The pandemic led to a burst of home remodeling, and some insurers have likewise found themselves in the middle of a dramatic remodeling project. Choices must be made. Which remodeling projects will modernize and optimize the business, and which ones will create a whole new business next door? COVID and its digital pressures have compressed previous time assumptions. Many initiatives and investments that were set for a three - to five-year path are now moved to 18 months or less.

For decades, the creation and evolution of insurance markets and products unfolded at a slow and steady pace. Insurers’ technology, data and processes were adapted to take advantage of these opportunities – sometimes through technology updates, extensive customization or through new technology. The result of this approach was highly customized and costly systems that did not adapt quickly to market changes. They became increasingly unresponsive to market shifts or opportunities. Companies managed and lived with slow transformation because everyone was in a similar position — new products took 9 -18 months or more to build and launch. Adding new distribution channels could take 6-12 months. These long timeframes slowed and limited market, revenue and growth opportunities because not only were they long but expensive.

But the market is much different now. The pace is significantly different. The types of change have expanded. The constantly changing risks, customer behaviors and expectations, technology-driven capabilities, new sources of data, and blurring market boundaries have increased insurance market demands for new products and services that the old technology cannot support. Today, insurers must be able to launch new products in weeks, new capabilities in days, new channels in weeks or days, and new rates or rules in hours.

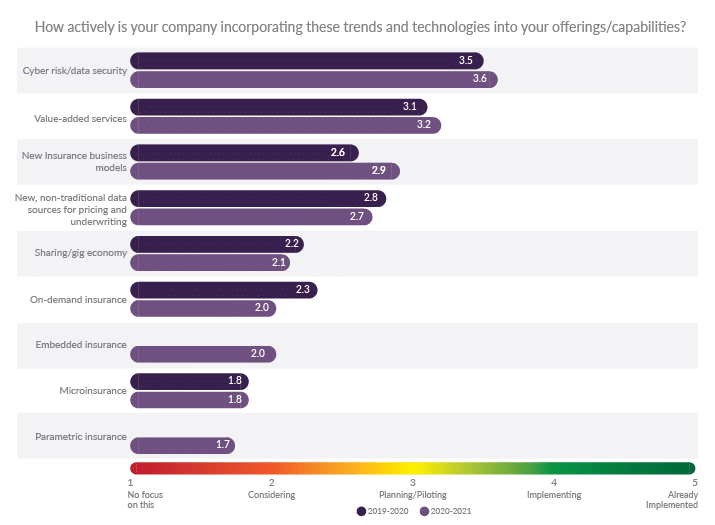

Majesco’s recent Strategic Priorities 2021 report looked at both “traditional” market trends and new and emerging market trends. Insurers continue to show the highest levels of action in the “traditional” market trends, where Cyber risk/data security and Creating value-added services moved past the Planning/Piloting stage and into implementation. Most continue to plan and pilot the use of New data sources for pricing and underwriting, something insurance customers, especially Gen Z and Millennials, want based on our consumer and SMB research.

Encouragingly, strong advances in Creating new insurance business models were made in the Planning/Piloting stage with the strongest year-over-year jump of all the trends (see Figure 1).

Lower Activity Among Emerging Trends

Within the newer or emerging trends, insurers continue to consider offerings for the Sharing/gig economy, Embedded insurance, and On-demand insurance, maintaining similar levels of activity as last year. Microinsurance and Parametric insurance show the lowest levels of interest. While low this year, we suspect that parametric insurance will see a rise next year due to an increased interest in UBI insurance as a result of changed behaviors and less driving.

Figure 1: Insurers’ responses to opportunities created by technology and market trends

The concern with these low levels of activity is that they represent blind spots for insurers as compared to the market potential and customer demand.

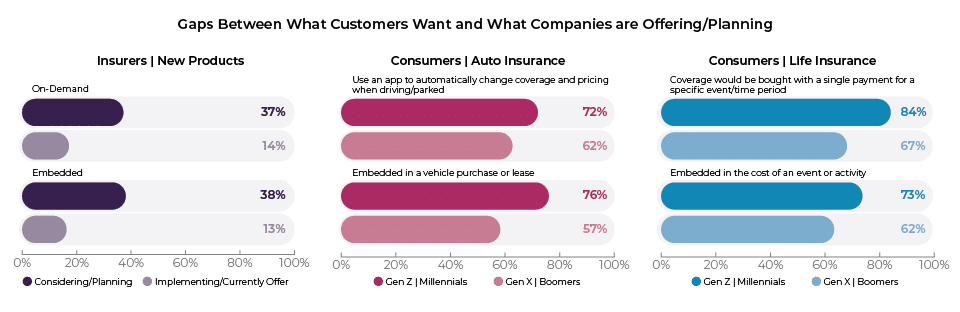

Embedded insurance, which is estimated to account for 25% of the worldwide market by 2030 with $700B in GWP, shows significant gaps between customers and insurers. (See Figure 2.) Only 13% of insurers offer or are implementing embedded insurance and only 38% are considering or planning/piloting it. The 60% gap between customer demand and insurer offering for Gen Z and Millennials reflects a major blind spot and market opportunity for those who can respond quickly. Offering what their parents bought and have is not necessarily what they want or need!

