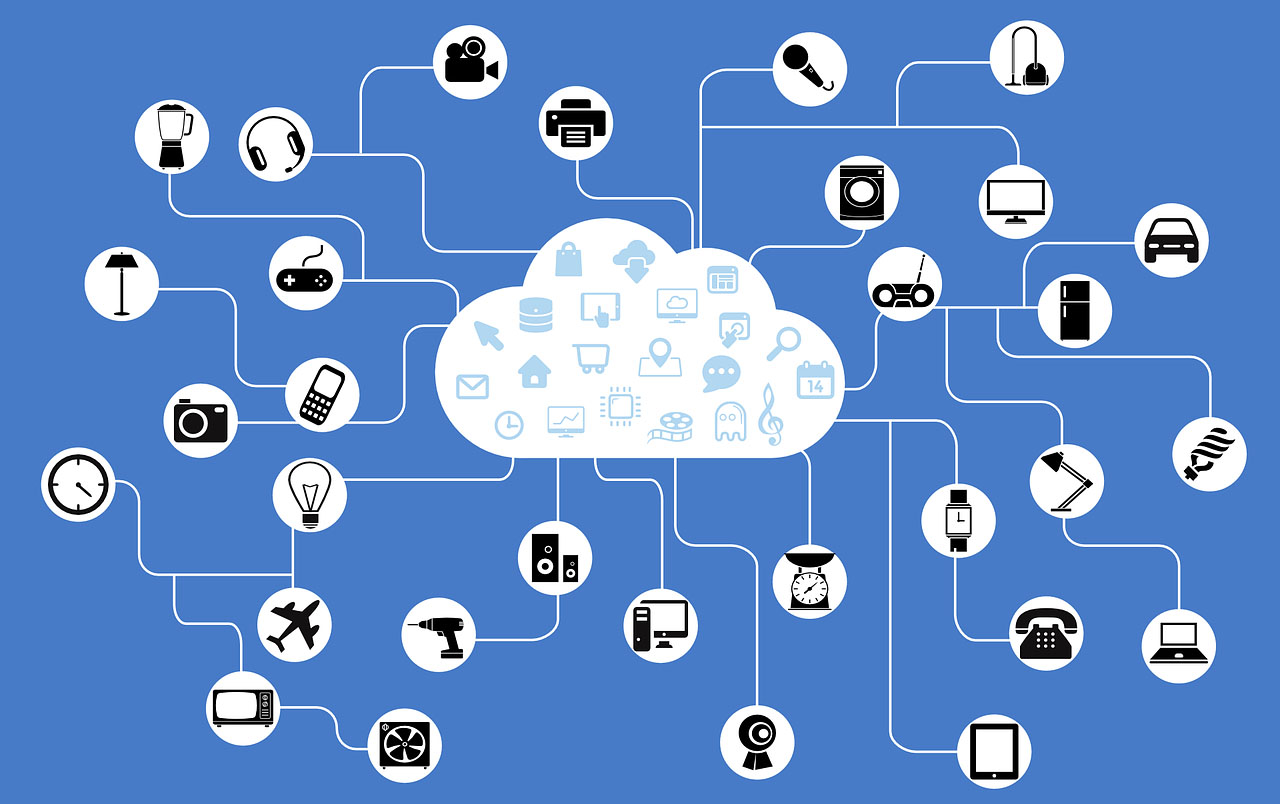

Data is the foundation of insurance, and two emerging technologies, the Internet of Things (IoT, and artificial intelligence (AI), are making that foundation more useful than ever.

IoT allows internet-connected devices to send and receive real-time data. Insurers are increasingly using IoT data to streamline operations, improve customer engagement, offer discounts for and encourage healthy behavior such as safe driving and regular exercise, calculate risks more accurately, boost competitive advantage and streamline compliance.

And that’s just the beginning. Connected devices will be increasingly valuable for other activities, including loss control, pricing, underwriting and marketing.

IoT produces a flood of big data that would be unmanageable without AI to organize it and extract what’s valuable. Using IoT and AI together can benefit not only insurers but brokers, employers, employees and consumers, too. Some IoT software vendors now offer built-in AI capabilities, such as machine-learning-based analytics. AI and analytics can find the needles of insight in the haystack of data and learn from them to identify patterns and trends that might otherwise be undetectable.

Technologies that monitor vehicle speed, brake function and driving habits are starting to transform auto insurance. Several insurers are offering savings to drivers whose data show that they’re safe.

About one in five Americans own a wearable fitness device. Wearables can provide extensive data, including an individual’s daily exercise level, heartbeat rate and even length and quality of sleep.

Life and health insurers selling both individual and group policies would love to get their hands on this data and use it to motivate insureds to adopt healthy lifestyles, to offer appropriate discounts and to improve underwriting. John Hancock already plans to require new insureds to use activity trackers and share their fitness data in exchange for discounted premiums and other benefits.

In underwriting, wearables provide data that can either lessen or eliminate the need for medical tests. Some insurance software vendors have integrated wearable data analytics with cardio fitness scores for simplified underwriting. The data also can also help guide product development.

Wearable devices that can detect heartbeat irregularities and high blood pressure can also alert insureds to the need for early treatment, potentially reducing costs for insurers. But there are downsides. The insurer has access to the most private type of information whenever it is connected to a customer wearing a device. (What could be more personal than one’s health?) So the insurer must take pains to ensure security and be able to credibly assure customers and employers (if it’s a group policy) that personal health information will be guarded like Fort Knox.

See also: Insurance and the Internet of Things

Insurers, of course, have always dealt with sensitive information, but the sheer volume of IoT data presents more opportunities for hackers and other criminals. AI may also have a role here, in providing early-warning detection of possible hacking or fraud.

IoT, combined with AI, is already beginning to transform the industry. Insurers looking to get the best return on investment for their data dollars would be wise to investigate making the combination a part of their technology strategy.