Lately, I've been getting a lot of questions about how to leverage multi-cloud AI capabilities across platforms while minimizing complexity and cost. In my experience working with P&C insurers implementing AI strategies, success depends on strategic clarity rather than the use of the latest technology. The most effective approach balances innovation with pragmatism.

A Business-First Approach

P&C insurers succeed with AI when they start with specific business challenges rather than technology capabilities. Insurers should identify quantifiable business objectives such as claims leakage, underwriting accuracy, customer retention, or operational efficiency. Then link AI initiatives directly to business KPIs aligned on those objectives. This business-first approach will help create a balanced road map of quick wins and strategic capabilities, ensuring investments address actual business needs.

Fit-for-Purpose Strategy

Recently, a client with an M365 E5 subscription was wondering whether implementing Copilot would conflict with their AWS-based analytics platform.

A fit-for-purpose approach would allow insurers to match appropriate AI technologies to specific functions, reducing integration complexity and avoiding the "one-size-fits-all" pitfall that has derailed many AI initiatives.

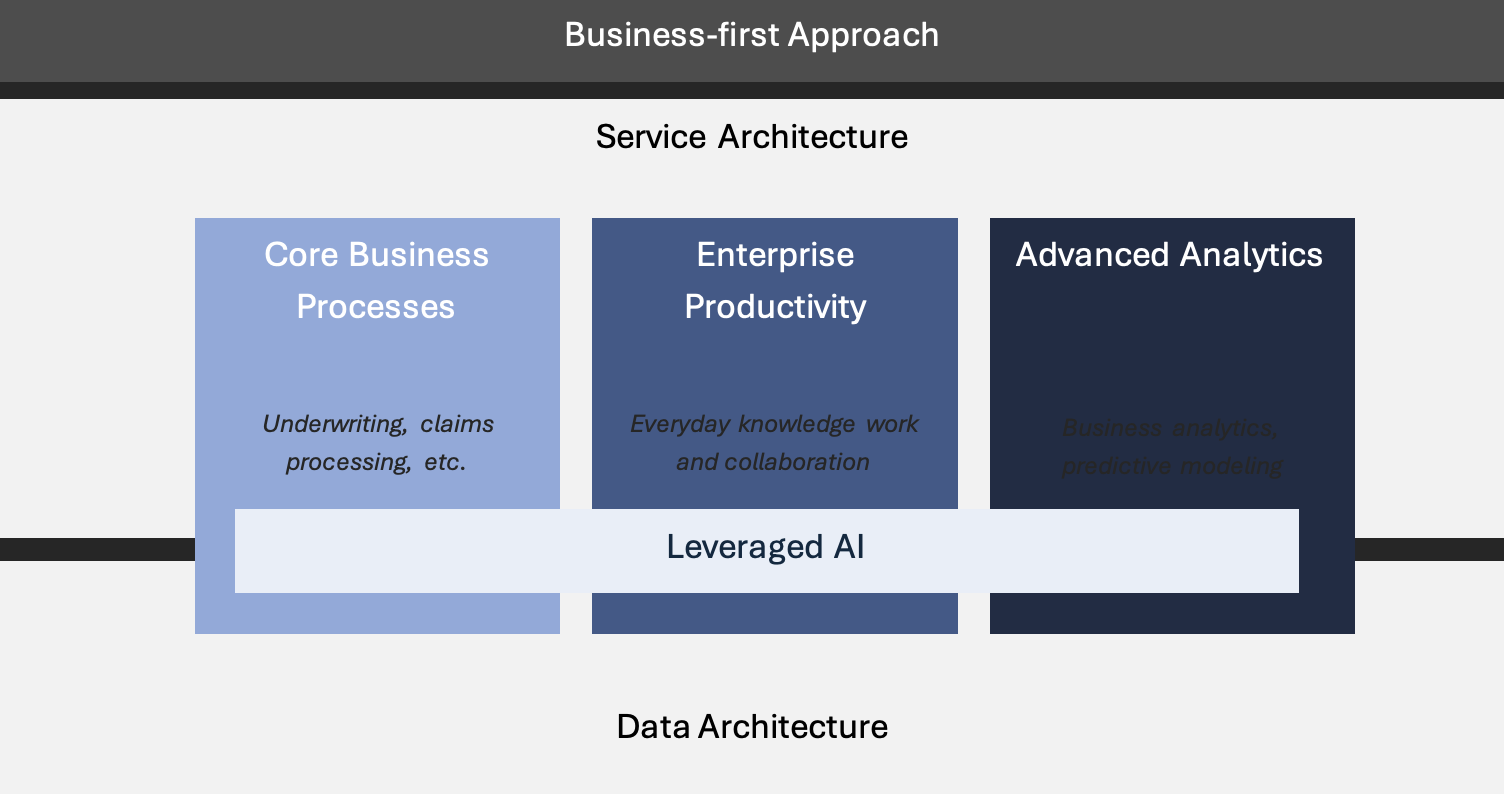

Here's one way to think about the AI landscape based on the purpose it would serve:

- Core Business Processes: Leverage specialized insurance AI solutions for underwriting, claims processing, and risk assessment through embedded AI in core platforms or third-party integrations. Reserve in-house development for capabilities that create genuine market differentiation or deliver clear ROI.

- Enterprise Productivity: Use the tool aligned with the enterprise productivity suite for everyday knowledge work and collaboration.

- Advanced Analytics: Deploy models via the cloud provider's AI suite for specialized use cases, aligning with the enterprise data management platform and technology stack.

When it comes to leveraging any pre-built AI models and services, including GenAI, insurers should start with defining a framework to leverage them either as-is or fine-tuned, through hosted environments or API integrations, depending on the use case, overall cost and security requirements. The focus should be on speed to value rather than development. Then, organizations should implement a cross-cutting approach that integrates leveraged AI into and enhances solutions across functional areas.

Let's now revisit the question around Copilot and AWS. These platforms serve different purposes in the organization. Microsoft Copilot would integrate with M365 for daily productivity, while AWS would provide the infrastructure for specialized insurance analytics. Microsoft Purview, included with E5, will provide the necessary governance framework to monitor AI usage across the productivity layer. AI infrastructure on AWS will closely align with the organization's broad analytical data architecture.

