Tunnels, once the greatest innovation in transportation, are poised to be the greatest once again through innovation and rethinking of transportation. While Elon Musk has been looking to the sky with SpaceX, he’s also been going underground with the Boring Company, creating test tunnels in California and operational tunnels in Las Vegas. The key to Musk’s tunneling concept is the rapid technological advancement being made in boring machines. Prufrock, the current all-electric boring machine, can dig a 12’ diameter tunnel up to one mile per day. The Boring Company has a goal of producing a machine that would be able to bore up to seven miles per day, a stunningly fast pace that will change the landscape of transportation and create a system that connects people and places more than ever before.

The value of tunneling is also a new level of versatility and looks at the concept of mobility rather than individual types of transportation. It will improve pedestrian traffic, auto traffic and certainly some forms of subway traffic, but it will also facilitate new types of underground travel, such as autonomous vehicle traffic and hyperloop travel. Tunnels can be dug without disruption to the infrastructure, and they could be an excellent way to improve ground-level and atmospheric environments through non-emission subterranean commuting. Who would have thought that digging could lead to a more sustainable future? It is just one more example of how complex problems are often best solved by breaking outside of the boundaries of convention and incorporating new 360-degree thinking with an outside-in perspective.

Recently, we have been looking at Majesco’s latest thought-leadership report, Digital Insurance: The Inflection Point, in an effort to peek into the future of the insurance experience. Increasingly, customers choose insurers not just for the risk product but for the combination of risk product, customer experience and value-added services. Because of this, future insurance leaders will be those who provide smooth, pleasant experiences with the best views into products and value-added services. Can we learn anything by digging deeper?

An Outside-In Mindset

No one will argue that insurance opportunities exist for those who can innovate and adapt. Each insurer has its own mining to do. Not only do they need to think ahead about the impact of new technologies, like the Boring Company, on P&C insurance products, but they need to think about the impact of 360-degree digital views and services that create greater value for customers today and tomorrow. When it comes down to it, the customer is the one who is pushing insurers to innovate. They are looking especially hard at companies that can provide unconventional solutions to difficult insurance puzzles.

Insurers must lay the groundwork of a new digital business model. We are facing a constant flow of disruptive factors at the same time we are witnessing unprecedented opportunities.

Consider the pressures, threats and opportunities, including:

- Non-Insurance Providers: Companies like Tesla and GM are offering/embedding insurance and have access to more real-time data to competitively price and underwrite the risk than most insurers will have, potentially cutting off traditional carriers from these opportunities.

- Connected Everything: Connected devices, beyond telematics, are enabling underwriting and pricing based on mileage, location, weather and behavior for P&C and L&A products, which would tie premium to usage, risk or more – providing more personalized coverage.

- On-Demand and Embedded Insurance: On-demand insurance, expected to increase 30% by 2026, will expand to nearly all lines of business. Furthermore, embedded insurance is poised to automatically include insurance in the purchase of something else -- like a vehicle, home or electronic device.

- Continuous Underwriting: Rather than pricing once, insurers are shifting to constantly updating the risk profile. This changes policy terms and pricing using the continuous flow of data from different sources like cyber, fitness devices, telematics and other IoT devices and encourages people to manage their risk, which can drive lower prices.

