The U.S. has been facing an affordable housing crisis, with millions of low- and middle-income families struggling to find stable housing.

The National Association of Realtors' Housing Affordability Index (HAI) shows that for most of 2023 and 2024, the typical U.S. family earned less than the required income to qualify for a mortgage on a median-priced single-family home. Although recent data shows easing in both the HAI and the national rent-to-income ratio, affordability challenges persist. A recent Pew Research Center survey found that 69% of Americans said they were "very concerned" about the cost of housing.

While policymakers, community groups and private developers work to expand affordable housing options, an invisible but significant barrier threatens to derail these efforts: the escalating home insurance crisis.

Impacts of Rising Home Insurance Costs

Losses from natural disasters and consequent insurer withdrawals from high-risk markets have driven the sharp increase in property insurance rates. Additional factors, including elevated home prices, inflation, worsening climate issues, and increased rebuilding costs, have contributed to skyrocketing premiums, making securing coverage more difficult and expensive for both individuals and developers.

In states prone to hurricanes, wildfires and flooding, consumers have seen insurance costs surge. Between 2017 and 2022, homeowners insurance premiums rose 40% faster than inflation.

In high-risk states like California, Florida and Texas, gaps in coverage are forcing homeowners to rely on expensive state-backed programs (often with reduced coverage) or to forgo insurance altogether. Regulatory efforts to stabilize the market have struggled to balance affordability with insurer sustainability, leading to further uncertainty.

How the Insurance Crisis Affects Housing Development

For affordable housing developers and providers, challenges in the property insurance market pose multiple barriers.

Higher Development Costs

Rising insurance premiums increase overall construction and operational expenses for affordable housing projects. Developers must secure insurance for both the construction phase and for property management, and with costs surging in high-risk areas, many projects become financially nonviable — especially for affordable housing providers who cannot (or choose not to) pass on the higher costs to tenants. From 2020 to 2023, multifamily insurance rates increased by an average of 13% annually — and some developers struggle to find insurers willing to provide coverage at all, leading to costly delays or project cancellations.

Reduced Investment Appeal

Lenders and investors assess risk when funding housing projects, and skyrocketing insurance costs add another layer of uncertainty. When premiums eat into projected profits, financial institutions may hesitate to approve loans for developments in disaster-prone areas. For developers, lower returns on investments make affordable housing projects less attractive, pushing them toward more profitable, higher-income developments. Even for those prioritizing mission over profits, funding and managing projects at a loss is not sustainable.

Limited Availability for Homeowners and Renters

Higher insurance costs are ultimately passed down to homeowners and renters in most cases. Low-income families may find homeownership unattainable as rising premiums inflate total housing costs. Renters, too, face increasing expenses as landlords adjust rental prices to cover surging insurance rates, further limiting affordable housing options.

In instances where raising rents is not an option, capped or against the developer's mission, many affordable housing providers face difficult choices like offloading properties that will likely become market-rate units, potentially displacing renters and eliminating existing affordable housing.

How Affordable Housing Providers Are Navigating Insurance Challenges

The impact of rising insurance costs on affordable housing is being felt across the country, with projects stalled, canceled or scaled back.

