Over 60% of Americans under 65 have healthcare coverage through their job. But traditional employer plans have seen premiums climb faster than inflation and wages over the past decade. This points to a need for more flexible, affordable options to lower risks. One promising approach that's emerged is insurance connected to hourly wages.

The Evolution of Risk Mitigation Strategies

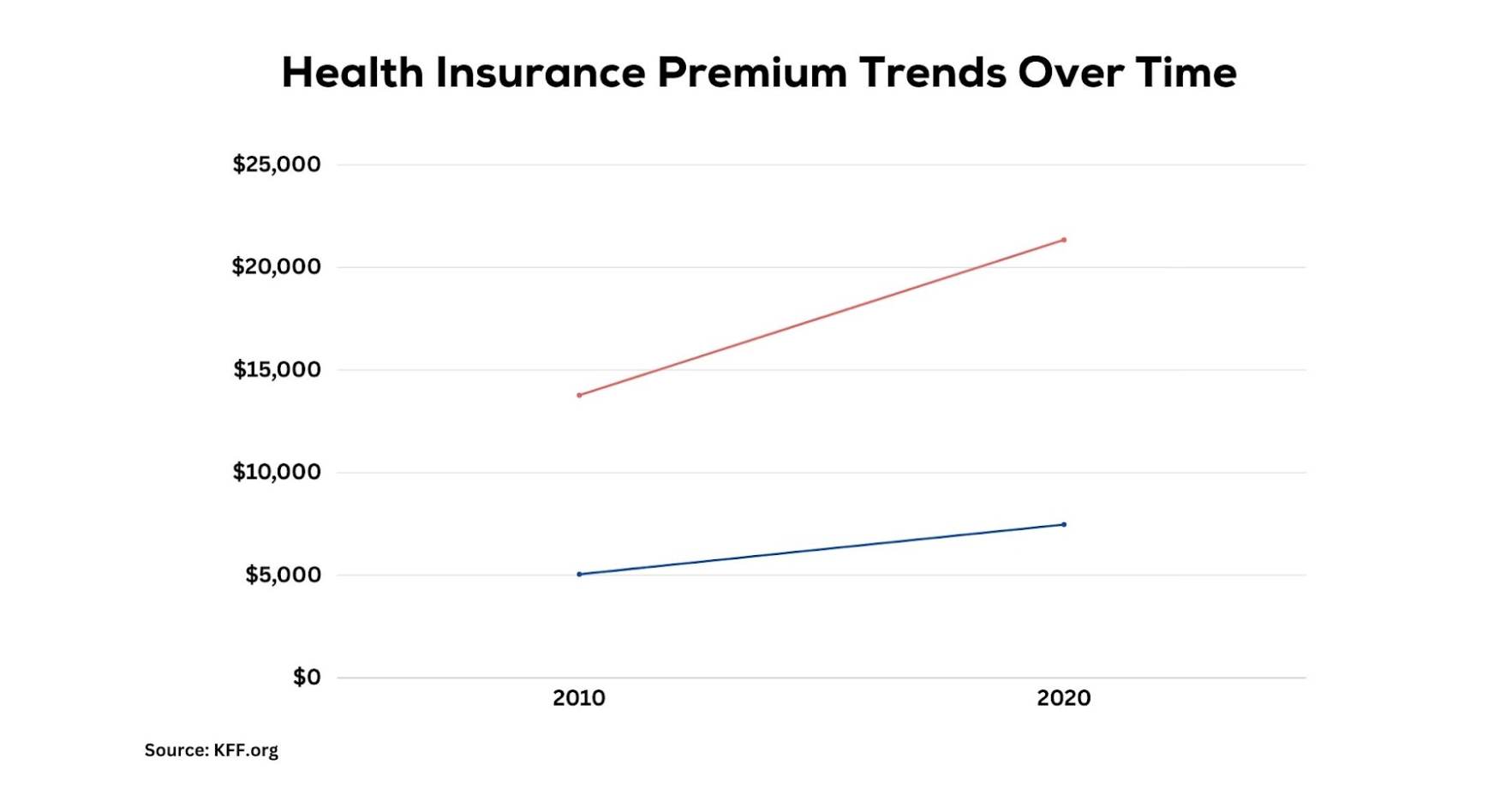

The standard employer health insurance model has used set yearly premiums. It is based on guessing how many employees will sign up and what coverage levels they'll need. But this approach has started to crack under growing pressure. In the last 10 years, the cost of job-based health plans has increased 54%, nearly double the 28% inflation over the same period.

