In the 1939 blockbuster film “The Wizard of Oz,” Dorothy, Toto and their three companions run toward the Emerald City across a field of poppies; an intoxicating scent puts her, Toto and the Cowardly Lion to sleep. Then, from the clear green-blue sky, snow starts to fall. Dorothy, Toto and the lion awake, and the lion says something like, “Unusual weather we’re having, isn’t it?”

Insurance companies across the U.S. might be saying something about unusual weather given the on-again, off-again occurrences of severe weather. In fact, with all the other issues the insurance industry has had to deal with from COVID-19 and the worldwide protests and riots, which will already account for higher than normal losses for some insurance companies, maybe the silver lining might be that the severe weather season has overall been a roller coaster and not just a straight plunge.

After an active April (second most active for tornadoes) of severe weather across the Southern states, which accumulated a total of about $6 billion in insurance loss, May and June have been much better. May was atypical, with just half the insured loss of April, which is truly welcome news for the insurance industry. This shows up in the severe weather reports as well, with May having well below normal severe weather reports, especially tornadoes.

In fact, May had the fewest severe weather reports since May 2014, led by what you might call a tornado drought that has resulted in the fewest recorded tornadoes since at least 1970. On top of that, May had the fewest number of EF2+ tornadoes in recorded history, according to preliminary data, and the insurance industry still has not experienced an EF5 tornado since May 20, 2013. Another way to gauge the lack of severe weather in May across the U.S. is by looking at the occurrences of moderate/high outlooks for severe weather. May 2020 was the first year without a moderate risk or higher for the day 1 outlook issued by NOAA Storm Prediction Center since 1995, and May had the fewest number of tornadoes watches in recorded history (1970 – present). May was truly unprecedented when compared with the active April that occurred across the U.S.

