The difficult economic and climatic conditions of the past few years have created a challenging environment for commercial property owners. Despite an improvement in reinsurance capacity since the financially devastating year of 2022, underwriters continue to face headwinds, and conditions remain less favorable than in past years.

Inflation and other macroeconomic pressures are not helping. Significant increases in structural steel and concrete products have been particularly challenging for builders and played a major role in ballooning construction costs. Meanwhile, construction wages have risen by 22% over the past four years, roughly matching the general level of inflation. These difficulties are exacerbated by labor shortages within the industry, with 77% of contractors reporting difficulties in sourcing skilled workers for building projects. All this has inevitably led to delayed construction timelines and higher business interruption costs.

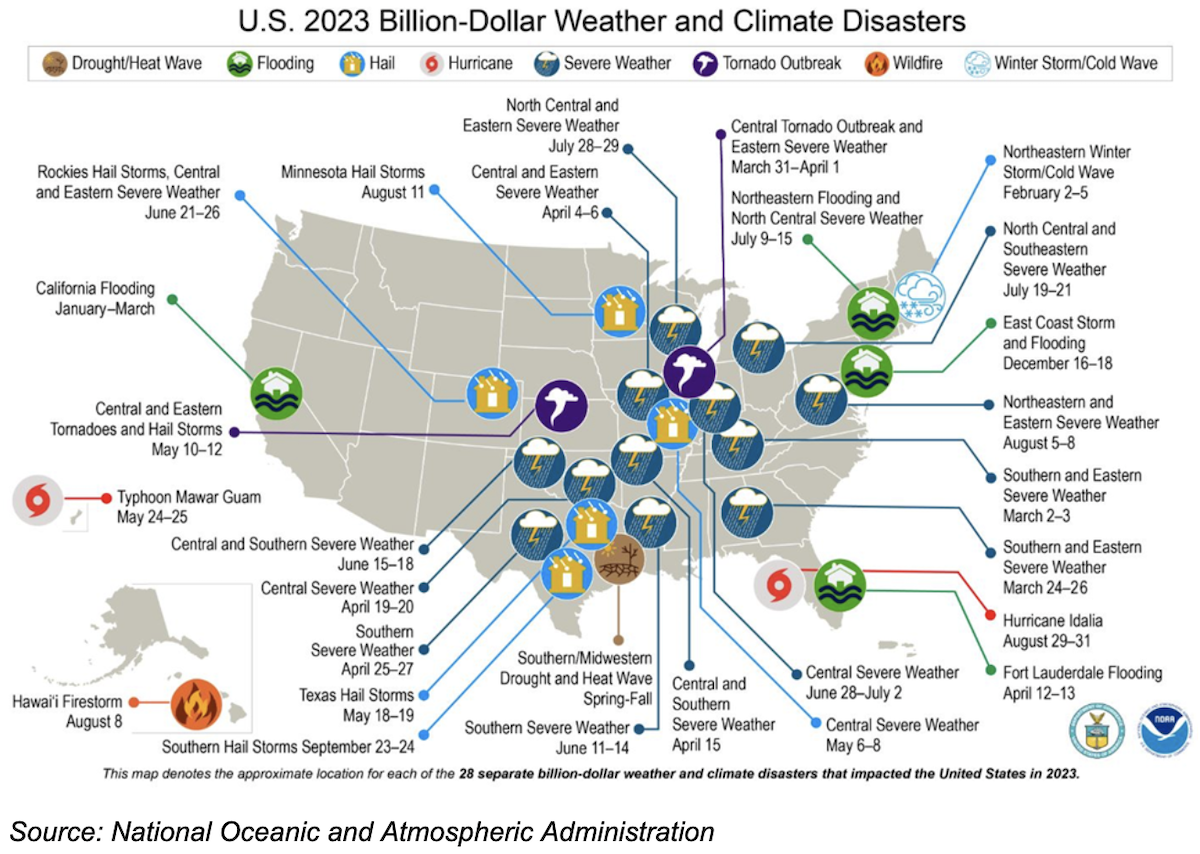

In addition to these economic pain points, geographic and climatic conditions have become major factors in elevated property insurance prices. Regions prone to hurricanes, floods, wildfires, tornadoes and winter storms typically see higher insurance rates due to the increased frequency and severity of these events, which collectively caused losses exceeding $100 billion in 2023 alone.

See also: Parametric Insurance Can Tackle Climate Risks

From 2020 to 2022, the U.S. experienced 60 weather and climate disasters with losses exceeding $1 billion each. The total damage from weather and climate disasters since 1980 amounts to approximately $2.7 trillion. On average, from 2018 to 2022, the U.S. endured 18 such disasters annually. The year 2023 set several weather and climate records. Notably, Earth experienced its warmest July on record, and Tropical Storm Hilary became the first tropical storm to hit Southern California in 84 years, shattering daily rainfall records. Overall, 2023 witnessed 28 weather and climate disasters with losses exceeding $1 billion each. Flooding events alone caused almost $7 billion in damages across the U.S.

The combination of a lackluster economy, workforce shortages,and escalating material costs has put commercial property owners in an unenviable position. In the past, property insurance rates primarily depended on the building's quality. Today's pricing is increasingly determined by factors such as construction year, materials used and whether a property’s location renders it vulnerable to surging natural disasters.

What should commercial property owners do?

Insurance strategies that would have been conservative in 2018 have been rendered prudent by the challenging property market of 2024. In this type of environment, it is crucial for property owners to ensure that their coverage is both adequate and cost-effective. Those who are concerned about their current coverage or dreading their next renewal should consider taking the following steps to mitigate their risk profile and make themselves as appealing as possible to insurers:

See also: Glimmers of Good News on Climate (Finally)

1. Conduct a Professional Property Inspection:

Engage a licensed professional or organization to thoroughly inspect your property. This step can help identify potential risks or existing damages that may affect your insurance premiums.

2. Obtain an Up-to-Date Building Valuation:

Have your insurance agency perform a detailed valuation of your building. This ensures your coverage reflects the current value and condition of your property, helping you avoid being underinsured. This is especially important in the context of recent inflation – outdated valuations may lead to underinsurance.

3. Benchmark Your Costs:

Compare the insurance cost per square foot of your property with similar structures in your area. This will help you understand if you are paying a competitive rate and where you might negotiate better terms.

4. Prioritize Repairs and Upgrades:

Address any delayed maintenance issues such as sprinkler system upgrades, roof repairs and updates to security and electrical systems. These improvements can reduce the risk of damage and potentially lower your insurance premiums.

5. Prepay Premiums and Bundle Policies:

Consider paying your premiums in advance, if possible, as some insurers offer discounts for prepayment. Additionally, bundling multiple policies with the same provider can also lead to savings.

6. Advocate for Your Coverage:

Ensure that your insurance agency is seeking the best possible coverages for your property. Regularly review your policy details with your agent and make adjustments as market conditions and your property needs evolve.

Balancing the priorities of premium costs and coverage quality is a perennial challenge for commercial property owners and one that has become more difficult than ever in the past few years. In this fluid economic and climactic environment, it is more important than ever that you look critically at your policy and take common-sense steps such as those listed above to lower your risk profile and get the best coverage you can. You have the power to avoid becoming a statistic. When significant damage occurs, there is no advantage to being underinsured.