This approach also helps insurers avoid the common pitfall of implementing GenAI as a technology-first initiative disconnected from real business challenges and outcomes.

Data Architecture

It is critical to prioritize data management, integration, and governance before sophisticated AI implementation. Insurers that approach data as strategic products rather than passive assets gain significant competitive advantages.

I recommend designing a unified data ecosystem connecting structured and unstructured business data into domain-specific data products that mirrors the organization's business architecture. It is also important to implement a data governance framework that ensures consistency, quality, and appropriate controls, and develop robust metadata that gives context and lineage for key data assets. Without this foundation, even the most sophisticated AI strategy will underperform against business expectations, as models will produce unreliable results.

By investing in a strong data architecture first, insurers can establish a reliable foundation for sustainable AI success.

Service Architecture

A robust service architecture enables services to deliver AI, to consume AI, and to be consumed by AI models using standardized protocols. A well-designed architecture helps transform AI from isolated experiments into scalable business capabilities, ensuring investments remain relevant as technologies evolve and new providers emerge.

AI services must be built around core business capabilities rather than technologies, and their effectiveness must be evaluated based on business metrics like loss ratio improvement and adjuster efficiency rather than technical metrics.

Core systems, data infrastructure, and AI capabilities must be connected using standard interfaces, creating an adaptive ecosystem rather than isolated point solutions. This integration serves as the glue between the functional areas mentioned earlier. It's also important to develop test-ready service endpoints and self-service validation interfaces for business users, fostering trust through transparency.

Governance protocols to address data drift, model drift, version control, and compliance-readiness should be baked into this architecture.

Conclusion

Successful P&C insurers understand that the value of AI lies not in specific vendor solutions but in the business capabilities it enables. By prioritizing data architecture and aligning efforts with business outcomes, insurers can navigate the rapidly evolving AI landscape while staying focused on what matters most: reducing complexity, controlling costs, and delivering measurable business impact early and incrementally.