See also: Wildfire Season Off to Perilous Start

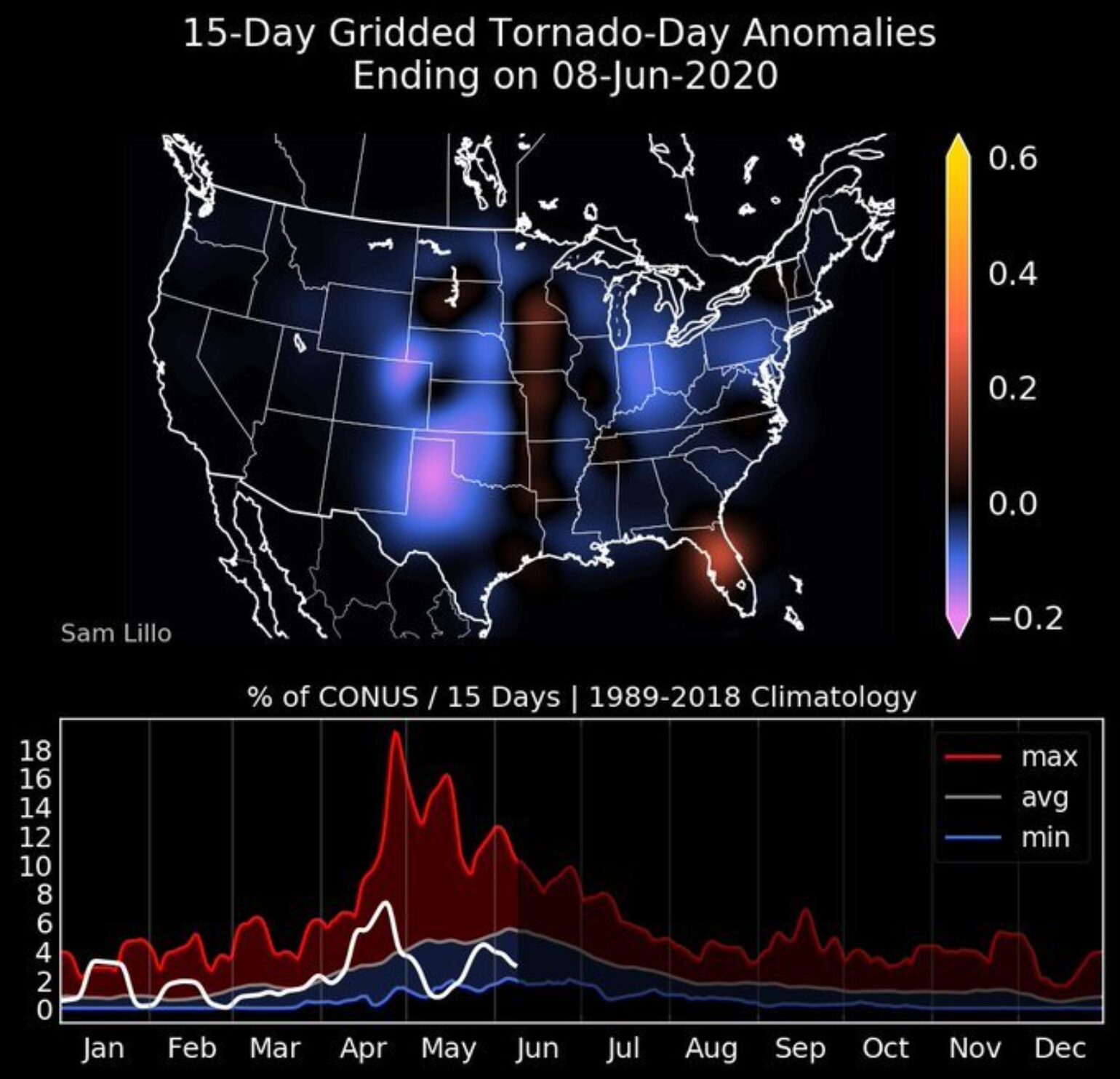

Sam Lillo, who is a postdoc at the Cooperative Institute for Research in Environmental Sciences at the University of Colorado Boulder, likely shows the situation best in the image he created below of tornado activity anomalies for the U.S. The map and graph show tornado activity is near record lows and for the last six weeks; none of the climatological favored areas for tornadoes have seen tornadoes. Negative anomalies are shown across Oklahoma, Texas, Colorado and Kansas. I guess Dorothy would truly say this is unusual weather for Kansas. And, if she were in Florida, it would be highly unusual to see above-normal tornado activity. In fact, for Florida, June has already matched their climatological average for the month, likely a result of Tropical Storm Cristobal, which produced 11 tornadoes across Florida. The average for June in Florida is 7.6 tornadoes.

