The U.S. has enjoyed the longest economic expansion in American history. One thing’s for sure, though – it’s not going to last.

Recessions are a normal part of the economic cycle. Expansions lead into contractions, which then lead into more expansions, and so on. The next downturn is coming, even if no one can predict exactly when.

It’s been a while since people had to talk about how to “recession-proof” their business. Indeed, given the length of the current expansion, there are plenty of business leaders out there who have no experience navigating a downturn.

For many, the knee-jerk reaction to a slowdown is to cut expenses – curtail travel, freeze hiring, postpone investments. While that can help, it can also hurt. A lot depends on where cuts are made, and how those cuts affect the customer experience.

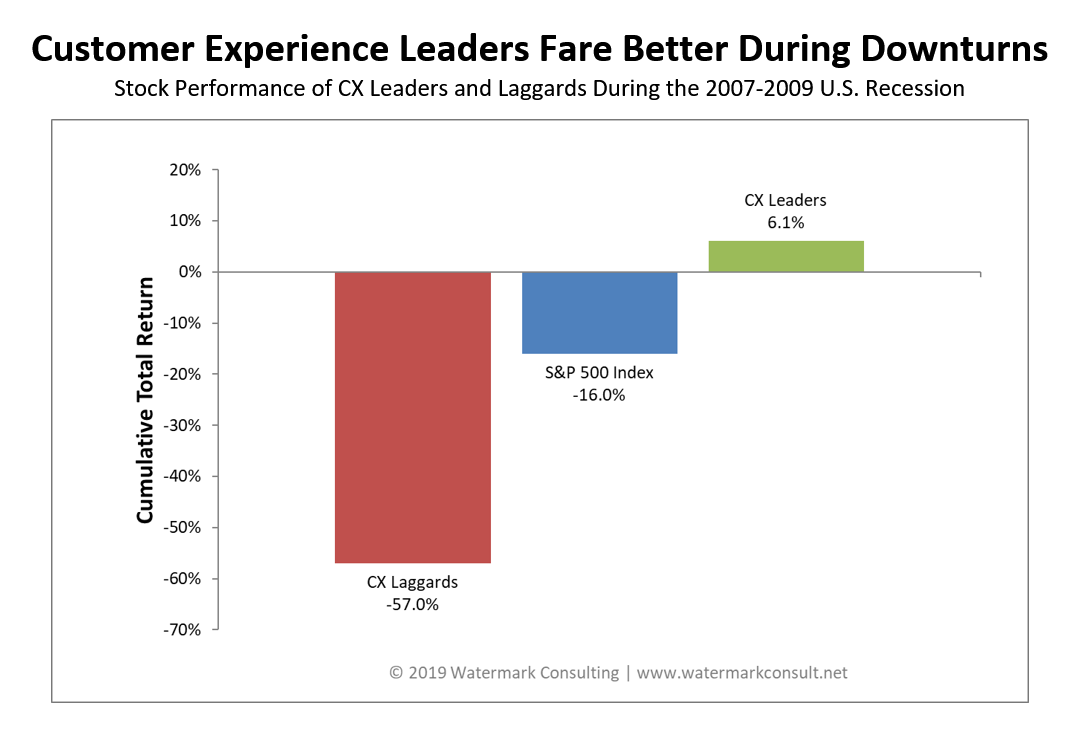

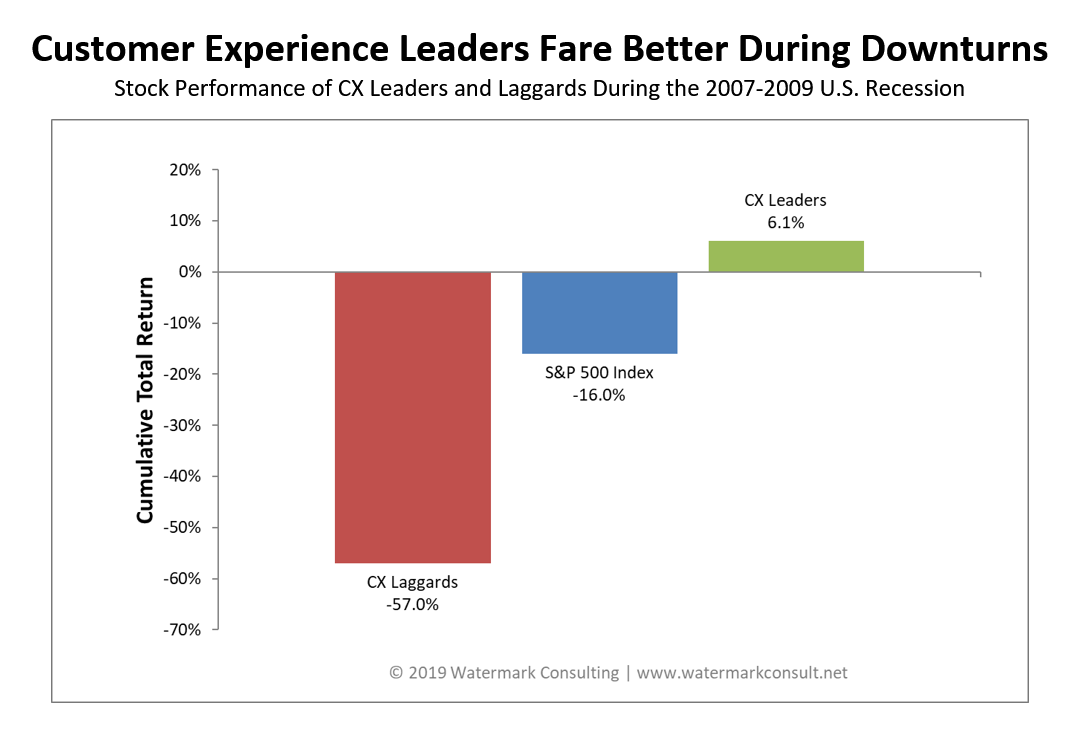

To illustrate the degree by which customer experience can truly recession-proof a business, we pulled data from Watermark Consulting’s

Customer Experience (CX) ROI Study. (The study analyzes the stock market performance of the top-rated companies in customer experience versus the bottom-rated. Follow the link for details on the study’s methodology.)

See also: Key Changes for Customer Experience

Specifically, we looked at the performance of CX Leaders and CX Laggards during the last U.S. recession, 2007-2009. (We chose that span based on the

National Bureau of Economic Research’s official designation of when the last contraction began and ended.)

The story the graph tells is striking. While CX Leaders weren’t immune from the recession, they clearly fared better than other companies. Whereas the broader market and the CX Laggards lost significant market value during the contraction, the CX Leaders actually notched positive returns. What does that tell us?

It certainly suggests that the quality of a company’s customer experience does influence its ability to weather a recession. CX Leaders tend to be cushioned from the most severe impacts of a downturn, because they represent one of the last places people cut back (or seek less expensive alternatives), as well as one of the first places to which they return.

Of course, the protection a great customer experience affords during economic slowdowns isn’t unqualified. There are many ways a company can sabotage its own success, despite offering an appealing customer experience (see this

story about the 2011 bankruptcy of the top-rated company in customer experience).

However, in general, companies offering a top-notch customer experience are far-better-positioned to withstand a recession than those that don’t. For business leaders, this means two things:

- First, when the economy is expanding or business is good, invest in the customer experience to further differentiate your company in the marketplace. This might sound obvious, but the fact is, when revenues are growing and the future looks bright, many organizations de-prioritize CX investments, under the premise that, if business is booming, customers must already be happy and loyal.