See also: 3 Ways to Improve Customer Experience

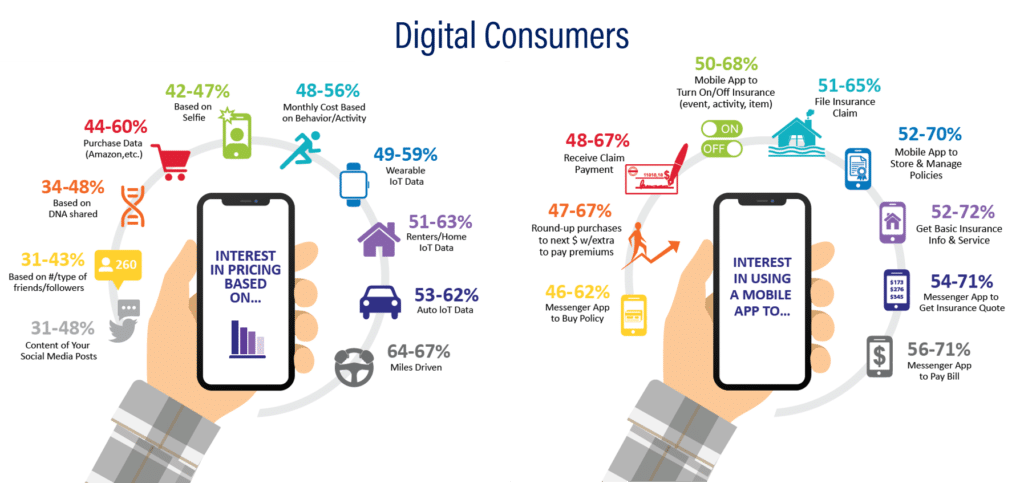

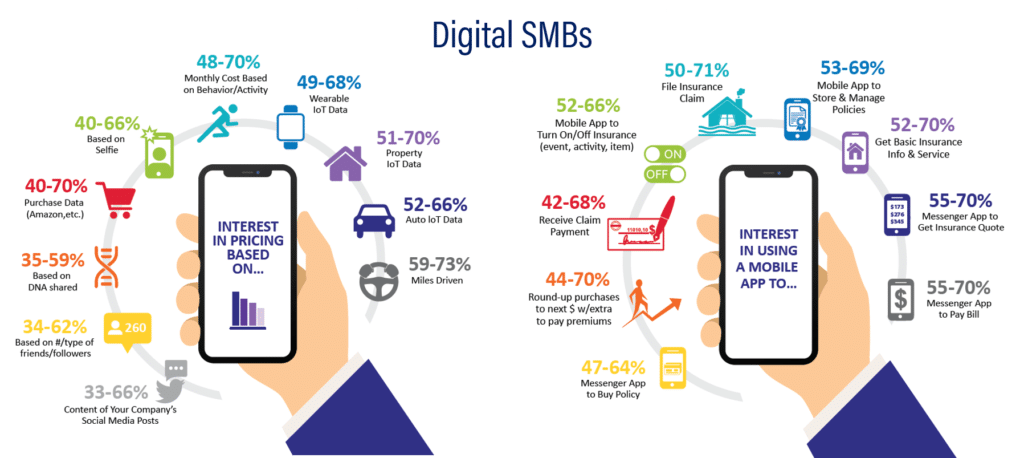

Today’s customers are extremely digitally adept, with higher expectations, different needs and a demand for better experiences that are not met with the “traditional” insurance approach, creating a fault line between customers’ expectations and insurers’ ability to deliver. In our customer research for individuals and businesses (Figures 1 and 2), the digital shift is well underway, reflected in the interest among both the older and younger generations for digital customer engagement and pricing.

Figure 1: Interest in digital customer engagement and pricing — consumers

Insurers leveraging digital technologies, data and AI/ML are poised to leapfrog the competition by organizing talent, technology and ways of working around a digital-first vision for empowering customers.

In the recently released reports on innovation rating status, AM Best found that while the pandemic forced businesses to cram years’ worth of innovations into one year, most companies still have a long way to go. The report also found that there is a perceptible link between superior ratings and use of cutting-edge processes and technology-leveraged innovation initiatives.

If insurers are willing to dig deeper, they may find that data, analytics and digital technologies can help them create paths to income and value. The costs of cutting-edge technologies are continually going down as their impact rises. For example, the flexible, scalable, volume-based pricing of cloud-based processes that are necessary for digital service create a tremendous cost savings over on-site, server-based systems, but more importantly provide the flexibility to connect with ecosystems and adapt to market changes rapidly.

This is similar to tunnel boring. Prufrock’s boring cost per mile is going down just as the necessity for tunnels is on the rise. The result in both cases (tunnels and insurance) will be an ability to improve traffic flow, improve speed, improve experience and meet demand while reducing the overall use of previous technologies. That’s what makes digital insurance a more sustainable solution in the long run. It is solving multiple formulas at the same time.

The bottom line … a digital-first strategy will position that insurer as a future leader.

Figure 2: Interest in digital customer engagement and pricing - SMBs

Can a Digital Strategy Meet the Digital Insurance Shift Quickly Enough?

Nothing satisfies an insurance customer more than having a positive personal interaction with any company --- even their insurer. All it takes is to meet their expectations of a personalized, smooth experience for a claim, a purchase or a routine contact such as billing and payments, creating the “Amazon experience” for insurance.

Of course, when interactions are disparate, frustrating, complex or redundant, the opposite is true. Customers become disillusioned and unsatisfied with the insurer.

COVID has tested insurers’ ability to pivot to a digital-first strategy, with an increased focus on customer experience. Years of adding disparate, siloed digital capabilities like functional portals were challenged. It became apparent that real digital transformation required a mindset shift to a new way of thinking, planning and doing. Leaders know this.

Unfortunately, insurance still embraces decades of legacy business assumptions and technologies that are roadblocks on the path to digital maturity. Many insurers were early adopters and innovators in technology but have built up a complex landscape of technical assets over decades, resulting in significant technical debt. The “modern” solutions of 10 years ago no longer meet the demands of a digital era or match the capabilities of insurtechs that are raising the bar.

Creating compelling experiences for customers that provide transparency, intuitiveness and efficiency require next-generation core, data and digital platform solutions that use cloud, applicating programming interfaces (APIs), microservices, AI/ML and other technologies. This next-generation technology stack allows the exchange and ingestion of valuable data from diverse sources to produce highly personalized customer experiences in near real time.

Insurers need to do some future-thinking around real-time risk assessment. They need to re-imagine customer journeys to move beyond a “tunnel-vision” portal to a new customer experience, to create new products offer new services and innovate their business models.