See also: The Rules of Digital Transformation

These blind spots reflect the challenge for insurers to respond to a new generation of buyers who want different products via different channels to meet a new era of customer needs and expectations.

Figure 2: Customer-Insurer gaps in embedded and on-demand insurance

Fortunately, some insurers are actively taking advantage of these opportunities. While likely offering traditional products as well, insurers offering new products lead significantly over others who are not. The only trend that is aligned between traditional and new is Cyber risk/data security and it isthe only trend where those who only offer P&C products do not come in last or second to last compared to those who offer new products, L&A/Group products, or multiline products.

This highlights the risk for the P&C-only segment. If they remain focused on only traditional products they will lose out on new and rapidly growing market opportunities.

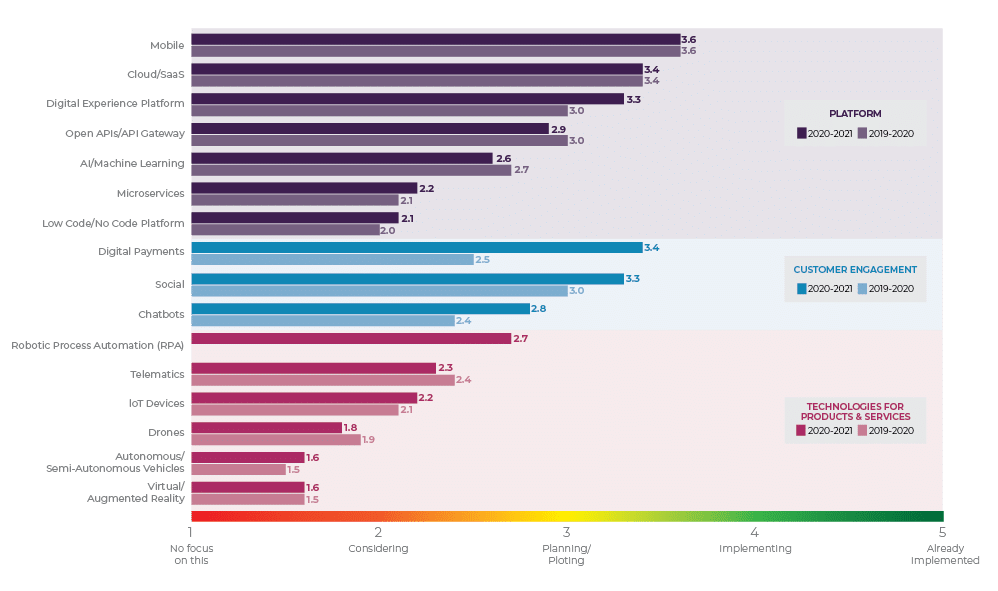

Platform Technologies

When it comes to the specific technologies that power the insurance platform, we’re seeing the strongest and most consistent adoption of mobile and Cloud/SaaS, while Digital Experience Platforms made a sizable jump year-over-year (see Figure 3). The results we’ve seen for Cloud/SaaS in our research are consistent with the trend SMA has also found: in their 2019 P&C Core Systems Purchasing Trends report, they noted that 84% of core system deals were deployed in the Cloud, and 32% of these cloud deployments were multi-tenant SaaS.

APIs and AI/Machine Learning are entering the Planning/Piloting phase, the tipping point for more widespread implementation and adoption. Microservices and Low Code/No Code Platforms are still in the early stage of adoption. These two critical components give the insurance platform its unique ability to adapt quickly to new market opportunities by making changes to components of insurance processes (microservices), rather than having to change an entire siloed process, and by opening up configurations to a wider audience of citizen developers (low code/no code).

Figure 3: Insurers’ levels of activity in adding platform technologies

All three Customer Engagement technologies – Digital Payments, Social and Chatbots – saw significant year-over-year increases in activity, driven by the sudden need to implement effective self-service capabilities in response to COVID. In particular, the increase in digital payments highlights the acceleration to open banking and innovative payment technology companies.

In a recent InsurTech Forum article, it was noted that open banking has encouraged competition and innovation by requiring banks to share data with third parties such as payment technology companies and by creating customized payment methods through new apps and data streams that will be difficult for companies (sellers like insurance) to ignore. The interest in advanced data-supported digital payments comes from customers’ increased comfort with online banking and shopping during COVID.

Knowing how and why this concerns insurers is of vital importance.

- Customers are quickly developing their own foundation for how they pay for services and move money — choosing those methods that are easiest and that gain them the most points or benefits.

