NOVEMBER 2021 FOCUS OF THE MONTH

Telematics

FROM THE EDITOR

In all my years covering all manner of technology, telematics may have caught me off-guard the most. When I first wrote about Progressive's auto telematics program, Snapshot, in 1998, it seemed like a slam dunk. Of course, it made sense to monitor how people drove and to price their insurance accordingly.

Or not.

It turns out that the devices didn't provide as much insight as expected -- was that a good hard brake, because someone did something stupid in front of you and you reacted quickly, or was that a bad hard brake because you were distracted and didn't see something you should have? I also underestimated how much people would be put off by even the simple process of installing a Snapshot device and how little people would respond to a discount in their premiums.

I often tell people that my favorite line from my Silicon Valley days is, "Never confuse a clear view with a short distance" -- and I surely made that mistake with telematics. (I sometimes think I keep using that line as a reminder to myself to not make that mistake again.)

The good news is that things you can see clearly eventually come to pass, and that's happening with telematics. The analysis of driving is becoming more sophisticated. So are the sensors put into cars (which may now include cameras). Understanding of human behavior has progressed, and carriers are finding incentives that matter more than modest discounts. The inconvenience of installation has diminished, as many now use their cellphones as sensors rather than having to plug something into the car.

Telematics have moved well beyond the car, too -- in particular, for insurance purposes, into the home. Sensors can now monitor for water leaks and other problems that can produce expensive losses and claims.

As you'll see in the articles and the interview that follow, as part of this month's ITL Focus, we've come a long way since 1998, and there's a clear path forward.

Not necessarily a short path, mind you, but a clear one that will deliver benefits to clients and to those insurers that figure out how best to help them.

Cheers,

Paul Carroll, ITL’s Editor-in-Chief

INTERVIEW WITH DAVID WECHSLER OF HIPPO INSURANCE

As part of this month’s ITL Focus on telematics, we spoke with Dave Wechsler, vice president of growth initiatives at Hippo Insurance, on how far telematics has come—and where it goes from here.

“Telematics should be a part of a productive partnership that helps the customer decrease their anxiety and ensures they are aware that we are on their side.”

David Wechsler

WHAT TO READ

Past, Present, Future of Telematics, UBI

Mobile-based data collection has vastly increased the reach of telematics programs by simplifying the sign-up.

Personalized Policies, Offered via Telematics

Increasingly, insurers can understand how and when people drive, as well as how vehicles interact with the road and their drivers.

Building Telematics Can Mitigate Risk

Advances in cloud computing, AI and sensors are combining to offer insurers new, better variables to characterize occupancy risk in buildings.

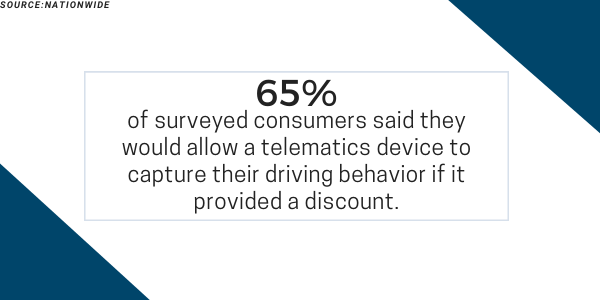

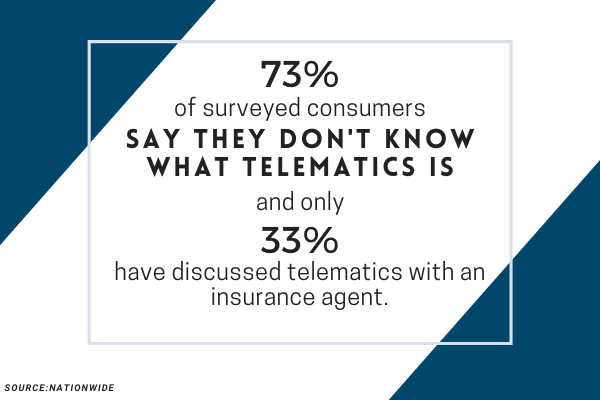

Telematics Consumers Are Ready to Roll

Telematics solutions let customers leverage their driving data’s potential to enable discounts and operational savings.

The Evolution of Telematics Programs

Interest in pay-as-you-drive or pay-per-mile policies has increased in 2020 as more Americans are working from home.

Tomorrow’s Insurance Is Connected

The connected insurance industry of the future will look nothing like it did in the last millennium.