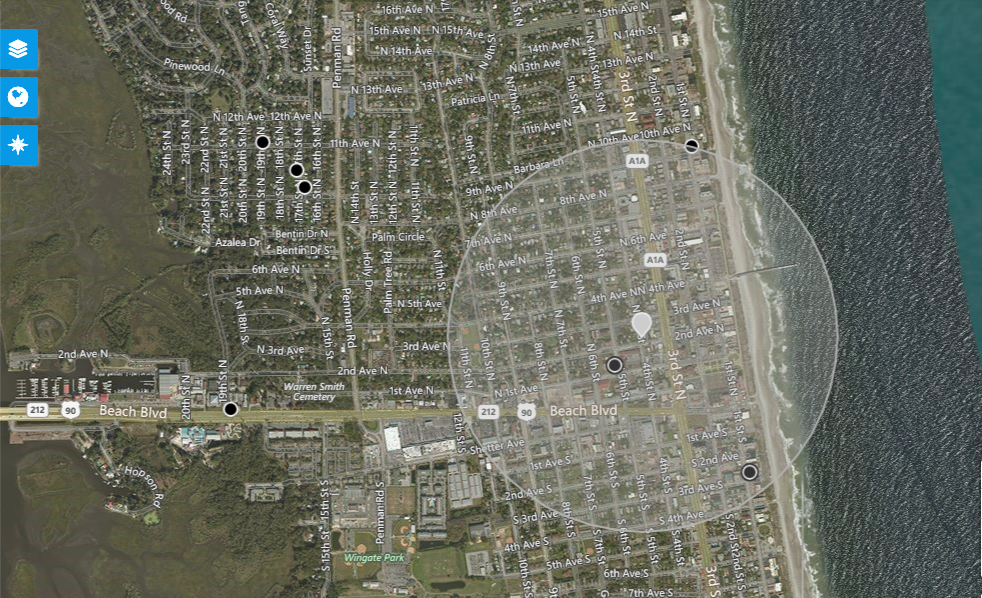

Figure 2: SpatialKey helps inform underwriting decision-making with a view of nearby risks (3 black dots) within this half-mile radius.

Figure 2: SpatialKey helps inform underwriting decision-making with a view of nearby risks (3 black dots) within this half-mile radius.

In Figure 2, three other risks (black dots) can be seen within a half-mile radius of the chosen location (grey pin). As insurers intelligently grow their flood business, an underwriting rule may dictate that, for example, residential flood should not exceed $1 million in a half-mile radius. Based on that underwriting rule, this particular property could prompt the agent to refer this policy to the home office for additional consideration and underwriting.

See also: How Tech Improves Flood Modeling

It’s clear that granularity is an asset, especially when selecting and pricing flood risk in the U.S. market. Any data source can be misleading or incomplete when used in isolation. The ability to compare multiple data points and multiple data sources in one place is increasingly important with complex events like hurricanes, for example, which involve multiple perils (i.e. wind, surge, flood).

By leveraging flood data within an advanced analytics platform, you can contextualize risk on a whole new level—helping you make more confident decisions, expand your foothold in the flood market and build a strong market reputation as a champion for superior flood coverage.

Figure 1: JBA location report within SpatialKey for Palm Shores property across fluvial, pluvial, and coastal flood.

The overall JBA flood rating for the property is medium, based on the likely depth of each flood type at different return periods or probabilities of occurrence. It’s weighted to reflect the fact that different sources of flooding will lead to different amounts of damage; coastal flooding is often more damaging due to the salinity of the water (and therefore has a higher score), whereas pluvial flooding is often cleaner and quick to recede.

The location report in Figure 1 shows that the property under the orange pin has only a 1-in-500-year fluvial flood hazard. This indicates that riverine flooding is likely to be infrequent in the area. There is also minimal coastal (or storm surge) flood hazard. However, there is a pluvial hazard at the 1-in-20-year return period, indicating that flooding from heavy rainfall may be frequent here, to depths of up to nine inches. The flood rating is medium rather than high because pluvial flooding is typically less damaging than the other flood types.

Understanding flood risk in the context of a wider portfolio

To make an informed decision on a policy, the impact of an additional flood risk to an in-force portfolio must also be considered. Decisions cannot be made in isolation. And, while information on the individual hazard is extremely beneficial, accumulations at that location should also drive the decision-making process.

Figure 1: JBA location report within SpatialKey for Palm Shores property across fluvial, pluvial, and coastal flood.

The overall JBA flood rating for the property is medium, based on the likely depth of each flood type at different return periods or probabilities of occurrence. It’s weighted to reflect the fact that different sources of flooding will lead to different amounts of damage; coastal flooding is often more damaging due to the salinity of the water (and therefore has a higher score), whereas pluvial flooding is often cleaner and quick to recede.

The location report in Figure 1 shows that the property under the orange pin has only a 1-in-500-year fluvial flood hazard. This indicates that riverine flooding is likely to be infrequent in the area. There is also minimal coastal (or storm surge) flood hazard. However, there is a pluvial hazard at the 1-in-20-year return period, indicating that flooding from heavy rainfall may be frequent here, to depths of up to nine inches. The flood rating is medium rather than high because pluvial flooding is typically less damaging than the other flood types.

Understanding flood risk in the context of a wider portfolio

To make an informed decision on a policy, the impact of an additional flood risk to an in-force portfolio must also be considered. Decisions cannot be made in isolation. And, while information on the individual hazard is extremely beneficial, accumulations at that location should also drive the decision-making process.

Figure 2: SpatialKey helps inform underwriting decision-making with a view of nearby risks (3 black dots) within this half-mile radius.

In Figure 2, three other risks (black dots) can be seen within a half-mile radius of the chosen location (grey pin). As insurers intelligently grow their flood business, an underwriting rule may dictate that, for example, residential flood should not exceed $1 million in a half-mile radius. Based on that underwriting rule, this particular property could prompt the agent to refer this policy to the home office for additional consideration and underwriting.

See also: How Tech Improves Flood Modeling

It’s clear that granularity is an asset, especially when selecting and pricing flood risk in the U.S. market. Any data source can be misleading or incomplete when used in isolation. The ability to compare multiple data points and multiple data sources in one place is increasingly important with complex events like hurricanes, for example, which involve multiple perils (i.e. wind, surge, flood).

By leveraging flood data within an advanced analytics platform, you can contextualize risk on a whole new level—helping you make more confident decisions, expand your foothold in the flood market and build a strong market reputation as a champion for superior flood coverage.

Figure 2: SpatialKey helps inform underwriting decision-making with a view of nearby risks (3 black dots) within this half-mile radius.

In Figure 2, three other risks (black dots) can be seen within a half-mile radius of the chosen location (grey pin). As insurers intelligently grow their flood business, an underwriting rule may dictate that, for example, residential flood should not exceed $1 million in a half-mile radius. Based on that underwriting rule, this particular property could prompt the agent to refer this policy to the home office for additional consideration and underwriting.

See also: How Tech Improves Flood Modeling

It’s clear that granularity is an asset, especially when selecting and pricing flood risk in the U.S. market. Any data source can be misleading or incomplete when used in isolation. The ability to compare multiple data points and multiple data sources in one place is increasingly important with complex events like hurricanes, for example, which involve multiple perils (i.e. wind, surge, flood).

By leveraging flood data within an advanced analytics platform, you can contextualize risk on a whole new level—helping you make more confident decisions, expand your foothold in the flood market and build a strong market reputation as a champion for superior flood coverage.