Employing an hourly salary calculator, innovative models tailor insurance coverage based on an individual's specific income and working hours.

See also: "Intelligent Decision-Making" Is the Future

Analyzing the Mechanics of Hourly Wage-Driven Insurance

The hourly wage-driven insurance model introduces dynamic pricing of premiums based on actual hours worked instead of fixed costs. Premium amounts are calculated in real time and adjusted based on payroll data. Premiums go up or down whether employees work more or fewer hours in a pay period.

In 2022, the yearly premium cost for employer's insurance averaged $7,739 for individual coverage and $22,463 for family plans -- a huge expense. With hourly wage insurance, this cost variability shifts from the employer to the insurance provider. The employer's percentage contribution can stay fixed, while the insurance partner handles adjusting premiums in real time.

For employees, there is flexibility to keep continuous coverage even if their hours change week to week. Deductibles and out-of-pocket costs also sync up to their income patterns rather than a static plan structure.

Case Studies: Success Stories and Challenges

Real-world implementation of hourly wage models highlights both opportunities and challenges.

A restaurant chain adopting this model saw a 5% drop in their overall health insurance costs. It allowed them to expand employee coverage despite business uncertainties from the pandemic. A retailer needed help to integrate their cumbersome legacy payroll system with the new insurance model. This resulted in payment delays and compliance issues, showcasing the need for automation.

A shift toward hourly wage alignment can be beneficial if the execution aligns with business infrastructure.

See also: Premium Leakage Due to Legacy Systems

Comparative Analysis With Traditional Insurance Models

Hourly wage insurance provides the agility to link insurance costs to business performance, which improves cost savings and risk protection when business volumes swing up or down. For remote work and gig economy jobs, the model provides coverage that fits on-demand needs rather than one-size-fits-all packages.

Overall, the model has demonstrated greater cost-effectiveness, flexibility and risk protection capability compared with traditional insurance.

Integration With Modern Business Practices

Certain structural shifts in today's economy make hourly wage insurance models suitable, if not essential. The rise of remote, freelance and gig work has led to more fluidity in employer-employee relationships. Models based on static wages fail to provide effective coverage under these circumstances.

Payroll integration enables seamless tracking of insurance costs in real time. This allows for instant adjustments and forecasting, creating an integrated HR-insurance infrastructure.

Regulatory and Compliance Aspects

As hourly wage models are new, regulations differ across states, which can create compliance challenges. Definitions of qualifying wages and hours become especially critical for proper policy pricing. Companies looking to adopt this model need rigorous assessment.

Future Prospects and Innovations

In the future, massive leaps in payroll automation and application programming interface (API) integration will likely expand adoption of hourly wage insurance. As more states enact accommodative policies, regulatory barriers will decline.

Nevertheless, cyber risks from payroll integration and privacy concerns will need to be addressed. Overall, the stage seems set for hourly wage insurance to disrupt the market in coming years.

See also: Building Resilience for Future Generations

Conclusion

Insurance tied to hourly wages gives a fresh option beyond traditional risk management strategies. As work and business get more dynamic and fluid, solutions that can flex along with them become critical. Even though it's early days, hourly insurance has huge potential to balance value for employers and workers.

Its focus on adaptability and integration make it a standout innovation for affordable risk mitigation. As this model gains traction, it could be a game changer for providing coverage that fits the modern workforce and economy.

While traditional employer plans still dominate, innovators are already pioneering alternatives that align with the future. As the landscape evolves, expect to see more out-of-the-box thinking that expands choices and accessibility.

FAQs

How does hourly wage insurance differ from traditional models?

Unlike fixed premiums, hourly wage insurance adjusts premiums up or down based on real-time payroll data. This links insurance costs dynamically to income flow.

What are the key benefits for businesses?

Hourly wage models provide enhanced cost control, reduced risks from income fluctuations and automated administrative management of premiums.

Which industries benefit the most from this model?

Industries with irregular income flow like retail, transportation, healthcare and food service derive the most benefits from flexible and adaptable risk protection.