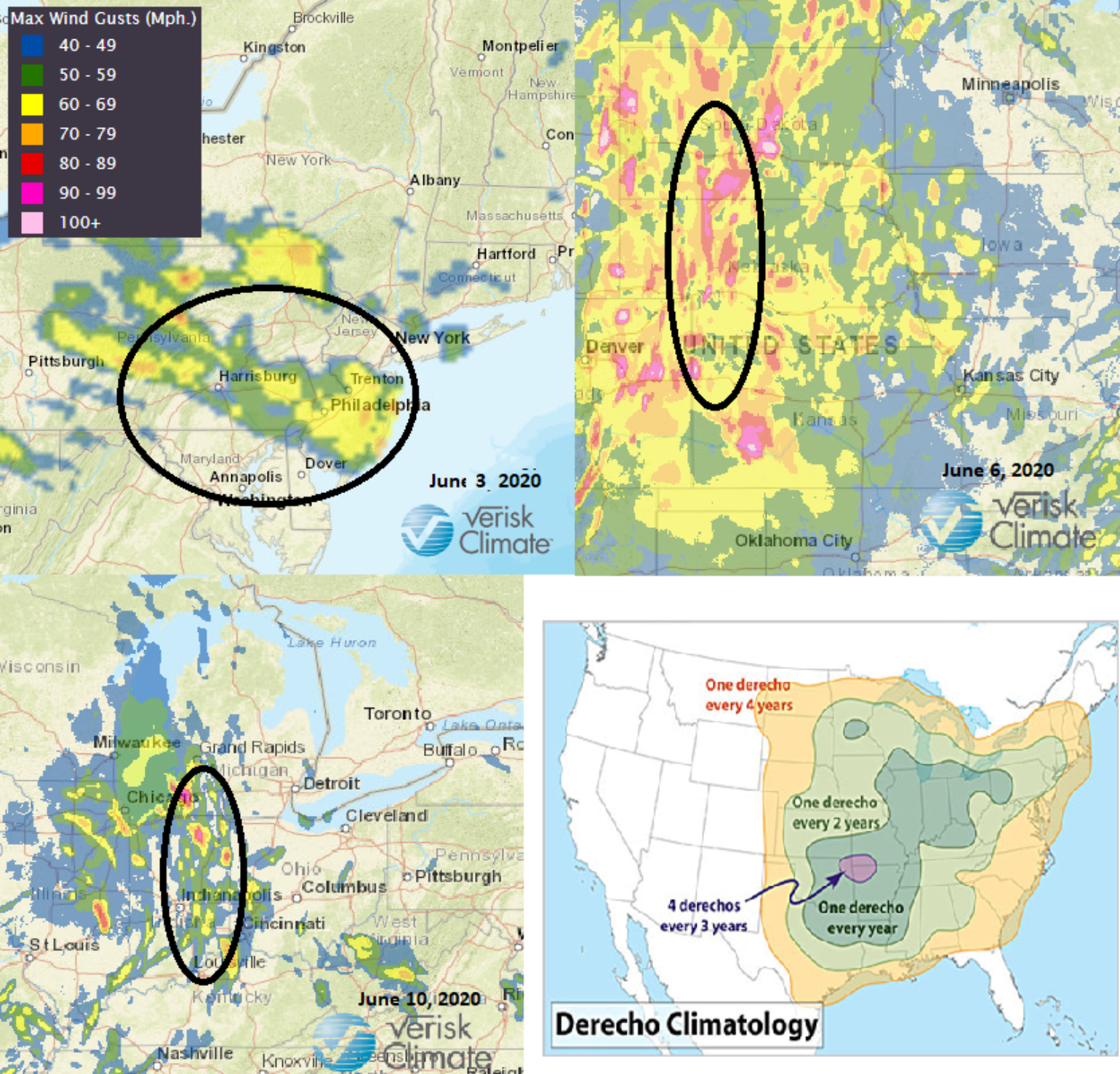

Speaking of Cristobal, its impacts will likely be felt by the insurance industry, but, as illustrated, the Florida tornadoes' impacts will be far away from the center of the storm. It might be possible that several states have a higher loss hundred of miles away from the landfall state of Louisiana with higher losses in the upper Ohio River Valley and Michigan. In total, Cristobal resulted in 497 wind reports for the area, which will likely lead to a loss level similar to a derecho wind event. In fact, with hail reports running below normal and the up and down of the tornado season, the wind reports are what could be driving the insurance industry losses this year, with several derecho wind events in atypical locations. On June 3, a derecho event went across central Pennsylvania; a few days later another derecho moved in northward from Colorado to South Dakota; and then the remnants of Cristobal merged with a mid-latitude cyclone that caused a lot of wind damage reports.

Rounding the corner

As the summertime heat starts to take over the overall U.S. weather pattern. the ingredients for severe weather outbreaks start to wane across the U.S. With the typical peak of the U.S. tornado season being the start of May, and the hail peak being the end of May, the overall focus will continue to be on wind-related events, which tend to peak in early July. Since tornado losses drive the overall large tail events for the insurance industry, and hail tends to drive the overall average annual loss overall. and with both of these perils now past their climatological peak, there are some positives for the insurance industry.

In terms of PCS severe weather insurance industry losses, typically 77% of the average U.S. severe thunderstorm loss and 64% of the total number of severe weather-related events have developed by July 1.

Of course, the forecast is for a busy 2020 Atlantic hurricane season....