Apple is known for great design, but it sells consumer electronics -- not life insurance. Surely, there is more to user-experience design for complex industries such as insurance, right? The answer is yes. And no.

Yes, digital experiences in life insurance need to be different from the digital experience of buying a pair of shoes or some new AirPods. But not as different as one might think; in many ways, the mechanics are the same.

The main goal of digital commerce conversion is to get the user from point A to B, where B is some level of engagement. For a site devoted to selling shoes, the ultimate engagement is a transaction. We recognize this as e-commerce.

For a platform devoted to life insurance, there is more to the experience than the transaction (e.g. awareness, education, needs assessment, etc.), but the ultimate goal is still commerce -- the sale of life insurance policies. While most life insurance carriers do not consider themselves to be engaged in e-commerce, the online experience plays a critical role in getting the user from point A to point B and ultimately to the transaction, even if it takes place offline.

Simply stated, everything we’ve learned about e-commerce experience and conversion also applies to the life insurance consumer -- no matter where or how a policy is purchased.

Simplicity and Magic: Not Just for Consumer Products

Anyone who has purchased goods online with a single click -- Amazon’s "Buy Now" button comes to mind -- understands the power of "simplicity and magic." All the complexity involved in the transaction is hidden in exchange for billing, shipping and payment information. With one click, a product you want is en route to your doorstep, often within 24 hours.

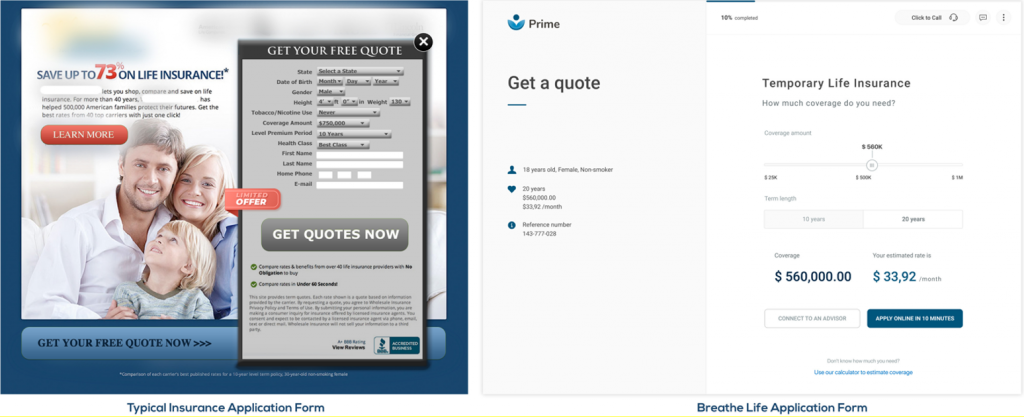

When you think about buying life insurance, “simple” and “magic” are not words that come to mind. Life insurance policies are serious products, so the buying experience needs to be serious, too. Life insurance marketers often assume that consumers want to see lots of hundred-dollar words and legalese in the fine print (even though it will never get read). They believe every page should have busy images that scream financial security and leave consumers overwhelmed and feeling out of their league.

Of course, this is not the experience any marketer is trying to create, but it’s not uncommon.

Complexity makes it hard to figure out where to start, whereas simplicity makes it easy to figure out what the next step is.

Imagine an insurance adviser who needs to generate qualified leads. She creates a Facebook ad with a needs analysis calculator to help consumers self-educate. Every time a potential client clicks on that calculator, a lead is created, and basic information is automatically captured.

As the prospect moves through the process, pages and forms update dynamically so information is only entered once and the questionnaire automatically updates based on answers previously provided. This may not sound very magical, but don’t you appreciate it when you don’t have to answer the same questions over and over to get the information you are looking for?

See also: Designing a New Employee Experience

More serious magic happens as the lead continues to click though the process. More information is captured, the lead is self-qualifying, and the adviser can access everything in real time through a simple dashboard that lets her know exactly what the next step is for each prospect. Moreover, the carrier is gaining valuable consumer insights and behavioral data to drive future decision-making. And all the adviser did was put a lure in the water; she didn’t need to do anything else - all the complexity happens on the back end, behind the scenes away from the customer and the adviser.

Good News | Bad News

The good news for insurers is that decades of prior design and customer-engagement learnings and best practices are available to us despite our not being in the business of selling consumer electronics. When it comes to moving a user from point A to point B, the best practices are proven, so we don’t have to start from scratch.

The bad news is that most teams don’t have a stable of customer-experience experts to draw from as design decisions are made. In fact, many times decisions affecting the customer experience are made without any concept of design principles, and, over time, this can result in a very messy experience... a button added here and there, opening a window here and there and so on.

Not a pretty picture.

This problem also extends to consumers of enterprise software and platforms. In the age of Netflix and Amazon, software that comes with a thick user manual is doomed before it’s been deployed. Today’s business users have high expectations for modern software based on their own consumer experiences, so you may want to think twice before designing two-days worth of training on your next new system.

Above All Else, Trust

Delivering simplicity and magic is the holy grail of great design, but there is another, equally important design consideration that must remain front and center, especially when designing for more complex industries: building trust.

Trust is built through consistent experiences, so one of the fastest ways to lose trust is to offer a confusing flow with new experiences at every stage. We know this from our own experiences with some e-commerce sites:

You find a product you want to purchase, and you click the “buy” button, only to land on another page that doesn’t look anything like the site you started on. You decide that you want the product enough to overlook the change in experience, until you go to pay and end up on yet another page that doesn’t look anything like the page you were on before that.

Instead of a straightforward purchase of a product you want, you are now faced with the choice to proceed or not...because an inconsistent experience erased your trust in the process.

As the e-commerce example outlines, first impressions are important, but consistency builds trust -- and trust enables engagement/conversion. It’s much harder to get users to move from point A to point B if they don’t trust you. Moreover, if they don’t trust you, they are less likely to buy from you or recommend your products and services to others.

See also: Designing a Digital Insurance Ecosystem

Likewise, with B2B platforms and enterprise software, users are more productive when they know what to expect from an application and its UI. For example, office productivity tools such as Google Suites or Microsoft Office have many design elements that are consistent between tools. Once you understand how to do something in Google Docs, you can typically also do it in Google Sheets, for example. And when users master these tools, those skills are transferable from employer to employer.

This is also a great example of how consistency is often more important than differentiation. When building new user experiences, the urge to differentiate is strong, but consistency is critical. If you know how to search and play video on one streaming service, you can probably do it on a rival service. Imagine if you had to re-train every time you wanted to use a new service. And yet we typically expect enterprise users to do just this when we introduce new software.

Designing for trust is an integral part of my job: It’s top of mind as I make design decisions as a chief product officer developing technology solutions for life insurance. Sometimes, I find it useful to start with the understanding that my decision might be wrong, flawed in some way I haven’t figured out yet. It’s not that I don’t trust my design instincts. I do. But the process of proving that my decision was the right one often results in a better understanding of what we’re trying to accomplish.