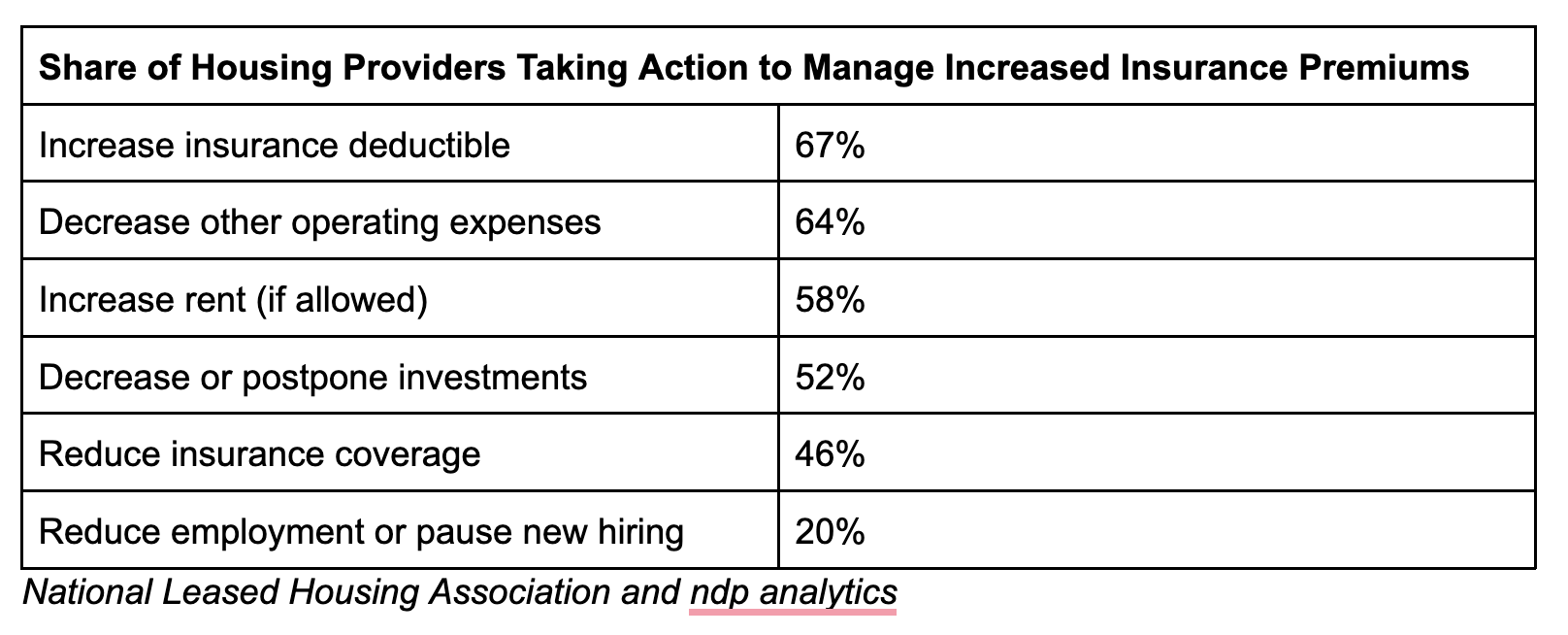

According to a 2023 survey from the National Leased Housing Association, 93% of affordable housing providers indicated they would need to adjust operations to manage increased insurance costs. More than half said they would decrease or delay investments in both existing housing stock and new projects.

Finding Effective Solutions

Developers warn that insurance costs are making affordable housing projects less viable, while insurers argue that increasing climate risks necessitate higher rates. Housing advocates stress the need for policy interventions to ensure that skyrocketing insurance costs do not exacerbate the nation's housing crisis. Consequently, addressing the home insurance crisis requires innovative industry solutions, targeted policy changes, and risk mitigation strategies that meet the needs of all stakeholders.

Some affordable housing providers suggest federal-backed statewide insurance pools, while others promote expanding state-run insurance programs. Others argue that doing so would ultimately drive up rates. Additional solutions include moving to a lower premium, higher deductible model, creating lower-cost policies for properties less vulnerable to extreme weather effects, subsidizing insurance costs, and creating a public reinsurance fund for insurers.

Measures developers could take include embracing resilient building techniques, such as fire-resistant materials and flood-resistant infrastructure, to reduce insurance risks and lower premiums. However, they call for guarantees from insurers that taking such measures would reduce rates; each potential solution naturally carries risk, costs and consequences.

A Complex but Urgent Matter

Policy reform and industry overhaul rarely happen quickly, but time is of the essence. The U.S. housing market is estimated to need up to six million more affordable units; losing more of these units to market-rate housing could intensify the crisis.

Addressing the impacts of elevated home insurance costs on affordable housing is not just about stabilizing the insurance market — it's essential for ensuring long-term housing equity, economic stability, and the ability to meet the nation's growing housing needs.