- If speed, ease and familiarity trump research, product strength or even pricing, then open banking and open platforms in general will allow any market-savvy company to generate insurance business. Companies with massive customer bases, like Walmart, Tesla, PetCo, Ikea and Amazon stand to win simply because of their placement within customer lifestyles.

- The end result is that not integrating a technology (such as IoT devices or Telematics) may harm an insurer’s ability to embed their products, offer their own new products through new partnerships, or capture a new line of business quickly.

Not surprisingly, companies in the New Products line of business segment lead all others in 11 of the 16 technologies covered by the survey, including the key platform technologies of Cloud/SaaS, APIs, AI/Machine Learning and Microservices. These same companies are in lock step with the Multiline Products segment for two other platform technologies, Digital Experience Platform and Low Code/No Code Platform.

Most importantly, those companies making the strategic decision to adopt these key platform technologies that outpace others are innovating with new products and services and adopting the viewpoint that they are “technology companies providing insurance” as opposed to “insurance companies using technology.”

Digital Capabilities

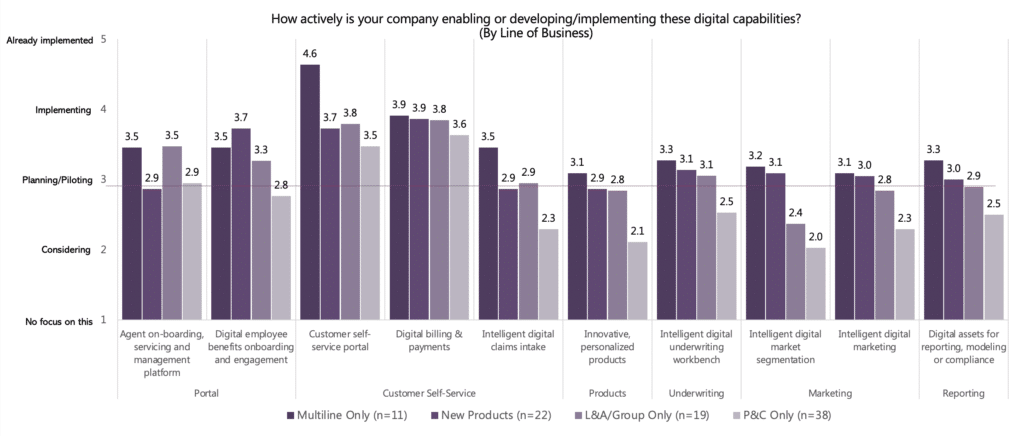

Insurers’ digital transformation is underpinned by increasing customer expectations for new experiences. In their response, insurers are heavily focused on customer self-service applications and portals, with 41% to 61% of companies saying they are implementing or have already implemented these.

Self-service tools and portals have been around for some time, but they do not meet the shift in the desire for personalized, holistic experiences because “out of the box” portals are functionally focused … i.e. a claims app or quote app. In contrast, digital insurance platforms transform these older approaches from siloed, separate transactions into more satisfying, holistic experiences for customers, channel partners and employees as we noted in our life and auto customer research.

Encouragingly, about a third of insurers are implementing or have implemented digital capabilities for intelligent claims intake, intelligent underwriting, intelligent digital marketing and market segmentation, and for reporting, modeling or compliance, with over 40% planning or piloting these, highlighting the acceleration of their digital capabilities.

While the overall high interest in these digital capabilities is encouraging, some very significant differences between business and IT must be resolved to maintain and accelerate momentum.

Business’ ratings were higher than IT for:

- +95%: Innovative, personalized products (3.7 vs 1.9) — This disconnect reflects the increased decision making by business leaders to use new SaaS core and digital platforms to launch new products rapidly, rather than on the existing systems or traditional process. In some cases, IT is not even needed.

- +42%: Digital employee benefits onboarding and engagement (3.4 vs 2.4) — The expansion of voluntary benefits and the complexity of signing up employees as well as keeping them informed is increasingly critical in winning the customer.

- +32%: Agent onboarding, servicing, management platform (3.3 vs 2.5) — Agents felt the impact the most during COVID with the lack of digital capabilities beyond the traditional quote portal or upload/download for AMS systems. Increased M&A with agencies puts pressure on the business to respond to keep and attract agents.

- +18%: Customer self-service portal (3.9 vs 3.3) — This has been a constant area of focus, but is shifting to expand beyond the traditional portal on websites to a much more personalized and sophisticated experience.

See also: Culture Side of Digital Transformation

Finally, multiline carriers are very active in establishing digital capabilities. Driven by the complexity of multiple products, they want to digitalize, simplify processes, and provide self-service capabilities for customers, employees and agents (see Figure 4).

Figure 4: Insurers’ levels of activity in adding digital capabilities by lines of business

So the question for each insurer is: What are you doing with your idle time during COVID? We can tell you the competition is taking advantage of this idle time!