- Second, when the economy sours or business slows, be especially judicious when considering expense cuts that could materially affect customer experience. Such actions might yield short-term gains, but they also introduce serious long-term risks. Furthermore, don’t ignore opportunities to actually improve the customer experience while simultaneously lowering expenses (read more about that approach here).

See also: Customer Experience Gets a Major Facelift

Famed investor (and CEO of Berkshire Hathaway) Warren Buffett once commented that “You only find out who is swimming naked when the tide goes out.” His point? Every business leader looks smart during economic booms; it’s only when adversity strikes that you see who the real geniuses are.

With an economic slowdown looming, the tide will soon go out. What will it reveal about

your business?

The story the graph tells is striking. While CX Leaders weren’t immune from the recession, they clearly fared better than other companies. Whereas the broader market and the CX Laggards lost significant market value during the contraction, the CX Leaders actually notched positive returns. What does that tell us?

It certainly suggests that the quality of a company’s customer experience does influence its ability to weather a recession. CX Leaders tend to be cushioned from the most severe impacts of a downturn, because they represent one of the last places people cut back (or seek less expensive alternatives), as well as one of the first places to which they return.

Of course, the protection a great customer experience affords during economic slowdowns isn’t unqualified. There are many ways a company can sabotage its own success, despite offering an appealing customer experience (see this story about the 2011 bankruptcy of the top-rated company in customer experience).

However, in general, companies offering a top-notch customer experience are far-better-positioned to withstand a recession than those that don’t. For business leaders, this means two things:

The story the graph tells is striking. While CX Leaders weren’t immune from the recession, they clearly fared better than other companies. Whereas the broader market and the CX Laggards lost significant market value during the contraction, the CX Leaders actually notched positive returns. What does that tell us?

It certainly suggests that the quality of a company’s customer experience does influence its ability to weather a recession. CX Leaders tend to be cushioned from the most severe impacts of a downturn, because they represent one of the last places people cut back (or seek less expensive alternatives), as well as one of the first places to which they return.

Of course, the protection a great customer experience affords during economic slowdowns isn’t unqualified. There are many ways a company can sabotage its own success, despite offering an appealing customer experience (see this story about the 2011 bankruptcy of the top-rated company in customer experience).

However, in general, companies offering a top-notch customer experience are far-better-positioned to withstand a recession than those that don’t. For business leaders, this means two things: